Pick The Right Funds For Your 401

Without a thorough understanding of your mutual fund options, its easy to make bad investing choices. For instance, lets say a sample companys 401 materials have 19 investment choices that arent target date funds: six growth funds, four growth and income funds, two equity income funds, two balanced funds, four bond funds, and one cash-equivalent money market fund.

If youre trying to invest according to our advice by splitting your 401 portfolio evenly between growth, growth and income, aggressive growth, and international funds, youre already in trouble. According to the brochure, you dont have any aggressive growth or international options! You meet with an investment professional and they let you konw that of the six options the brochure has listed as growth funds, two are actually international funds and one is an aggressive growth fund. Thats exactly the kind of insight you need to help you make smart investment selections.

A lot of people dont know you can work with an outside professional to select your 401 investments, but you can!

Other investors worry that working with their own investing pro will be expensive. Your investing professional may charge a one-time fee for a 401 consultation, and thats a reasonable cost for the time they spend to help you make smart 401 selections. Just make sure you know what to expect before your appointment so there are no surprises.

Open Your Account As Soon As You Start Working

If you want to maximize the value you get from your 401, you should sign up for it and start contributing right away. Do this with your very first job if you can. Or if it’s too late for that, do it with your current or future employers as soon as you become eligible.

The sooner you start contributing to your 401, the sooner your investment account balance can begin growing. Once you start investing, your money earns returns that are reinvested. This compound growth makes building wealth much faster and easier.

Next

S To Max Out A 401 & What To Do After Maxing Out

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

There are a number of retirement accounts that allow you to save and invest toward your retirement goals, but one of the most common in the U.S. is the 401. As of September 2020, 401k plans in the U.S. held an approximate $6.5 trillion in retirement assets, according to the Investment Company Institute.

An employer-sponsored 401 retirement account allows both you and your employer to make contributions. When you set up a 401k, you can opt to have a certain amount of your paycheck go directly to your 401k, and sometimes an employer will match employee contributions up to a certain percentage or dollar amount.

To max out a 401 for 2022, an employee would need to contribute $20,500 in salary deferralsor $27,000 if theyre over age 50. Some investors might think about maxing out their 401 as a way of getting the most out of this retirement savings option. Heres what you need to know about the benefits of maxing out a 401, any potential drawbacks, and exactly how to do it.

You May Like: Can I Roll My Pension Into My 401k

The More Money Your Retirement Savings Earn For You The Less Youll Need To Contribute To Hit Your Goals

Whether youre just opening your first retirement savings account or youve had one for decades, you need to make sure your 401 is set up to bring in as much money as possible. The higher your investment returns are, the less money youll need to save out of your paycheck in order to have enough money once you retire.

Lets go through the steps of priming your retirement savings for impressive long-term gains.

Read Also: How 401k Works After Retirement

Roll It Over Into Your New Employers Plan

Youll have to double check with your new employer to make sure they accept rollovers from a previous job. But if you get the go ahead to do this, youd be able to just manage one 401 account rather than two different accounts potentially from two different plan providers .

Some people find that having just one 401 account makes it easier to see all their money in one place, MacDonald explained.

The money will still have the chance to grow in your new employers plan just make sure you like the new investment options available to you. And youll be able to save on all the additional costs that come with just keeping your balance with your old employer.

And unlike with the IRA rollover option, you wont have to take required minimum distributions at age 72 if you move the money into your new employers 401 plan.

Ultimately, it comes down to convenience, MacDonald said. And if you like seeing all of your assets in one place then this option could make sense.

Recommended Reading: Can I Rollover From 401k To Roth Ira

Automating Your Savings Could Mean Youll Have More Money For Retirement

This chart shows that if you miss making contributions, you could lose a lot of money for your retirement. If you save $100 per month for 40 years, for a total investment of $48,000, it could grow to $196,857. But if you skip 2 of the $100 contributions a year for 40 years, for a total investment of $40,000, it could grow to only $164,058.

Can I Afford To Participate In My 401k

Some say, you cant afford NOT tobut reallyits a line item on your budget just like anything else. You need to consider your financial situation.

Do you have high-interest debt? If so, it may make sense to pay that off before participating in your employers 401k savings plan.

Are you living paycheck to paycheck? Are you financially strapped from taking care of your children and your parents? If so, consider these ways to free up some cash to invest in your 401k .

If youre just getting by, and theres nothing left to trim from the budget, consider allocating your next raise towards starting your retirement savings.

At this stage, if you’ve contributed to a retirement plan through a previous employer, it may make sense to consider rolling those funds into your current employers plan.

Youll want to see how your money is performing in your previous employers 401k savings plan, first. Be sure to check on what fees that plan charges as well.

If your current employers plan allows for incoming rollovers. and offers better investment choices with lower fees, contact your former plan to initiate the rollover.

Note: If you decide now is not a good time for you to participate , beware of automatic enrollment. Some 401k savings plans are set up to enroll new hires automatically which results in a certain percentage of your salary being diverted into this account unless you explicitly opt-out. Please check with your HR department.

Recommended Reading: How Can I Find My 401k

Complete Your Plan Enrollment Form

This is the form youve been waiting for! Its the one youll use to officially commit a percentage of your paycheck for retirement. But there are a couple of other things about this form you dont want to miss:

- Pre-tax or Roth: Whats the difference between a traditional pre-tax 401 and a Roth 401? A pre-tax 401 allows you to make contributions from your pay before taxes are taken out. But when you contribute to a Roth 401, your contributions are made after taxes are taken out. We always recommend the Roth option since you wont have to pay taxes on the money you withdraw from your Roth 401 in retirement. Pre-tax contributions will lower your taxable income now, but youll pay taxes on withdrawals in retirement.

Your Action Step: Contact your 401 plan manager to find out if you have the option to choose pre-tax or after-tax contributions. If you can, take advantage of the Roth option with your next paycheck!

Your Action Step: Again, your 401 plan manager can tell you if your plan offers an automatic rebalancing feature for your investment selections. Tip: call the plan manager and speak with an actual person.

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Also Check: How Can I Rollover My 401k To Roth Ira

What Happens To My Money If I Leave The Company

You generally can take a distribution of your account balance once you leave your company. You may be able to roll your money to an individual retirement account or into a new employer sponsored retirement plan. Or you could cash out via a distribution, though additional taxes may apply. Knowing the rules helps you avoid surprises and develop the best plan. Each choice may offer different investment options and services, fees, expenses and rules. These are complex choices, so take time to compare options.

What To Do With Your 401k In Your 60s

Social Security benefits retired workers and their families but dont provide enough income for most retirees. Thats why many people turn to other sources of retirement income. These include pension plans, 401ks, IRAs, annuities or even Social Security Disability Insurance .

The most common question that retirees ask themselves is What should I do with my 401 in my 60s? Many people are unaware of the options available to them. It can lead them to make a decision that may not be in their best interest.

As you age, it is important to consider what you will do with your 401k in your 60s. Here are some options:

- You can use it as a nest egg and invest it into a guaranteed investment certificate or bond fund and live off the interest for the rest of your life.

- You can also use it as an emergency fund. But make sure you withdraw from this account when you need to spend money in an emergency.

- You can also leave this account alone and not touch it until you retire from work at age 65 or older, at which point you can draw from this account without paying any taxes on withdrawals.

Ultimately, retiring is a big decision that you should make carefully. You should know what you want to do, where you want to live and how much money you need in order to accomplish your goals.

When planning for your retirement, its important for you to consider your financial goals first.

Recommended Reading: Can I Roll My 401k To A Roth Ira

Automate Your Contribution Increases

Many employers now offer an automated contribution increase feature in their 401k plans. Employees who participate in this feature see their contributions automatically increase each year, usually by 1 percent. Boosting your contribution limit by 1 percent a year can double your 401k balance in just five years.

If your employer does not offer the feature, or you want to boost your contribution level by a higher amount, you can still use this strategy. You will just have to manually increase your contribution amount each year. Talk to your human resources department to find out how your company manages 401k contributions.

| Auto Increase Contribution Each Year |

| $60,000.00 |

| $ 124,761.51 |

Know How Social Security Fits In Your Retirement Plan

Will it be around when you retire? Maybe. Maybe not. Or it could be reduced or replaced by something else. This is what we know about Social Security today:

- The earliest you can draw Social Security is age 62, but the longer you wait to take it, the more money youll generally get.

- If you’re a middle income earner hoping to have 80100% of your pre-retirement income, you can plan to collect about 40% of that income from Social Security.3

- If you take Social Security before your full retirement age , and youre working and receiving benefits, there are limits on how much income you can make.

- Your benefits can be taxed! Up to 85% of your check. Its a complex formula, so learn all about it on the Social Security web site.

Set up a my Social Security account at ssa.gov to get an estimate of your potential future benefits and log the information in the retirement savings checklist .

Another reason to set up an account is to help protect your personal information. Only one account is permitted per Social Security number and address, so claiming your account is one more way to keep your information secure.

Want to learn more?

- Read this Q& A: Will Social Security have you covered?

Recommended Reading: How To Find 401k From Previous Employer

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Balance Retirement Savings And Paying Down Debt

Most likely, saving for retirement is not your only financial goal. Far from it.

Youll likely need to balance your 401 contributions with paying down debt or saving for other goals like a house or a family.

Thats fine. Just dont use competing goals as an excuse to forgo making 401 contributions. Youll miss out on the prime years to make your 401 a million-dollar nest egg. Even if you have debt, contribute enough to your 401 to get your employer match. Then, as you clear money out of the debt pile, reallocate the funds to the retirement pile through payroll deductions.

You May Like: How Much Income Will My 401k Generate

Read Also: Can You Use 401k To Refinance A House

Get Team 401 And Team Roth Ira On The Same Side

When it comes to your 401 and a Roth IRA, theres no need to pick sides! The investments you choose for both accounts should complement each other. They should work together to help you make the most of the stock markets growth while limiting your risk.

Dont know where to start? The SmartVestor program can connect you with experienced investment professionals who can help you find out if youre on track to meet your retirement goals and what you can do to make your outlook even brighter.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

You May Like: Can You Roll A 401k Into An Existing Roth Ira

Contribute A Percentage Of Your Salary Rather Than A Set Amount

If you have a choice between contributing a percentage of your salary or a set amount of money each paycheck, always opt for a percentage of salary. If you do that, your contribution amount will go up automatically as your income increases. You won’t need to go back and change things to invest more when you earn more.

Next

Recommended Reading: Should I Roll My Old 401k Into My New 401k

Maximize Your Employers 401 Match

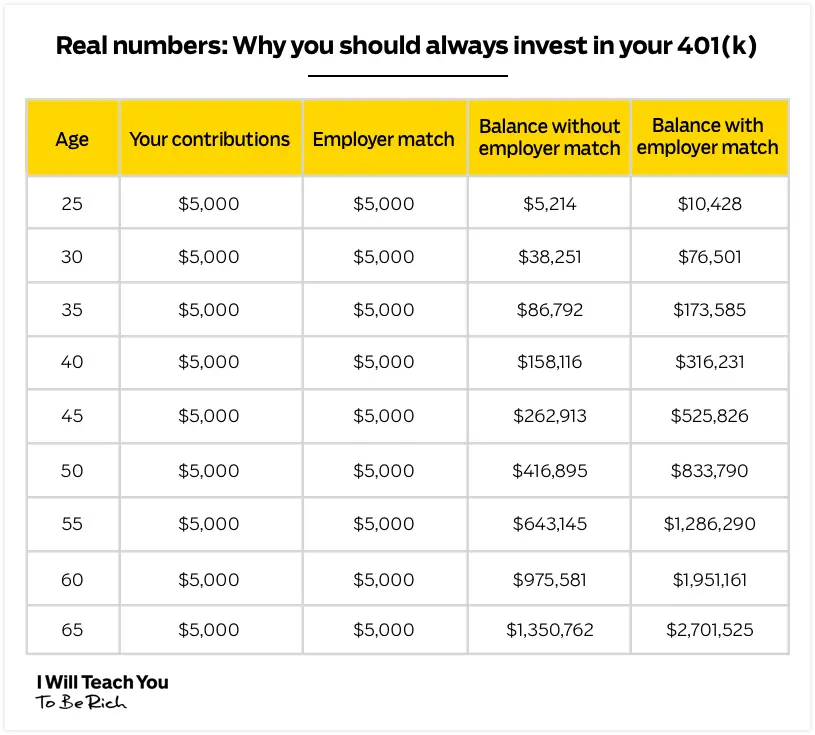

Some employers will match their employees contributions at either 50 or 100 percent up to a certain amount, sometimes 3 to 5 percent of an employees salary. Thats free money that you should take advantage of, if you can.

Some plans will also require a vesting period before employees are entitled to fully own company matches, often for a year or longer. Vesting schedules vary by company, but they mean that if you leave your job before a certain time period, you will not be able to keep the money your employer contributed on your behalf. Your own contributions, though, are always fully vested and available to you.

After fully meeting your companys vesting schedule, you will have 100 percent ownership of any matching contributions.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Learn About Your Investment Options

Youll also use your plan enrollment form to select your investments for your 401 portfolio. This is where a lot of people get lost. Many folks feel like theyre not doing enough to prepare for retirement or simply dont know how to get started.1

Remember that brochure or booklet that came with your enrollment packet? Its from your 401 plan manager. It should provide fairly detailed descriptions of all your 401 selection options. Some companies do a better job at this than others, but no brochure is going to give you the complete lowdown on all your investing choices.

Another problem with these materials is that they make a big push for target date funds. Target date funds have predetermined investment mixes depending on the date you plan to retire. If youre young and have 30 or more years to retire, youll start out with a decent mix of growth stock mutual funds, but, as your retirement date gets closer, the mix will become more and more conservative.

As your investments move to less and less risk, there is less and less return. When you reach retirement age, your 401 will be heavily invested in bonds and money markets that wont provide the growth you need to support you through 30-plus years of retirement.

Your Action Step: Ignore the target date funds so you can build your own 401 portfolio from individual funds.

Read Also: How To Get A Loan From My 401k