How Do Hardship Withdrawals Work

- Hardship withdrawals only apply if you still work at the employer that administers the 401K. A hardship withdrawal can be made because of an immediate and heavy financial need and is limited to the amount necessary to satisfy that financial need

- Most plans stipulate that you can only withdraw your own contributions, not the employer contributions, but some plans allow both

- Your employer and plan administrator will provide specific criteria for hardship withdrawals if they do offer them. For example, one plan may allow hardship withdrawals for medical expenses but not for tuition. Debt repayment is not always considered an approved hardship.

- Requests for hardship withdrawals may be rejected if an employee is determined to have other resources available to meet the need including the assets of a spouse or children

- Some employers and plan administrators do not offer them.

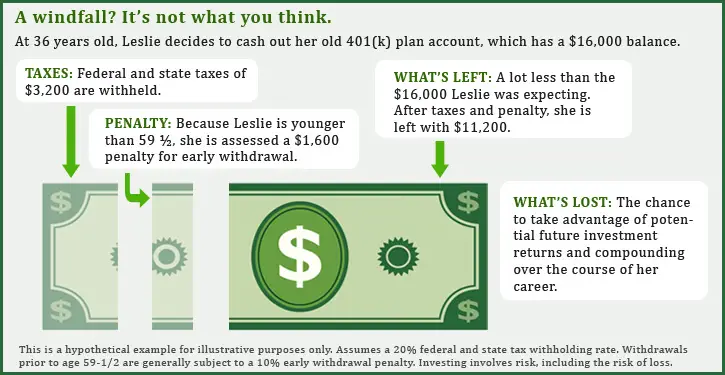

- Hardship withdrawals are taxed as ordinary income and are subject to a 10% penalty if you are less than 59½ years old

- Hardship withdrawals are not a loan and you do not have to pay the amount back

- You may be prohibited from contributing to the 401K for several months after the hardship withdrawal

- Once you leave your employer, your reason for an early withdrawal no longer matters – you can withdraw as much as you want including the employer contributions, but you may have to pay ordinary income tax and a penalty

Substantially Equal Periodic Payments

You can take regular withdrawals from your IRA without penalty by using it as an annuity. Withdrawals are based on life expectancy. Life expectancy is calculated by a professional. Withdrawals are taken at least annually. If at any time you dont withdraw the right amount, penalties may be applied.

You must continue this plan for at least 5 years, or until you reach age 59 1/2.

There are three ways to calculate your SEPP payments:

This is a popular way to access your accounts early.

401k: Eligible

IRA: Eligible

When Faced With A Sudden Cash Crunch It Can Be Tempting To Tap Your 401 More Than A Few Individuals Have Raided Their Retirement Account For Everything From Medical Emergencies To A Week

But if you’re under 59-1/2, keep in mind that an early withdrawal from your 401 will cost you dearly. You’re robbing your future piggy bank to solve problems in the present.

You’ll miss the compounded earnings you’d otherwise receive, you’ll likely get stuck with early withdrawal penalties, and you’ll certainly have to pay income tax on the amount withdrawn to Uncle Sam.

If you absolutely must draw from your 401 before 59-1/2, and emergencies do crop up, there are a few ways it can be done.

Hardship withdrawals

You are allowed to make withdrawals, for example, for certain qualified hardships — though you’ll probably still face a 10% early withdrawal penalty if you’re under 59-1/2, plus owe ordinary income taxes. Comb the fine print in your 401 plan prospectus. It will spell out what qualifies as a hardship.

Although every plan varies, that may include withdrawals after the onset of sudden disability, money for the purchase of a first home, money for burial or funeral costs, money for repair of damages to your principal residence, money for payment of higher education expenses, money for payments necessary to prevent eviction or foreclosure, and money for certain medical expenses that aren’t reimbursed by your insurer.

Loans

Most major companies also offer a loan provision on their 401 plans that allow you to borrow against your account and repay yourself with interest.

You then repay the loan with interest, through deductions taken directly from your paychecks.

Don’t Miss: Can I Transfer My 401k To Another Company

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Build More Passive Income Through Real Estate

One way to prevent yourself from withdrawing funds from a 401k or IRA is by developing perpetual passive income streams. One of the best ways to generate passive income is through real estate. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. These properties now generate a significant amount of mostly passive income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Don’t Miss: How Do I Transfer 401k To New Employer

What If You Only Need The Money Short Term

Although there are other qualifying exceptions to withdraw IRA or 401k assets penalty-free, those listed above are the major ones. But suppose youre not interested in paying any taxes at all. You can still use your 401k to borrow money via a loan. The interest goes to you, the loan isnt taxable, and it wouldnt show up on your credit report. Heres how it works.

How To Withdraw From A 401/ira Early And Not Pay A Penalty

Most people are unaware of the available strategies on how to withdraw from a 401, 457, 403, TSP, IRA and not pay the penalty if you want to retire before age 59 1/2.

If youre looking to retire early and youve put enough money away in your 401, one of the most important questions to answer is:

How am I going to pay for my early bird dinners at 4:30 in the afternoon?

You cant collect social security until age 62 . The imperial federal government wants to protect you from going broke by hitting you with a penalty if you take money out of retirement accounts before age 59 1/2.

But smart people like you arent relying on the government to take care of them. And neither should you rely on the government to do your retirement or early retirement planning.

There are ways to take early withdrawals from your 401 without paying the 10% penalty before age 59 1/2. Ill share with you how to do it.

WARNING WARNING WARNING1) broke2) paying huge penalties

How To Get Started Investing

The international bestseller by CERTIFIED FINANCIAL PLANNER Scott Alan Turner. Choose the right accounts & investments so your money grows for you automatically. No jargon, confusion, or pie in the sky promises. Just a proven plan that works.

Also Check: When Can I Roll A 401k Into An Ira

Accessing 401 Assets Early: Know The Optionsand The Potential Hurdles

Over the past 40 years, 401 plans have supplanted traditional defined benefit pension plans as the retirement plan that Americans are most familiar with. But while 401 plans are popular for retirement savings, federal rules restrict withdrawals from these plans even more than they do for IRAs. Even so, it may be worth discussing how to gain early access to plan assets, especially with clients who may be dealing with financial repercussions of the coronavirus pandemic.

Please see the companion article in this issue of The Link, which addresses taking early distributions from IRAs.

Who Is Eligible For Coronavirus

If you, your spouse or a dependent have been diagnosed with COVID-19, you qualify for the above benefits. However, eligibility for coronavirus-related distributions extends well beyond those who have been diagnosed.

According to an IRS notice issued on June 19, qualified individuals include anyone who has encountered “adverse financial consequences” as a result of the individual, the individual’s spouse or a member of the individual’s household experiencing any of the following due to COVID-19:

-

Being quarantined, furloughed or laid off.

-

Having their hours at work cut.

-

Having a job offer rescinded or delayed or their income reduced.

-

Being unable to work because of a lack of child care.

-

Slashing operating hours or shutting down a business due to the outbreak.

This means that if your spouse experiences financial hardship, you may qualify for a coronavirus-related distribution from your retirement account, even if you’re still employed.

Read Also: How To Check How Much Is In Your 401k

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

You May Like: What Is A 401k Profit Sharing Plan

Tips On How To Retire Early Without Touching 401 Plans

The 401 plans and other retirement accounts are not there for investors to enjoy anytime they want. They are available so they can have money during their sunset years when theyre already out of work.

Besides knowing how to retire early with a 401, an investor may also want to learn how to do it without touching the plan. Here are some tips:

Loan Or 401 Withdrawal

While similar, a 401 loan and 401 withdrawal aren’t interchangeable and have a few key differences. While you can use either to access up to $100,000 of your retirement funds penalty- and tax-free as part of the Consolidated Appropriations Act, they each have their own rules.

As part of a 401 withdrawal:

- Repayment isn’t required.

- There’s no withdrawal penalty.

- Distribution will be taxed as income, but you can pay it back within three years and claim a refund.

As part of a 401 loan:

- You must repay the loan within a specified time frame .

- The loan amount isn’t taxed initially, and there’s no penalty. If you can’t pay it back within the specified time frame, the outstanding balance is taxed and you’ll also be assessed a 10 percent early withdrawal penalty, if you are under age 59 1/2.

- If you leave your job, you have until mid-October of the following year to offset the outstanding loan amount. Otherwise, you could owe 401 early withdrawal taxes and penalties.

Work with your plan sponsor to learn more about the pros and cons of a 401 withdrawal vs. 401 loan.

Don’t Miss: How To Transfer 401k To Bank Account

Your Age And 401 Early Retirement Withdrawals

Early retirement cant begin soon enough for some. Of course, setting up a 401 retirement plan should result in financial independence at an advanced age.

What happens, though, if you end up retiring early? Would you be able to enjoy your retirement benefits?

Often, 401 early retirement questions come to mind for would-be retirees. This is if they plan on retiring earlier than the average person.

This article talks about the penalties and taxes and the methods you can implement to use funds from your assets before the mandated retirement age.

Roth 401 Or Roth Ira Conversion

Since you can withdraw from your Roth account without a penalty at any time, you might consider converting your Traditional 401 to a Roth account. You might even have the option to rollover to a Roth IRA, but there are some differences between an IRA and 401. You should check with your plan administrator to make sure this is allowed. Also note that you will be required to pay income taxes when you make the conversion. Since you contribute to a traditional plan with pre-tax dollars and contributions to a Roth plan are with after-tax dollars, you will have to go ahead and pay taxes on those dollars when you perform the conversion. Make sure you have enough cash on hand to cover those taxes. Once the conversion is complete, you will be free to make a withdrawal from your Roth account without any associated penalties.

You May Like: Can I Invest My 401k In Gold

Exhausting All Other Options

Investment advisors emphasize that people should exit a 401 only when they deem it absolutely necessary and have exhausted all other options. Remember, the 401 is above all a retirement account. It is wise to consult an investment professional before taking such a dramatic course of action.

“Many employees, as they are exiting their employment through retirement or a job change, rightly seek out advice from financial professionals,” noted Wayne Titus III, who owns AMDG in Plymouth, Michigan. “These may include a range of professions, from insurance agents, brokers, tax preparers, or CPAs.”

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

Recommended Reading: Can You Contribute To 401k And Roth Ira

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

- Taking a coronavirus-related withdrawal: There are special rules in place in 2020 allowing a penalty-free withdrawal of up to $100,000 if you’re experiencing hardships related to the coronavirus.

You May Like: Can You Roll A 401k Into A Roth