How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

Consider Mobile Check Deposit

If you’re already a Vanguard client and you’re registered for online access, remember that you can use our mobile check deposit option offered through the Vanguard app. It’s faster than mailing a check!

When you’re logged on and using the app, just tap the Mobile check option under the main menu and then follow the instructions. Learn more about mobile check deposit

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Don’t Miss: Can I Manage My Own 401k

How Much Can I Roll Over If Taxes Were Withheld From My Distribution

If you have not elected a direct rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over within 60 days, you must use other funds to make up for the amount withheld.

Example: Jordan, age 42, received a $10,000 eligible rollover distribution from her 401 plan. Her employer withheld $2,000 from her distribution.

If you roll over the full amount of any eligible rollover distribution you receive :

- Your entire distribution would be tax-free, and

- You would avoid the 10% additional tax on early distributions.

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

Recommended Reading: How Do I Stop My 401k

How To Move Your 401k To Gold Ira All You Need To Know

There are several moving parts to complete a 401 to gold rollover.

Working with a reputable gold IRA company experienced in gold IRA rollovers takes the effort out of the process.

It is important that the rollover process is executed as per the Internal Revenue code guidelines to avoid IRS penalties, including an early withdrawal tax penalty.

Fortunately, there are plenty of gold IRA companies experienced in rolling over 401 to gold IRA plans without any tax penalties.

What Are Your Investment Options With A Rollover Ira

Once youve made the decision to do a 401 Rollover into an IRA, the next decision is how you want to invest your account.

If you plan to engage in self-directed investing, buying and selling individual stocks, options, funds, bonds, real estate investment trusts and other securities, it will come down to selecting the broker to hold your IRA with.

Popular investment brokers that offer nearly unlimited investments and charge no trading fees on many of them include:

|

Product |

|---|

|

on Noble Gold website |

If you prefer to invest in mutual funds or ETFs, Vanguard may be the broker of choice.

They offer trading in stocks and other securities but they do charge trading fees on those.

However, they offer thousands of fee-free ETFs and mutual funds for you to invest in.

Given that Vanguard funds are found in most professionally managed portfolios, you can take that as a hint of how good their funds are.

Choosing a Managed Option: Robo-advisors

If you want a fully managed IRA account, you can opt for a robo-advisor.

Theyll create a portfolio of stocks, bonds and other asset classes for you, based on your risk tolerance, investment goals and time horizon.

After that, theyll fully manage the portfolio for you, including reinvestment of dividends, and periodic rebalancing to make sure your portfolio maintains its target allocations.

Popular robo-advisors include:

Betterment and Wealthfront will manage your IRA for a fee of just 0.25% per year .

Recommended Reading: How To Get Your 401k Without Penalty

Decide Where You Want The Money To Go

If youre making a rollover from your old 401 account to your current one, you know exactly where your money is going. If youre rolling it over to an IRA, however, youll have to set up an IRA at a bank or brokerage if you havent already done so.

Bankrate has reviewed the best places to roll over your 401, including brokerage options for those who want to do it themselves and robo-advisor options for those who want a professional to design a portfolio for them.

Bankrate has comprehensive brokerage reviews that can help you compare key areas at each provider. Youll find information on minimum balance requirements, investment offerings, customer service options and ratings in multiple categories.

If you already have an IRA, you may be able to consolidate your 401 into this IRA, or you can create a new IRA for the money.

Why Roll A 401 Into An Ira

IRAs are a way to save for your retirement from your own contributions, which is ideal if you are planning to work for yourself or your new employer does not offer a retirement plan. They also offer certain benefits that 401s do not. For example, while most employer-sponsored plans offer limited investment choices, IRAs put you in the driver’s seat when it comes to growing your wealth. Stocks, bonds, money-exchanges, real estate investment trusts, certificates of deposit you can invest in all of these and more with an IRA.

Like a 401, you are supposed to leave the money in the IRA until you retire. Withdraw the money before age 59 1/2, and the tax man will hit you with an early payment penalty equal to 10 percent of the distribution, and you’ll have to pay income tax on the amount you’ve withdrawn. An IRA is more flexible than a 401, however, in that you can withdraw up to $10,000 penalty-free before age 59 1/2 to purchase a first-time home or to pay for college expenses.

Also Check: Can 401k Be Transferred To Roth Ira

What Is A 401k Rollover

If you lose or leave your job, your 401k retirement savings can come with you. When this happens there are options for your 401k funds and one is to conduct a rollover into an Individual Retirement Account . The IRS allows you to direct the rollover to another plan or IRA. Having a financial advisor to assist you in clarifying your options and in the decision making is sometimes helpful.

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover Chart PDF summarizes allowable rollover transactions.

Read Also: How To Transfer 401k From Fidelity To Vanguard

Why It Works To Move Your Retirement Plan To A Self

There are numerous reasons people choose to transfer and/or rollover their retirement account to a self-directed IRA. The main reason is to protect their savings from a volatile stock market or unpredictable changes in the economy. By diversifying their investments, they have a greater opportunity to stay on track with their retirement goals.

Self-directed IRAs are also known to perform much better than stocks and bonds. A recent examination of self-directed investments held at IRAR suggests that investments held for 3 years had an ROI of over 23%. This is why most investors are self-directing their retirement.

Rollover To An Ira Can Mean Tax

If you rollover to an IRA you may have a wide choice of investment options, including choices that employers might not offer, such as mutual funds, annuities and bank CDs. This option allows your funds to continue growing tax-deferred. And you can simplify your financial life by moving the account to a company where you already have funds or even into an existing IRA.

If you choose a Traditional IRA, you won’t pay any taxes when you conduct a rollover. If you roll money into a Roth IRA, you’ll be taxed on the money going into the account, but pay no federal income taxes when you withdraw the money . Money from a Roth 401k can be rolled into a Roth IRA tax-free.

When rolling over a 401k balance into an IRA it’s important to do a full comparison on the differences in the guarantees and protections offered by each respective type of account as well as the differences in liquidity/loans, types of investments, fees and any potential penalties.

You May Like: Can I Roll My Roth 401k Into A Roth Ira

What Happens To My Retirement Money When I Reach Age 72

The IRS says you must begin withdrawing money from your employer plan account by April 1 following the year you turn 72 or retire, whichever is later . Withdrawals from traditional IRAs must begin by April 1 following the year you turn 72. If you dont withdraw the minimum required amount, the IRS will penalize you with a 50% tax on any amount that should have been withdrawn but wasnt. Roth IRAs are not subject to required minimum distributions.

The SECURE Act increased the age when required minimum distributions must begin from 70½ to 72, effective for individuals turning 70½ on or after January 1, 2020. If you reached age 70½ before this date, you are still required to take RMDs.

A Direct Rollover Is The Preferred Route When Moving Any Retirement Money

A direct rollover is not only the more common way to move retirement money, but its also the safest from a tax standpoint.

A direct rollover is just what the name implies, money leaves one retirement account and goes directly to another. It is a trustee-to-trustee transfer, where the money never touches your hands or your bank account. This is the safest and therefore preferred way to move any retirement money.

For tax purposes, the IRS doesnt even consider a direct rollover to be a rollover at all. As a result, there is no limit to the number of direct rollovers that you can do in a given year, and that wont change going forward.

Read Also: When Leaving A Company What To Do With 401k

How Many 401k Rollovers Per Year

The IRS imposes certain restrictions on the number of times you can rollover 401s and IRAs. Find out how many times you can rollover 401 per year.

If you are looking for greater flexibility with your retirement money, you could consider rolling over your 401. The IRS allows 401 participants to move the retirement money from one retirement account to another. You can rollover your 401 funds to a new 401 or an IRA. However, 401 rollovers are subject to certain restrictions that participants must observe.

There is no limit on the number of 401 rollovers you can do. You can rollover a 401 to another 401 or IRA multiple times per year without breaking the once-per-year IRS rollover rules. The once-per-year IRS rule only applies to the 60-day IRA rollovers. You can only rollover the 60-day IRA rollover once per year, but there is no limit on direct trustee-to-trustee IRA rollovers.

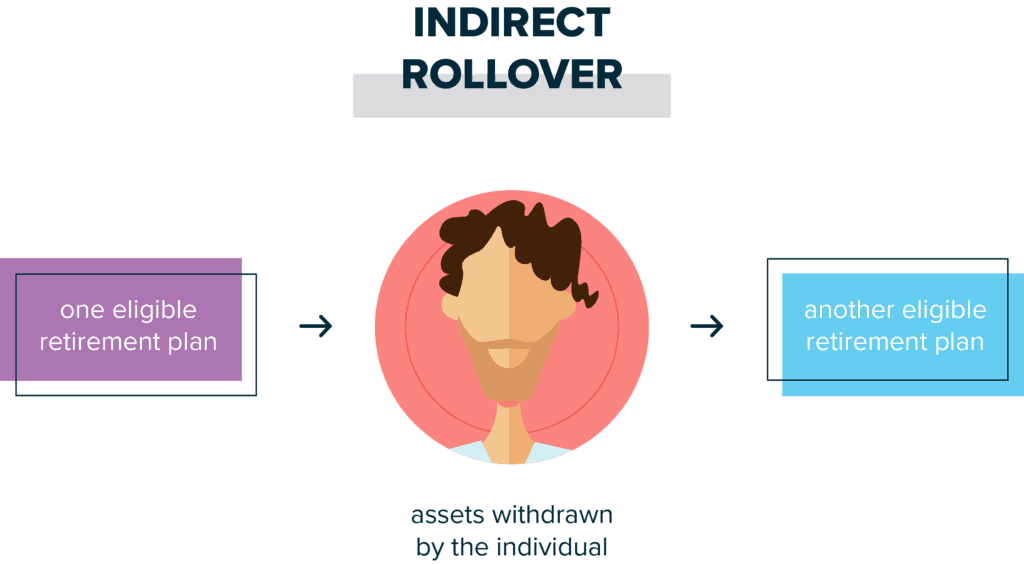

Direct Rollover Vs Indirect Rollover: Whats The Difference

Okay, once you decide to roll money from one account to another, you have two options on how to do the transfer: a direct rollover or an indirect rollover. Spoiler alert: You always want to do the direct transfer. Heres why.

With a direct rollover, the money in one retirement accountan old 401 you had in a previous job, for exampleis transferred directly to another retirement account, like an IRA. That way, the owner of the account never touches it, and you wont have to pay any taxes or penalties on the money being transferred. Once its done, its done!

Indirect rollovers, on the other hand, are a bit more complicatedand needlessly risky. In an indirect rollover, instead of the money going straight into your new account, the cash goes to you first. Heres the problem with that: You have only 60 days to deposit the funds into a new retirement plan. If not, then youre going to get hit with withholding taxes and early withdrawal penalties.

Now you should see why the direct rollover is the only way to go. Theres just no reason to take a chance on an indirect rollover that leaves you open to heavy taxes and penalties. Thats just dumb with a capital D!

Don’t Miss: How Much In 401k To Retire

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What Is The Time Limit For An Indirect Rollover

When it comes to rollovers, the clock starts ticking only if you perform an “indirect rollover.” This happens where the company sends the account balance to you personally, instead of transferring it directly to your IRA. You’ll almost always get an indirect rollover if there’s less than $1,000 invested in your 401 as the employer can send you a check for the money.

The rule here is that you must deposit the funds into your IRA within 60 days of the old account being closed. Miss the deadline even by one day and the IRS will treat the rollover as if you made an early withdrawal. In other words, you have to pay income taxes on the fund balance and the 10 percent early withdrawal penalty.

Here’s an illustration. If you received a check for, say, $50,000 from your employer and deposited it in your IRA on day 59, nothing would happen. There would be no tax bill and no penalty. But if you deposited it on day 61, your taxable income for the year just went up by $50,000. You also pay a $5,000 penalty if you’re under age 59 1/2.

Recommended Reading: How To Lower 401k Contribution Fidelity

Why Should I Roll My Retirement Plan Money Into An American Funds Ira

American Funds is one of the most experienced investment managers in the United States. Weve been managing investors assets since 1931. We take a conservative, long-term approach thats consistent with the needs of most people saving for the future. Thats why most of our shareholders investments are intended for retirement.

Decide Where To Open Your New Ira

When opening an IRA, most people will look towards a brokerage, and for obvious reasons. 401 accounts are notorious for their relatively limited investment selections. But by rolling your funds into an IRA at a brokerage, youll get to choose from a significantly larger pool of potential investments. In fact, many offer some combination of stocks, bonds, exchange-traded funds , mutual funds, options and more.

Managing your own retirement funds takes a lot of time and energy, but a financial advisor can do it for you. Many financial advisors specialize in retirement planning and investing, which is exactly the combination youll need. If you go this route, your advisor will manage your investments in an IRA according to your needs and current savings situation.

If you prefer an even more hands-off approach to investing, a robo-advisor could be a good option. When you open an IRA with a robo-advisor, an asset allocation profile will be created for you based on your age, risk tolerance and proximity to retirement. The robo-advisor will then invest and manage your assets for you according to this plan.

Regardless of which way you go, make sure you understand any account, investment or advisory fees you may incur. An overbearing fee structure can have an extremely negative effect on your portfolio, so keep an eye out for this.

Recommended Reading: How Do I Know If I Have A 401k