How Can I Find Out My 401k Balance

Over $5.3 trillion is held in 401 plans as of September 2017, according to the Investment Company Institute. If you’re using a 401 to help you save for retirement, it’s important to know how much you have in your plan so you can determine if your savings are in line with the amount you’ll need to fund your golden years. If you don’t receive paper statements with your 401 balance, there are other ways you can check how much you’ve saved.

When You Want To Retire

The age when you plan to leave employment for retirement impacts how much you need to save in your 401 to retire.

The age when you plan to retire has an impact on how much you need to save to retire. Typically, the longer you delay your retirement, the fewer savings you need since you will have fewer years in retirement. Delaying your retirement gives your money more time to grow through compounding.

Though the retirement age has changed over the years, most people retire in their 60âs and 70âs, or even later if they are healthy. If you are young, you might not know when you will retire, but you should have an idea of when to retire so that you can plan how much to save.

If you work in a less stressful job and you are happy in the company, you can extend your retirement by several more years to stash more cash into your 401. For example, if you are 65 and you expect to live healthy until 90, you can work five more years, so that you will have fewer years to live solely on your retirement income.

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your company’s HR department or plan administrator to see if it’s an option for you.

If it is and you decide it’s your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don’t handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers don’t allow you to transfer money out of your 401 if you’re a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

Recommended Reading: How To Take Money From 401k Without Penalty

Check On Your 401 Periodically

As mentioned, it’s essential to check how much is in your 401 throughout the year. Ideally, more than once, however, annual checks are enough.

The reason to monitor your retirement savings is to keep up with your retirement goals. For instance, as you near retirement, you may want to move your money to safer investments like bonds. Or, if one area has over-performed others, you might decide to reallocate your money to limit your exposure to one category.

Typically these drastic swings in your portfolio won’t happen that quickly. But by scheduling an annual check of your 401 balance, you’ll get a good picture of your 401 portfolio.

Tags

Anything Else I Should Know

Yep. A few things, actually.

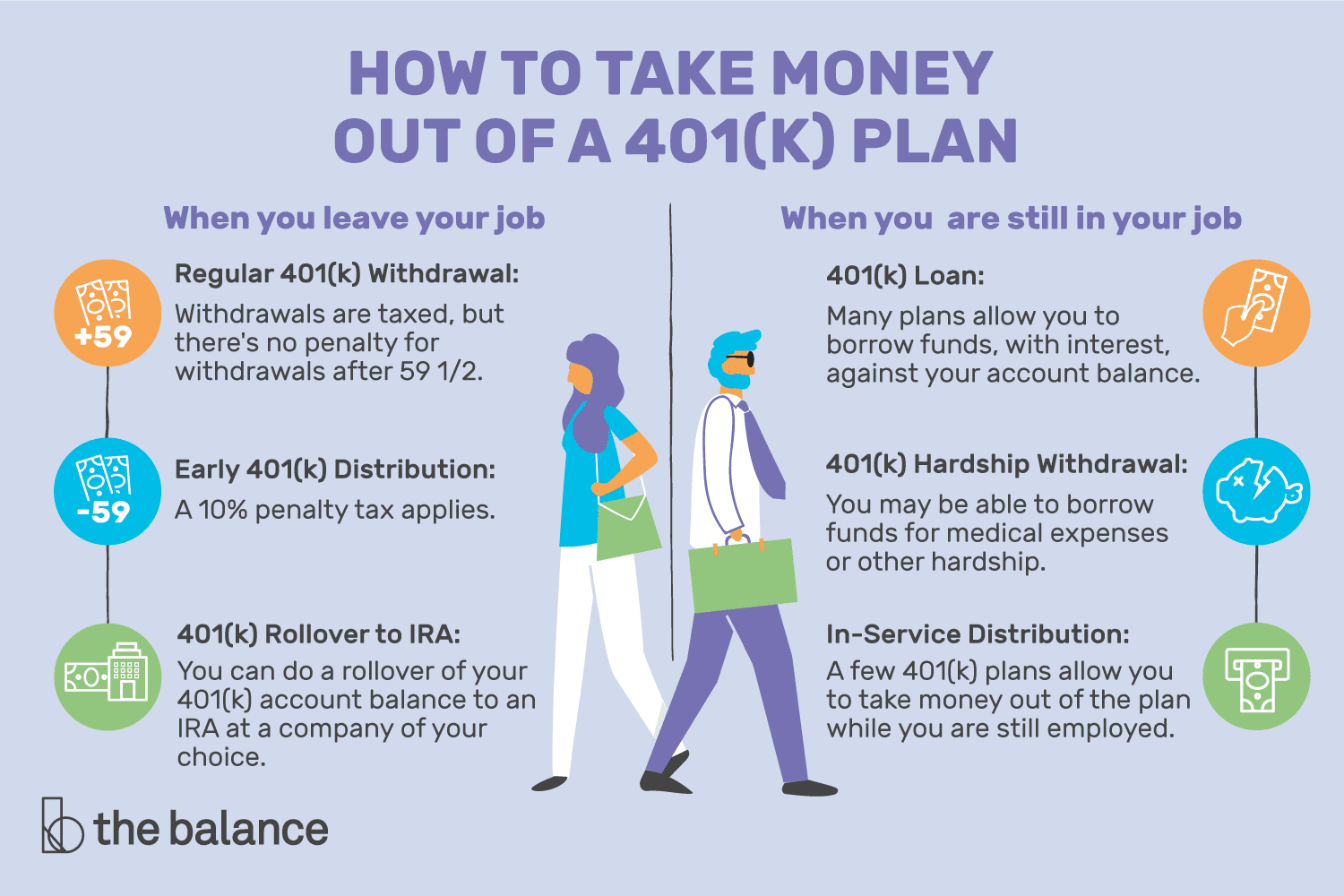

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Recommended Reading: Can An Llc Have A Solo 401k

Vested Versus Unvested Amounts

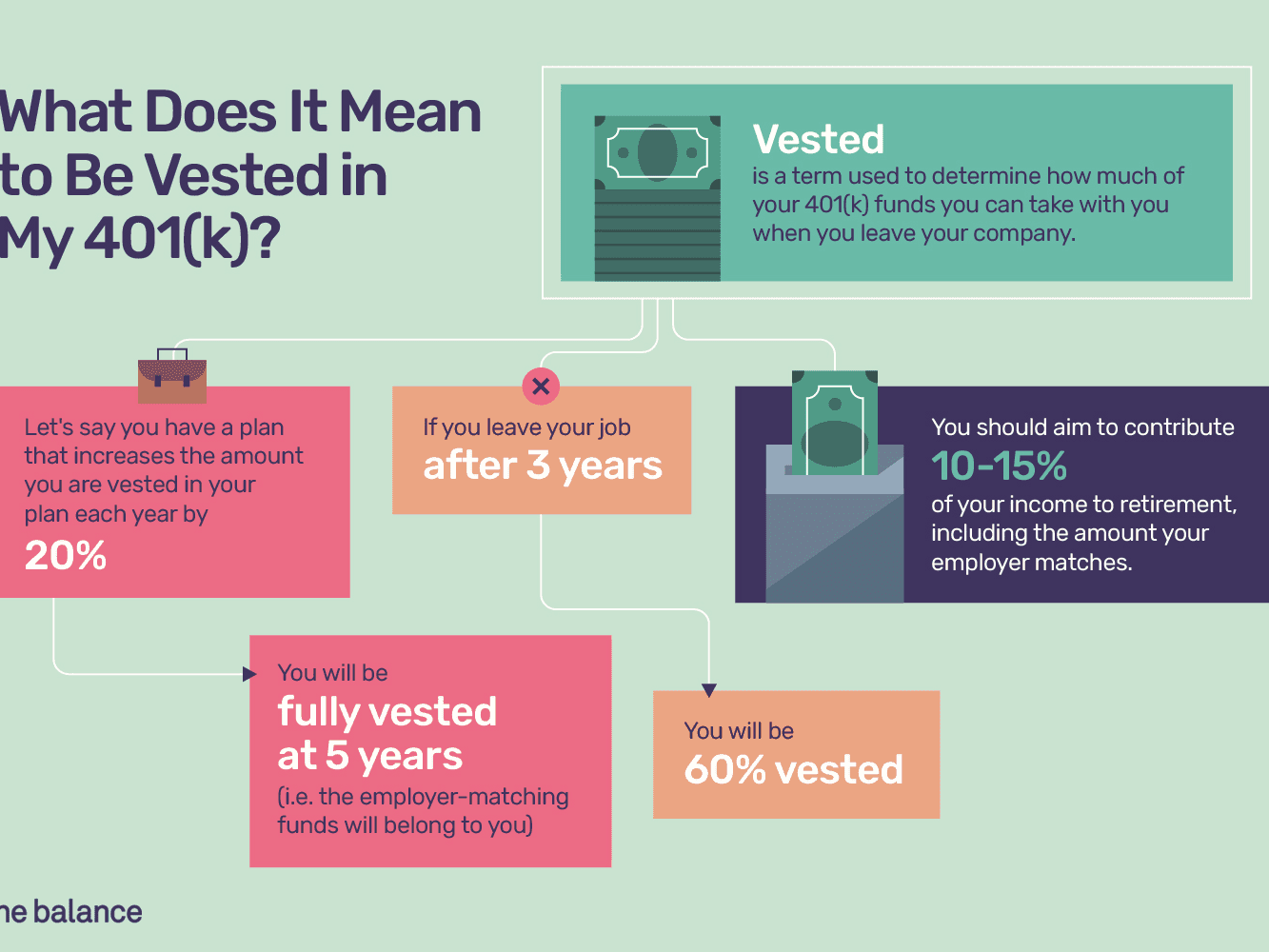

When you find your 401 balance, you might notice that some of the account is vested and some of it isn’t. Amounts that are vested are yours no matter what if you leave the company, you get to take that money with you, but you would lose any unvested amounts. You’re always 100 percent vested in your contributions. However, your employer may make contributions to your 401 plan on your behalf but might put vesting requirements on the money. According to federal law, contributions must vest at least as fast as either the cliff vesting or graded vesting schedules. With cliff vesting, you must be fully vested at the end of three years of service. With graded vesting, you must be 20 percent vested by the end of your second year of service, and must vest an additional 20 percent each year after that, making you fully vested by the end of your sixth year.

Tracking Down Your Plan

If you think youve lost track of a savings plan, search your files for old retirement account statements. These should provide some key data to help your search, such as your account number and contact information for the plan administrator. If you dont have any statements, contact your former employers human resources department.

If your employer filed for bankruptcy, your 401 balance is protected from creditors and is likely still held at the investment company that administered your plan. In the case of a pension, it was either taken over by an insurance company or the federal Pension Benefit Guaranty Corp., which protects traditional pensions. You can track down your pension at pbgc.gov/search-all.

Its also possible that your employer turned over your 401 balance to your states unclaimed property fund. Your states treasury department should offer an online service that lets you search for your money. You can also check the National Registry of Unclaimed Retirement Benefits.

You May Like: How To Borrow From Your 401k

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Other Common Types Of Vesting

Aside from 401s, employers may offer other forms of compensation that also follow vesting schedules, such as pensions and stock options. These tend to work a little bit differently than vested contributions, but both pensions and stock options may vest immediately or by following a cliff or graded vesting schedule.

Don’t Miss: What Is The Difference Between 401k And 403b

What Is Vested Balance

The vested balance is the amount of money that belongs to you and cannot be taken back by an employer when you leave your jobeven if you are fired.

Contributions that you make to your 401 are automatically 100% vested. Vesting of employer contributions typically occurs according to a set timeframe known as a vesting schedule. When employer contributions to a 401 become vested, it means that money is now fully yours.

Being fully vested means that when you leave the company, those employer contributions will remain in your account. It also means that you can decide to roll over your balance to a new account, start making withdrawals, or take out a loan against the account, if your plan allows it. However, keeping a vested 401k invested and letting it grow over time may be one of the best ways to save for retirement.

Youll owe taxes on withdrawals made before age 59 ½, and they may be subject to early withdrawal penalties, plus youll miss out on future growth of those earnings.

Whether a company contribution is vested will depend on what type of contribution it is. Contributions known as safe harbor matches are immediately 100% vested. Employers may make these matching contributions only for employees who themselves make elective deferrals to their account. Or they can make contributions on behalf of all employees whether or not those employees make contributions themselves.

Recommended: How Much Should I Put Towards My 401?

Contact Your Old Employer About Your Old 401

Employers will try to track down a departed employee who left money behind in an old 401, but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If its been a while since youve heard from your former company, or if youve moved or misplaced the notices they sent, start by contacting your former companys human resources department or find an old 401 account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

You may be allowed to leave your money in your old plan, but you might not want to.

If there was more than $5,000 in your retirement account when you left, theres a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like until youre age 72, when the IRS requires you to start taking distributions, but you might not want to. Heres how to decide whether to keep your money in an old 401.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

Don’t Miss: Can I Borrow From My 401k To Refinance My House

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement.

To help you maximize your retirement dollars, the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way. You can contribute up to $19,500 in 2021 and $20,500 in 2022.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

Don’t Miss: How To Invest 401k With Fidelity

What You Can Do Next

To keep track of your retirement accounts, you first must know where they all are. Once you gather all your old accounts in one place and make sure they are properly balanced, its about sticking to the same investment principlesensuring your money is in diversified, low-cost fundsthat you would follow for your current company retirement plan.

For Compliance Use Only:1020356-00003-00

Average 401k Balance At Age 22

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart, compounding interest is no joke.

Recommended Reading: Can You Transfer 403b To 401k

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

How Do I Access My Wells Fargo Retirement Account

Wells Fargo & Company is a self-described community-based financial services company with assets totaling almost $2 trillion. Among the products that Wells Fargo offers its customers, retirement accounts provide a savings vehicle outside other types of savings accounts and workplace retirement plans. Customers can remotely access their Wells Fargo retirement account without making a bank visit.

Tip

In addition to visiting an account representative at your local Wells Fargo branch, you can access your Wells Fargo retirement account by reaching a Wells Fargo representative over the phone, creating an online account or using Wells Fargos mobile app for your smartphone.

Also Check: How Do You Transfer 401k

Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up only takes a couple of minutes and Beagle will help you find all your 401 accounts!

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

Roll It Over Into An Ira

If youre not moving to a new employer, or if your new employer doesnt offer a retirement plan, you still have a good option. You can roll your old 401 into an IRA. Youll be opening the account on your own, through the financial institution of your choice. The possibilities are pretty much limitless. That is, youre no longer restricted to the options made available by an employer.

The biggest advantage of rolling a 401 into an IRA is the freedom to invest how you want, where you want, and in what you want, says John J. Riley, AIF, founder, and chief investment strategist for Cornerstone Investment Services LLC in Providence, R.I. There are few limits on an IRA rollover.

One item you might want to consider is that in some states, such as California, if you are in the middle of a lawsuit or think there is the potential for a future claim against you, you may want to leave your money in a 401 instead of rolling it into an IRA, says financial advisor Jarrett B. Topel, CFP for Topel & DiStasi Wealth Management LLC in Berkeley, Calif. There is more creditor protection in California with 401s than there is with IRAs. In other words, it is harder for creditors/plaintiffs to get at the money in your 401 than it is to get at the money in your IRA.

If you have an outstanding loan from your 401 and leave your job, youll have to repay it within a specified time period. If you dont, the amount will be treated as a distribution for tax purposes.

Read Also: How Much Do You Need In 401k To Retire