Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Other Investment Accounts For Retirement

In addition to a Wells Fargo IRA and employee-sponsored retirement plans that Wells Fargo services, the financial services company also offers other investment options that you may be using to plan for retirement, including mutual funds, stocks and exchange-traded funds. By opening a WellsTrade® online and mobile brokerage account, you’ll not only be able to access your account online, but you’ll also be able to manage your own investment portfolio.

Visit the Wells Fargo online and mobile brokerage webpage and click “Apply Online” to set up your WellsTrade® account. After you set up your account, you’ll be able to plan for and manage your IRA by choosing the investments you want, entering self-directed online trades, transferring funds between your accounts and accessing this account information any time.

You May Like: When Can I Roll A 401k Into An Ira

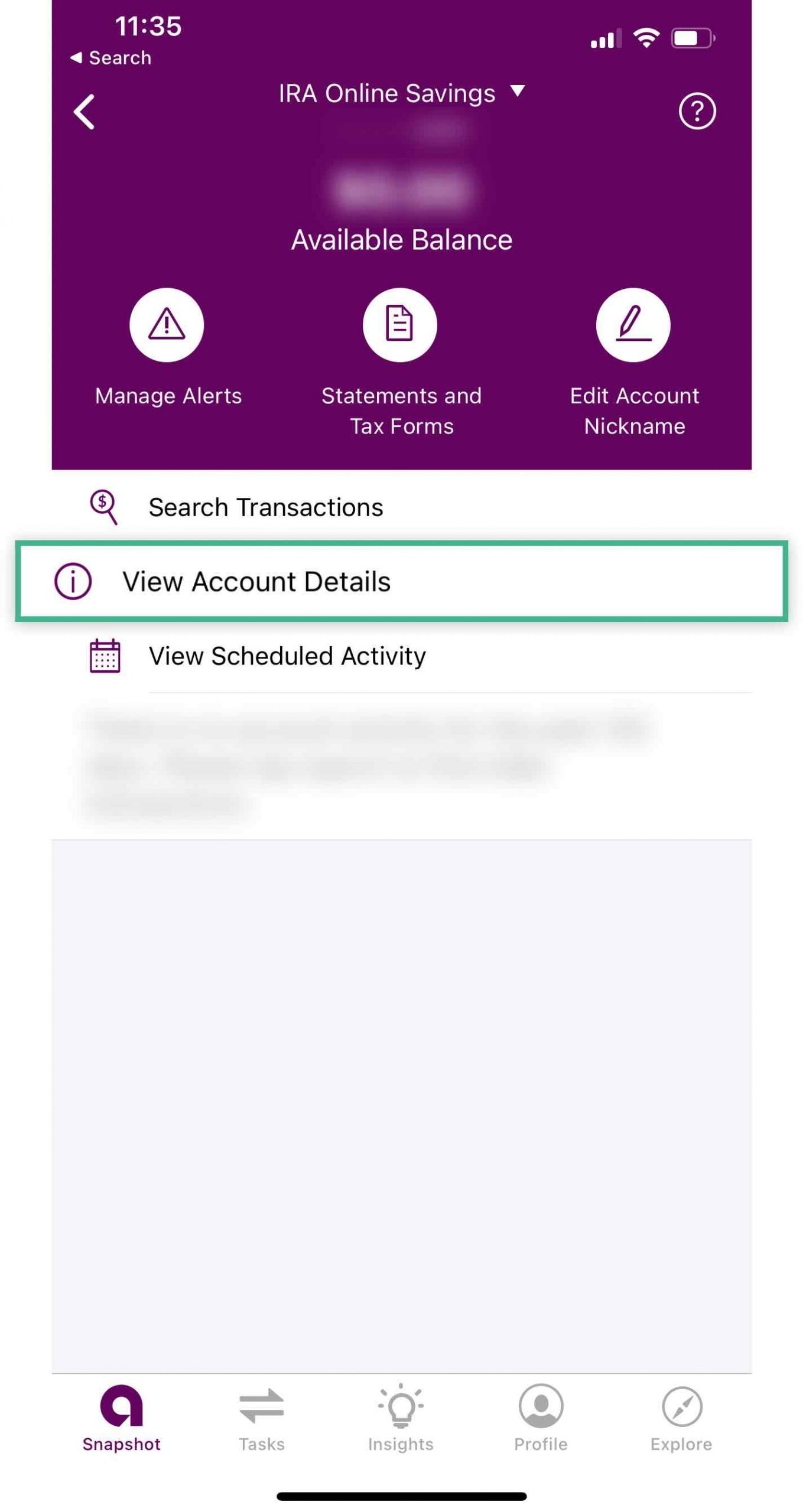

How Do I Access My Wells Fargo Retirement Account

Wells Fargo & Company is a self-described community-based financial services company with assets totaling almost $2 trillion. Among the products that Wells Fargo offers its customers, retirement accounts provide a savings vehicle outside other types of savings accounts and workplace retirement plans. Customers can remotely access their Wells Fargo retirement account without making a bank visit.

Tip

In addition to visiting an account representative at your local Wells Fargo branch, you can access your Wells Fargo retirement account by reaching a Wells Fargo representative over the phone, creating an online account or using Wells Fargos mobile app for your smartphone.

Prevent Misplacing Future Iras

As mentioned above, consolidating your old IRAs into one is the best way you donât lose track of them in the future.

Furthermore, itâs a good idea to find your old 401s and roll them over into either your current 401 or an IRA. This prevents losing track of your 401 accounts you held at former employers.

Additionally, make a plan to monitor your retirement account at once per year. By doing this annualâor moreâyour account stays fresh in your mind.

Also Check: Can You Buy A House With 401k

Level One Bancorp Announces Quarterly Preferred Stock Cash Dividend

Your best bet is to visit FreeERISA.com, which can help you track down your old 401 using the following website tools:

- Code search: Find employee benefit and retirement plan filings by location.

- Dynamic name search: Find 5500s even if the plan sponsor’s name changed.

- Instant View: See benefit filings right in your browser instantly.

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent, on any appreciation. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

You May Like: What Is A Pension Vs 401k

How Is An Ira Different From A 401

A 401 is a tax-deferred retirement savings account. Typically provided by an employer, contributions are made directly from your paychecks before taxes are taken out. An employer or outside firm manages the 401 plan and determines the planâs rules like vesting schedules and eligibility.

Conversely, an IRA is a different retirement savings account. Although not provided by an employer, IRAs are relatively easy to set up. Large institutions like Fidelity or Vanguard are the main places to open an IRA. However, more tech-forward companies called robo-advisors are entering this space and provide IRAs as options to invest.

A traditional IRA works in the same way as a 401 for the most part. Contributions are made using pre-tax dollars, and distributions are taxed.

Alternatively, a Roth IRA uses after-tax dollars. Distributions during retirement, then, are tax-free.

Your Ira May Be With The State

If itâs been longer than five years and you havenât been in contact with your IRAâs custodian, it could be a little more difficult finding your IRA.

IRA custodians require your up-to-date contact information to send you pertinent information about your account, like statements and tax documents. However, itâs up to you to keep this information current. Fail to do so, and the institution goes about their business as if youâve been in the loop.

If their calls go unanswered and mail and email attempts are returned, by law, they must give up. This prevents your information from getting into the wrong hands accidentally.

When this happens, IRAs get handed off to the treasurer of the state where you opened the account and may have incurred a 10% tax penalty by the IRS.

Your stateâs treasurer is where you can search for any unclaimed money thatâs owed to you. Unclaimed.org can help you locate your stateâs appropriate department.

Depending on the state, youâll enter your name and social security number, and the database will pull up and money belonging to that information.

Itâs not always guaranteed, but it may turn up lost IRAs

Also Check: How To Collect My 401k Money

Disadvantages Of Rolling Over Your 401

1. You like your current 401

If the funds in your old 401 dont charge high fees, you might want to take advantage of this and remain with that plan. Compare the plans fee to the costs of having your money in an IRA.

In many cases the best advice is If it isnt broke, dont fix it. If you like the investment options you currently have, it might make sense to stay in your previous employers 401 plan.

2. A 401 may offer benefits that an IRA doesnt have

If you keep your retirement account in a 401, you may be able to access this money at age 55 without incurring a 10 percent additional early withdrawal tax, as you would with an IRA.

With a 401, you can avoid this penalty if distributions are made to you after you leave your employer and the separation occurred in or after the year you turned age 55.

This loophole does not work in an IRA, where you would generally incur a 10 percent penalty if you withdrew money before age 59 1/2.

3. You cant take a loan from an IRA, as you can with a 401

Many 401 plans allow you to take a loan. While loans from your retirement funds are not advised, it may be good to have this option in an extreme emergency or short-term crunch.

However, if you roll over your funds into an IRA, you will not have the option of a 401 loan. You might consider rolling over your old 401 into your new 401, and preserve the ability to borrow money.

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

You May Like: Can I Take Money Out Of My Fidelity 401k

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employer’s plan. As with an IRA rollover, this maintains the account’s tax-deferred status and avoids immediate taxes.

It could be a wise move if the employee isn’t comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plan’s administrator.

In addition, if the employee is nearing age 72, note that money in a 401 at one’s current employer may not be subject to RMDs. Moving the money will protect more retirement assets under that umbrella.

Looked For Unclaimed Money

“Ghosted” 401 money certainly qualifies as missing money, and it could be uncovered on digital money-funder platforms like missingmoney.com.

The site, run by the National Association of Unclaimed Property Administrators, runs free searches for not just retirement funds, but for money in old bank accounts, safe deposit boxes, escrow accounts, and insurance policies. According to the website’s directions, if you get a “hit” on the site, just claim the property and fill out the requested details, then submit and you will receive instructions on the next steps from the state where you made the claim.

Recommended Reading: Should I Roll My 401k Into An Annuity

Track Down Previous Employer Via The Department Of Labor

If you cant find an old statement, you may still be able to track down contact information for the plan administrator via the plans tax return. Many plans are required to file an annual tax return, Form 5500, with the Internal Revenue Service and the Department of Labor . You can search for these 5500s by the name of your former employer at www.efast.dol.gov. If you can find a Form 5500 for an old plan, it should have contact information on it.

Once you locate contact information for the plan administrator, call them to check on your account. Again, youll need to have your personal information available.

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Don’t Miss: How To Set Up A 401k Account

How To Find Old Iras

With how easy it is to open an IRA, it can be just as easy to lose track of past accounts. With the growing number of institutions competing for investors to open new accounts or rollover their existing funds to their institutions, a person could have a few IRAs scattered across the investing landscape.

Luckily, forgetful investors can find old IRAs using information they already know. The tricky part is knowing where to look.

Is It Worth Having A 401 Plan

Generally speaking, 401 plans are a great way for employees to save for retirement. They make it easy to save because the money is automatically deducted. They have tax advantages for the saver. And, some employers match the contributions made by the employees.

All else being equal, employees have more to gain from participating in a 401 plan if their employer offers a contribution match.

You May Like: How To Get Your 401k Without Penalty

Ways Of Finding My Old 401s Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some free help to find your 401 accounts from companies like Beagle.

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying a tax penalty.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the owner of a traditional 401 makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals, as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against the money they have contributed to a 401 plan. Basically, they’re borrowing from themselves. If you consider this option, keep in mind that if you leave the job before the money is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Also Check: How To Avoid Penalty On 401k Withdrawal

How To Find An Old : 7 Ways

People prone to leaving things behind usually don’t lose a 401 account, but it happens more often than you think – especially if you don’t have a great deal of cash stashed away in a 401.

Data from Plan Sponsor Council of America shows that 58% of 401 transfer balances are between $1,000 and $5,000 when a career professional leaves an employer. That’s not an insignificant range of money, but it’s money you could have working for you, if you could only find it.

Additionally, the U.S. Government Accountability Office states that over 25 million Americans with cash in a 401 or other employer retirement plan left that money behind when they moved on to greener career pastures.

People leave old 401 accounts behind for many reasons. The account holder may have engaged in a string of job-hopping experiences and lost an old retirement account in the shuffle. Or, the 401 account holder’s company merged with another firm, was bought out, or went bankrupt.

You might even automatically have been enrolled in an old 401 company by a firm you only spent a year or so working at, didn’t realize it, and completely missed bringing the 401 account along with you to your next job.

If that sounds vaguely familiar, how do you find the money you lost in an old 401 account and what do you do with it when you get it back?

There are plenty of ways to get the job done. Let’s take a closer look.

Contact Your Old 401 Provider

First, identify the provider of your old 401. If you aren’t sure who your old 401 provider is, the name should be on your account statements. If you have trouble finding this information, call your former employer.

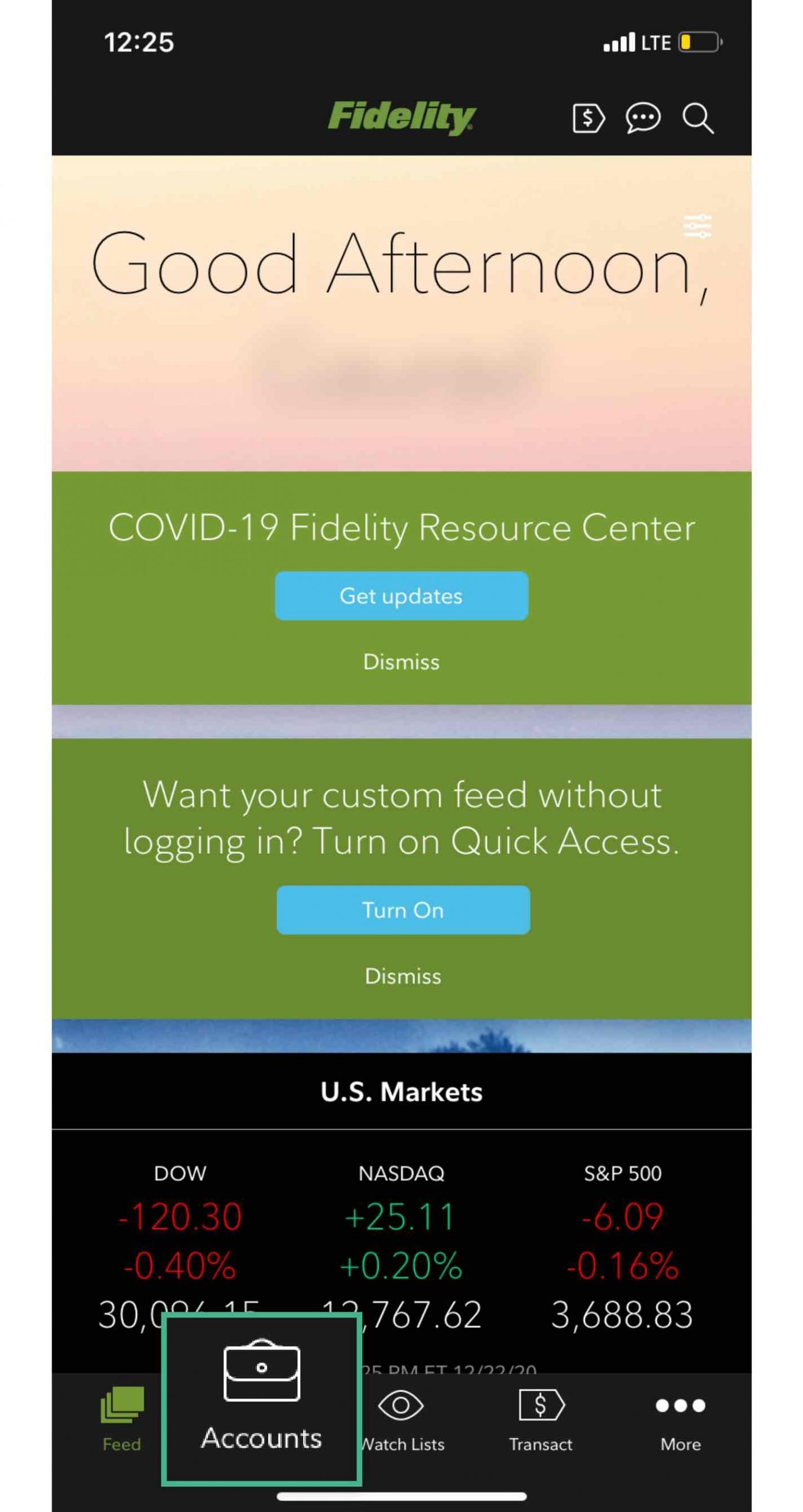

Is your old 401 with Fidelity? If so, you can do the entire rollover through your NetBenefits®. account. You don’t need any additional paperwork, and the money can be directly transferred.

Is your old 401 with a different provider? If so, they will need to start the rollover process, so you’ll need to either call them or initiate the process online. They may need some paperwork, such as a Letter of Acceptance from Fidelity, or their own paperwork completed and signed by you or a Fidelity representative. If you have multiple accounts or employers, you may need more than one LOA.

Here are some questions to ask when you contact them. If you’d like to have a Fidelity rollover specialist on the line with you when you call, call us first at 800-343-3548.

Covington, KY 41015-0037

Do you own company stock?

If you have shares of company stock, it’s easiest to give us a call at 800-343-3548 and one of our rollover specialists can help you understand your options and take action.

Also Check: How Do I Find Out Where My Old 401k Is