Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Tracking Down A Lost 401

Its easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps this is why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 Left unattended too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If youre among those with misplaced savings, heres how to locate and retrieve them:

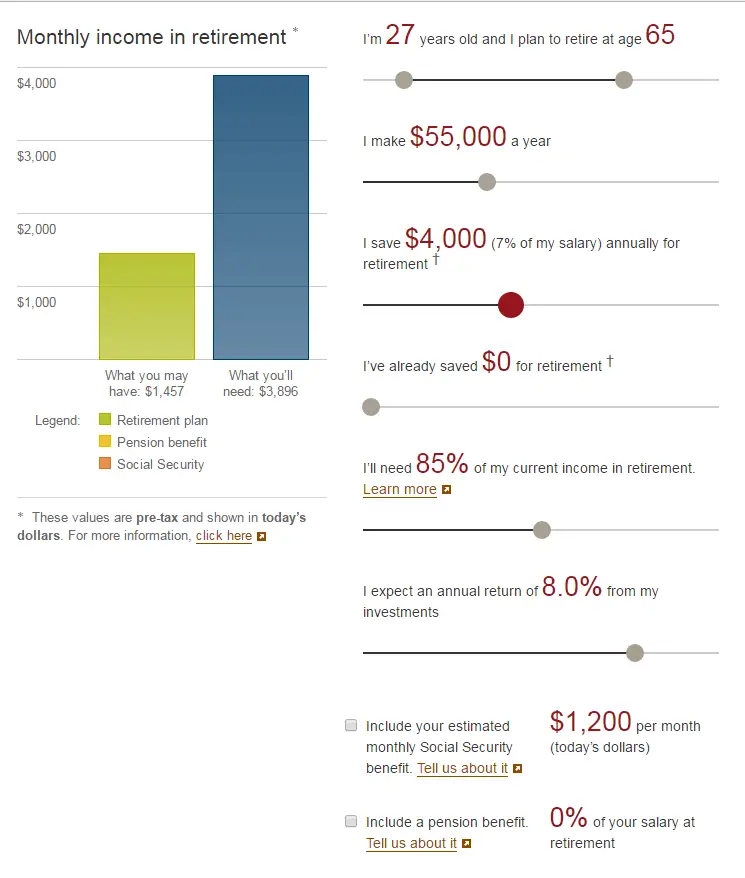

How Much Retirement Savings Should You Have

Theres no magic savings number thatll guarantee you financial security in retirement. A good rule of thumb is to stash away enough cash so that by the time you leave the workforce for good, you have 10 to 12 times your ending salary on hand in savings.

But remember, thats the total you should be aiming for at the time of your retirement. And so if youre 30 years old and are sitting on a retirement plan balance of $33,472, or something in that vicinity, you may not be in such poor shape.

Read Also: Can You Borrow Money Against Your 401k

How To Find An Old 401 Account

During the frenzy of leaving behind an old job and getting acclimated to a new position, rolling over your 401 plan isnt always your first priority. Some people even lose track of a 401 plan at a former employer. Heres what to do if youre trying to find funds held in a previous employers 401 plan.

Contact Your Former Employer.

The simplest and most direct way to check up on an old 401 plan is to contact the human resources department or the 401 administrator at the company where you used to work. Be prepared to state your dates of employment and Social Security number so that plan records can be checked. Hopefully you have some record regarding your 401 and you have contact information for either the employer or the entity that is administering the plan for the employer, says Anna-Marie Tabor, director of the Pension Action Center at the University of Massachusetts Boston. If you know who administers the plan, you should reach out to the administrator and explain the situation. It can be helpful to find old 401 statements. You can also check whether you made a 401 contribution in a given year on box 12 of your W-2 tax forms. When you file for Social Security benefits you may receive a SSA Potential Private Pension Benefit Information Notice, which contains Internal Revenue Service data about employer retirement benefits you earned while working.

What Is A Social Security Statement

A Social Security Statement is a statement that is available through the Social Security Administration . It shows you the benefits that youll be entitled to when you retire, or if you need to file a claim for disability.

The purpose of the form is to let you know what your benefits will be. Its important to remember that the information provided is just an estimate.

For example, your Social Security retirement benefit is based on your earnings history. Since youre still working, the information that will be needed to determine that benefit is not complete.

The SSA has a record of your earnings and taxes paid up to this point. But what they dont know is what your future earnings will be. The estimate makes the assumption that your earnings will continue at the same level as it was for the most recent earnings year.

So lets say that in 2016 you earned $50,000. Now this is earned income only, so investment earnings, retirement plan liquidations, unemployment insurance, and other unearned sources will not count toward your benefits calculation. Only your earned income wages, self-employment income, contract revenues, and the like are used to calculate your benefits.

The SSA will make the assumption that youll continue to earn $50,000 per year between now and the time you collect benefits.

Recommended Reading: What Time Does Fidelity Update 401k Accounts

Check On Your 401 Periodically

As mentioned, it’s essential to check how much is in your 401 throughout the year. Ideally, more than once, however, annual checks are enough.

The reason to monitor your retirement savings is to keep up with your retirement goals. For instance, as you near retirement, you may want to move your money to safer investments like bonds. Or, if one area has over-performed others, you might decide to reallocate your money to limit your exposure to one category.

Typically these drastic swings in your portfolio won’t happen that quickly. But by scheduling an annual check of your 401 balance, you’ll get a good picture of your 401 portfolio.

Tags

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your companys HR department or plan administrator to see if its an option for you.

If it is and you decide its your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you dont handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers dont allow you to transfer money out of your 401 if youre a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

Recommended Reading: How To Make A Loan From 401k

If I Leave My Job Do I Lose The Money I Put In The Plan

The contributions you put in the plan along with any earnings are owned by you. If your employment ends for any reason, the money is yours to take with you. The contributions made by your employer may be subject to a vesting schedule. You should check your Summary Plan Description you received when you enrolled in the plan to determine the vesting schedule.

Check Your Super Statement

Most people would have a rough idea of the value of their home, but do you really know what your superannuation is worth and whether your fund is delivering the best value for you?

It all starts with that annual superannuation statement you receive. It is one of the most important bits of paper youll receive all year. While finance nerds like us run through their statements every year with a fine-toothed comb, we reckon thats not the case for most people. Many of you probably never read your superannuation statement, preferring to file it away the moment you receive it. Dont make that mistake.

Read Also: How To Find 401k From Previous Employer

If You Received A 401 Plan Refund Check Heres What To Do

- If you got a 401 refund check, the IRS likely didnt find your company plan up to snuff.

- Check whether your employer plans to make any changes in the coming year to allow you to invest as much as youd hoped.

- If not, there are other financially sound ways to apply those erstwhile 401 contributions, such as paying off high-interest debt and starting a taxable investment account.

If you contributed to a 401 plan at work and received a refund for a portion of your contributions, then chances are your plan failed Internal Revenue Service compliance testing.

IRS guidelines require 401 plans to meet certain criteria known as annual contribution percentage and annual deferral percentage to determine the amount participants are able to contribute.

The reason a person receives a 401 refund check is most likely that the employers plan has failed one or both of these tests, which prevents the employee from contributing above a certain amount. And that occurs when eligible participants in the companys 401 plan are not contributing enough of their income, and employers are not contributing a significant enough amount on the employees behalf, either.

The reason why these so-called non-discrimination rules were initially put into place makes sense: to prevent owners and high-ranking executives from keeping the vast majority of company profits instead of paying better wages or offering retirement benefits to all employees.

Follow These Steps With Help If You Need It

At the same time, finding your old accounts may be challenging for several reasons. In the first year of the pandemic, for example, hundreds of thousands of U.S. businesses closed permanently. In addition, says Zigo, you may have moved, or changed your email address, so your previous employer cant find you. Your old 401 plan may have changed sponsors. One of my clients has tried 10 times to reach a previous sponsor. It can be a frustrating process. And the bigger the hurdle, the less likely we are to try, she says. But help is available. A qualified financial planner can guide you through the following steps.

1. Take stock of your accounts

First, make a list that includes every employer where you contributed to a 401, suggests Charles Sachs, a CFP at Kaufman Rossin Wealth LLC in Miami, Florida. Next, call each one to see if they still have an account in your name, and update your contact information, if needed. Reaching out to them is the only way to find out where you stand, Sachs says. Its common for our clients to discover one or two old plans where they still have funds.

2. If a company has closed, check these websites

You can search for your money, which may be considered unclaimed property, at databases such as unclaimed.org and missingmoney.com. Both have links to state treasurers, comptrollers or other officials who update their lists of unclaimed assets regularly.

3. Rollover the money directly to avoid expensive withholding

Read Also: How To Protect 401k From Identity Theft

Account Balance Vs Vested Balance

Why Is the Vested Balance Lower?

If your vested balance is lower than your account balance, you are not yet 100% vested in all balances. You may have matching funds or profit-sharing dollars in your account, but you have not met the service requirements to be fully vested. To get those numbers to match, you need to be 100% vested, which may require that you keep working at the same employer.

How Much Do I Get?

When you are not fully vested, you receive less than your full account balance. For example, if you quit your job and youre 40% vested, you would only get your vested balance as a rollover or cash-out payment. However, its crucial to verify your exact vesting percentage with your plans administratoras you read through statements and find information online, you might get inaccurate information .

How Do I Check My 401k Balance

There are a few ways to check your 401k balance.

One way is to use your 401ks online service. This will allow you to see your account balance, as well as the latest transactions.

You can also use an app on your phone to check your account balance.

Finally, you can check your account balance at your employers office.

You May Like: When Can I Roll Over My 401k To An Ira

Don’t Miss: What Is A 401k For Dummies

Is There A Company Match And If So What Are The Rules

Many employers offer incentives for employees to contribute to their 401 plans by matching contributions up to a certain point. For instance, some companies may match every dollar you contribute with 50 cents of their own, up to a certain percentage of your salary. Thats a nice benefit you dont want to miss out on. But individual plans vary widely, and there may be restrictions on qualifying for the company match or vesting schedules for the match. Ask your plan administrator for the rules that apply to your companys plan.

Us Department Of Labor Abandoned Plan Search

If your former employer has filed for bankruptcy, gone out of business, or was purchased by another company, your 401 might be in limbo.

In these cases, employers are required to notify you so you can receive your funds. However, if your contact information has changed or youve moved, your plan may have been abandoned.

You can use the Department of Labors Abandoned Plan Search tool to locate your old 401s. You will need to enter basic information about your former employer then, you can narrow your search using your social security number.

Like the National Registry of Unclaimed Retirement Benefits, the DOLâs Plan Search tool only located abandoned plan. Thereâs a good chance your old 401s wonât show up in these results.

You May Like: How Do You Cash In A 401k

Follow These 2 Tips To Prevent This Issue

Read Also: Is Fidelity Good For 401k

Features And Services Of Speed Post

- Indian postal service offers up to one lakh on consignments based on the terms and conditions.

- 24 hours booking facility available in selected offices in major cities.

- You can find the consignment status of your article by using an internet track and trace system and SMS based system.

- You can receive an SMS on your registered mobile number when the article is received at the destination point.

- Free pick up for corporate and bulk customers. This service is at their premises through on-call or regular collection service.

- Corporate and contract customers have credit facilities. They can book the article and pay later. And also India Post provides huge discounts to them.

- Cash on delivery for e-commerce.

- The maximum weight for an international speed post is 35 kg.

- India postal service pays INR 1000 if the domestic article is lost or damaged.

- Department Of India Post office pays 30 SDR if the international article is lost or damaged.

Don’t Miss: How To Sign Up For 401k At Work

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

You May Like: How To Use 401k To Pay Off Debt

Prevent Losing Your 401s In The Future

Having a plan is the best way to prevent you from losing your 401s in the future. You should actively manage a 401 plan to ensure youre on pace to meet your retirement goals.

Yearly or semi-yearly checkups are best. Itll prevent you from analyzing your accounts performance and help you keep tabs on your account.

Having your 401 in the back of your mind, you more likely to remember to bring it with you when you leave your job.

Tags