Can I Transfer My Roth 401 To A Roth Ira

Generally, once you leave the employer, you can transfer your Roth 401 into a Roth IRA. You will need to be careful not to inadvertently move any pre-tax money thats in your 401 into a Roth IRA because this would trigger a taxable event. If you wanted to avoid any additional tax, but you decide to move all of the money out of the 401 is the best decision, you would need to move traditional money into a traditional IRA. Then the Roth money would go into a Roth IRA to keep the same tax treatment in place.

Plan The Details Carefully

Of course, before contributing to a Roth IRA account, consider contributing enough to your employers retirement plan to take full advantage of any matching contribution your employer offers. Otherwise, youre turning down free money.

To help plan for your retirement, consider working with a financial advisor who focuses on helping you make informed choices around every part of your financial life.

We are a national wealth management firm with the resources and engaging systems to help our clients live the life they want.

What Is A Roth 401

A Roth 401 is a type of employer-sponsored retirement account. Many employers offer company 401s that allow employees to defer some of their income into the account to save for retirement. Many employers also match those contributions up to a percentage or flat dollar amount. Many employers are now adding the option for the employee contributions to be Roth or traditional, or a mixture of both. It is up to the employee to choose how they want to save their money.

If you choose to contribute to your Roth 401, your money will be taxed now and grow tax-free. If your employer matches or makes a flat contribution to your 401, the employer funds will be traditional because no income tax has been paid on them yet. So you will have both a traditional 401 holding employer contributions and Roth 401 holding your contributions. This can actually work out in your favor in retirement because you will have the option for strategic tax planning surrounding those withdrawals, allowing you to pay less tax in retirement than you otherwise would if you only had traditional funds to use.

If you work for a company that offers a 401, check to see if they allow Roth contributions.

Don’t Miss: How To Pull From 401k

Recordkeeping For Roth Ira Contributions

You do not have to report your Roth IRA contribution on your federal income tax return. However, it is highly advisable for you to keep track of it, along with your other tax records for each year. Doing so will help you demonstrate that youve met the five-year holding period for taking tax-free distributions of earnings from the account.

Each year that you make a Roth IRA contribution, the custodian or trustee will send you Form 5498, IRA Contributions. Box 10 of this form lists your Roth IRA contribution.

Saving For Retirement In A Roth Ira

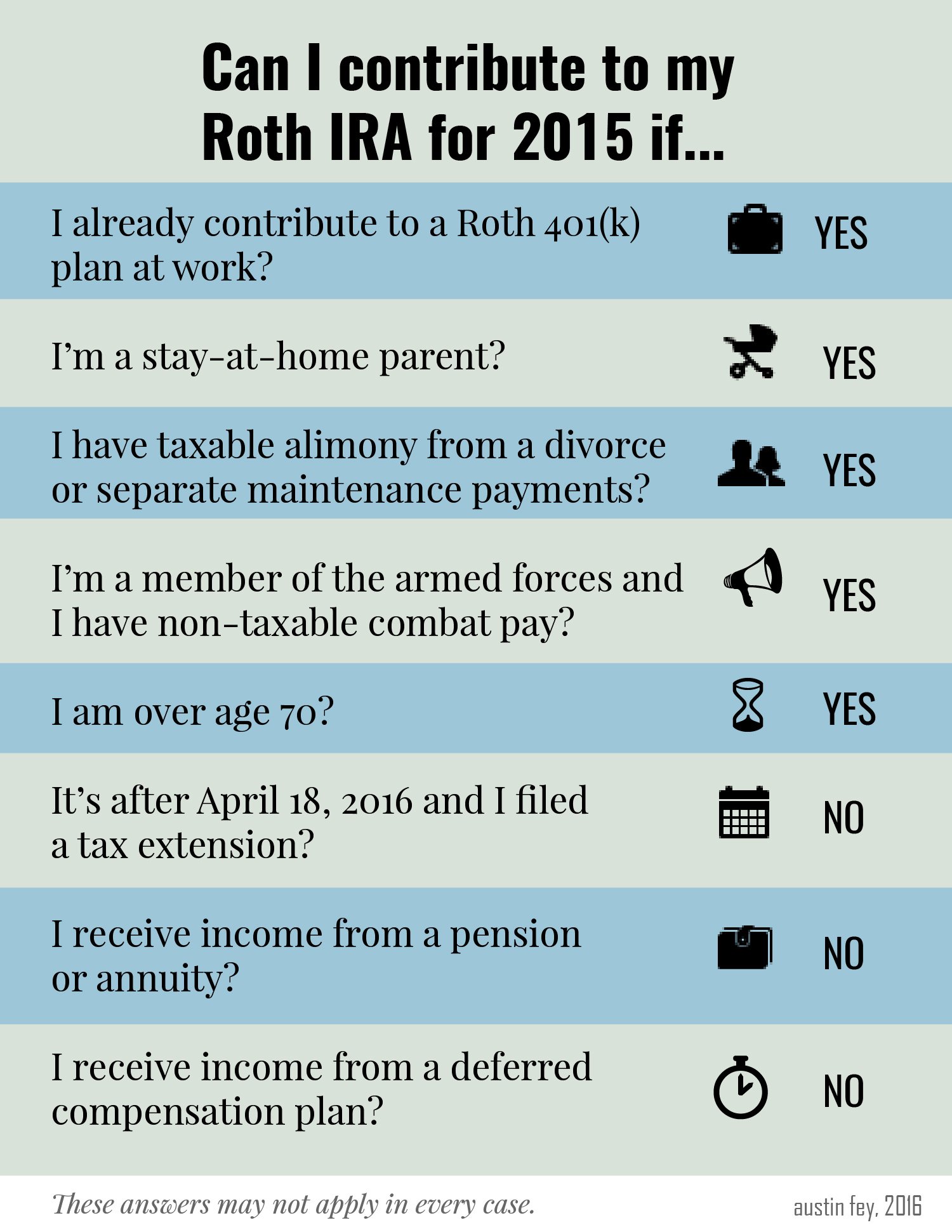

If you meet the income requirements for contributions, there are two compelling reasons to use a Roth IRA for retirement savings.

Recommended Reading: Can I Buy Individual Stocks In My 401k

Roth Ira Or Roth : Which Is Better

Determining which account will best suit your needs depends on your current and future financial situations, as well as your own specific goals.

High earners who want to make contributions to retirement accounts each year should consider a Roth 401, because they have no income caps. Additionally, individuals who want to make large contributions can put more than three times the amount in a Roth 401 as in a Roth IRA.

Those who want more flexibility with their funds, including no required distributions, might lean toward a Roth IRA. This would be especially helpful if you want to leave the account to an heir. But Roth 401 accounts can be rolled over into a Roth IRA later in life anyway.

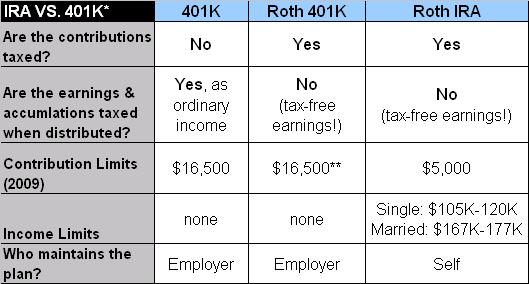

Key Differences Between A Roth 401 And A Roth Ira

- Roth 401 accounts and individual retirement accounts allow for after-tax savings. Money withdrawn during retirement is tax-free.

- However, there are some big differences between Roth 401 plans and Roth IRAs.

- They include contribution limits, income qualification and required minimum distributions.

Roth accounts are after-tax accounts with unique benefits for retirement savers.

Namely, investments grow tax-free, and withdrawals aren’t subject to tax during one’s retirement years. But there are some key differences between Roth savings in a 401 plan and in an individual retirement account.

Here are some of the biggest.

Also Check: How Does Taking Money Out Of 401k Work

Contribution Limits For Iras

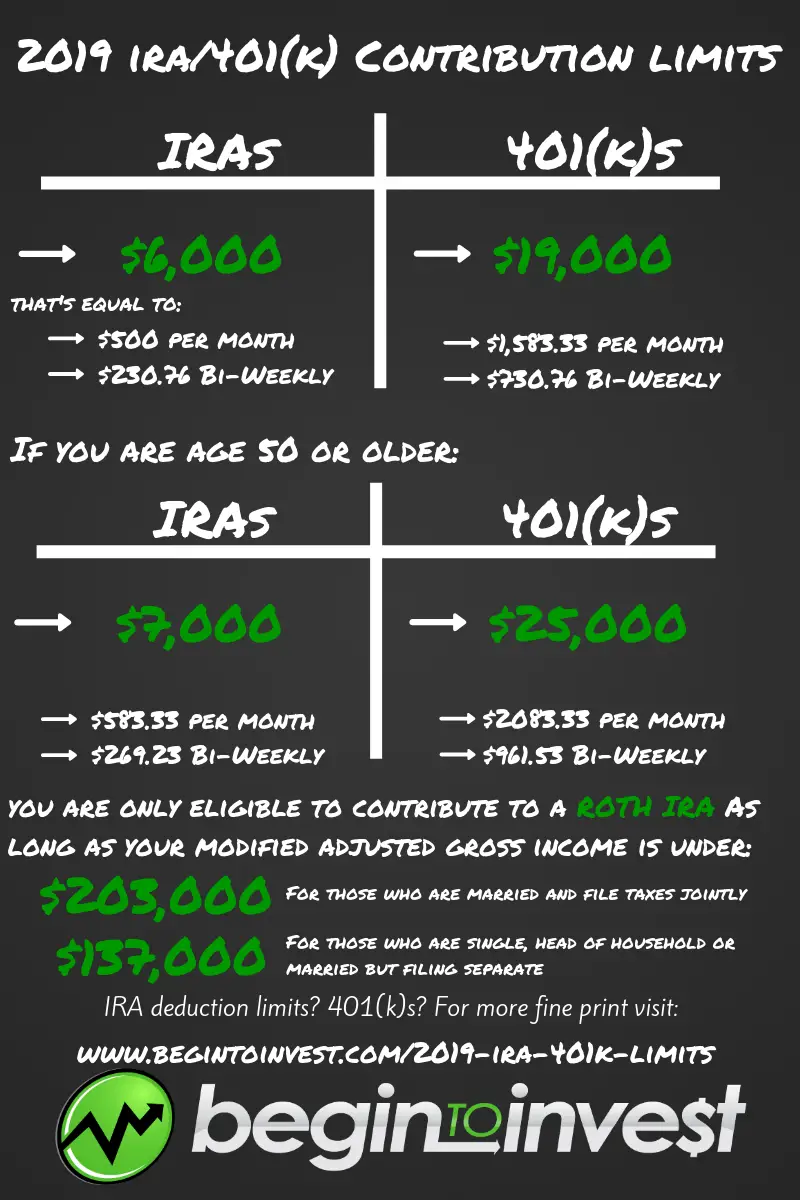

The IRS contribution limits for IRAs for 2018 are $5,500 per year. For those age 50 and older, additional catch-up contributions of $1,000 per year are allowed.

This brings the total contribution limit for IRAs up to $6,500 per year for those age 50 and above. These limits apply whether youre contributing to a Traditional IRA, a Roth IRA or both.

Additional Limits

Note that there are some other limits to 401 and IRA contribution as well. For instance, the IRS has set a limit of $55,000 or maximum compensation, whichever is less, as a combined retirement savings contribution maximum.

However, your employers plan may set lesser limits. Check with your benefits center to be sure. Check with an investment specialist or the IRS for income and other limits regarding 401 and IRA contributions.

Can You Contribute To A 401 And A Roth Ira

The short answer is yes, you can contribute to both a Roth IRA and an employer-sponsored retirement plan such as a 401. In fact, there are two advantages to doing so:

Knowing how to do both effectively can help you live the life you want during your retirement years. Be sure to seek out professional tax advice on this type of decision and discuss your plans with your tax advisor.

You May Like: How Do You Take Money Out Of 401k

Trustee And Investment Selection

This is another area that usually favors Roth IRA plans. As a self-directed account, a Roth IRA can be held with the trustee of your choosing. That means you can decide on an investment platform for the account that meets your requirements for both fees and investment selection. You can choose a platform that charges low fees, as well as offering the widest variety of potential investments.

But with a Roth 401, since its part of an employer-sponsored plan, gives you no choice as to the trustee. This is one of the biggest issues people have with employer-sponsored plans. The trustee selected by the employer may charge higher than normal fees.

They also commonly restrict your investment options. For example, while you might choose a trustee for a Roth IRA that has virtually unlimited investment options, the trustee for a Roth 401 may limit you to no more than a half a dozen investment choices.

What Is A Designated Roth Contribution

A designated Roth contribution is a type of elective deferral that employees can make to their 401, 403 or governmental 457 retirement plan.

With a designated Roth contribution, the employee irrevocably designates the deferral as an after-tax contribution that the employer must deposit into a designated Roth account. The employer includes the amount of the designated Roth contribution in the employees gross income at the time the employee would have otherwise received the amount in cash if the employee had not made the election. It is subject to all applicable wage-withholding requirements.

The law does not allow designated Roth contributions in SARSEP or SIMPLE IRA plans.

Recommended Reading: How Much Money Should I Put In My 401k

Workers Of All Ages Can Benefit From Stashing Away After

If your employer offers a Roth option in your 401, it’s a great idea to invest in it, or at least consider investing a portion of your 401 contribution in the Roth. Contributions to a Roth 401 won’t reduce your tax bill now. While pretax salary goes into a regular 401, after-tax money funds the Roth. But as with Roth IRAs, withdrawals from Roth 401s are tax- and penalty-free as long as you’ve had the account for five years and are at least 59½ when you take the money out.

Because there are no income limits on Roth 401 contributions, these accounts provide a way for high earners to invest in a Roth without converting a traditional IRA. In 2021, you can contribute up to $19,500 to a Roth 401, a traditional 401 or a combination of the two. Workers 50 or older can contribute up to $26,000 annually.

If you get matching funds from your employer, they go into a traditional pretax 401 account. However, a proposal in the Securing a Strong Retirement Act, which has been nicknamed the SECURE Act 2.0, would allow workers to have employer matching contributions invested in a Roth 401. The House Ways and Means Committee has approved the bill, though it still needs to be voted on by both chambers of Congress.

How Many Iras Can You Have

You can as many traditional IRAs and Roth IRAs as you want. A brokerage may limit you to one account per account type, but you can always open an account with another brokerage. However, opening multiple Roth IRAs or multiple traditional IRAs is not a way around contribution limits they still apply as a total limit across all accounts.

Also Check: How Do I Find Out Where My Old 401k Is

Should You Convert Your Traditional 401 To A Roth 401

The law now allows employees to convert funds from a traditional 401 plan to a Roth 401, if the plan allows it. About half of employers offer a Roth 401, according to 2017 data from Transamerica Center for Retirement Studies.

You’ll have to pay taxes in the year you convert, just as you would if you converted a traditional IRA to a Roth. Plus, a large conversion could bump you into a higher tax bracket. Note that unlike converting from a traditional IRA to a Roth, you can’t change your mind and undo a 401 conversion to a Roth.

What Is A 401

In simple terms, a 401 plan is a retirement savings account offered by your employer, with contributions set as a consistent monthly amount, typically as a percentage of your salary.

The main advantage of a traditional 401 is that you can make contributions straight from your paycheck pre-taxsaving you 10% to 37% on your contributions, depending on your income tax rate.

Investment growth in your 401 is also tax-deferred meaning you dont need to pay annual taxes on interest earned. All of this adds up to a big upside for long-term, tax-deferred growth. However, with a traditional 401 you will need to pay income tax on all your earnings when you withdraw from the account.

Another benefit of a 401 is that many employers will match up to a certain contribution amount, effectively doubling your savings. Every company differs in their contribution matching limit, but a common amount is a 50 cents match for every dollar, up to 6% of an employees pay. matching here.)

However, with all the benefits come a few restrictions. The most significant is the contribution limit of $19,500 for employees in 2020. There is also a 10% early distribution penalty tax if you access your funds before age 59½, but the CARES Act may let you waive that penalty if you made an early withdrawal for reasons related to the pandemic, including financial hardship.

Also Check: How Do I Transfer My 401k To A Roth Ira

Roth Ira Contribution Limits

Anyone of any age can contribute to a Roth IRA, but the annual contribution cannot exceed their earned income. Let’s say that Henry and Henrietta, a married couple filing jointly, have a combined MAGI of $175,000. Both earn $87,500 a year, and both have Roth IRAs. In 2021, they can each contribute the maximum of $6,000 to their accounts, for a total of $12,000.

Couples with highly disparate incomes might be tempted to add the higher-earning spouse’s name to a Roth account to increase the amount they can contribute. Unfortunately, IRS rules prevent you from maintaining joint Roth IRAsthat’s why the word “individual” is in the account name. However, you may accomplish your goal of contributing larger sums if your spouse establishes their own IRA, whether they work or not.

How can this happen? To illustrate, let’s go back to our mythical couple. Say that Henrietta is the primary breadwinner, pulling in $170,000 a year Henry runs the house, earning $5,000 annually. Henrietta can contribute to both her own IRA and to Henry’s, up to the $12,000 max. They each have their own IRAs, but one spouse funds both of them.

A couple must file a joint tax return for the spousal IRA to work, and the contributing partner must have enough earned income to cover both contributions.

Limitations On Having Both An Ira And 401

As mentioned, while you are always eligible to contribute to both retirement accounts, if your income is too high, you may not be eligible for the tax benefits of both. To work through this yourself you need to answer two questions:

If you answered no to the first question, then youre set. However, if you or your partner participate in a work-sponsored retirement plan such as a 401, you will be ineligible to deduct your IRA contributions because your income exceeds whats known as the phase-out limit.

If you are filing as single or head of household, the phase-out limit is between $64,000 and $74,000. If your income is less than $64,000, you are eligible for full tax deduction of your contribution to an IRA. If its over $74,000, you are not eligible, and if you are in between you are eligible for a partial deduction.

If you are filing jointly, the limit is $103,000 to $123,000. The same rules apply .

Also Check: Can I Open A 401k Without An Employer

When Can I Start Making Designated Roth Contributions To A Designated Roth Account

You may begin making designated Roth contributions to your 401, 403 or governmental 457 plan after you become a participant in a plan that allows contributions to Roth accounts. If your plan doesnt have a designated Roth feature, the plan sponsor must amend the plan to add this feature before you can make designated Roth contributions.

Can I Contribute To A 401k And An Ira

It is a question that comes up frequently when it comes to retirement planning: Can I contribute to a 401k and an IRA? The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans.

Fortunately for your retirement nest egg, you can contribute to both types of retirement accounts. In fact, both workplace and individual retirement accounts represent important building blocks in your retirement savings. Supplementing your workplace retirement account is a great way to boost your retirement savings and put even more of your money to work in tax-advantaged accounts.

An added bonus: IRAs also often offer more investment options than the typical 401k plan. Just as with your traditional 401k, you may contribute pretax dollars to a traditional IRA and then benefit from tax-deferred growth and distributions. As I later cover, be aware that you can only contribute pretax dollars up to certain income levels.

Read More: When is the IRA Contribution Deadline?

Read Also: How To Make 401k Grow Faster

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Past performance is no guarantee of future results.

Investing involves risk, including risk of loss.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Roth 401 Money Grows Tax

Like a traditional 401, a Roth 401 is an employer-sponsored savings plan. But unlike a traditional 401, your Roth 401 contributions are included in your taxable income at the time they are made. Since you include your Roth 401 contributions in your taxable income when they are made, you generally won’t owe federal income taxes when it’s time to make withdrawals.1

Recommended Reading: How To Collect My 401k Money