Use A Roth Ira Before Retirement For Other Purposes

The ability to tap money in a Roth IRA without penalty before age 59 1/2 allows for flexibility to use the Roth IRA for other purposes. In essence, this account can act as an emergency fund and could be used to pay off significant unexpected medical bills or cover the cost of a child’s education.

But it’s best to only tap into these funds if it’s absolutely necessary. And if you must withdraw any money from a Roth IRA before retirement, you should limit it to contributions and avoid taking out any earnings. If you withdraw the earnings, then you could face taxes and penalties.

You Pay Taxes Now Instead Of Later

Roths turn traditional IRA and 401 rules on their head. Rather than getting a tax break for money when it goes into the account and paying tax on all distributions, with a Roth, you save after-tax dollars and get tax-free withdrawals in retirement.

By accepting the up-front tax breaks for traditional IRA accounts, you accept the IRS as your partner in retirement. If you’re in the 24% tax bracket in retirement, for example, 24% of all your traditional IRA withdrawalsincluding your contributions and their earningswill effectively belong to the IRS. With a Roth, 100% of all withdrawals in retirement are yours.

The Roth strategy of paying taxes sooner rather than later will pay off particularly well if you’re in a higher tax bracket when you withdraw the money than when you passed up the tax break offered by the traditional account. If you’re in a lower tax bracket, though, the Roth advantage will be undermined.

What Is The Difference Between A Rollover Ira And A Roth Ira

The main difference between Rollover IRAs and Roth IRAs is how they are taxed. Contributions to an IRA are tax deductible, while traditional contributions to a revolving IRA are tax deductible. Rolling IRAs are generally tax-deferred, meaning people don’t have to pay taxes right away.

Also Check: Can I Rollover My 401k To A Roth Ira

Why You Might Not Want To Combine Your Ira With Your 401

On the flip side, there are plenty of areas where a traditional IRA has a leg up on a 401 that is, of course, why so many people roll a 401 into an IRA. Here are the biggest you should know:

-

Wider investment selection: Within an IRA, you can invest in nearly anything under the sun not just the mutual funds, index funds and exchange-traded funds that show up in 401 plans, but also individual stocks and even options . You can also shop around for the absolutely lowest-cost funds, which can save you money. As noted above, you should look closely at your 401 plan and its investments to see if youd save money by leaving your funds in your IRA.

-

More loopholes for early withdrawals: Aside from the aforementioned loans, a 401 may allow hardship withdrawals in certain situations the IRS defines hardship as an immediate and heavy need, which means things like unreimbursed medical expenses, funeral expenses or disability. Those will waive the 10% penalty on early distributions youll still owe income taxes on the withdrawal. But a traditional IRA casts a wider net, allowing early distributions without penalty but with taxes still owed for higher education expenses and a first-time home purchase .

-

Low-cost options for investment management: If your 401 plan doesnt come with anything in the way of investment advice, and you want that sort of thing, youll have more options for getting it on the cheap within an IRA if youre open to a robo-advisor. .)

Dmitriy Fomichenko President Sense Financial

The value of your 401k minus loan balance can be rolled over into an IRA if your plan permits doing partial rollovers. Some plans dont and require you to rollover the entire balance. That is if your 401k is with the past employer. If it is with the current employer the chances are you can not . So if you get OK to rollover the balance and continue paying the loan you are OK. Otherwise the outstanding loan balance will be considered a distribution which will result in taxes . You need to contact your plan administrator or custodian and discus this.

You May Like: How To Transfer 401k From Fidelity To Vanguard

You May Like: Can You Move A 401k Into A Roth Ira

Convert Traditional Ira To Roth

Can you switch from a traditional to a Roth IRA?

- Determine how much of your traditional IRA you can convert to Roth.

- Determine the tax you must pay when converting. Subtract the IRA expenses you didn’t subtract from the present value of your IRA.

- Open a new Roth IRA account to keep your converted money.

Paying Taxes On Your Contributions

The point of a Roth IRA is that the money gets taxed as income upfront, then grows tax-free. But the money in your 401 was shielded from taxes. So youll now need to pay income tax on that money so that it qualifies for a Roth.

The funds you roll over are added to your taxable income for the year you do the rollover. Income taxes you owe will be calculated from that new total. Since the income from your IRA isnt coming from a paycheck, though, the tax you owe on it wont be withheld. Itll have to come out of your pocket, and to avoid a penalty, you may need to make an estimated tax payment before filing your taxes for the year.

Youll need to make an estimated tax payment if the taxes withheld from your paycheck arent enough to cover at least a) 90% of the taxes youll owe for the tax year of your rollover or b) 100% of the taxes you paid for the previous tax year . Once you know your estimated payment, you can either pay it all at once or split the amount between the quarters remaining in the tax year. Quarterly estimated tax payments are due on or before April 15, June 15, Sept. 15 and Jan. 15 of the next year.

If you overestimate how much your tax bill is going up and overpay your estimated tax payments, thats OK. Youll get a refund if you end up paying more than you owe.

Recommended Reading: How To Get My 401k Early

Option : Leaving Money In Your Former Employer’s 401 Plan

Leaving money in your current 401 may be an option, depending on the terms of your plan. Many additional factors, such as the option to add money and make certain investment choices, will also depend on the terms of your plan. Here’s what youj should know:

- Ability to add money: Once you leave your employer, you generally won’t be able to add money to your plan.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your former employer’s plan beginning at age 72.

Contact your plan administrator to learn more about fees and the terms of your plan. Your Participant Fee Disclosure and/or Summary Plan Description should have this information.

When You Should Consider Converting A 401 To A Roth Ira

If you anticipate your tax bracket being higher in retirement due to required minimum distributions or other sources of income, then it may make sense to pay income tax now while you are in a lower tax bracket.

Another reason to convert to a Roth is when you have a sizable pool of tax-free Roth assets relative to your tax-deferred retirement accounts. The tax benefits of a Roth IRA are most significant in this case. If your Roth IRA savings are only 5% or 10% of your entire retirement savings, it may not be enough to justify the loss of tax deferral.

Keep this in mind as an isolated conversion of relatively small dollar value may not make a material impact on your overall wealth. A financial plan can help you weigh whether maintaining tax-deferred growth is a better strategy to maximize your wealth.

Recommended Reading: How To Transfer 401k From Vanguard To Fidelity

Should You Convert To A Roth Ira Now

Once youâve decided a Roth IRA is your best retirement choice, the decision to convert comes down to your current yearâs tax bill. Thatâs because when you move money from a pre-tax retirement account, such as a traditional IRA or 401, to a Roth, you have to pay taxes on that income. Another issue is that the Build Back Better bill, currently before the Senate, could limit or ban some types of conversions.

-

You pay tax on the conversionâand it could be substantial.

-

You may not benefit if your tax rate is lower in the future.

-

You must wait five years to take tax-free withdrawals from the Roth after a rollover, even if youâre already age 59½.

It makes sense: If you had put that money into a Roth originally, you would have paid taxes on it for the year when you contributed.

A Roth IRA rollover is most beneficial when:

How To Convert To A Roth Ira

There are plenty of reasons to consider a Roth individual retirement account rollover, which moves funds from an existing traditional IRA into a Roth IRA. Here’s a quick look at how to convert to a Roth IRA, plus considerations when deciding whether it makes sense for you.

Recommended Reading: When Can I Set Up A Solo 401k

What Is The Waiting Period Before I Can Withdraw Rollover Funds Penalty

You will be subject to a 10% early withdrawal penalty if you do not wait 5 years from the rollover.

Please note, for the purposes of calculating the five-year period, the rollover is considered to have been made at the beginning of the calendar year in which the rollover is complete. For example, if you roll $5,000 from your traditional IRA to your Roth IRA on Feb. 15, 2022, you will be eligible for tax and penalty-free withdrawal of the funds as early as Jan. 1, 2027.

Should You Contribute To A Traditional Ira Or Roth Ira

Traditional IRA – Expenses are tax deductible and taxes are deferred until withdrawn. Mouth of the IRA: Contributions are not deductible, but withdrawals are not tax deductible. But this is just the beginning. Here’s what you need to know that could influence your decision. All age groups with an earned income are eligible for premiums.

Read Also: Should I Roll My 401k Into An Ira

Roth Iras Have No Required Minimum Distributions

One significant advantage of a Roth IRA is that these accounts do not have required minimum distributions. That means you are not forced take out a certain amount each year so these funds can remain in the Roth IRA, earning tax-free. Other types of retirement accounts, including traditional IRAs and most 401s, do have RMDs.

How Do I Rollover If I Receive The Check

If you receive a distribution check from your 401 rollover to a Roth IRA, then chances are good they will hold around 20% for taxes. If you want a direct 401 rollover to a Roth IRA, you may want to send that check back to your employer 401 provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account .

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

Recommended Reading: Is It Good To Invest In 401k

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Recommended Reading: Should You Roll Your 401k Into An Ira

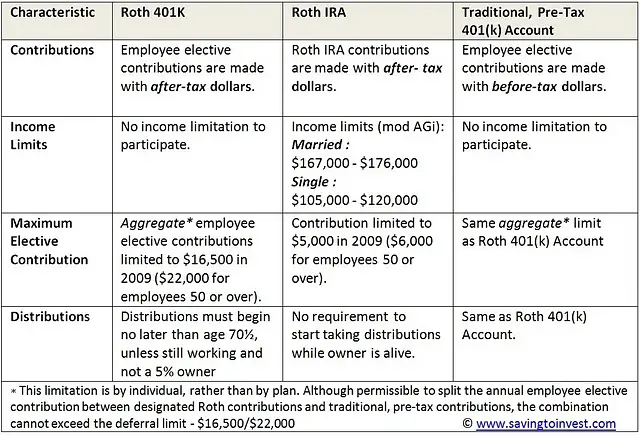

What Is The Difference Between A Traditional And A Roth Ira

Traditional IRA and Broken IRA. The traditional IRA and the Rota allow you to save during your retirement. This drawing highlights some of their similarities and differences. The maximum amount you can contribute to all of your Traditional and Roth IRAs is $5,500 for 2018, or $6,500 if you are age 50 or older at the end of the year, or.

Will Taxes Be Withheld From My Distribution

- IRAs: An IRA distribution paid to you is subject to 10% withholding unless you elect out of withholding or choose to have a different amount withheld. You can avoid withholding taxes if you choose to do a trustee-to-trustee transfer to another IRA.

- Retirement plans: A retirement plan distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll it over later. Withholding does not apply if you roll over the amount directly to another retirement plan or to an IRA. A distribution sent to you in the form of a check payable to the receiving plan or IRA is not subject to withholding.

Read Also: How To Borrow From 401k For Down Payment

What Is A Rollover Ira

A rollover IRA is an individual retirement account often used by those who have changed jobs or retired. A rollover IRA allows individuals to move their employer-sponsored retirement accounts without incurring tax penalties and remain invested tax-deferred. Consolidating multiple employer-sponsored retirement accounts can make it easier to monitor your retirement savings.

*Note: If you have an existing rollover or traditional IRA at Prudential, you can roll your assets into that account.

What Is The Difference Between A Roth And An Ira

The main difference between a traditional IRA and a Roth IRA is how contributions for tax credit are deducted. While traditional IRA contributions are deductible or non-deductible, Roth IRA contributions are not yet deductible. As a result, Roth IRAs offer tax-free growth, while traditional IRAs offer tax-free growth.

Read Also: Where To Move Your 401k Money

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .