Enter The Roth 401k/403b

Almost 80% of these qualified plans now offer a Roth option for employee contributions. The main difference between Roth 401k contributions and Traditional 401k contributions is when you owe federal income tax on the money. When making Traditional contributions, you get an upfront tax benefit because your taxable income is reduced by the amount you contribute. For example, if youre in the 32% marginal tax bracket and you contribute the maximum $19,500 contribution for 2020, you would reduce your 2020 income tax bill by $6,240 which is significant savings to be sure. It isnt until you begin withdrawing your money that your withdrawals are taxed to you as regular income at whatever your marginal tax rate is for that year.

When you contribute to a Roth 401k/403b the money is taxed in reverse. Youll owe federal income tax on the amount you contribute for the year the contribution was made. However, assuming some basic conditions are met, youll wont owe any taxes on that money when its withdrawn. If youre in the 32% marginal tax bracket and you contribute $19,500 to your Roth account in 2020, youd owe $6,240 in federal income tax however, the IRS will never be able to tax that money, or the decades of compounded growth that it generates over the years, again! This benefit cannot be overstated!

How Roth 401 And Pre

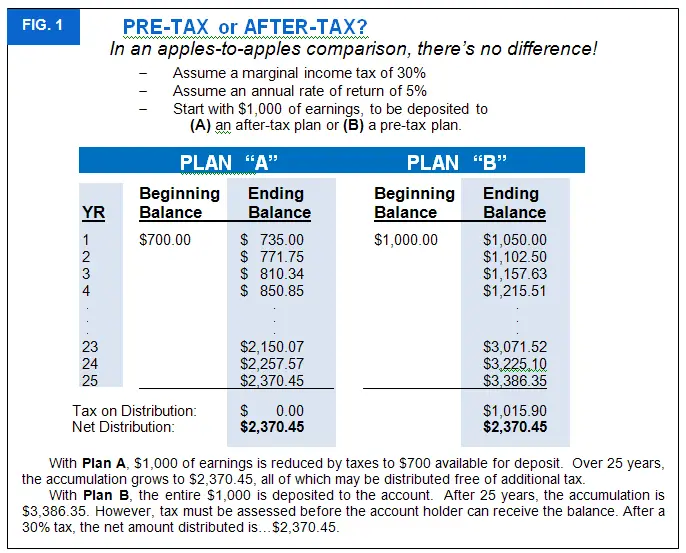

Lets look at a real quick example. Lets say were doing a pre-tax contribution, a traditional 401 pre-tax contribution, and you make $2,000 every couple of weeks, $4,000 a month. Lets just say that your tax rate is 15%. And we can run a thousand different scenarios, but lets just assume that your tax rate is 15%.

Now, if youre saving 10%, youre going to get that straight $200, because youre not paying tax on that $2,000 semi-monthly check on the contribution of that. So lets just say $4,000 a month, youre not paying that that 15% in taxes and then making the contribution. Youre actually getting that full $200 per paycheck, $400 per month, into the pre-tax 401.

Now, lets take a look at the Roth contribution. With a Roth contribution, that same semi-monthly paycheck is actually going to be the same $4,000. However, now youre paying 15% in taxes on that $4,000 that you just earned.

Youre paying your income taxes now. And so, that 15%, thats going to basically knock down that 10% that you can save, which leaves you $170 per paycheck that you can actually put into the 401. So its less money that goes in because you already paid your taxes.

So just keep that in mind. If youre playing apples to apples with the comparison, youre going to be saving less money into the Roth IRA because, all things being equal, you paid your taxes up front. So just keep that in mind.

Why We Recommend The Roth 401

If youre investing consistently every monthwhether its in a Roth 401, a traditional 401 or even a Roth IRAyoure already on the right track! The most important part of wealth building is consistent saving every month, no matter what the market is doing.

But if choosing between a traditional 401 and a Roth 401, we’d go with the Roth every time! Weve already talked through the differences between these two types of accounts, so youre probably already seeing the benefits. But just to be clear, here are the biggest reasons the Roth comes out on top.

Don’t Miss: What Is An Ira Account Vs 401k

When The Traditional 401 Is Better

Heres when the traditional 401 plan is probably the better option:

Youre in a high tax bracket and save money

Because the traditional 401 gives you a tax break on contributions today, it can make sense to use that break today when your tax costs are high.

If someone is in the highest tax bracket , and they think they will be earning less as they approach retirement, then it may make sense to contribute on a pre-tax basis, says Ma.

Thats the course of action recommended by Marianela Collado, CFP, at Tobias Financial Advisors in Fort Lauderdale, Florida, but she adds an important stipulation.

Having said that, even this only makes sense if you are disciplined enough to take the savings associated with making that traditional 401 contribution and you save that, too, says Collado.

Collado says that if youre not disciplined enough to invest that tax savings from the traditional 401, then the tax-free growth will far outweigh what you couldve accumulated in a traditional plan on an after-tax basis.

You cant get matching contributions on a Roth 401

Some employers dont offer matching contributions for 401 plans at all. However, some subset of employers provide this perk for traditional 401 plans only but not Roth 401 plans, because of how tax laws benefit these traditional plans.

Using Schindlers strategy you can still capture the full employer matching which advisers universally agree is the thing you must do with early-year contributions to a traditional plan.

What Kinds Of Mutual Funds Should I Choose For My Roth 401

![Do I Need a Roth 401k? [4 Easy Questions] Do I Need a Roth 401k? [4 Easy Questions]](https://www.401kinfoclub.com/wp-content/uploads/do-i-need-a-roth-401k-4-easy-questions.jpeg)

Diversifying your portfolio is key to maintaining a healthy amount of risk in your retirement savings. Thats why it’s important to balance your investment among four types of mutual funds: growth and income, growth, aggressive growth, and international funds.

If one type of fund isnt performing as well, the other ones can help your portfolio stay balanced. Not sure which funds to select based on your Roth 401 options? Sit down with an investment professional who can help you understand the different types of funds, so you can choose the right mix.

Don’t Miss: How To Open A Solo 401k

More Factors To Consider

If your employer gives you the opportunity to contribute to either, the following are some personal factors that might point to favoring the Roth option:

- You have quite a few working years left to save for retirement.

- You are in a low tax bracket today or you’re fairly sure that your tax bracket will be higher when you retire.

- You don’t want to ever have to pay taxes on the money your investments earn while they are in your account.

- If something happens to you, you want to be sure your heirs keep as much of their inheritance as possible.

- You can manage the strain of paying in a chunk of your taxable income month after month.

Reasons to stick to the traditional retirement account might include:

- You’re on a very tight budget right now. It’s easier to squeeze out enough for a traditional pre-tax contribution since some of that money comes back to you immediately as a lower tax on your paycheck.

- You expect to be in a lower tax bracket after you retire. Tax rates are impossible to predict, but many people do have lower incomes after retirement, and therefore owe less in income taxes.

- You’re close to retirement age. Those taxable returns have a few more years, not decades, to add up.

Roth 401 Vs Traditional : Similarities Differences And Examples

The 401 is a common financial tool for building up retirement savings. Not only does it offer tax advantages, but some employers match their employees contributions. If youre starting a new job, opening and contributing to a 401 is almost always a good idea. But should you put your money into a traditional 401, as nearly nine in ten do, or opt for a Roth 401? Can you do both? And how should you decide?

Well break down the differences between the two, and help you decide which retirement account is best for you.

You May Like: When Leaving A Company What To Do With 401k

Your Tax Situation Will Help You Decide

Scott Spann is an investing and retirement expert for The Balance. He is a certified financial planner with over two decades experience. Scott currently is senior director of financial education at BrightPlan. Scott is also a published author and an adjunct professor at Maryville University, where he teaches personal finance.

Saving for retirement can put you on the path to true financial independence. With rising concerns about the solvency of Social Security beyond 2037 and the savings burden placed on individuals, choosing to participate in an employer-sponsored 401 plan can have a positive impact on your future retirement preparedness. But you have another critical decision to make after choosing how much to contribute to the plan: whether to contribute to a traditional 401 or a Roth 401.

If you understand the differences between a traditional and a Roth 401 and identify the contribution limits, you can decide which option makes sense for you. You may even potentially reduce your total lifetime income taxes.

What Are The Similarities Between A Traditional 401 And A Roth 401

Lets start with what a traditional 401 and a Roth 401 have in common.

First, these are both workplace retirement savings options. With either type of 401 plan, you can enjoy the convenience of having the contribution drafted out of your paycheck.

Second, both can include a company match. About 86% of companies that offer a 401 or similar product provide a match on employee contributions.3 If you work at a place that offers a match, take it. Your employer is giving you free money!

Third, both types of 401s have the same contribution limit. In 2021, the contribution limit is $19,500 per year or $26,000 if youre over 50.4 The opportunity to invest that much every year is a huge perk of either type of 401, especially when compared to the Roth IRAs contribution limit of $6,000 per year.5

The Roth 401 includes some of the best features of a 401convenient contribution methods and the possibility of a company match if your employer offers one. But thats where their similarities end. Lets dig into the distinct differences between these two retirement savings options.

You May Like: How Do I Invest In My 401k

When To Choose A Roth 401

If youre a younger employee, a financial planner might sway you toward a Roth 401.

This is because income is usually lower during our early working years.

A Roth 401 is also a solid option if you want to enjoy tax-free withdrawals in retirement, but your income is too high to qualify for a Roth IRA.

Recent Graduate With New Job: Choose Roth 401 Or Traditional 401

I just graduated, and I’m starting a new job soon. My employer has pretty good policy for matching 401 contributions, so I want to invest as much as possible, especially during this first year.

My question is: should I invest in a traditional 401, a Roth 401, or some combination of the two? On the one hand, tax rates may be much higher when I retire, and I might be in a higher tax bracket, so a Roth 401 would be good. On the other hand, I might be in a lower tax bracket when I retire, so a traditional 401 might be better. It’s hard to know where I will stand in 30 years.

Is this the same trade-off as with a traditional / Roth IRA, or is there any other tax difference I should know about?

I would go for the Roth for the reasons already described by JoeTaxpayer and JohnFx. Furthermore, there are two additional things I’d like to point out:

First, income tax rates in the U.S. may, in general, rise in the future. If tax rates are expected to rise, then it makes sense to pay the tax now and not later, even if your own income level were otherwise unchanged. While guessing what tax rates might be in retirement does amount to speculation, I suggest there’s little chance of income tax rates remaining low in the U.S., with continuing large budget deficits each year.

Below is a supporting reference for that second point, from IRS Publication 4530 , a pamphlet called “Designated Roth Accounts under a 401 or 403 Plan”. Here’s the relevant excerpt:

- 2

Read Also: How Do I Transfer 401k To New Employer

If Your Tax Rate Is Low Now And You Expect It To Be Higher In Retirement

-

You may want to make contributions with after-tax dollars which you can do with a Roth 401.

-

Then you wont pay taxes at that higher rate when you take qualified distributions in retirement.

-

This scenario of lower rate now, higher rate later can affect many workers, especially those early in their careers. Your income and standard of living likely will increase over time, so you may want to draw more money in retirement than youre earning now.

-

Theres also the possibility of across-the-board legislative tax increases current tax rates are low when put in historical context.

What You Need To Know When Deciding Between Roth And Traditional

- Roth and traditional retirement accounts are taxed differently.

- Which account you choose should be based on your current and future marginal tax rates.

- Choosing the right account can help you avoid paying excess taxes.

When youre working and saving for retirement, you typically have a choice between traditional and Roth retirement accounts, including IRAs and 401s. But how do you choose which account to open? Taxes are a primary factor to consider, says Roger Young, CFP®, a senior financial planner with T. Rowe Price. You dont want to pay more in taxes than necessary, so choose carefully.

The tax treatment of Roth and traditional accounts varies considerably. Thats because the way you put money into these accounts and how you take it out later is very different:

- Traditional retirement accounts are generally funded with money on a pretax basis, meaning it comes straight out of your paycheck before you pay any taxes on it. This reduces your taxable income and essentially gives you a tax break for the same year. However, that tax break comes with strings attached. When it’s time to start taking money out of those accounts, youre going to have to pay taxes on every dollar you withdraw.

- Roth accounts, on the other hand, are funded with money that youve already paid taxes on. So contributing to a Roth doesnt reduce your taxes today. However, qualified distributions are tax-free.

Consider Your Current and Future Tax Rates

Roth or Traditional?

Having Trouble Deciding?

Read Also: How Do I Transfer My 401k To A Roth Ira

Whos Eligible For A Roth 401

Theres really no restriction on whos eligible for a Roth 401. If your employer offers it, youre eligible.

Unlike a Roth IRA, a Roth 401 doesnt have income limits. For example, according to the IRS, youre not eligible to contribute to a Roth IRA if you earn more than $140,000 as a single filer .

But you can contribute to a Roth 401 no matter how much you earn. Both the traditional and Roth 401 contribution limits for 2021 allow you to contribute up to $19,500. Account-holders age 50 or older can contribute an additional $6,500 as a catch-up contribution.

Should Higher Earners Choose A Roth Or Traditional 401

by Joe Allaria | Jan 25, 2019

Why Income Level is Important

Your total income isnt as important as your effective tax rate. However, more income usually results in a higher effective tax rate, so income is one of the first factors you should evaluate when deciding between a Roth or Traditional 401. The higher the income, the more likely it is that a Traditional 401 is better.

Heres another way to look at this scenario. Try and estimate if your effective tax rate will be higher today or in retirement? If you think it will be higher today , youd probably want to avoid paying taxes today. Assuming your tax rate will be lower in the future, it would be reasonable to want to defer those taxes to the future. This would suggest using a Traditional 401.

If you expect your effective tax rate to be lower today than in retirement, then a Roth option could allow you to pay taxes today, at a lower rate, and avoid taxes in the future, when you expect your effective tax rate to be higher.

The major kicker in trying to evaluate this question is that nobody knows what tax rates could look like in 10, 20, or 30 years from now. Therefore, you wont know if you made the perfect decision until you reach the point that you are making withdrawals from these accounts.

What is an Effective Tax Rate and Why Does it Matter?

Other Guidelines

Bottom Line

1https://www.forbes.com/sites/jrose/2018/12/05/tax-brackets-and-rates-2019/#d176a0c3ec50. The New 2019 Federal Income Tax Brackets and Rates.

Recommended Reading: How To Take Out 401k Money For House

Tax Advantages: Will I Be In A Higher Tax Bracket Today Or When I Retire

The most important distinguishing factor between Roth 401 and a traditional 401 is when the money is taxed.

-

Traditional 401 contributions are pre-tax, meaning that you can deduct your contributions from your current income, and youll be taxed on the money you withdraw upon retirement.

-

Roth 401 contributions are after-tax, so your deductions wont impact this years tax returns, but youll get to withdraw them tax-free on retirement.

Well walk through a few examples in a minute, but heres a quick-and-dirty answer:

Traditional And Roth 401s

When you participate in a traditional 401 plan, the taxable salary that your employer reports to the IRS is reduced by the amount that you defer to your account. This means income taxes on that money are postponed until you withdraw from your account, usually after you retire.

An increasing number of employers are offering employees a relatively new 401 choicea Roth 401. If you participate in a Roth 401, the amount you defer doesn’t reduce your taxable income or your current income taxes. But when you withdraw after you retire, the amounts you take out are tax-free, provided you’re at least 59½ and your account has been open at least five years.

Both the traditional 401 and Roth 401 offer tax advantages when you defer a portion of your salary into an account in your employers retirement savings plan. Both feature tax-deferred compounding of contributions that are made to the account. Both have no income limits and require minimum distributions after you turn 72 in most cases, and both can be rolled over to an IRA when you retire or leave your job for any reason.

Here is a chart showing the different tax structures for the two 401 options:

Whats more, if your modified adjusted gross income is too large to allow you to qualify for a Roth IRA, a Roth 401 is one way to have access to tax-free withdrawals. There are no income restrictions limiting who can participate. The only requirement is being eligible to participate in your employers plan.

Don’t Miss: How Much Money Should I Put In My 401k