And Ira Withdrawals For Covid Reasons

The CARES Act had many provisions that received attention, especially the Paycheck Protection Plan loans and the individual relief checks that went to a majority of Americans. One less-noticed part of the bill, though, changes the way that pre-retirement withdrawals from retirement plans work.

Section 2022 of the CARES Act allows people to take up to $100,000 out of a retirement plan without incurring the 10% penalty. This includes both workplace plans, like a 401 or 403, and individual plans, like an IRA. This provision is contingent on the withdrawal being for COVID-related issues. The following reasons are permitted for making these special withdrawals:

- You have been diagnosed with COVID-19

- Your spouse or a dependent has been diagnosed with COVID-19

- You have financial issues because of being quarantined, furloughed or laid off due to COVID-19

- You have financial issues because you cant work due to a lack of childcare caused by COVID-19

- Youre experiencing financial hardship because the business you own or operate had to close or reduce hours

This is obviously a fairly broad set of circumstances. Essentially, if youre having a hard time financially because of circumstances caused by the pandemic, youre likely to qualify for these early withdrawals.

Withdrawals After 59 1/2

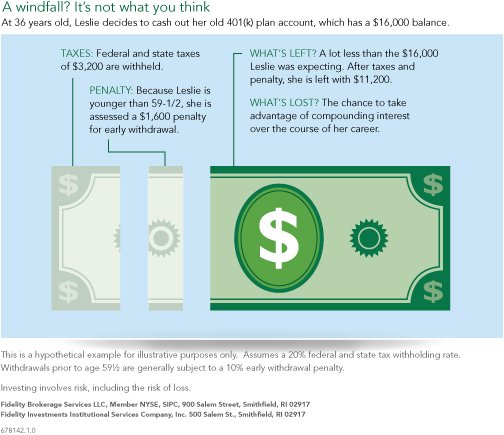

To encourage retirement saving, the IRS slaps you with a 10 percent penalty if you siphon money from your 401 before reaching 59 1/2, even if you can prove a financial hardship. This is on top of regular income taxes on the withdrawal. While the penalty disappears after 59 1/2, you’ll still be liable for the income taxes. If you have a Roth 401 account, the contributions are made with after-tax dollars. Roth withdrawals are tax-free, as long as you’ve had the account open at least five years.

Early Withdrawals From Roth Retirement Accounts

You may be able to withdraw funds from Roth retirement accounts early without penalties, too.

In general, you can withdraw only the money you contributed without paying taxes or penalties. This is because you already paid income taxes on this money.

Things get more complicated if you withdraw earnings early. In some cases, you can withdraw earnings penalty and income tax free, too.

To withdraw earnings from a Roth IRA without paying penalties or income tax, you must take the withdrawal:

- at least five years or more after you open the account, and

- be withdrawing money because you suffered a disability, or

- youre using up to $10,000 for a first home purchase within 120 days of withdrawal.

Read Also: How Much In 401k To Retire

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the bank or brokerage firm with instructions to roll the money into your IRA, 401, or 403.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your employer is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401, 403, or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money, but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401, 403.

Consult A Fiduciary Fee

If you feel lost, don’t be afraid to talk to a professional to get advice about your specific situation.

Look:

A fiduciary fee-only financial planner charges a flat rate for services. Other advisors may charge a commission or a percentage of assets under management.

Both types of financial planners can help draft a financial plan. This plan can help you meet your retirement goals.

However, using a fee-only fiduciary adviser can provide a plan without paying ongoing fees or biased advice.

Recommended Reading: How Do You Take Money Out Of 401k

You Want To Prepare For Retirement But Exactly How Much Should You Contribute To Your 401

Many companies featured on money advertise with us. Many of the offers appearing on this. Early distributions from a 401 plan can trigger penalties that can be avoided with certain hardship distributions. If you withdraw money from your 401k before retirement, you could face taxes and penalties, which usually make it not a good idea. No matter how much money you earn in your 401k, you won’t have to worry about paying taxes on those gains. We’ve got all the details you need. Best credit monitoring services how to get your free credit report how to read & understand your credit repor. Here’s what to know before you do many companies featured on money advertise with us. There are also changes to the 401k hardship withdrawal rules you should kno. Even though you’re leaving the country, irs tax rules will follow your plan wherever y. Check out the basic protections and benefits offered by the coronavirus aid, relief, and economic security act to see if you might qualify. Just like in hockey, there can be penal. The fidelity suite of products offer a wide range of services that help individuals do everything from saving for retirement to investing extra money to trade on the stock market.

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

You May Like: How Do I Transfer My 401k To A Roth Ira

Pick The Right 401 Withdrawal Reasons

While the IRS may allow you to make a hardship withdrawal, that doesnt mean youll escape the 10 percent penalty tax .

Only certain kinds of early withdrawals escape the penalty tax, including the following:

- Medical expenses above 10 percent of adjusted gross income

- Permanent disability of the account owner

- A series of substantial equal periodic payments from the account

So if they need the money for other hardship reasons , account owners will still end up paying the 10 percent penalty tax.

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived.

Also Check: Can You Roll A Traditional 401k Into A Roth Ira

Sra Age 59 Withdrawal

If you have a 403 SRA with TIAA or Fidelity, or both, you may withdraw your accumulations while you are still working for the university starting at age 59½. Income tax will be due on the amount you cash out SRA amounts). TIAA and Fidelity Investments are required by federal regulations to withhold 20% of the amount of the withdrawal for income tax purposes. There is no IRS 10% early withdrawal penalty on a withdrawal made at or after age 59½.

To arrange for a withdrawal, contact TIAA or Fidelity and request a 403 SRA withdrawal application.

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Read Also: How To Pull From 401k

Cashing Out A 401 Due To Covid

Even before COVID-19, people turned to retirement plans as a funding source for paying off medical bills, settling a bankruptcy or getting out of debt. For many, it was a last resort due to having to meet specific requirements, pay an early withdrawal penalty of 10% and navigate their retirement plans complex withdrawal rules.

The Coronavirus Aid, Relief and Economic Security Act, which was signed into law earlier this year, eased some of these restrictions. One section of the law relaxes existing 401 withdrawal rules to provide additional support for Americans who have been affected by the virus. If youre considering cashing out a 401 during COVID-19, learn more about the law and how it affects you.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Also Check: How To Find My Fidelity 401k Account Number

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Make Sure To Consider Tax Consequences

Now that you understand the major buckets you can withdraw retirement funds from, you must come up with a strategy to do so.

One of the major things to consider is how each type of withdrawal will impact your taxes.

You have to take RMDs, so youll have to pay income tax on that money. After that, you can explore the types of investment accounts you have.

Make a plan to withdraw money from the different types of accounts to keep your tax bill as low as possible over the long-term. This may mean you need to have a spending plan for the future to know how much income youll need each year.

A spending plan can help you determine when its most advantageous to withdraw money from each account.

The plan can offer guidance for when withdrawing from tax-free Roth accounts or when withdrawing from a traditional retirement account makes more sense.

You May Like: How To See How Much 401k You Have

Make A 401 Withdrawal

Your second option would be to make a direct withdrawal from your 401 account. As mentioned above, this is the less desirable of the two options.

An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover an immediate and heavy financial need as a hardship withdrawal. Whether or not the purchase of a home using your 401 counts as a hardship withdrawal is a determination that falls to your employer, and you will need to present evidence of hardship before the withdrawal can be approved.

Regardless, you will still likely incur the 10% early withdrawal penalty. There are exemptions in place for specific circumstances, including home buying expenses for a principal residence. Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely wont qualify for an exemption. Even if you do, your withdrawal will still be taxed as income.

How To Withdraw Money From 401s And Iras During Retirement

If youve built a nest egg big enough for retirement, congratulations!

You may have thought saving enough to retire would be the hardest part.

Now:

For some people, figuring out how to withdraw from a 401, IRA or other retirement savings is more difficult.

Once you understand some basic concepts, things become more clear.

Read Also: Can Business Owners Have A 401k

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

Whats The Perfect Way To Withdraw Funds

The perfect way to withdraw the money needed to fund your retirement is a unique solution for you.

Remember to take RMDs if youre required to.

After that, there are plenty of options you can mix and match based on the types of accounts you hold.

Keep in mind:

Youll need the money to fund your entire retirement.

Dont use up all of your tax advantages in the beginning unless thats what makes the most financial sense for you.

Read Also: How Does Taking Money Out Of 401k Work

Accessing Money Before Traditional Retirement Age

But what happens if you retire before age 59 ½? Can you access your money early without penalties?

You could use the 401 option discussed above.

Unfortunately:

You must retire from the company with the 401 in the calendar year you turn 55 for this to work.

If the 401 option doesnt work for you, there is another option called Rule 72. This rule requires you to follow strict guidelines. That said, it allows you to take penalty-free withdrawals from traditional retirement accounts.

To do so, you must take substantially equal periodic payments.

How Do You Withdraw Money From A 401 After Retirement

To withdraw money from your 401 after retirement, you’ll need to contact your plan administrator. Depending on your company’s rules, you may be able to take your distributions as an annuity, periodic or non-periodic withdrawals, or in a lump sum. Your plan administrator will let you know which options are available to you. You can typically have funds deposited into an account or have your plan send you a check.

Recommended Reading: Can I Manage My Own 401k

Finding The Right Withdrawal Strategy

Let’s start with a key question that many retirees ask: How long will my money last in my retirement?

As a starting point, Fidelity suggests you consider withdrawing no more than 4-5% from your savings in the first year of retirement, and then increase that first year’s dollar amount annually by the inflation rate. But from which accounts should you be taking that money?

Traditionally, many advisors have suggested withdrawing first from taxable accounts, then tax-deferred accounts, and finally Roth accounts where withdrawals are tax-free. The goal is to allow tax-deferred assets to grow longer and faster.

For most people with multiple retirement saving accounts and relatively even retirement income year over year, a better approach might be proportional withdrawals. Once a target amount is determined, an investor would withdraw from every account based on that accounts percentage of their overall savings.

The effect is a more stable tax bill over retirement and potentially lower lifetime taxes and higher lifetime after-tax income. To get started, consider these 2 simple strategies that can help you get more out of your retirement savings, depending on your personal situation.