Converting Roth 401 To Roth Ira

A Roth 401 plan is similar to a Roth IRA in that the contributions are made from post-tax money in both the cases. Hence, it is easier to convert a Roth 401 account into Roth IRA when compared to traditional 401-to-Roth IRA conversions.

However, taxes may be due on matching contributions from your employer, since such contributions are normally made from pre-tax money and kept in an accompanying regular 401 account. You can set up a new Roth IRA and roll over your 401 funds to it.

Rolling Over A 401 To A Roth Ira: Should You Convert To A Roth

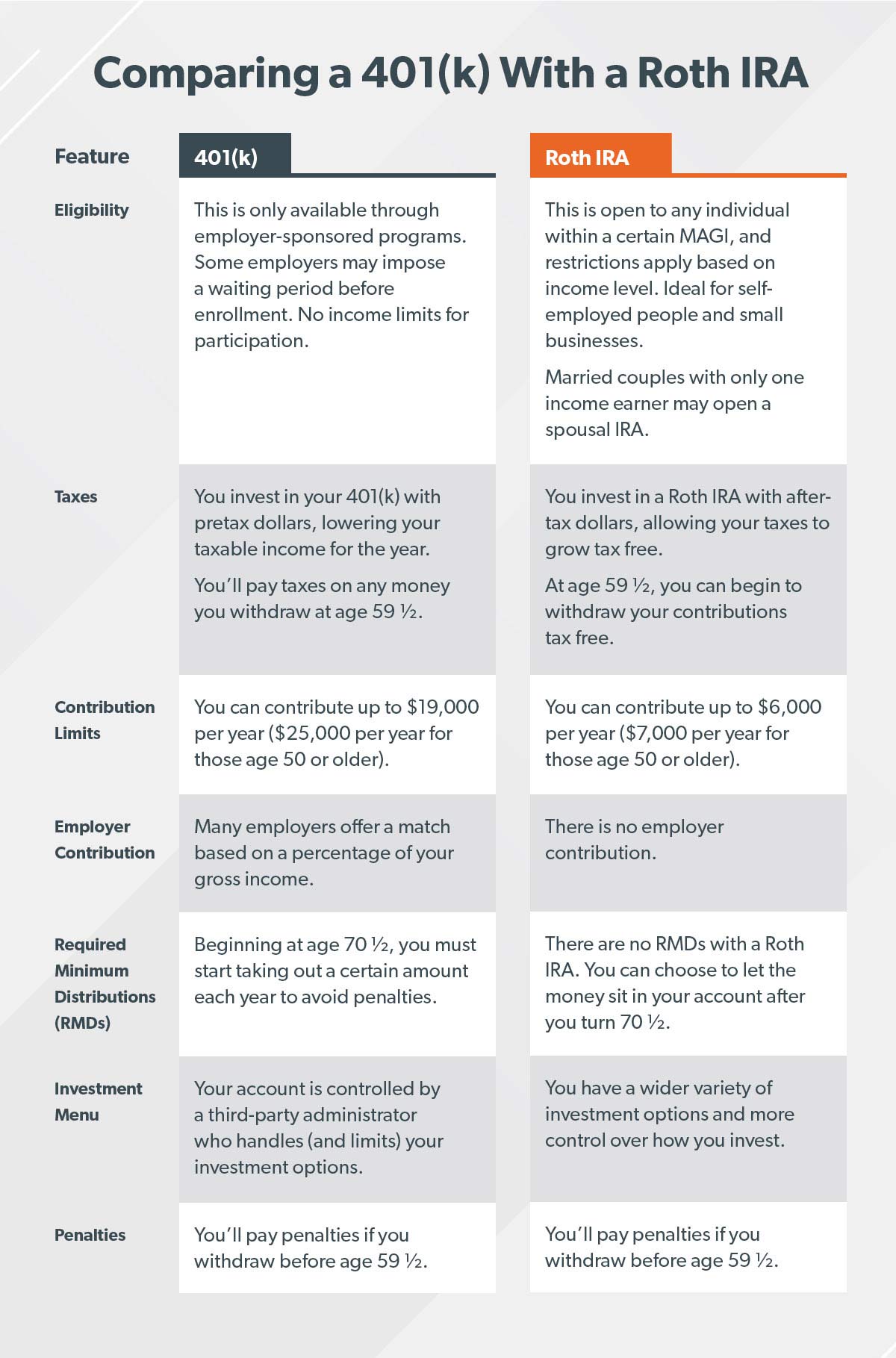

What are your 401 rollover options? You may consider rolling over an old 401 to a Roth IRA, which is properly described as a Roth conversion. Converting your old 401 or 403 to a Roth IRA is worth considering. A Roth IRA offers unique benefits unavailable in other types of retirement accounts: no RMDs, tax-deferred growth and tax-free withdrawals. But a 401 to Roth IRA conversion doesnt make sense in every situation. For high-earners, it may not make sense to pay tax on your retirement savings now.

Roth Ira Conversion Ladder

A Roth IRA conversion ladder is a series of Roth IRA conversions made year after year. It’s a way for people to tap their retirement savings early without penalty. The government lets you withdraw your Roth IRA conversions tax- and penalty-free after they’ve been in your account for five years, and Roth IRA conversion ladders leverage this to get around the government’s 10% early-withdrawal penalty on tax-deferred savings for those under 59 1/2.

You start by converting the sum you expect to spend in your first year of retirement from your 401 or other tax-deferred account to a Roth IRA at least five years beforehand so you can access it penalty-free when you retire. Then, four years before you’re ready to retire, you convert another sum you can use in your second year of retirement. You continue doing this until you have enough to last you until you’re 59 1/2, at which point you can use all your savings penalty-free.

It requires a lot of retirement savings to pull off, and it could result in a larger tax bill, but it’s a strategy worth considering if you plan to retire before you’re 59 1/2.

There are quite a few rules to keep in mind when you’re doing a 401 to Roth IRA conversion, but as long as you check your plan’s restrictions and prepare yourself for the accompanying tax bill, you shouldn’t run into any problems.

You May Like: How Do You Take Money Out Of 401k

What If You Deposit The Funds In The Wrong Account

When you receive a rollover check, you have 60 days to deposit it into the appropriate account. If you miss the 60-day deadline, your rollover will not count as a rollover and will thus become taxable.

Exceptions to the 60 day rollover time frame are hard to come by unless your financial services company made a gross error. That’s why it’s important to have a clear plan for where your rollover funds are going and to make sure your financial advisor or plan administrator knows exactly where to put the money.

If you do miss your 60-day window, you can look at other ways to get money into a Roth IRA by converting an IRA to a Roth or contributing other eligible earned income to a Roth IRA.

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Don’t Miss: How Do I Stop My 401k

When You Should Consider Converting A 401 To A Roth Ira

If you anticipate your tax bracket being higher in retirement due to required minimum distributions or other sources of income, then it may make sense to pay income tax now while you are in a lower tax bracket.

Another reason to convert to a Roth is when you have a sizable pool of tax-free Roth assets relative to your tax-deferred retirement accounts. The tax benefits of a Roth IRA are most significant in this case. If your Roth IRA savings are only 5% or 10% of your entire retirement savings, it may not be enough to justify the loss of tax deferral.

Keep this in mind as an isolated conversion of relatively small dollar value may not make a material impact on your overall wealth. A financial plan can help you weigh whether maintaining tax-deferred growth is a better strategy to maximize your wealth.

A Conversion May Affect Government Programs

If you participated in government healthcare programs or others that depend on your income, its vital to note that a conversion could affect your eligibility in those programs or their cost.

The Roth conversion is viewed as taxable income in the year it occurs, says Keihn. This means that it could affect your eligibility for Obamacare or financial aid or your childrens financial aid. If you are on Obamacare or completing a FAFSA application, it is important to factor that into the decision of how much to convert, if any.

People who are two years from receiving or are receiving Medicare benefits need to know that their Medicare premium most likely will go up two years after they convert to a Roth IRA, says Gilbert. Medicare has a two-year look-back to determine premiums and in the year you convert, your income will be higher than other years. But this is a one-year spike that will then decrease the following year.

Also Check: What Is An Ira Account Vs 401k

Roll Over An Ira To A : The Pros And Cons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

In the world of retirement account rollovers, theres one type that doesnt get much love: the IRA-to-401 maneuver, which allows you to roll pretax traditional IRA assets into a 401. Its frequently overshadowed by rollovers in the other direction 401 to a rollover IRA because theyre more common. But in some cases, this less common move is also worth considering.

Tips For Saving For Retirement

- Having trouble figuring out how taxes fit into your retirement plan? It may be smart to work with a financial advisor on such decisions. An advisor can take a comprehensive look at your finances and identify opportunities to save on taxes and grow your nest egg. To find a financial advisor in your area, use SmartAssets financial advisor matching tool. Just answer some questions about your financial goals and situation, and the tool will pair you with up to three qualified financial advisors in your area.

- As you plan for your retirement income, you should also consider how Social Security benefits fit into the equation. Our Social Security calculator can help in this regard. Fill in your age, income and target retirement date and well calculate what you can expect in annual benefits.

Don’t Miss: How Do I Transfer 401k To New Employer

Do I Want To Pay The Taxes

Sometimes, making a good financial move can be a difficult thing to do. Thats the feeling many traditional IRA owners get when considering a Roth IRA conversion. Can you imagine someone having $300,000 in an IRA and, right upfront, giving up $75,000 of it? A Roth IRA conversion may look good on paper, but in the real world it may be more complicated.

You can use charitable contributions to offset the taxes for a Roth conversion. Tax deductions may be an effective strategy to lower the tax cost of a Roth IRA conversion. Of course, you must first have the financial resources and a desire to gift to a charitable organization to use this strategy.

How Do You Convert To A Roth Ira

The actual process for converting a 401 or traditional IRA to a Roth IRA is simple. In fact, its so straightforward that you can create problems before youre aware that youve done so.

Here are the three basic steps to convert your retirement account to a Roth IRA:

If you manage your own funds, you should be able to find steps to do a Roth conversion on your investment platforms site, says Kerry Keihn, financial advisor at Earth Equity Advisors in the Asheville area, noting that each institution has a slightly different process or forms.

Within a couple weeks and often sooner the conversion to the Roth IRA will be made.

When it comes time to file taxes for the year you made the conversion, youll need to submit Form 8606 to notify the IRS that youve converted an account to a Roth IRA.

Recommended Reading: How To Recover 401k From Old Job

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around just got easier. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. When you leave the company and want to move your money, allocating these retirement funds to new plans becomes tricky.

The new allocation rules take effect beginning in 2015, but taxpayers can choose to apply them to distributions beginning on September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula. This resulted in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You now can choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

Make Sure You Understand These Rules Before Converting Your 401 Funds To A Roth Ira

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRA’s tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount you’d like to convert. Here’s a closer look at how 401 to Roth IRA conversions work and how to decide if they’re right for you.

Don’t Miss: Should I Do Roth Or Traditional 401k

Youll Pay Higher Tax Rates Later

Theres also a rule of thumb for when a conversion may be beneficial, says Victor. If youre in a lower income tax bracket than youll be in when you anticipate taking withdrawals, that would be more advantageous.

The reason for why you might be in a higher tax bracket could be anything: living in a state with income taxes, earning more later in your career or higher federal taxes later on, for example.

Lets say that you are a Texas resident and you convert your IRA to a Roth IRA and then in retirement, you move to California, says Loreen Gilbert, CEO, WealthWise Financial Services in Irvine. She points to high-tax California and no-tax Texas as examples. While the state of California will tax you on IRA income, they wont be taxing you on Roth IRA income.

In this example you avoid paying state taxes on your conversion in Texas and then avoid paying income taxes in California when you withdraw the funds at retirement.

Saving For Retirement In A Roth Ira

If you meet the income requirements for contributions, there are two compelling reasons to use a Roth IRA for retirement savings.

Read Also: Why Cant I Take Money Out Of My 401k

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Tips For Converting Your 401 Into A Roth Ira

Even if they wanted to, investors with larger 401 balances may not have the option of converting that entire amount in a given year, since doing so would create a substantial tax bill at years end. If you decide to roll over some of your pre-tax investments, select an amount that wont put you in a cold sweat. We highly recommend Roth conversions if it doesnt put a burden on your cash flow, says Pearson.

For those doing a partial conversion, prioritizing is key. Pearson recommends homing in on investments thats likely index or mutual funds for 401 holders that have taken the largest short-term hit in valuation. Withdrawing those funds will result in a lower tax liability come April 15 of next year. Should those investments shoot back up again, you wont have to worry about paying tax on those gains once you retire.

In addition, Pearson recommends choosing asset classes where youre going to see the biggest tax benefits. That means focusing on growth-oriented stock funds rather than bond funds, which dont have the same upside. Says Pearson: What youre trying to do is maximize your returns while minimizing the amount of tax youre going to pay.

Also Check: How To Transfer 401k From Fidelity To Vanguard

What Is The Tax Rate On A Conversion

Your conversion will be taxed at your marginal tax rate: The top tax bracket that the withdrawal puts you in when its added to your other income. And tax brackets arent carved in stone. They are adjusted periodically to accommodate inflation and legislation.

For instance, you would have been in a high, 28% tax bracket if filing as single on income of $85,000 in 2010, including the amount of retirement savings you withdrew to make a conversion. Now fast-forward to 2021. That $85,000 would put you at a marginal tax rate of just 22% because 2018 legislation changed the percentage rates and the spans of income they applied to. You would have paid less in taxes if you had waited 11 years to take that tax-deferred distribution and convert it to a Roth account.

Add your anticipated taxable income for the year to the amount of Roth conversion withdrawal you plan to take to find out the percentage rate youll pay on your top earningsthat portion of your income that includes the conversion distribution you tookin 2021:

| 2021 Rate |

| $628,301 or more |

President Biden has expressed his intention to increase the tax rates of higher-income Americans, so the tax bite could increase for high earners in coming years.