Find A Solo 401 Provider

The most critical step in the setup process is finding the right solo 401 provider. The best solo 401 providers should provide a simple, straightforward, affordable plan. You should choose a provider that can also support your business as it grows and its needs change.

When choosing a solo 401 provider, you should consider these three factors:

- Costs: Choose a provider with manageable and competitive fees. Be sure to compare the fees of multiple providers to find the most affordable plan that matches your business needs.

- Level of management: Some providers will offer hands-on management for a monthly or annual fee, assisting you with regulatory and compliance filings. However, not all providers actively administer solo 401 plans. Consider the level of management needed from your provider before choosing.

- Investment flexibility: Choose a provider that gives you access to the investment options you want in alignment with your financial needs.

If you already have an investment account or IRA plan, ask your current provider if they offer solo 401 plans. Otherwise, choose a provider that offers factors that align with your personal needs.

How Can Paying Off Student Loan Debt Soon Help Save For Retirement

One of the more revolutionary changes included in the Secure 2.0 Act of 2022 is the option for employer plans to credit student loan payments with matching donations to 401 plans, 403 plans or Simple IRAs. Government employers will also be able to contribute matching amounts to 457 plans.

This means that people with significant student loan debt can still save for retirement just by making their student loan payments, without making any direct contributions to a retirement account. The new regulation will take effect in 2025.

How To Open A Solo 401k

Wondering how to open a Solo 401 when youâre self-employed? There are a few things to know ahead of time. Learn about some of the benefits, limitations, and what youâll need to open a Solo 401.

Being an entrepreneur has many benefits. However, one drawback is the lack of a traditional 401 plan many Americans participate in through their employer. A Solo 401 solves this problem and provides an excellent retirement savings tool for self-employed individuals.

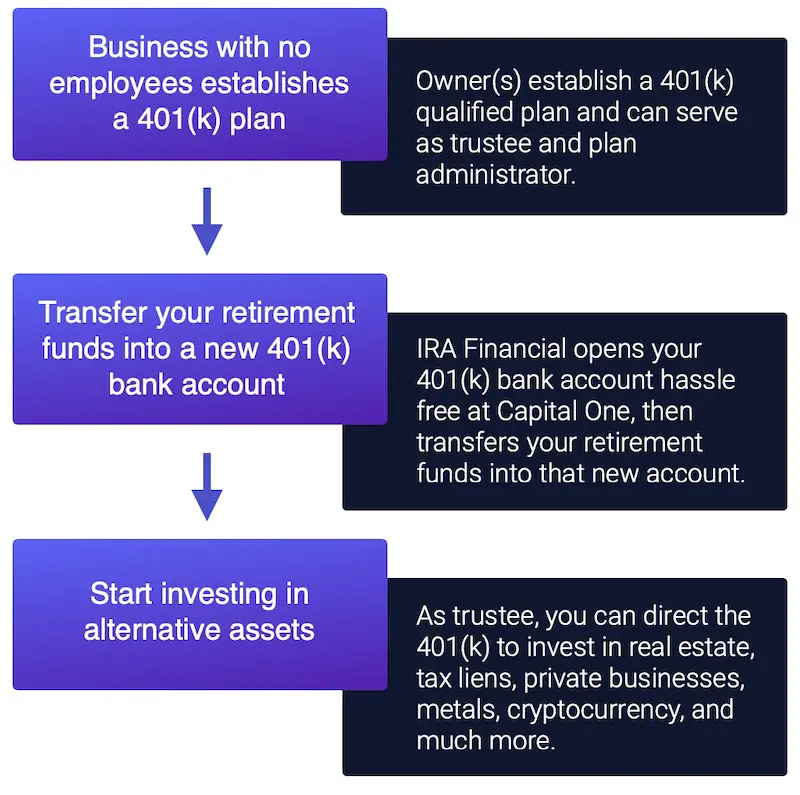

An entrepreneur or self-employed individual can open a Solo 401 with any financial institution that provides one. All youâll need is your businessâs tax EIN, and you can open a Solo 401 quickly and easily.

Before we get into how to open a Solo 401, letâs go through some details.

Don’t Miss: How Does A Solo 401k Plan Work

The Two Approaches To Setting Up And Managing A Solo 401 Plan

Solo 401 plan participants usually dont write their own plan documents they rely on third parties to draft template documents to ensure they comply with applicable laws and regulations. Generally, there are two ways that participants go about obtaining and adopting plan documents: They use a pre-written set of documents provided by a financial institution , or they hire a third-party provider to write the documents to their specifications . Understanding the mechanics and potential benefits and drawbacks of each approach can help individuals better select a plan that meets their needs.

Pros & Cons Of A Solo 401

At some point in everybodys life, you contemplate the dilemma of what retirement plan best suits your needs. Today, there are over 50 million individual retirement accounts. However, that doesnt necessarily mean the IRA is the right retirement strategy.

Determining whether you can enhance your retirement savings with a Solo 401 or self-directed 401 plan) completely depends on whether you are self-employed and have a business.

There are a number of significant advantage to establishing a Solo 401 over an IRA.

Also Check: How Do I Find An Old 401k

How A Simple Ira Works

The SIMPLE IRA follows the same investment, rollover, and distribution rules as a traditional or SEP IRA, except for its lower contribution thresholds. You can put all your net earnings from self-employment in the plan, up to a maximum of $14,000 in 2022, plus an additional $3,000 if you are 50 or older.

Employees can contribute along with employers in the same annual amounts. As the employer, however, you are required to contribute dollar for dollar up to 3% of each participating employee’s income to the plan each year or a fixed 2% contribution to every eligible employee’s income whether they contribute or not.

Like a 401 plan, the SIMPLE IRA is funded by taxdeductible employer contributions and pretax employee contributions. In a way, the employer’s obligation is less. That’s because employees make contributions even though there is that mandated matching. And the amount you can contribute for yourself is subject to the same contribution limit as the employees.

Early withdrawal penalties are hefty at 25% within the first two years of the plan.

Managing Your Retirement Funds

It’s important to start saving for retirement as soon as you begin earning income, even if you can’t afford to save that much at the beginning. The sooner you begin, the more you’ll accumulate, thanks to the miracle of compounding.

As your savings build, you may want to get the help of a financial advisor to determine the best way to apportion your funds. Some companies even offer free or low-cost retirement planning advice to clients. Robo-advisors such as Betterment and Wealthfront provide automated planning and portfolio building as a low-cost alternative to human financial advisors.

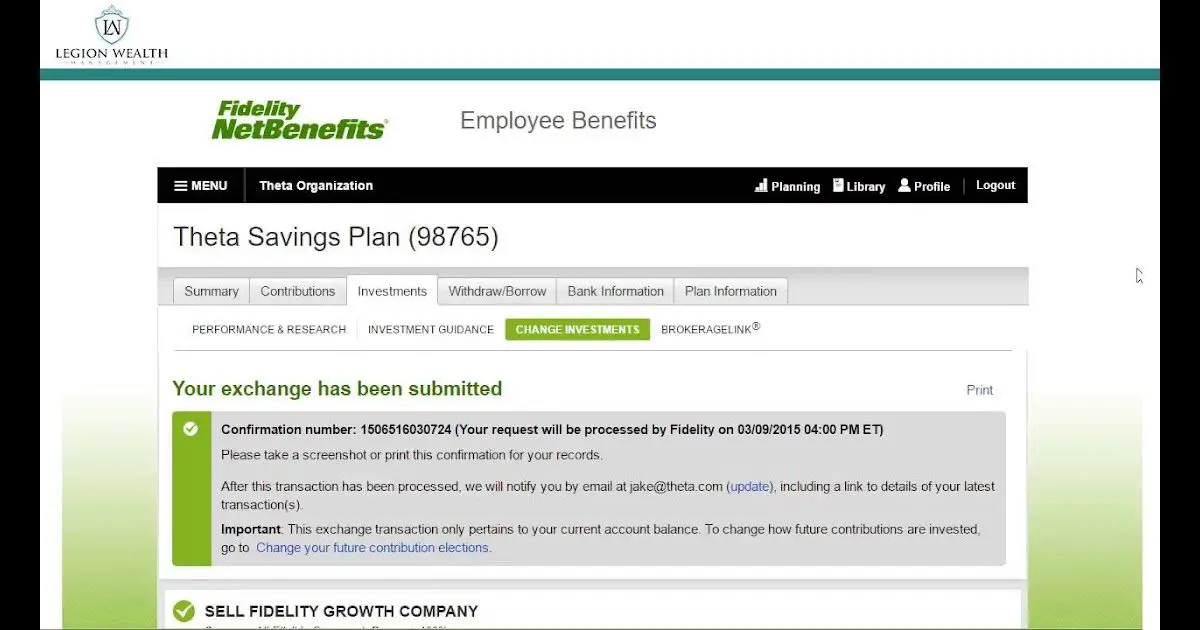

Read Also: How To Access My 401k Online

If I Offer A 401 To My Employees Are There Compliance Regulations I Must Follow Or Can The Retirement Plan Provider Help With These

Certain employers who offer 401 and other retirement plans must abide by the Employee Retirement Income Security Act of 1974, as amended, which helps ensure that plans are operated correctly and participants rights are protected. In addition, a 401 plan must pass non-discrimination tests to prevent the plan from disproportionately favoring highly compensated employees over others. The plan fiduciary is usually responsible for helping comply with these measures.

This information is intended to be used as a starting point in analyzing employer-sponsored 401 plans and is not a comprehensive resource of all requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. For specific details about any 401 they may be considering, employers should consult a financial advisor or tax consultant.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

How Do I Create A 401 Plan

Creating a 401 plan for a companyeven a small oneis a complex process. The following is a basic overview of the steps for getting approval and starting the plan:

- Write a plan with the help of a plan adviser and send it to the IRS for a determination letter .

- Find a trustee to help you decide how to invest contributions and manage individual employee accounts.

- Begin making employer contributions, if offered, and allowing employee contributions through your payroll system.

You May Like: What Is A 401k For

What’s The Difference Between A Traditional 401k And A Roth Ira

The primary difference between a 401k and a Roth IRA is how the savings are taxed. Contributions to a 401k are made before tax deductions, whereas those to a Roth IRA are made after tax deductions. When employees retire, their income from a 401k savings plan is subject to taxes. Qualified withdrawals from a Roth IRA, on the other hand, are tax free.

What Else Do I Need To Know

Here is some more important information that you need to know as a business owner when considering starting a 401 plan.

A 401 plan is considered a qualified plan, under IRS rules. That means it must meet the requirements of the Internal Revenue Code for this type of retirement plan, which include issuing periodic reports about the plan to participants and the IRS.

The 401 and some other types of employer-sponsored retirement plans are called defined contribution plans because the contributions are defined, but not the benefits, as is the case with traditional pensions. The value of the account changes with the level of contributions and the performance of the persons investments.

Contributions to deferred retirement plans, including 401 plans, are not taxed initially. But the account owner must pay tax on the investment and earnings when they are taken out of the plan, at retirement or under specially allowed circumstances.

Don’t Miss: What Is The Contribution Limit For 401k

Who Can Open A Solo 401

As mentioned, Solo 401s provide self-employed individuals a place to save for their retirement. The term individual is vital because Solo 401s are limited to small business owners with zero employees.

Freelancers and the self-employed tend not to have any employees however, small businesses with even one other employee on the books are not eligible.

There is one caveat to this rule. If your spouse is the only other person employed by your small business, both of you can contribute and receive matching contributions from the business-but more on that in a bit.

How To Set Up Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Every new job comes with a stack of documents to sign, initial and, months later, try to remember where they were hastily tossed. Race too quickly through this first-day ritual and you could be leaving thousands of dollars of employee perks on the conference room table.

If you missed the pitch for the company retirement plan during employee orientation, dont worry. Unlike some employee benefits, such as opting in for insurance or setting up a flexible spending account, you can enroll in a 401 year-round.

If you havent enrolled already, consider eating lunch at your desk today and taking care of this 401 business.

You May Like: How To Transfer My 401k To My New Job

How Much Should You Contribute

In 2022, the IRS allows workers to contribute up to $20,500 to their 401 plan, with an additional $6,500 allowed as a catch-up contribution for workers age 50 and older.

That being said, such a large contribution may not be feasible for all workers. Additionally, even those who could invest $20,500 per year may choose not to, especially if they have another retirement account.

The first thing to consider is whether youre eligible for an employer match on your 401 contributions. While a match isnt available for union employees, there is one available for non-union employees. And if youre eligible for a match, you should invest at least enough to receive your full match. Its essentially free money that you dont want to pass up.

After you account for the employer match, things get a bit more complicated. After all, everyone will have different retirement income needs. A great way to figure out how much you should save is by using the Personal Capital Retirement Planner, which can tell you how much you should save per month based on your current retirement savings and your retirement goals.

But remember that you dont only have a 401 available to you. Many workers choose to contribute up to the employer match in the 401 plan but then turn to a traditional or Roth IRA for additional retirement savings.

How Much Should I Invest

If you are many years from retirement and struggling with the here and now, you may think a 401 plan isn’t a priority. However, the combination of an employer match and a tax benefit should make it irresistiblethe employer’s match is tax-deferred money invested for you.

When starting out, the achievable goal might be a minimum contribution to your 401 plan. That minimum should be the amount that qualifies you for the entire match from your employer. You also need to contribute the maximum yearly contribution to get the full tax savings.

You May Like: Should I Roll Over To Ira Or 401k

Should I Choose A Traditional Or Roth Solo 401

For many investors, deciding between a traditional or Roth solo 401 comes down to whether you believe youre in a lower tax bracket today than you will be in retirement. If you think you are paying lower taxes now, you might choose a Roth solo 401. If you anticipate being in a lower tax bracket in retirement, a traditional solo 401 may be a better bet.

Theres another wrinkle with a Roth solo 401 account: You can only contribute up to $20,500 in 2022 and $22,500 in 2023, plus catch-up contributions if youre 50 or older. If youre able to save more than this amount, you will need to contribute the extra into a traditional solo 401 account. You can make both employer and employee contributions to a solo 401, but your employer contributions cannot be saved in a Roth account.

What Are The New Contribution Limits For 401 Plans And Iras

While the standard limits for contributions to 401 plans and IRAs won’t change, the law will boost the “catch-up” limit for Americans over 50 and introduce additional potential “catch-up” contributions for those older than 60.

IRS law currently allows people 50 and up to contribute an additional $1,000 to their retirement accounts each year over the standard limit. Starting in 2024, instead of a flat $1,000 more, older Americans will be able to contribute an additional amount that is indexed to inflation.

Now, for people aged 60-63, they will soon be able to contribute even more catch-up money. In 2025, those seniors will be allowed to contribute up to $10,000 per year or 50% more than the standard catch-up contribution for those 50 and up. Those increased contribution limits will also be indexed with inflation starting in 2025.

Recommended Reading: How To Borrow From 401k To Buy A House

What Is A Simple Ira

A SIMPLE IRA is a retirement savings plan designed for small businesses, particularly those with less than 10 employees. As such, its typically low cost and easy to set up and administer. Employees who participate in a SIMPLE IRA can defer a percentage of their salary to their savings account and their employer is required to either match it or make non-elective contributions.

How To Create A 401 Plan

Once youve decided on the type of 401 plan thats most appropriate for your business, starting one can be relatively simpleespecially if you bring in an experienced plan administrator, such as a mutual fund company, to assist you.

The Internal Revenue Service breaks it into four steps:

Heres a brief look at each requirement.

Also Check: How To Find Out If You Have A Lost 401k

How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

Ive used Solo 401 providers for my own business, and I helped my wife with this as well. I suggest keeping things as simple as possible . Thats based on our experience, plus the dozens of larger employers Ive worked with. When you go beyond essential plan features, its easier to make mistakes and waste time.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.

Ease Low Cost And Flexibility

Individual 401 accounts are easy to open and manage. If you open one at a discount broker, you may incur practically no costs other than for trading. They are also extremely flexible when it comes to investing. In addition, you are not required to file Form 5500 with the Internal Revenue Service, provided your plan contains less than $250,000 worth of assets. This is true for both individual 401 plans and SEP IRA plans.

You May Like: Does Fidelity Offer Self Directed 401k

Differences Still Need To Be Worked Out

The House passed its version of Secure 2.0, the Securing a Strong Retirement Act , in late March with a bipartisan vote of 414-5.

In the Senate, committees with jurisdiction over retirement-related provisions have already approved proposals that collectively form the basis of that chambers Secure 2.0 version: The Health, Education, Labor and Pensions Committee advanced the so-called Rise & Shine Act in June, and the Finance Committee approved a bill in September known as the EARN Act .

Of course, differences between the House-passed bill and the Senates proposals would need to be worked out before a final package could be approved by both chambers.

Our understanding is that staff of the committees with jurisdiction have begun discussions, Richman said.

If Secure 2.0 doesnt make it into law by the end of 2022, the entire legislative process would have to start over with new proposals in a future Congress.

Here are some key provisions under consideration for Secure 2.0, some of which are the same or similar in both the House and Senate Secure bills and others that are not.