It’s More Than Just Who Contributes

Scott Spann is an investing and retirement expert for The Balance. He is a certified financial planner with over two decades experience. Scott currently is senior director of financial education at BrightPlan. Scott is also a published author and an adjunct professor at Maryville University, where he teaches personal finance.

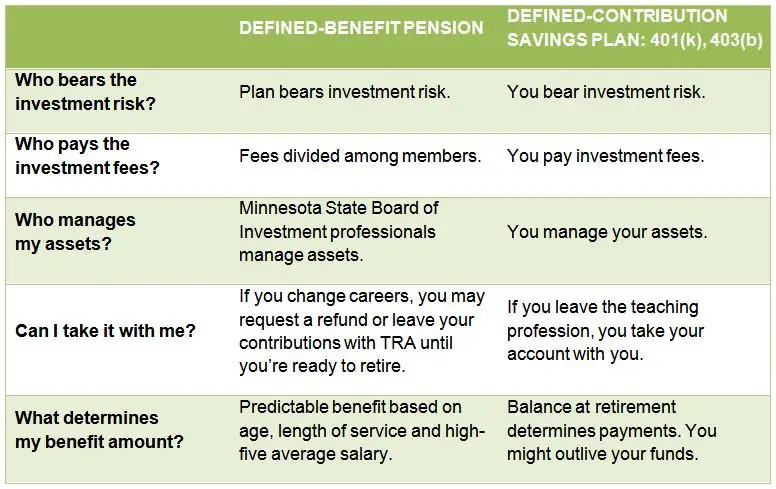

One of the biggest trends in the retirement plan industry over the past few decades has been the shift from traditional defined benefit pension plans to defined contribution plans like 401s. Employers contribute to pension plans, while employees contribute to 401s. Learn more about the differences between these two options.

Pension Vs : Which Is Better

In the pension vs. 401 debate, pensions have the edge, says Tim Quillin, a chartered financial analyst and partner with Aptus Financial, a Little Rock, Ark.-based financial advisory. If you have a pension, you generally dont have to contribute any money of your own, and youre guaranteed a set payment each month for your entire lifetime.

A good old-fashioned pension gives you a source of stable and predictable income in retirement, so you dont have to worry about depleting assets in defined-contribution plans like 401s, says Quillin. Pensions take some of the guesswork out of retirement planning. Even well-funded 401s offer no such certainty.

With a 401, its your responsibility to save for retirement, and not all employers match contributions. If you dont save enoughor withdrawal too much in retirementyour retirement fund could run out of money.

That said, you probably wont get the choice between a pension and a 401. While some non-profit and government jobs offer both types of plans, pensions are becoming increasingly rare. According to the Bureau of Labor Statistics, just 26% of workers have access to a pension plan compared to 60% who have access to a defined contribution plan.

The decline of pensions is mostly due to cost, according to Rick Frink, head of corporate 401 sales for Equitable, a financial services company specializing in retirement solutions.

Is A 401 An Ira For Tax Purposes

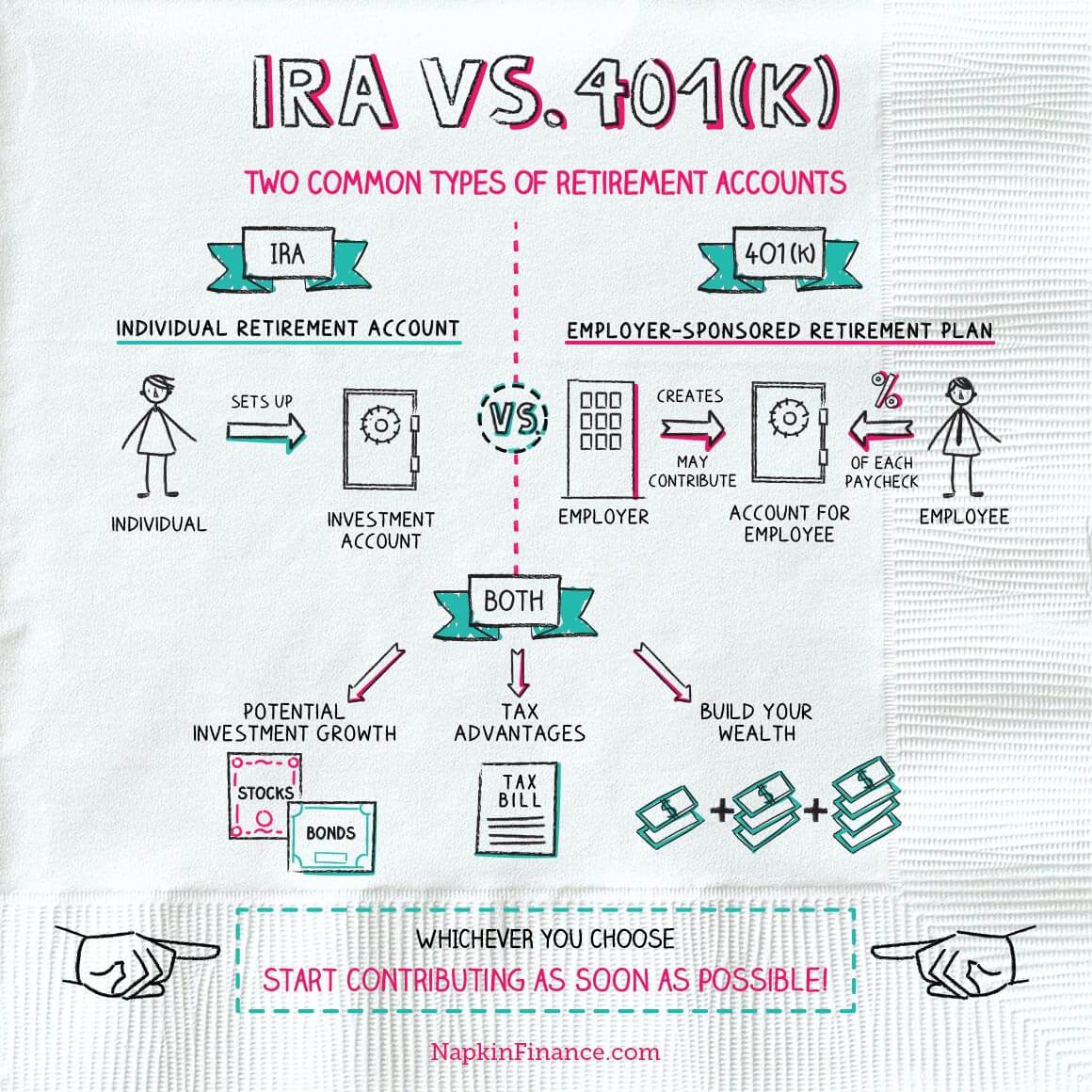

Not all retirement accounts have the same tax treatment. There are different tax benefits for IRAs and 401s. Roth IRAs dont offer a tax deduction for contributions, but withdrawals are tax-free in retirement. Traditional IRAs offer a tax deduction, while 401s allow pretax income to be deposited, which reduces taxable income in the year of the contribution. Distributions in retirement from 401s and IRAs are considered taxable income.

Also Check: How Do I Know Where My 401k Is

What Is A Pension

With a pension, your employer guarantees you a regular monthly payment, starting at retirement and lasting for the rest of your life. Depending on your plan, a portion of these benefits may continue for a spouse or beneficiary after you die. Typically, you have to work for the employer for a set number of years before youre fully vested, or eligible to receive the full pension amount.

With pensions, your employer takes on all of the risk for providing you with income in retirement. They put away money for you each year you work as well as manage any investments over the lifetime of your pension account. You receive a certain payment regardless of how your pensions investments perform. Youll receive the same amount whether the markets are up or down.

S Allow You To Set The Contribution Schedule

With a 401, you can contribute as much of your paycheck as you’d like, as long as you don’t exceed the annual contribution limits. Contributions are withdrawn directly from your paycheck, and you can change your contributions by filling out some paperwork with your employer.

With a pension, your employer decides how much to contribute. Unfortunately, this can sometimes result in underfunding. In fact, pension plans sponsored by S& P 1500 companies have an aggregate deficit of $433 billion as of Sept. 2020. Underfunded pensions are at risk of not being able to pay out promised benefits, whereas 401s are funded by employees and not susceptible to underfunding.

Recommended Reading: When Leaving A Company What To Do With 401k

How Common Are Pension Plans

At the peak of their popularity in the 1980s, 38% of private employees had pension plans to help them in retirement. Today, pensions are a relative rarity in the private sector, with about 15% of employees receiving one.

Pension plans remain popular in the public sector, with 86% of state and local government workers receiving them. This includes occupations like law enforcement, mail carriers, DMV workers, politicians and more.

Pros And Cons Of 401 Plans

Pros

- Full control of your funds. You can invest your money in mutual funds, index funds, ETFs or other options.

- Withdraw funds before retirement. You can tap into your balance early, though with limitations, fees and tax obligations, in most cases.

- Roll over funds when changing jobs. Most 401s let you take your money to a new employer 401 or an IRA account

Cons

- You are responsible for contributions. Your 401 is funded by a percentage of your salary.

- Payout amounts can fluctuate. Your payout correlates with your investments portfolio and market performance over the years.

- Annual contribution limits. Cotributions are limited to $19,500 in 2021. If youre 50 or older, you can add another $6,000 in catchup contributions.

How do pension plans differ from 401s?

Pension plans and 401s differ in many ways, including who funds and manages the account and how its paid out at retirement.

| Pension defined benefit plan |

|---|

Disclaimer:

Also Check: Can I Manage My Own 401k

What Is The Best Investment Strategy For Retirement

Many workers have both a 401 plan and an IRA at their disposal, so that gives them two tax-advantaged ways to save for retirement, and they should make the most of them. But it can make sense to use your account options strategically to really max out your benefits.

One of your biggest advantages is actually an employer who matches your retirement contributions up to some amount. The most important goal of saving in a 401 is to try and max out this employer match. Its easy money that provides you an immediate return for saving.

For example, this employer match will often give you 50 to 100 percent of your contribution each year, up to some maximum, perhaps 3 to 5 percent of your salary.

To optimize your retirement accounts, experts recommend investing in both a 401 and an IRA in the following order:

Pension Vs : The Short Version

There are a few main differences between a pension and a 401. The first is the way each plan is funded. Pension benefits are almost always funded completely by your employer. That means that your employer is automatically placing money into your account without taking anything from your paycheck. A 401, however, is funded mostly by the employee. Money is taken from your paycheck and placed into the account. While some employers will match a portion of your contributions, the bulk of funding for the 401k comes from your own money.

Another key difference is where the risk lies. With a 401, you assume the risk of any investments that you make. If you make great investments, then your money grows and you have more available at retirement. If your investments do not pay off, then you might be left with too little money when it comes time to stop working. On the flip side, the risk of a pension plan lies with your employer. They basically guarantee you certain benefits upon retirement, and they must assume the risk of the investments that they make with the money in the retirement plan.

Don’t Miss: Is There A Maximum You Can Contribute To A 401k

One: How Will Working Families Fare In Retirement

The first section of the chartbook looks at the retirement prospects of working-age families, focusing especially on retirement account savings. Except for one, all charts in this section are based on data from the Federal Reserve Boards Survey of Consumer Finances . In the Survey of Consumer Finances, a family consists of an economically dominant single person or couple, whether married or living together as partners, and all other persons in a household who are financially interdependent with that person or couple. The familys age and education level are based on the age and education of the male in a mixed-sex couple or older spouse in a same-sex couple .

Most of the charts focus on retirement account savings, a measure that includes savings in 401-style defined-contribution plans, IRAs, and Keogh plans for self-employed people and small-business owners. The measure excludes assets held by defined-benefit pension funds, which are not account-type plans.

In addition to other demographic factors, the charts show trends in retirement preparedness by six-year age group or birth cohort from 1989 to 2013. Six-year groups were chosen because the Survey of Consumer Finances is conducted every three years, but six-year groups produce larger sample sizes. All charts use inflation-adjusted dollars and, where possible, are shown on comparable scales. Dollar amounts in charts may reflect rounding by survey respondents.

Key findings of the following charts include:

More From Portfolio Perspective

As more workers change jobs throughout their career the average is 12 jobs, according to one government study it’s not unusual for multiple 401 accounts to be left with ex-employers. More than 16 million accounts of $5,000 or less $8.5 billion in the aggregate remained in workplace plans from 2004 through 2013, according to a report from the Government Accountability Office.

“People assume the money will still be there when they need it,” Tabor said. “The problem is that there can be lots of changes the employer could go out of business, go bankrupt or merge with another company, or the plan may be terminated.”

The congressional proposal would create an office at the Pension Benefit Guaranty Corporation to oversee and administer the lost and found program. It would accept account transfers of less than $1,000 from plans and would try to locate the owner. Individuals also would be able to search the database for contact information for their plan.

“If the company has moved to South Carolina or New Zealand or wherever, or is now Company Z not Company X, the lost and found will have that information,” said Karen Ferguson, president of the Pension Rights Center, a consumer advocacy group.

Generally speaking, companies with retirement plans are expected to do their due diligence in trying to locate account holders.

Recommended Reading: How To Open A Solo 401k

The Bottom Line: Is A 401 Or A Pension Plan Better

It is difficult to say whether one plan is better than the other. Many people would argue that a traditional pension plan is better because it is fully funded by your employer, although these plans are becoming more difficult to find in the private sector. Pension plans today are more common in the public sector like government jobs, but a 401 can help you achieve your goals just as well. In fact, some people choose to use both types of plans because their employer match into their 401 is like free money. Whichever plan you choose, just remember to begin saving early and often and make smart investment decisions. When you reach retirement age, you will be glad you did!

Two: How Are Older Americans Faring In Retirement

Charts in this section focus on the income of people 65 and older and are based on data from the U.S. Census Bureaus Current Population Survey Annual Social and Economic Supplement . Unlike the Survey of Consumer Finances, the CPS focuses primarily on individuals rather than families. Though the goal is to assess retirement outcomes, some people in this age group are still working.

Until recently, the CPS did a poor job of capturing distributions from retirement accounts and other types of asset income, making it a problematic source for assessing retirement income. A 2014 survey redesign to correct this problem resulted in large percentage increases in these income measures . But as charts in this section will show, income from retirement accounts remains modest in dollar terms.

Because many families withdraw retirement account savings in lump sums, the size of these distributions for any family in a given year, whether a large sum or nothing at all, does not tell us how important this income source is for that family. But the mean value of these distributions across families does give a sense of the importance of retirement account savings relative to other sources of income. Going forward, it will be possible to assess how much these distributions are affected by economic conditionsfor example, people tapping retirement funds when they lose jobs in recessions.

Key findings of the following charts include:

You May Like: How Many Loans Can I Take From My 401k

For Pension Vs Retirement:

The Pension plan usually has fixed calculations guided by the employees length of time in service and contributions made to the fund. This can then be paid out in a cash sum or in monthly installments. Retirement may or may not be attached to a company fund or to a private fund set up by the employee. Retirement is generally associated with ending your working life, but you can retire from a game or a competition. That would be our personal choice to leave the game and retire.

Eliminating The Security Of Pensions

Unfortunately, stories like my fathers are disappearing. Not only has the guaranteed security of pensions been attacked, but I fear that weve hit a critical point of no return. 401Ks are now so ingrained in our culture that pensions are viewed as a Jurassic, boring old benefit of yesteryear.

To add insult to injury, employers have not only changed the plans, but theyve scaled back the benefits as well. Many of my peers have 401Ks that only offer a 2 or 3% max 401K match. How can anyone retire on that?

Even Social Security, a type of defined benefit pension, is under attack. Had the Bush administration gotten its wish, it would have shifted to private management as well right before one of the biggest drops in stock market history.

Don’t Miss: How To Get Your 401k Without Penalty

Types Of Retirement Plans

401 and similar plans are referred to as defined-contribution plans because employer contributions, rather than retirement benefits, are determined in advance and employers incur no long-term liabilities. Participants in these plans are responsible for making investment decisions and shoulder investment and other risks. In contrast, in traditional defined-benefit plans , employers are responsible for funding promised benefits, making up the difference if the contributions are insufficient due to lower-than-expected investment returns, for example.

401s are an accident of history. In 1980, a benefit consultant working on revamping a banks cash bonus plan had the idea of adding an employer matching contribution and taking advantage of an obscure provision in the tax code passed two years earlier clarifying the tax treatment of deferred compensation. Though 401s took off in the early 1980s, Congress did not intend for them to replace traditional pensions as a primary retirement vehicle, and 401s are poorly designed for this role .

The term defined-contribution is somewhat misleading because employers may not contribute anything to these plans, and employer contributions most often take the form of matching contributions contingent on employee contributions. In contrast, under traditional defined-benefit plans in the private sector, employers are generally responsible for the entire cost, though public-sector workers often share in pension costs.

What’s The Difference Between A Pension Plan And A 401 Plan

- A pension plan is funded by the employer, while a 401 is funded by the employee. contributions.)

- A 401 allows you control over your fund contributions, a pension plan does not.

- Pension plans guarantee a monthly check in retirement a 401 does not offer guarantees.

Pension plans have been in existence for a long time, while 401s are now more common. In fact, the 401 will most likely be replacing pension plans all together in the near future.2 However, there are still employers who offer both a pension plan and a 401 plan – if you’re lucky enough to be in that fortunate situation.

All Learning Center articles are general summaries that can be used when considering your financial future at various life stages. The information presented is for educational purposes and is meant to supplement other information specific to your situation. It is not intended as investment advice and does not necessarily represent the opinion of Protective Life or its subsidiaries.

Learning Center articles may describe services and financial products not offered by Protective Life or its subsidiaries. Descriptions of financial products contained in Learning Center articles are not intended to represent those offered by Protective Life or its subsidiaries.

Companies and organizations linked from Learning Center articles have no affiliation with Protective Life or its subsidiaries.

Also Check: How To Avoid Penalty On 401k Withdrawal

How Do Cash Balance Plans Differ From Traditional Pension Plans

While both traditional defined benefit plans and cash balance plans are required to offer payment of an employee’s benefit in the form of a series of payments for life, traditional defined benefit plans define an employee’s benefit as a series of monthly payments for life to begin at retirement, but cash balance plans define the benefit in terms of a stated account balance. These accounts are often referred to as “hypothetical accounts” because they do not reflect actual contributions to an account or actual gains and losses allocable to the account.