Tip : Tax Rateshigher Now Or Later

Retirement accounts like 401s, 403s, and IRAs have a lot in common. They all offer tax benefits for your retirement savingslike the potential for tax-deferred or tax-free growth. The key difference between a traditional and a Roth account is taxes. With a traditional account, your contributions are generally pretax. They generally reduce your taxable income and, in turn, lower your tax bill in the year you make them. On the other hand, you’ll typically pay income taxes on any money you withdraw from your traditional 401, 403, or IRA in retirement.

A Roth account is the opposite. Contributions are made with money that has already been taxed , and you generally don’t have to pay taxes when you withdraw the money in retirement.1

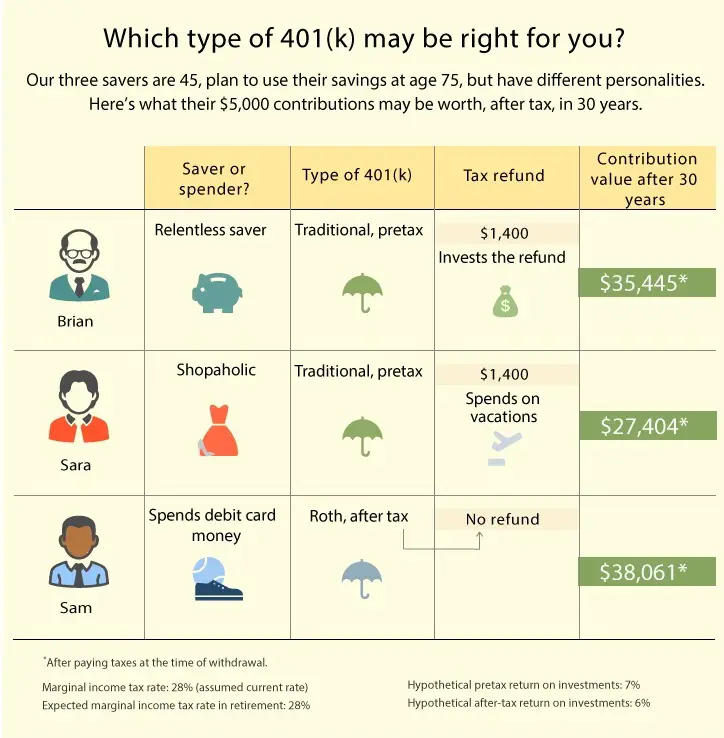

This means you need to choose between paying taxes now or in retirement. You may want to get the tax benefit when you think your marginal tax rates are going to be the highest. In general:

You Want To Pass Along Tax

A Roth 401 can play a valuable role in your estate plan. With a traditional 401, your heirs will need to pay taxes on distributions just as you would. And, depending on your asset balance, this could generate a significant tax bill.

By choosing a Roth, you remove this tax burden for the loved ones who will inherit your 401. Plus, if you don’t plan to use the funds yourself, you can roll a Roth 401 into a Roth IRA to get around the age 72 minimum distribution requirement.

You Need To Make Withdrawals Within 5 Years Of Opening Your 401

Unlike a Roth IRA, a Roth 401 is actually less flexible when it comes to the timing of withdrawals than its traditional 401 counterpart.

You can begin making withdrawals from a traditional 401 penalty-free at age 59 ½. However, with a Roth 401, you’ll need to wait at least five years from opening your account, regardless of how old you are, to avoid taxes and penalties . So if you open the account at age 58, you won’t be able to make tax-free withdrawals until you reach age 63.

For twenty- and thirty-something workers, this won’t be a concern. But if you’re getting a late start on retirement savings or you’ve started working for a new employer near age 59½, you may want to stick with a traditional 401 to avoid this 5-year rule.

You May Like: What Is A Good Percentage To Contribute To 401k

You Can Withdraw Your Contributions From Either Plan At Any Time Tax

There is another unique feature of Roth accounts, and it applies to both Roth IRAs and Roth 401s. That is, you can withdraw your contributions from a Roth plan at any time, without having to pay either ordinary income tax or the 10% early withdrawal penalty on the distributions.

This is in part because Roth IRA contributions are not tax-deductible at the time they are made. But its also true because of IRS ordering rules for distributions that are unique to Roth plans. Those ordering rules enable you to take distributions of contributions, ahead of accumulated investment earnings.

There is some difference in exactly how early distributions are handled among Roth IRAs and Roth 401s.

Early distributions from Roth IRAs enable you to first withdraw your contributions which were not tax-deductible and then your accumulated investment earnings once all of the contributions have been withdrawn. This provides owners of Roth IRAs with the unique ability to access their money early, without incurring tax consequences.

With Roth 401s the contribution portion of your plan can also be withdrawn free of both ordinary income tax and early withdrawal penalties. But since theyre 401s, theyre also subject to pro-rata distribution rules.

If you have a Roth 401 that has $20,000 in it, comprised of $14,000 in contributions and $6,000 in investment earnings, then 30% of any early distribution that you take, will be considered to represent investment income.

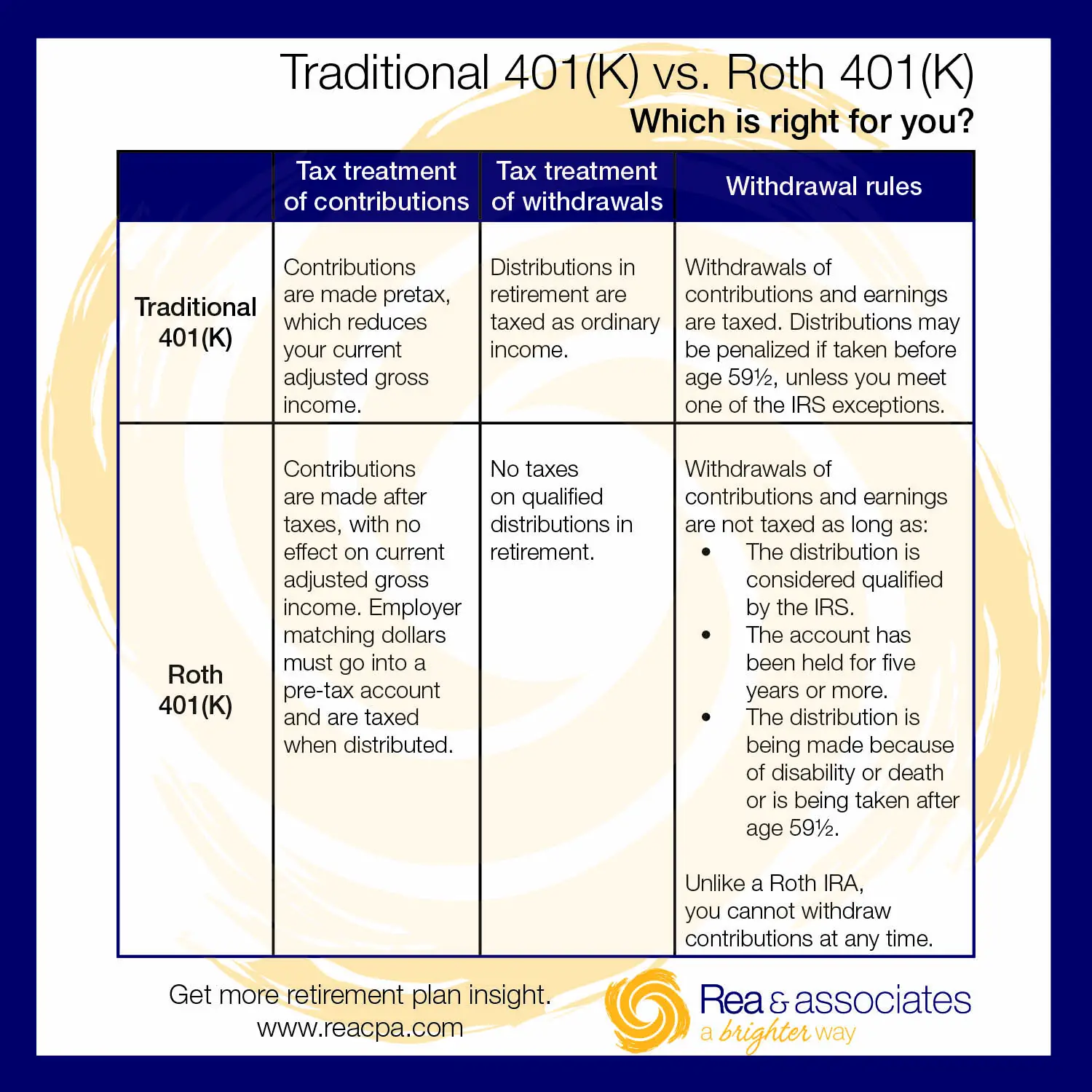

As More Employers Offer Both Retirement Plans Its Important For Employees To Know The Difference

More and more employers are adding Roth options to their 401 plans. If you recently gained the option to save in a Roth account, you may need to examine the advantages and disadvantages of a Roth 401versus a traditional 401.

The biggest difference between a Roth account and a traditional 401 account is how youâre taxed. With a traditional 401, youâll save on income tax now and pay income tax on your withdrawals in retirement. With a Roth 401 youâll pay income tax on your contributions, but no tax when you withdraw funds from the account. However, there are several caveats to consider.

Donât Miss: How Do I Withdraw Money From My 401k Fidelity

Don’t Miss: How To Move Money From One 401k To Another

Traditional 401 Vs Roth 401

|

Yes, but funds go into traditional 401 account |

One thing to keep in mind is if your employer matches a portion of your traditional 401 contributions, there’s a strong chance that it may offer the same match for your Roth 401 contributions as well.

However, the money that your employer contributes will still go into a traditional 401 even if you opt for a Roth. These contributions are classified as pre-tax dollars and will be taxable when you withdraw from them.

Common 401 Management Errors To Avoid

Cashing Out Too Soon

The worst thing you can do with an existing IRA is to withdraw funds before retirement. This is the final option for these savings, as they are difficult to replace later in your career. At all costs, you should avoid taking this path.

Investing Too Little to Get Maximum Matching Funds

The IRS has some of the most stringent requirements in terms of what you must do to qualify for their matching funds, but many firms have far more stringent standards. One typical error is not saving enough money, which lowers or eliminates your employers contribution amount.

Before you sign on, double-check the firms withdrawal criteria. This policy should be clearly stated in your strategy if it is not, ask for clarification. If you have made a mistake and do not realize it, act swiftly to correct it.

Taking 401 Loans

In a difficult job climate, it can be nearly as bad to take loans on your 401 as simply cashing it out and reinvesting elsewhere. The restrictions on what you are allowed to withdraw funds for can be exacting. In addition to the amount of principal removed from your account, there is an interest rate that you will be responsible for paying back.

Investing Too Aggressively

The majority of 401 plan losses in 2008 were caused by aggressive investing. When several plans fell at the same time, some investors focused on unsecured debt or junk bonds, which made them fall even more.

Rolling Over Into IRA Savings

Recommended Reading: What To Do With 401k

Roth 401 Withdrawal Rules

There are three types of withdrawals from a Roth 401: qualified distributions, hardship distributions and non-qualified distributions. Each type has its own rules, pros and cons.

You can start making qualified distributions from a Roth 401 once youve satisfied two conditions: Youre age 59 ½ or older and youve met the five-year rule. This rule states that you must have made your first contribution to the account at least five years before making your first withdrawal. Note that if you retire and roll your Roth 401 balance into a Roth IRA that has been open for more than five years, the five-year requirement is met.

For example, if you started contributing to a Roth 401 at age 58, you would have to wait until you were 63 to begin making qualified distributions.

There are a few other conditions that allow you to withdraw money from your Roth 401 due to hardship, depending on the rules of your plan. These include:

- To pay for medical expenses that exceed 10% of your adjusted gross income.

- You become permanently disabled.

- If youre a member of a military reserve called to active duty.

- If you leave your employer at age 55 or older.

- A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation.

Additionally, if you die, the full amount in your Roth 401 can be distributed to your named beneficiaries without penalty.

Can I Contribute To Both A 401 And A Roth 401

If you want to take advantage of the benefits of a traditional 401 and a Roth 401, you can do so. For example, you could make contributions for the first half of the year into the Roth version to take advantage of its tax-free withdrawals in retirement and use the second half of the year to get benefits from the traditional 401 plans tax breaks on contributions. Or you could alternate years, using the Roth plan one year and the traditional plan the next. Either way, your plans administrator will track and categorize your contributions appropriately for tax purposes.

Regardless of which 401 plan you choose or if you choose both your total contributions in any single year are limited to the annual maximum That maximum does not include any employer match on your contributions, however. So the match counts as a bonus above and beyond your own personal contributions. With this employer contribution, the maximum you can put into the account is $61,000, or $67,500 for those 50 and over.

Don’t Miss: When Can I Start Drawing From My 401k

Roth 401 Vs Roth Ira: An Overview

There is no one-size-fits-all answer as to which is better, a Roth 401 or a Roth individual retirement account . It all depends on your unique financial profile: how old you are, how much money you make, when you want to start withdrawing your nest egg, and so on. There are advantages and disadvantages to both.

Here are the key differences you should consider when comparing the two types of Roths.

Issues With 401 Plans

Despite the fact that 401 plans have become the de facto standard of retirement savings in the United States, there are still issues with 401 plans that investors at all income and participation levels should be aware of. Many employees are carefully considering and deciding what to do with their retirement investments following a substantial decline in many plans value for the first time in many years.

Given that the expected rate of saving is anticipated to drop during a lengthy recession, performance of 401 accounts and fund managers capacity to be suitably defensive or reactive may be hampered by changing circumstances. Knowledge is a powerful weapon.

Transferring 401 Earnings

It can be challenging to move your 401 plan to a new employer. Along with the complicated tax paperwork that needs to be organized and filed you will also have to coordinate actions with your former employers.

When changing jobs, it is always advisable to consider the financial situation and your options to see if your money would be better off staying where it is. Naturally, doing all of this requires time and effort from a lot of people who are not used to investing either in speculative financial matters. That is the main reason why so many people have their investments managed by professionals.

Hidden Costs

401 management fees have risen steadily since the early 2000s, as have several of the unpleasant problems with account transparency.

Common Transparency Issues

You May Like: How To Make 401k Grow Faster

Compared To A Roth 401

A traditional 401 and a 401 Roth account haveseveral similarities. Like a traditional 401, the Roth 401 limits are$19,000 per year if you are under age 50 and $25,000 per year if you are olderthan age 50. The higher Roth 401 contribution limits after age 50 arebecause of catch-up contributions of an additional $6,000 per year.

Both types of accounts have required minimumdistributions when you reach age 70 1/2. However, a Roth 401 differs in whenyou will be assessed taxes. Since the contributions are made after tax, youwill not pay taxes when you take disbursements.

When you compare a Roth 401 vs. a Roth IRA, you willnotice that both have contributions made on an after-tax basis, and neitherwill subject you to taxes when you take distributions. However, a Roth 401vs. a Roth IRA has higher annual contribution limits. The Roth 401contribution limits are the same as the contribution limits of a traditional401. Another difference is that a Roth 401 has requiredminimum distributions beginning at age 70 1/2 while a Roth 401 does not haveany required minimum distributions.

A Couple Of Added Thoughts

Like a traditional 401and unlike a Roth IRAyou do have to take a required minimum distribution from a Roth 401 unless you’re still working for that employer. The SECURE ACT of 2019 raised the age for taking an initial RMD to 72 beginning in 2020 for individuals not already 70½ .

It’s possible to eliminate that requirement by rolling over your Roth 401 into a Roth IRA. But before you make that decision, you should carefully consider others factors such as fees, legal protection, loan provisions and other particulars of each account.

If you’re thinking even farther ahead to estate planning, inheriting money in a Roth could be good news for your heirs because, provided the Roth 401 is at least 5 years old, they wouldn’t have to pay income taxes on the distributions from an inherited Roth.

It’s great that you have a choiceand the best choice of all may be to invest in both types of accounts. Whatever you decide, you’re already planning and saving for retirement. And that’s the best decision of all.

Have a personal finance question? Email us at [email protected]. Carrie cannot respond to questions directly, but your topic may be considered for a future article. For Schwab account questions and general inquiries, contact Schwab.

Recommended Reading: Can I Withdraw Money From 401k

Weighing The Pros And Cons

Roth IRAs and Roth 401ks are both good options for retirement savers. The answer to which account is the better option will really depend on your unique situation. Its always a good idea to talk to your financial advisor to weigh the pros and cons and come up with what the best choice is for your situation.

Read More:What is a Fiduciary? Heres Why It Matters in Money Management

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: How To Transfer 401k From Old Job

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts.

But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But whatever you do, do not pull that money out of the investment itself!

Before you roll over accounts, sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and figure out whether it makes sense for your situation.

Is It Better To Invest In A 401 Or Roth Ira

If youre wondering whether its better to contribute to a 401 or a Roth IRA, dont because you should be investing in both. Experts agree that the first account you should take advantage of should be a 401, if youre eligible through one at your job. Make sure you are putting enough to get the employer match first.

As I mentioned earlier, an employer match is free money that you dont want to miss, Yu said.

Then move onto your Roth IRA. Try to max out the $6,000 a year , and $6,500 a year . If you are eligible, and if you have enough money after that, go back to your 401 and max it out to the entire $20,500 annual limit.

Also Check: Can You Rollover A 401k Without Leaving Your Job

Which Is Right For You

Our Solo 401k plans are about maximum flexibility. Regarding Roth and Traditional Solo 401ks, one size does not fit all. The right answer for you depends on your current tax situation and whether your tax rate is likely to be higher or lower in retirement.

Because you dont pay any taxes on Roth withdrawals, the higher your tax bracket in retirement, the more advantageous a Roth Solo 401k is likely to be. Robust savers, such as those who contribute the maximum amount allowed by the IRS each year, are top Roth candidates. This is because they are likely to take larger annual distributions in retirement that will benefit from Roths tax-free withdrawals.

Another Roth Solo 401k opportunity exists if you are in a low tax bracket today. The amount of taxes that you pay on contributions today is likely to be less than the tax rate you will pay on traditional distributions during retirement when you may be in a higher tax bracket.

A third option is contributing to both a Roth and Traditional Solo 401k during the same year. Since no one knows what tax rates will be in the future, diversifying with contributions to both might be a way to hedge your tax bets with your retirement savings. The high contribution limits allowed with both types of Solo 401k accounts make this a very feasible strategy.