Should You Convert Your Traditional 401 Into A Roth 401

7 Minute Read | September 27, 2021

Over the past few years, you might have received an email from your companys human resources department introducing a new retirement savings plan option: the Roth 401.

More and more companiesespecially large onesare adding Roth options to their 401 plans. In fact, seven out of 10 employers now offer this option to their employees.1 If the Roth 401 is on the table at your workplace, thats great news for you!

But if you now have a Roth 401 option, youre probably wondering what to do with your existing 401. Is converting an existing 401 to a Roth the way to go? Or should you just leave it alone?

There are some things to keep in mind before you make this decision, so lets dive in.

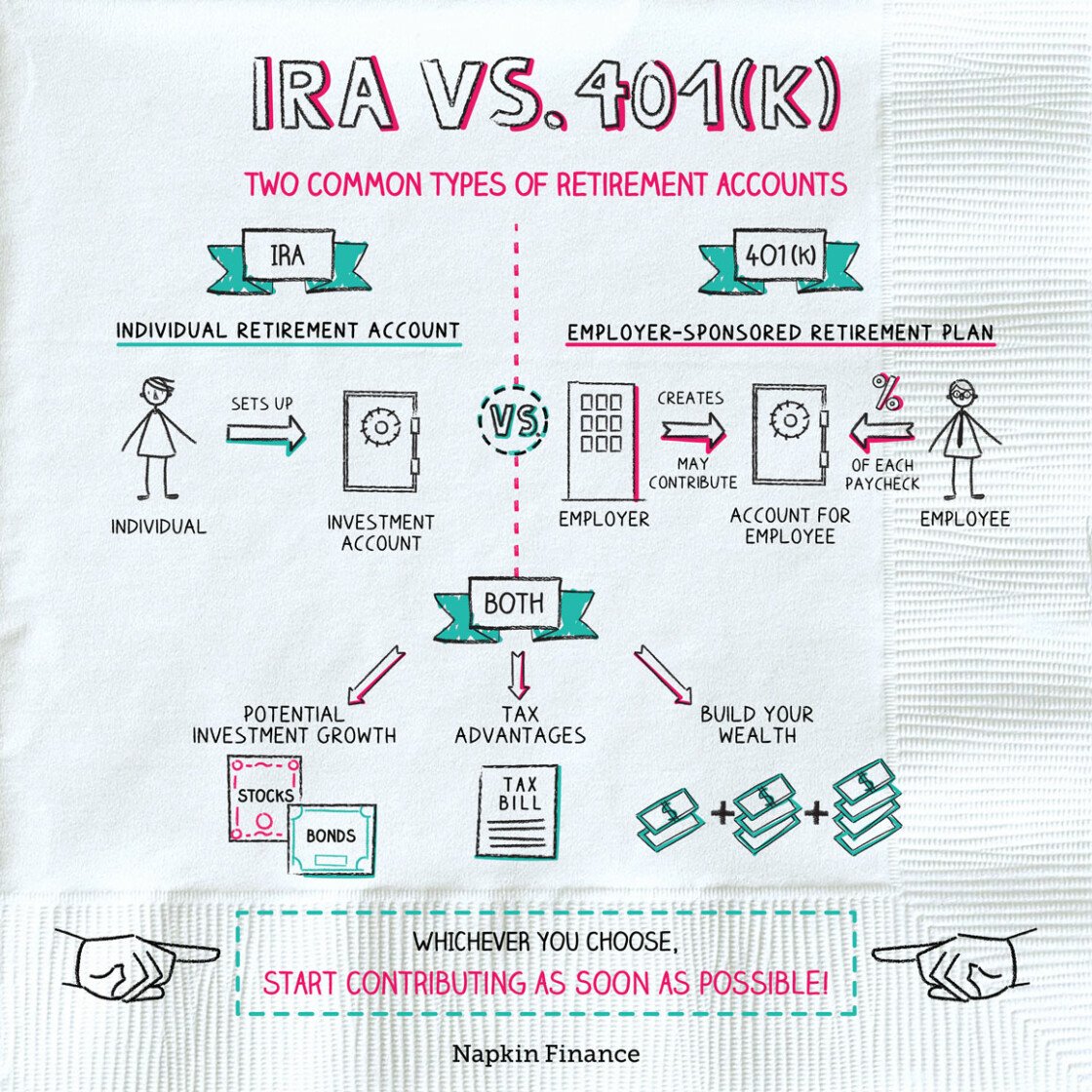

Rollover To A Roth Ira

Rollovers are a great time to alter the tax treatment offered by your retirement account, such as rolling your 401 funds over into a Roth IRA. Its a beneficial choice for many retirement savers, but it may be especially appealing for people with high incomes who may not be able to otherwise save in a Roth IRA.

This type of rollover can also help you avoid required minimum distributions that come even with a Roth 401.

However, there will most likely be tax consequences. Because traditional 401 contributions are made with pre-tax dollars, you will owe income taxes on the funds you convert to a Roth IRA, which holds after-tax contributions.

Roth 401 To Roth Ira Conversion

Roth 401s are essentially the same as traditional 401s, except they’re funded with after-tax dollars, like the Roth IRA, instead of pre-tax dollars. The exception to this rule is employer-matched funds. These are considered pre-tax dollars even in a Roth IRA.

Because the government taxes Roth 401 and Roth IRA contributions the same way, you can roll over Roth 401 savings to a Roth IRA without paying any taxes on your Roth 401 contributions. But if the amount you’re rolling over includes employer-matched funds, these will affect your tax bill for the year.

Also Check: Can I Liquidate My 401k

How To Roll Over An Old 401

8 Minute Read | September 27, 2021

Back in the old days, it was pretty common for someone to work for the same company for 40 years before retiring with a nice pension and a gold watch. Well, those days are long gone.

A recent study found that the youngest baby boomers worked 12 different jobs over the course of their careers.1 Did you hear that? Twelve! And younger generations are even more likely to look for greener employment pastures. In fact, almost a third of millennials say they would quit their jobs as soon as possibleif they could.2

But in the process, many American workers are leaving behind a trail of forgotten 401s, sometimes with thousands of dollars in retirement savings left behind!

Theres even a name for those retirement accounts that are left behind: orphan 401s. Even the name is sad! Its time to stop for a minute and think about giving the money in those long-forgotten accounts a new home.

Thats where rollovers come in.

Dont Miss: Do I Need Ein For Solo 401k

You Want To Relax Early

Proponents of the FIRE movement invest aggressively so they can become work-optional in their 50s or even earlier.

If thats your plan, youll want at least a portion of your investments to be in an account thats more accessible than a 401, which you cannot tap without penalty before the age of 59 ½. A strategy known as a Roth conversion ladder involves converting 401 funds into a Roth IRA over a period of years.

Its a bit complex, says Hernandez. Theres a small number of people that it could make sense for. Its important to understand the tax impact.

Read Also: How Do I Convert A 401k To A Roth Ira

Rolling Over Your 401 To An Ira

You have the most control and the most choice if you own an IRA. Unless you work for a company with a very high-quality planthese are usually the big, Fortune 500 firmsIRAs typically offer a much wider array of investment options than 401s.

Some 401 plans have only a half dozen funds to choose from, and some companies strongly encourage participants to invest heavily in the companys stock. Many 401 plans are also funded with variable annuity contracts that provide a layer of insurance protection for the assets in the plan at a cost to the participants that often run as much as 3% per year. Depending on which custodian and which investments you choose, IRA fees tend to run cheaper.

With a small handful of exceptions, IRAs allow virtually any type of asset: stocks, bonds, certificates of deposit , mutual funds, exchange traded funds, real estate investment trusts , and annuities. If youre willing to set up a self-directed IRA, even some alternative investments like oil and gas leases, physical property, and commodities can be purchased within these accounts.

If you opt for an IRA, then your second decision is whether to open a traditional IRA or a Roth IRA. Basically, the choice is between paying income taxes now or later.

Who Needs To Know About The Roth 401 Rollover 5 Year Rule

If you are just starting out and beginning to save for retirement, youre a prime candidate for this information. Virtus Wealth Management is a great place to start, we specialize in wealth management and can answer any questions you may have about the subject.

Are you a seasoned employee with an employer-sponsored 401? Virtus Wealth Management can help with Roth 401 conversions give us a call at 717-3812.

You May Like: Can I Pull Out My 401k

Recommended Reading: Can You Have A Solo 401k And An Employer 401k

Dave Anthony President And Portfolio Manager

@DaveAnthony09/28/15 This answer was first published on 09/28/15. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

ROTH–ROTH–ROTH. Look, if you have any substantial amount of money saved up , then you need to convert your monies over to tax free accounts while you still can.

Our country is $19 trillion in debt—Baby Boomers are retiring at 10,000/day and are putting an enormous strain on Social security and Medicare plans. The government has already passed the legislation to come ofter those “affluent” boomers–those that make over $44k/year in retirement, and they will be the ones paying for these out of control programs. You’ll be one of them as well unless you strategically allocate your money into the five accounts that don’t count toward SS taxation and Medicare surcharge penalties.

Both of these programs are means based, if you follow the old-school train of though and defer, defer, defer your retirement income into all IRA/401 plans, you’ll be in for a world of hurt once you hit 70 1/2 and are required to take distributions.This will cause a triple whammy of ordinary income tax, Social security tax, and probably Medicare penalty premium tax. OUCH!

Pay taxes now, at some of the lowest rates in a long time, and go tax free.

Should You Convert To A Roth Ira Now

Once youâve decided a Roth IRA is your best retirement choice, the decision to convert comes down to your current yearâs tax bill. Thatâs because when you move money from a pre-tax retirement account, such as a traditional IRA or 401, to a Roth, you have to pay taxes on that income. It makes sense: If you had put that money into a Roth originally, you would have paid taxes on it for the year when you contributed.

Democrats tried to put a moratorium on backdoor Roth conversions, primarily for the wealthy through the Build Back Better bill, which was first introduced by President Joe Biden in 2020. The bill aimed to create RMDs for accounts that exceeded $10 million while closing the door on additional contributions. This would, thus, close loopholes used by many wealthy individuals. The bill did not pass and was replaced by the Inflation Reduction Act of 2022.

-

Huge tax advantages, including tax-free growth and tax-free withdrawals in retirement

-

Withdrawals are allowed at any time, for any reason, tax-free

-

Doesn’t have required minimum distributions

-

You pay tax on the conversionâand it could be substantial

-

You may not benefit if your tax rate is lower in the future

-

You must wait five years to take tax-free withdrawals from the Roth after a rollover, even if youâre already age 59½

A Roth IRA rollover is most beneficial when:

Read Also: How Much Can You Transfer From 401k To Roth Ira

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Roth Ira Conversion Methods

There are several ways to enact a Roth conversion, depending on where you hold your retirement accounts:

- With a 60-day indirect rollover, you receive a distribution in the form of a check paid directly to you from your traditional IRA. You then have 60 days to deposit it into your Roth IRA.

- A simpler way to convert to a Roth IRA is a trustee-to-trustee direct transfer from one financial institution to another. Tell your traditional IRA provider that you’d like to transfer the money directly to your Roth IRA provider.

- If both IRAs are at the same firm, you can ask your financial institution to transfer a specific amount from your traditional IRA to your Roth IRA. This method is called a same-trustee or direct transfer.

Also Check: What Is The Average Management Fee For A 401k

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is free and only takes a few minutes.

Also Check: Can I Rollover My 401k To An Existing Ira

Can A 16 Year Old Open A Roth Ira

Anyone can bet on a Roth IRA, regardless of age. This includes babies, teenagers and grandparents. Contributors must have income for the year in which the deposit is made.

Who is not allowed to open a Roth IRA? If your adjusted gross income is greater than $ 196,000 for married performers or $ 133,000 for single performers, you will not be able to make a Roth contribution.

You May Like: How Do 401k Distributions Work

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

Why Bother With A Backdoor Roth Ira

Both Roth and traditional IRAs let your money grow within the account tax-free however, Roth IRAs have a couple of advantages over traditional IRAs.

First, they dont have required minimum distributions . You can leave your money in your Roth for as long as you want, which means it can keep growing indefinitely. This characteristic may be valuable to you if you expect to have enough retirement income from another source, such as a 401, and you want to use your Roth as a bequest or an inheritance.

The lack of RMDs also simplifies record-keeping and makes tax preparation easier. It will save you time and headaches in retirement when youd rather be enjoying your free time.

Second, Roth distributionswhich include earnings on your contributionsare not taxable. Future tax rates may be higher than current tax rates, so some people would rather pay taxes on their retirement account contributions, as one does with a Roth, than on their distributions, as one does with a traditional IRA or 401. Other people want to hedge their bets by making both pretax and post-tax contributions, so they have a position in both options.

Don’t Miss: Can You Contribute To 401k And Ira

Taxes On Roth Ira Conversions

One of the biggest reasons investors gravitate toward Roth IRAs is the tax benefit. The money is put into the account after tax, so when its time to retire, youll be able to take the money out tax-free. That makes the Roth IRA a natural contender for rolling over 401s since it allows you to enjoy tax-free distributions during your golden years.

However, its important to understand the rollover 401 to Roth IRA tax consequences. You didnt pay taxes when you put money into your 401, with the understanding that youd pay when you took it out. A Roth IRA is funded with money youve already paid taxes on, which is why you dont pay taxes when you take it out. This means that the IRS has to get its money now, when youre putting the money into the Roth IRA account.

You May Like: How To Borrow From 401k To Buy A House

Need To Open A Roth Ira

My favorite online broker is Ally Invest but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign-up bonuses. There are many good options out there, but I have had the best overall experience with Ally Invest. No matter which option you choose the most important thing with any investment is to get started.

Also Check: Can I Close My 401k

Invest The Money In Your Roth Ira

A common pitfall for people that go through this process is that theyll see the funds arrive in their Roth IRA, and think that the process is complete. It is not.

Youll need to go into the account and actively invest the money, ideally in the context of all of the accounts you have.

When youve completed this step, youre done! You now have a tax-exempt Roth IRA growing in perpetuity all with a zero tax liability .

Read Also: How To Use 401k To Buy Stock

Converting From An Employer

You can convert other retirement accounts, such as an employer-sponsored 401 or 403 plan, too, once you leave your job. Some plans let you access the money while youâre still workingâan âin-service distribution.â However, you usually have to reach age 59½ before you can do so.

If you want to convert assets from your 401 or another employer-sponsored plan to a Roth IRA, make sure the money is transferred directly to the financial institution through a trustee-to-trustee transfer.

If your company issues the check to you, it must withhold 20% of the account balance for tax purposes. Then youâll have just 60 days to deposit all the money into a new Roth accountâincluding the 20% that you didnât receive. That must come from another source. Miss the deadline and any money not rolled over to a Roth IRA will be subject to a 10% early withdrawal penalty if you’re younger than 59 ½.

You May Like: Can I Get A Loan Using My 401k As Collateral

How Does A 401 Rollover Work

There are two ways to roll over a 401 accounteither directly or indirectly.

With a direct transfer, you will fill out paperwork to transfer funds from your old 401 account into a new retirement account . The money will get transferred from one account to another, with no further involvement from you.

With an indirect transfer, you would close, or cash out, the 401 account with the intention of immediately reinvesting it into another retirement fund. To make sure you actually do transfer the money into another retirement account, the government requires your account custodian to withhold a mandatory 20% taxwhich youll get back in the form of a tax exemption when you file taxes.

The hitch: You will have to make up the 20% out of pocket and deposit the full amount into your new retirement account within 60 days. If you retain any funds from the rollover, they may be subject to an additional 10% penalty for early withdrawal.