Taxes On 401 Contributions

Contributions to a traditional 401 plan come out of your paycheck before the IRS takes its cut. Youll sometimes hear this referred to as pre-tax income, and it means two things: 1) you wont pay income tax on those contributions, and 2) they can reduce your adjusted gross income.

An example of how this works: If you earn $50,000 before taxes and you contribute $2,000 of it to your 401, that’s $2,000 less you’ll be taxed on. When you file your tax return, youd report $48,000 rather than $50,000.

A few other notable facts about 401 contributions:

-

In 2021, you can contribute up to $19,500 a year to a 401 plan. If youre 50 or older, you can contribute $26,000.

-

In 2022, the contribution limit increases to $20,500 a year. If you’re 50 or older, you can contribute $27,000.

-

The annual contribution limit is per person, and it applies to all of your 401 account contributions in total.

-

You still have to pay some FICA taxes on your payroll contributions to a 401.

-

Your employer will send you a W-2 in January that shows how much it paid you during the previous calendar year, as well as how much you contributed to your 401 and how much withholding tax you paid.

See more ways to save and invest for the future

-

Our retirement calculator will show whether you’re on track for the retirement you want.

-

Stocks are a good long-term investment even during periods of market volatility. Here’s what to know.

Avoid Taxes On Your 401 Rollover

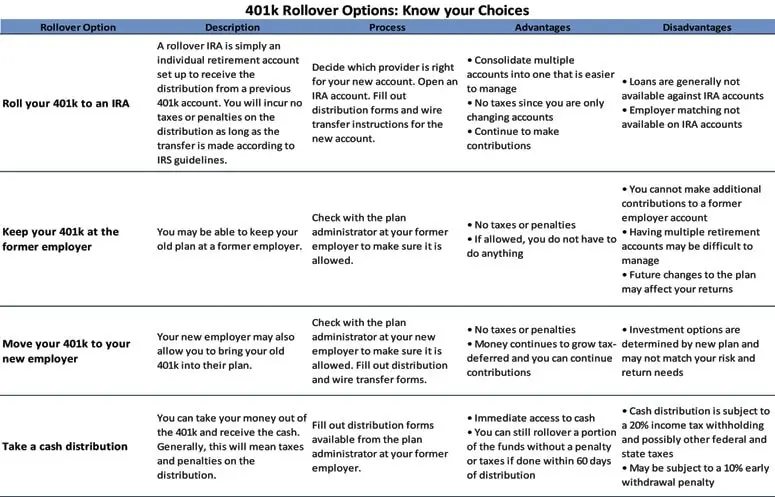

Rolling over a 401 to an IRA or a new employer-sponsored retirement account isn’t considered a distribution as long as you do it properly. There are two ways you can go about it. The first is called a direct rollover. You provide your 401 provider with details about where you’d like your funds transferred, and they will automatically send the money to your new account. You may pay a one-time service fee for doing this. If you’re unsure how to get started, talk to your 401 plan administrator.

The other option is an indirect rollover. Here you withdraw all of the funds from your 401 yourself and then deposit them into your new account. As long as you deposit the funds into the new account within 60 days of the withdrawal, the government won’t consider it a distribution. But if you don’t deposit the money in time, or you fail to deposit the full amount you withdrew from your 401, the government is going to come around asking for its cut.

That’s why the direct rollover method is usually considered safer. You don’t touch the money at all, so you don’t have to worry about owing taxes right now. It is possible to do an indirect rollover without paying taxes as well, but make sure you deposit the new funds right away to avoid any issues.

What Is Capital Gain

Capital gain is the appreciation in the value of an asset, and it is realized when an asset is sold. Usually, when you sell an asset at a higher value than you originally paid for it, you will have realized a capital gain. For 401 owners, capital gain occurs when the assets you hold in your portfolio like stocks, bonds, and real estate appreciate, and you realize a gain when you finally sell it.

The tax you pay on the capital gains depends on the duration you held the assets. Typically, capital gains can be grouped into either short-term or long-term capital gains. Short-term capital gains occur when assets are held for less than one year and are taxed as regular income. On the other hand, long-term capital gains occur when assets are held for more than one year before they are sold, and they are taxed based on graduated thresholds for taxable income at 0%, 15%, and 20%.

Read Also: How To Transfer 401k Accounts

How Long Does A 401 Distribution Take

There is no universal period of time in which you must wait to receive a 401 distribution. Generally, it takes between three and 10 business days to receive a check, depending on which institution administers your account and whether you are receiving a physical check or having it sent by electronic transfer to a bank account.

How To Minimize Taxes On 401 Withdrawals

Although thereâs no way to dodge the tax responsibility altogether, there are ways to minimize the tax burden of your 401 withdrawals.

If you own any company stock as a portion of your 401, you could treat the growth of that stock as capital gains. Capital gains tax is notably lower than the income tax rate. The long-term capital gains tax rate is either 0%, 15%, or 20%, depending on your tax bracket. In order to benefit from this, youâll need to roll over the stock into a taxable brokerage account. To prevent any mistakes that could lead to even bigger tax mess, consult an expert prior to doing so.

Another way to minimize the tax responsibility of your 401s withdrawals is to look at where you fall on the various tax brackets. If taking 401 withdrawals sends you into the bottom of a higher tax bracket, consider taking 401 withdrawals earlier. This will spread out your withdrawal amounts, thus reducing your annual income amount than taking higher distributions. Doing this after 59½ will reduce your tax bill.

Don’t Miss: How Can I Look At My 401k

Q14 How Do Plans And Iras Report Coronavirus

A14. The payment of a coronavirus-related distribution to a qualified individual must be reported by the eligible retirement plan on Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. This reporting is required even if the qualified individual repays the coronavirus-related distribution in the same year. The IRS expects to provide more information on how to report these distributions later this year. See generally section 3 of Notice 2005-92.

Tax Rules: Withdrawals Deductions & More

If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pre-tax money in 2021. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

Also Check: How To Take Money From 401k Without Penalty

How Are 401 Withdrawals Taxed For Nonresidents

If youre a citizen of Canada, Mexico, or another country and sometimes live and work in the U.S. on a visa, you may be considered a nonresident alien. For tax purposes, the IRS defines a nonresident alien as a non-U.S. citizen who is legally present in the U.S. but either lacks a green cardor does not pass the substantial presence test. As a nonresident alien, the IRS requires you to pay income tax only on the money you earn from a U.S. source.

Many nonresident aliens who live and work in the U.S. choose to invest in a 401 retirement plan offered by their American employers. However, when its time to return to your home country, this can create quite a quandary. Should you leave your funds in the 401? Should you cash it out before you leave the U.S. or wait until youre back in your home country? Should you roll it over into another account? And how will your 401 withdrawals be taxed once you no longer live in the U.S.?

Keep reading to learn how to solve this nonresident 401 conundrum.

Consider A Roth Ira Conversion

If youâre still saving for retirement, you could also consider converting a portion of your 401 to a Roth IRA. You will owe tax on the amount of your Roth conversion in the year that you convert, but you likely wonât owe any additional taxes during your lifetime. This can help set you up to be more tax-efficient during retirement.

While you canât avoid paying taxes on a 401 withdrawal, itâs a good idea to work with a financial advisor on your retirement plan. He or she can help you build a tax-efficient plan that also protects your retirement portfolio against other risks to your money, like market downturns or a long lifespan.

Recommended Reading

Recommended Reading: What Do I Do With My Old 401k

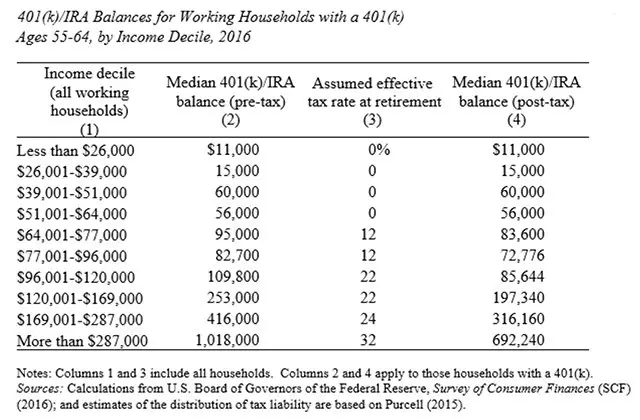

Your 401 Distribution And Taxes

Distributions from your 401 are taxed as ordinary income, based on your yearly income. That income includes distributions from retirement accounts and pensions and any other earnings. As a result, when you take a 401 distribution, it is important to be aware of your tax bracket and how the distribution might impact that bracket. Any 401 distribution you take will increase your yearly earnings and could push you into a higher tax bracket if you’re not careful.

There is a mandatory withholding of 20% of a 401 withdrawal to cover federal income tax, whether you will ultimately owe 20% of your income or not. Rolling over the portion of your 401 that you would like to withdraw into an IRA is a way to access the funds without being subject to that 20% mandatory withdrawal. Tax-loss selling on poorly-performing investments is another way to counter the risk of being pushed into a higher tax bracket.

Deferring taking Social Security is another way of reducing your tax burden when you take a 401 withdrawal. Social Security benefits are not usually taxable unless the recipient’s overall annual income exceeds a set amount. Sometimes a large 401 withdrawal is enough to push the recipient’s income over that limit. Here’s a look at these and other methods of reducing the taxes you need to pay when you withdraw funds from your 401

How Can I Get My 401 Money Without Paying Taxes

How can I get my 401 money without paying taxes? Find out the exact strategies you can use to reduce or eliminate the tax burden on your 401 withdrawals.

When you take money from a traditional 401, the IRS subjects the distributions to ordinary income tax. The amount of tax you pay depends on your tax bracket, and you can expect to pay a higher tax for a higher distribution. You may also be required to pay a 10% penalty on the distribution if you are below 59 ½ years.

You can rollover your 401 into an IRA or a new employerâs 401 without paying income taxes on your 401 money. If you have $1000 to $5000 or more when you leave your job, you can rollover over the funds into a new retirement plan without paying taxes. Other options that you can use to avoid paying taxes include taking a 401 loan instead of a 401 withdrawal, donating to charity, or making Roth contributions.

If you want to get your 401 without paying taxes, there are certain strategies you can use to avoid or reduce your tax bill. Read on to find out how to avoid taxes on 401k withdrawals when the IRS wants a cut of your distributions.

You May Like: Where Should I Put My 401k Money

Taxes Withheld From Distributions For Active Employees

When you take a distribution from your deferred compensation accounts, you will pay taxes on the distribution. The amount of tax you pay depends on several factors:

- The amount you withdraw in a calendar year, and your income in that year

- The type of Plan you have 401 or 457

- Your age and employment status

Basically, any amount you withdraw from your 401 account has taxes withheld at 20%, and if youre under age 59½, youll be taxed an additional 10% when you file your return.

Any amount you withdraw from your 457 account has taxes withheld at 20%. However, if you select a periodic distribution over 10 years, then only 10% is withheld for taxes.

Employees Retirement System of Texas

Can I Withdraw From My 401k In 2021 Without Penalty

Although the initial payout provision of 401,000 that it will be

When do I have to pay taxes on coronavirus-related distributions?

Usually, your wages are counted pro rata over a three-year period, starting with the year in which you receive your paycheck. For example, if in 2020 you received a coronavirus-related distribution worth $ 9,000, you would report income of $ 3,000 in your federal tax return for 2020, 2021, and 2022. However, you can include the entire distribution in your payday income.

How do qualified individuals report coronavirus-related distributions regarding retirement plans?

If you are a qualified individual, you may designate any qualifying distribution as a Coronavirus-related distribution as long as the total amount indicated as Coronavirus-related distribution does not exceed $ 100,000. As mentioned earlier, a qualified individual may treat a distribution that meets the requirements to be a coronavirus-related distribution as such, whether or not a qualifying retirement plan treats the distribution as a coronavirus-related distribution. You must report a coronavirus-related distribution in your individual federal tax return for 2020. You must include the taxable portion of the distribution in your income proportionally over the 3-year period 2020, 2021 and 2022 unless you choose to include the entire amount in your income in 2020.

What is a coronavirus-related distribution?

Prev Post

Recommended Reading: Can I Rollover From 401k To Roth Ira

Pulled Money From A 401 Plan For An Emergency What It Means For Your Taxes

- The CARES Act allows individuals facing hardships from the pandemic to withdraw up to $100,000 from a 401 plan or from an individual retirement account this year.

- Affected individuals can spread the income and the taxes over the course of three years. The CARES Act also waives the 10% penalty for withdrawals taken prior to age 59 ½.

- Took money from your savings? It’s time to think about how you’ll deal with next year’s tax bill.

In this article

Under almost any circumstance, tapping your retirement plan savings for cash is a bad idea.

Tax professionals and financial advisors will almost universally tell you to use all other sources of liquidity before you hit your tax-advantaged retirement accounts.

“Certain IRAs and qualified plans are protected from creditors,” said Ryan Losi, a CPA at Piascik. “If you’re looking at bankruptcy, the worst thing you can do is take money out of those plans, pay taxes on it and make it available to creditors.”

More from Smart Tax Planning:

But for millions of Americans who have suffered financially as a result of the coronavirus pandemic, retirement plan savings may now be their only source of cash.

Enter the coronavirus-related distribution.

Under favorable terms granted as part of the federal CARES Act passed in late March, eligible individuals can withdraw up to $100,000 known as a coronavirus-related distribution from qualified plans, including 401 plans and individual retirement accounts.

If You Withdraw The Money When You Retire

For traditional 401s, the money you withdraw is taxable as regular income like income from a job in the year you take it. You can begin withdrawing money from your traditional 401 without penalty when you turn age 59½. The rate at which your distributions are taxed will depend on what federal tax bracket you fall in at the time of your qualified withdrawal.

A few important points:

-

If youve retired, you have to start taking required minimum distributions from your account when you’re 72.

-

If you dont take the required minimum distribution when youre supposed to, the IRS can assess a penalty of 50% of the amount not distributed.

-

You can withdraw more than the minimum.

Don’t Miss: What Is The Best Fund To Invest In 401k

Keep Your Capital Gains Taxes Low

Try to only take withdrawals from your 401 up to the earned income amount that will allow your long-term capital gains to be taxed at 0%. In 2022, singles with taxable income up to $41,675 and married filing jointly tax filers with taxable income up to $83,350 can stay in the 0% capital gains threshold. Any amount over this is taxed at the 15% tax rate.

Nathan Garcia, CFP®, with Strategic Wealth Partners in Fulton, Maryland, says retirees can subtract their pension from their annual spending amount, then calculate the taxable portion of their Social Security benefits and subtract this from the balance from the previous equation. Then, if they are over 72, subtract their required minimum distribution. The remainder, if any, is what should come from the retirees’ 401, up to the $41,675 or $83,350 limit. Any income needed above this amount should be withdrawn from positions with long-term capital gains in a brokerage account or Roth IRA.

Avoid The Mandatory 20% Withholding

When you take 401 distributions and have the money sent directly to you, the service provider is required to withhold 20% for federal income tax. If this is too muchif you effectively only owe, say, 15% at tax timethis means you’ll have to wait until you file your taxes to get that 5% back.

Instead, “roll over the 401 balance to an IRA account and take your cash out of the IRA,” suggests Peter Messina, Vice President at Salt Lake City’s ABG Consultants, which specializes in retirement plans. “There is no mandatory 20% federal income tax withholding on the IRA, and you can choose to pay your taxes when you file rather than upon distribution.”

If you borrow from your 401 and neglect to repay the loan, the amount will be taxed as if it was a cash distribution.

You May Like: Can I Roll My Ira Into My 401k

Withdrawal Taxes: How To Minimize Them

You wont be able to get out of paying taxes on the funds you withdraw from your 401. However, there are a couple of tips and tricks that might help you lower the total tax you pay. Be sure to check with a tax expert or financial advisor if you want to be sure of the best course of action for your specific situation.

If you happen to hold stock of your company within your 401 account, you could potentially treat the appreciation of that stock as a capital gain rather than ordinary income. The long-term capital gain tax rate is 0%, 15% or 20%, depending on your tax bracket. For many investors, this means a lower tax rate than their ordinary income tax rate. To actually pull this off, youll need to transfer the stock into a taxable brokerage account. Dont be afraid to consult with an expert if you want to take advantage of this strategy.

The other factor to consider is your tax bracket. If your 401 distributions will put you in the lower end of one tax bracket, see if you can start distributions earlier, spreading things out and potentially dropping you into a lower bracket. As long as you start after age 59.5, you could save on your total tax bill with this method.