Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Investment Options With Self

Once the rollover is complete, you will be ready to start making some new investment choices. With the wealth already accumulated through your former 401, you can invest in many options with a Self-Directed IRA, such as:

- Real estate, including apartments, single family homes, commercial properties, or undeveloped land

- Limited Liability Companies

- Equipment leasing

- Other investments options

With such a varied list of alternative investments, you can build a strong, versatile portfolio that will utilize the funds you accumulated with your previous employer 401 while also enjoying the benefits of a Self-Directed IRA. To learn more about how to set up a new Self-Directed IRA, contact us for a free consultation today.

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why it’s also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

Recommended Reading: How To Get Your 401k Without Penalty

Givemethegoldcom: Gold Investing And Retirement Planning

Affiliate Disclosure: The owners of this website may be paid to recommend the following companies: Goldco, Augusta Precious Metals, Noble Gold Investments, Birch Gold, and Regal Assets. The content on this website, including any positive reviews of the mentioned companies, and other reviews, may not be neutral or independent.

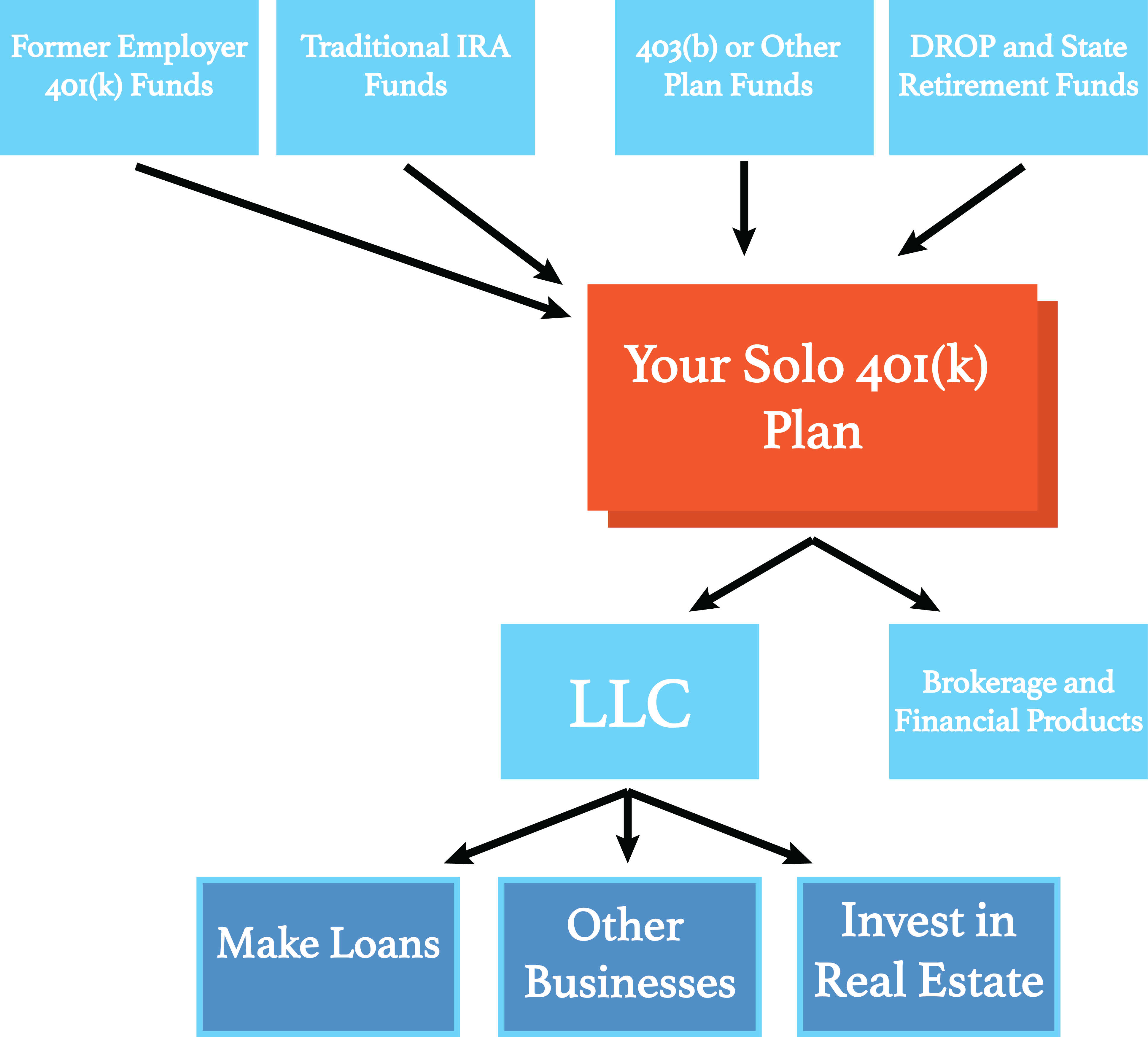

How To Rollover Real Estate From The Self

Lean how to rollover real estate from a self-directed IRA into your new self-directed Solo 401k plan with checkbook control

Rolling over from a self-directed IRA to the Solo 401k is a fairly straightforward process, but youll want to work with your current IRA custodian to ensure the process goes smoothly.

Each custodians process varies slightly. Weve included some best practices recommended from well-known custodians below:

Recommended Reading: Can You Roll A 401k Into A Roth

Rollover Vs Cashing Out

First things first, the temptation to just cash out your existing 401K may be hard to resist but should be avoided at all costs. Not only will cashing out your retirement savings slow the growth of your account, but it will also make your money susceptible to an early withdrawal penalty by the IRS of up to 10% of your total saved funds. You should also be prepared to pay between 7%-25% for state and federal income taxes. These fees will whittle away at your retirement savings, not making it worth the short-term cash-out.

Rolling over your account from one custodian to another will prevent the IRS, state, and federal fingers out of your savings account. Each custodians process and rules can vary, but the IRS gives account holders 60 days after distribution to deposit funds into a new account.

Why Roll Over An Ira Into A 401

There are a few reasons you might want to roll a traditional IRA into a 401, though it should be noted you can do this only if your company plan accepts incoming transfers . Here are the pro IRA-to-401 rollover highlights:

-

Potential for earlier access to that money: If you leave your job, you could start tapping your 401 as early as age 55. Qualified distributions from traditional IRAs cant begin until 59½ unless you start a series of substantially equal distributions a commitment to take at least one distribution per year for at least five years or until you turn 59½, whichever comes last. The distribution amount is based on IRS calculation methods that take into account your IRA balance, age, life expectancy and, in some cases, interest rates. It could mean taking more than you need, for longer than you want to.

Compare costs among your retirement plans to find out where youre getting the better deal.

» See how a 401 could improve your retirement: Try our 401 calculator.

Read Also: How To Withdraw Money From My Fidelity 401k

How To Pick An Ira To Roll Over To

The most important question you need to ask is whether you want to start a traditional IRA or a Roth IRA. Traditional IRAs work much like traditional 401 plans. You contribute money before you pay taxes. The 2021 maximum contribution limit for traditional and Roth IRAs is $6,000.

With a traditional IRA, the money you contribute is deducted from your taxable income for the year. When you reach retirement, the money is taxable as you withdraw it. A Roth IRA, however, works differently. You contribute money post-taxes. The money is then not taxable when you withdraw it in retirement. If you think you might want to keep contributing to your new IRA after the rollover is complete, its important to decide which type of IRA you want.

Its also important to consider the tax implications. If you have a traditional 401 plan, that means you didnt pay taxes on the money when you contributed it to your account. If you want to move that money into a Roth IRA, youll have to pay taxes on it. You can roll over from a traditional 401 into a traditional IRA tax-free. Same goes for a Roth 401-to-Roth IRA rollover. You cant roll a Roth 401 into a traditional IRA.

Rolling Over A 401k To A Self

A rollover is a transfer of funds from one retirement savings account to another retirement savings account type. The reason that you may want to roll over an account can range from dissatisfaction with the performance of your current account, a change in employment, or maybe youve inherited an IRA. Regardless of your reason, there are rules that the IRS has made clear need to be followed so that no penalties or fees come your way.

Read Also: How Do I Know If I Have A 401k

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

Rolling Over Your 401 To A Traditional Ira Vs A Roth Ira

You have the option of rolling your 401 into either a traditional IRA or a Roth IRA. One isnt better than the other, and ultimately its up to you and your investment goals.

You do have to worry about a few things, though, and the major difference is this: Roth IRAs require after-tax contributions. If youre rolling over money from a traditional 401, then you havent paid taxes on that money as it came out of your salary before you got your paycheck. As a result, rolling your traditional 401 balance over to a Roth IRA will require you to pay income taxes on the entire balance in the year that you do the rollover. This could mean thousands of dollars in taxes. So just be cautious of this.

However, rolling a traditional 401 into a traditional IRA is easier, since both contain pre-tax dollars. You dont have to worry about triggering a taxable event.

On the same note, a Roth 401 and Roth IRA are both funded with after-tax dollars, meaning rolling one into the other wouldnt require a tax payment.

Paying income taxes by rolling a traditional 401 into a Roth IRA isnt necessarily a reason not to do it: Roth IRAs can be a powerful retirement savings tool, and some investors may prefer to pay the tax bill now for the benefit of withdrawing the money tax-free during retirement.

But whatever decision you make, its important that you understand the consequences and have your budget ready.

Read Also: How Much In 401k To Retire

Rolling Over To A New 401

If youre moving to a different employer that also offers a 401, then you might consider rolling your balance over to the new company. The benefit of this option is the simplicity youll have just one retirement account to keep track of, rather than multiple accounts.

In most cases, this type of rollover can be as easy as filling out a few online forms, and the companies that manage your 401s can usually take care of things on their end.

This process is most frequently initiated by paperwork from the receiving 401 plan, Deering says. For example, if my 401 was at T. Rowe Price and I wanted to roll over an older 401 plan I had at Fidelity, I would contact T. Rowe Price to get their rollover paperwork and submit it to Fidelity to make the check distribution.

Can I Rollover Or Transfer Myexisting Retirement Account To Aself

|

Transfer/Rollover |

|

|---|---|

|

I have a 401 account with a former employer. |

Yes, you can rollover to a self directed IRA. If it is a Traditional 401, it will be a self-directed IRA. If it is a Roth 401, it will be a self-directed Roth IRA. |

|

I have a 403 account with a former employer |

Yes, you can roll-over to a traditional self-directed IRA. |

|

I have a Traditional IRA with a bank or brokerage. |

Yes, you can transfer to a self-directed IRA. |

|

I have a Roth IRA with a bank or brokerage. |

Yes, you can transfer to a self-directed Roth IRA. |

|

I dont have any retirement accounts but want to establish a new self-directed IRA. |

Yes, Yes, you can establish a new Traditional or Roth self-directed IRA, and can make new contributions according to the contribution limits and rules found in IRS Publication 590. |

|

I have a 401 or other company plan with a current employer. |

No, in most instances your current employers plan will restrict you from rolling funds out of that plan. However, some plans do allow for an in-service withdrawal if you are at retirement age. |

Recommended Reading: How Do I Find Out Where My Old 401k Is

Moving The Funds Into An Ira

If you were a part of a 401 plan at your previous employer, one of the most common options available to you on what to do with the funds is being able to move the funds into an IRA at a new custodian. When you leave your job, you have the ability to continue investing those funds on your own in an IRA or Self-Directed IRA, and when moving those funds to another qualified retirement account, you dont experience any tax hits.

One thing you would want to consider is what type of investment you plan on doing because this will help you determine the perfect custodian for your needs. Some Americans choose to put their money in a regular IRA and hand their money to a financial advisor at a public custodian to make all the decisions about their account for them. Others choose to take control and invest with a Self-Directed IRA at a non-traditional custodian that will hold private assets.

You may be thinking about what the difference is between those two types of IRAs. A Self-Directed IRA is simply an IRA in which the IRA owner directs all investments in the account. There is no legal distinction between a Self-Directed IRA and any other IRA except with a truly self-directed IRA the account agreement allows the broadest possible spectrum of investments, which could include real estate and private or start-up companies. Understanding the difference between these two accounts shows that there are many options available just within the first category!

Way #: Initiate Transfer/distribution From Ira Custodian

Read Also: When Leaving A Company What To Do With 401k

How To Complete A Self

Many benefits come with self-directed IRAs, such as having the freedom to invest in whatever you want. However, you may be wondering how you can move money that you have from an older 401 or IRA. Well, its quite simple to roll over or transfer from an existing into a new SDIRA account. If you need some assistance on how to complete a self-directed IRA rollover, we are here to help. Follow our guide on how to do so below.

Why Choose A Self

Self-Directed IRAs are for those who want to be in the drivers seat of managing their retirement. Experienced investors and/or those who have a great interest in investing are often drawn to these accounts, because they allow for alternative investments, such as real estate, private equities, lending money, and much more.

While the IRS does require that you work with a certified IRA custodian, such as our firm IRA Innovations, its this freedom to choose, combined with the tax advantages offered through a Self-Directed IRA that are some of the biggest benefits listed by our clients.

Don’t Miss: How To Grow 401k Fast

What Is A Rollover

First of all, its important to understand what a rollover is before getting started with a self-directed IRA rollover. A rollover is when you move the funds from a qualified fund, such as a 401, 403, 457, or defined benefit, to an IRA. In completing a rollover, youll move more money into your self-directed IRA, so you can have more freedom with your investments. A major benefit of rolling over is that you typically dont pay taxes on that money until you withdraw the funds from a new retirement plan, which means you can continue to save money, tax-deferred. There are several ways you can roll over your account, including the following:

Can I Rollover My Existing 401 Or Ira

Yes, you may rollover most IRA, SEP IRA, SIMPLE IRA , 457, 403, Profit Sharing and other Solo 401s into your eQRP®.

Types of rollovers

IN KIND ROLLOVER

A Self Directed IRA can be rolled into an eQRP. If you have assets inside the Self Directed IRA you can still do the rollover without liquidating those assets. Youre simply doing an IN-KIND rollover moving the assets from the IRA custodian to your plan where youre in control. This is tax free and penalty free.

IN SERVICE ROLLOVER

In some instances you may be able to do a rollover of funds from a 401 at your current employer through whats called an In-Service Distribution. Unfortunately most large employers are highly restrictive and make this nearly impossible. Just ask them if they have an inservice rollover option.

You can also rollover your assets in your self directed IRA into your eQRP with what is called an in-kind rollover

Read Also: Can I Manage My Own 401k

What To Do With Employee Stock

If you have employee stock through your former employer, youll also have to decide what to do with those shares. In the case of stock you already own, Deering advises that it might make sense to sell those shares. At the very least, ensure the stock doesnt make up a disproportionate percentage of your portfolio, as can sometimes happen with employee stock.

According to Deering, the primary consideration is whether theres anything that prevents you from selling the stock. In some cases, there may be lock-up periods that bar you from selling your shares for a particular amount of time. And if youve owned the shares for less than one year, then it makes sense to hold them until the one-year mark when you qualify for long-term capital gains tax treatment.

If you have any remaining stock options, those will likely expire within three months of leaving the company. Whether you choose to exercise those should depend on the current stock price compared to the price your options allow you to purchase them at, as well as how much of the companys stock you already have in your portfolio.