How To Make Your 401 Grow Faster

Rule No. 1: Enroll

What Is a 401?

Simply put, a 401 is retirement plan that is offered to employees by their employer. What makes it advantageous to U.S. workers is the accounts tax advantages — it lets employees contribute a percentage of their paycheck pre-tax.

Additionally, 70% of 401 plans offer employer-matching programs, where an employer matches employee contributions up to a certain percent — in other words, the employee earns free money when contributing cash to his or her own savings account.

According to Bloomberg, two-thirds of Americans don’t contribute anything to a 401 or other retirement account available through their employer.

Don’t Miss:The 5 Benefits to Know About Rolling Over Your 401…

Many workers feel they just can’t spare the cash due to other financial concerns. Additionally, some don’t know what a 401 is or how it works — especially if employers aren’t making much of an effort to sign them up. For example, the only info an employee might receive on 401s could be part of a stack of orientation papers received the first day on the job.

But putting something — anything — into a 401 throughout your working years will pay off big time. To put into context what enrolling in a 401 and just contributing a few hundred dollars a month can do for you, here’s an example Fitz-Gerald told members on Dec. 19, 2016:

That’s the power of enrolling in your employer’s 401 plan.

Rule No. 2: Accept the Free Money

The Pitfalls That Make Retirement Less Affordable

To retire as soon as possible, you must avoid three pitfalls when saving throughout your working years – underperforming investments, inappropriate asset allocation, and excessive administration fees. Avoiding these pitfalls could add hundreds of thousands of dollars in compound interest to your savings by the time you retire.

Establish An Emergency Fund For Liquidity

Around the same time as youre paying off debt, you need to have some money on the side. Not necessarily a ton, but some.

The statistics are alarming for the percentage of people that couldnt come up with $500 if they had to. There are so many things that can go wrong, like a car breaking down, or a medical issue, or a death in the family, or a variety of other things, and you need to have liquidity to act on those things without turning to a credit card.

Recommended Reading: How To Take Out 401k Money For House

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Ditch Your Money Drama

Your 20s are the starter years. No matter your career, you’re just starting to spread your wings. At the end of that decade, you might be considering marriage, children and a home. In the beginning, though, you’re relatively unencumbered.

That makes it the perfect time to figure out your finances and develop healthy habits for a good foundation.

First: Master your cash flow, says Douglas Boneparth, a certified financial planner and president of Bone Fide Wealth. It’s not difficult, but it is time-consuming.

Look through past credit card and bank statements to see what you spend on meals out, groceries, entertainment, rent, utilities, transportation and debt repayment. Compare spending with income and see what’s left over, if anything. Learn to spend more consciously and see where you can make some cuts.

Master your cash flow. It’s not difficult.Douglas Boneparthcertified financial planner

Your other task: Learn to save. It’s all about attitude. From your own spending history, find one or two items you can save on. Maybe you’ve been eating in restaurants three times a week. Cut it to two or even one those meals are the amount you can save. Use a separate account. Earmark it for a vacation, holiday gifts or use it to pay down debt.

If you don’t know what investments to choose, consider a target-date fund. It’s a simple way to make sure you are diversified.

Read Also: When Leaving A Company What To Do With 401k

What Returns Can You Expect

Over the long term, large-cap stocks have returned close to 10% per year on average, while bonds hover around 4% to 5% per year on average. In the short term, however, returns can vary enormously. That’s why it’s important not to panic if a market crash causes the value of your retirement savings to drop suddenly. When you have years or decades to go before you retire, you don’t need to worry about short-term swings in the market. Your stocks and bonds will have plenty of time to recover and then some.

Avoid Fees And Penalties

If you withdraw money from your 401 before youre 59 1/2, you can be penalized up to 10 percent for the early withdrawal, in addition to applicable income tax. But don’t wait too long: at age 72, you are required to take what is known as a “required minimum distribution” . If you fail to do so, you will be required to pay a 50% penalty .

Are you interested in more information on how your 401 can be a significant source of income in retirement? If so, contact a qualified financial advisor who can help you.

Also Check: Can You Convert Your 401k To A Roth Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Ways To Grow Your 401 For Long

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

If financial peace of mind in your retirement years, tax advantages, and free money sound good to you, then dont wait another year before you start contributing to your 401. It may be one of the best fiscal decisions that you ever make.

Whether you are in your 20s or your 50s, if you havent started putting money away in your 401, then the best time to start is the present. Many people don’t always realize that a 401 plan can be a major source of income to ensure a comfortable retirement. Here are six helpful ways to maximize your 401 growth:

Recommended Reading: How To Grow 401k Fast

Never Underestimate Compound Interest

Starting a retirement account with steady contributions at age 20 versus 30 makes all the difference in the world.

Albert Einstein once called compound interest the most powerful force in the universe and he was a pretty smart guy, says John McFarland, coordinator of the financial planning track at the Virginia Commonwealth University School of Business.

Lets say a 20-year-old begins plunking down just $45 a month with a 50% company match. If she raises contributions by the same amount as any pay raises she gets, shell have more than $1 million by age 65. That assumes annual raises of 3.5% and an 8.5% return on 401 investments.

The Best Choice: Work With A Pro

Heres the deal: Investing is worth the hard work. If you dont save and invest now, you wont have anything to live on in retirement. It can be intimidating and complex, but you dont have to do this alone.

Talk with an investment professional like our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your 401 and Roth IRA contribution options and create a plan for your situation.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

You May Like: How Do You Take Money Out Of 401k

The 401 And Ira Features You Want For The Long

To avoid the pitfalls that make retirement less affordable, you want a 401 account or IRA with three features:

How To Accumulate One Million Dollars In Your 401k

One relatively painless and fastest way to make one million dollars is by investing in a retirement 401 plan.

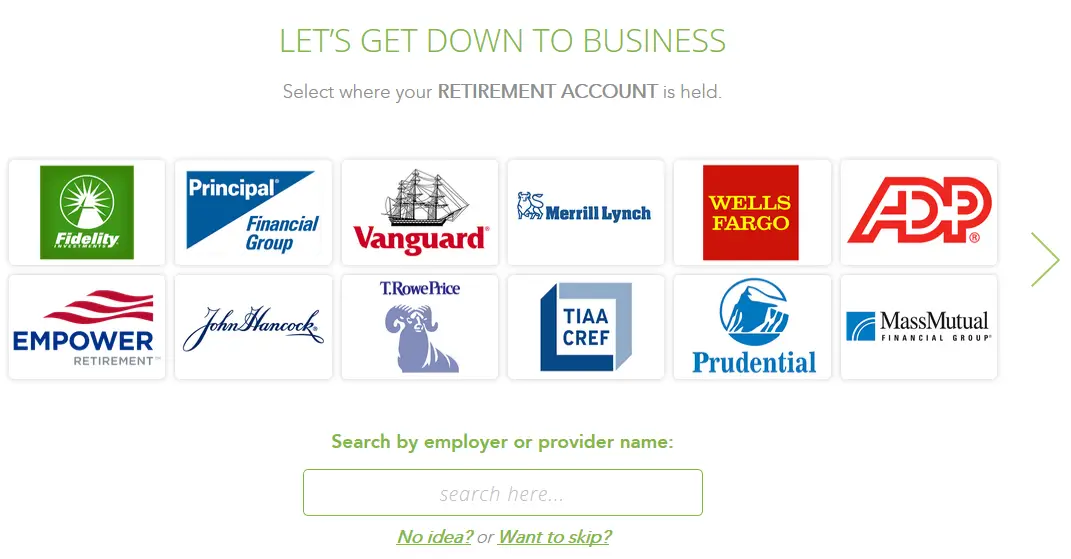

A 401 plan is one in which you contribute a certain amount of your paycheck to a retirement account that your employer sets up with an asset management firm or a financial institution like Vanguard or Fidelity. What you may not know is that you can easily accumulate one million dollars.

For example, if you contribute $19,000 per year in your account for 30 years, assuming an annual return of 7%, you will have over one million dollars sitting in your account.

But how do you reach one million dollars? Obviously, this is easier said than done. Making a million dollars requires careful planning and discipline. So its essential to consult with a financial advisor in your area to help you set a financial plan to reach the 1 million dollars goal.

Follow the steps below to learn how to make a million dollars.

You May Like: Can I Roll My Roth 401k Into A Roth Ira

Max Out Your Retirement Plan Contribution

In 2020, the maximum amount you can contribute to your 401 plan is $19,500. If youâre 50 or older, youâre eligible to make âcatch-upâ contributions up to an additional $6,500âfor a maximum possible 401 contribution of $26,000.5 Those contribution limits remain unchanged for the 2021 tax year.6

When you max out your 401 plan, you not only save more for retirement, you potentially pay less in taxes that year since your taxable income would be lowered. Thatâs because all contributions to your 401 plan are taxed when they are withdrawn, not when they are made.

To max out your 401 plan in 2020 or 2021, youâll first need to calculate the percentage of your annual pay that adds up to $19,500 or $26,000 . For example, a 42-year old worker earning $140,000 annually would need to contribute approximately 13.9% of her salary to a 401 plan to max out in either year. Make sure to adjust your deferral rate after you receive a raise or bonus to avoid exceeding the 401 contribution limit.

Most Retirement Income Projections Don’t Incorporate Market Moves

Basic compounding calculators may be a good starting point, but they omit a key part of the retirement planning equation: markets go up and down. A Monte Carlo analysis takes market volatility and cash flows into account to get closer to determining a risk-adjusted withdrawal rate.

Financial planning is a complex and highly personalized process. Its art and science. To help investors understand some of the factors they should consider, weve run a Monte Carlo analysis in specialized financial planning software for a hypothetical couple to illustrate how maxing out a 401 could translate into retirement income.

Important note: The information contained in this article is for illustrative purposes only and should not be misconstrued as the rendering of personalized recommendations, financial or investment advice, nor is it intended to provide a sufficient basis on which to make any financial or investment decisions. If you have questions about your personal financial situation, consider speaking with a financial advisor.

Assumptions made in the hypothetical analysis:

Results:

Also Check: How Do I Stop My 401k

Take Your 401 With You

Most people will change jobs more than half-a-dozen times over the course of a lifetime. Far too many of them will cash out of their 401 plans every time they move. This is a bad strategy. If you cash out every time, you will have nothing left when you need itespecially given that you’ll pay taxes on the funds, plus a 10% early withdrawal penalty if you’re under 59½. Even if your balance is too low to keep in the plan, you can roll that money over to an IRA and let it keep growing.

If you’re moving to a new job, you may also be able to roll over the money from your old 401 to your new employer’s plan, if the company permits this. Whichever choice you make, be sure to make a direct transfer from your 401 to the IRA or to the new company’s 401 to avoid risking tax penalties.

Now Youre Ready To Make A 401 Rollover Decision

401s and IRAs can offer dramatically different investments, fees, and features. Their variability is why making the right 401 rollover decision is so important. Choosing an overpriced 401 or IRA now could set your retirement back years.

Need further assistance evaluating your 401 rollover options? Talk to a fiduciary-grade investment adviser. While brokers and insurance agents can give conflicted rollover advice that puts their interests ahead of yours, an investment adviser is obligated by law to give impartial advice thats in your sole best interest.

Recommended Reading: What Happens When You Roll Over 401k To Ira

Earmark Savings For Each Goal

Now that you know how much you can afford to save each month, youre ready to decide how much money to direct to each of your savings goals. If, for example, you are planning a wedding for next year, you might choose to devote the majority of your earmarked savings to that purposeat least until you have enough to fund the event. Once you reach that goal, perhaps youll decide to put half of those monthly savings toward retirement, and the other half into your emergency fund. Or perhaps youll set your sights on a home renovation, or a special trip.

There are even some bank accounts, such asEQ Banks Savings Plus Account, with digital tools that let you create virtual envelopes so you can set and track each of your various savings goals all in one place.

How To Produce Investment Income Forever

One way to figure out how much wealth you need to accumulate to reach your financial goals is to determine how much investment income you want it to provide you per year.

A common rule of thumb is to withdraw no more than about 4% per year if you want your portfolio to last forever.

Thats not a perfect rule but its a good starting point.

Heres a table that shows how much withdrawn investment income that different portfolio sizes can generate at different annual withdraw rates:

The ones highlighted in green are fairly safe, but once you start withdrawing more into yellow or red territory, your chances of eroding your principal increase.

In reality, your withdraw rate depends on what rate of return your portfolio delivers. If you have a portfolio invested entirely in bonds and treasuries that provide you a rate of return of 2.5% per year, and inflation is 2% per year, then of course you cant withdraw 4% per year without reducing your principal.

If US stocks only grow at 5% per year over the next decade, then the general rule of withdrawing 4% per year will be too aggressive, since inflation will be eating away your principal faster than it replenishes itself.

If you want your portfolio to last forever, then subtract the approximate inflation rate from your portfolios expected rate of return, and dont withdraw more than the remaining number.

Max withdraw rate = Annual RoR Annual Inflation Rate

So, stick to this to be safe:

You May Like: Why Cant I Take Money Out Of My 401k