Perks For Older Investors

If you happen to be 50 or older, youre entitled to make catch-up contributions by adding an additional $6,500 for a total contribution of $26,000 in 2021, which is the same as the contribution limits from 2020. The total maximum that can be tucked away in your 401 plan, including employer contributions and allocations of forfeiture, is $64,500 in 2021, or $6,500 more than the $58,000 max for everyone else. Forfeitures come from an account in which company contributions accumulate from departing employees who werent vested in the plan.

Talk With An Investment Pro About Your Roth 401

If you want to learn more about your Roth 401 or other investing options, find an investing pro in your area. A financial advisor can help you understand your investments and make confident decisions.

A do-it-yourself approach to investing is never a good idea. Even the pros work with a financial advisor! Your familys future is way too important to wing it.

Looking for a qualified investing pro? Try the SmartVestor program! Its a free way to find top-rated financial advisors near you. Start building a relationship with an investing pro who understands the financial journey youre on.

Live Life To The Fullest

Make sure you have a proper asset allocation of stocks and bonds that is more conservative. Too many people were too aggressive investing in stocks right before the financial crisis hit in 2009. As a result, not only did many lose 50% in their investments, they also had to work for years to come.

Your number one goal as a ~60 year old is capital preservation. Hopefully youve accumulated enough, or have a pension or Social Security to help you through if your 401k amount is light. If you havent, know that the fear of running out of money in retirement is overblown. You should be able to live within your means and not need as much money due to the massive amount of extra freedom you have.

I retired at the age of 35 to work on my hobbies, and I dont regret leaving Corporate America one bit. If youre afraid of pulling the rip chord, find some inspiration in these findings from a palliative nurse named Bronnie Ware who took care of her patients during their last days.

Also Check: How To Transfer 401k From Fidelity To Vanguard

Plan To Replace About 80% Of Income

When you stop working, aim to replace about 80% of pre-retirement earnings from all income sources combined, such as 401s and IRAs, Social Security, and pensions.

You can anticipate spending less, because youll no longer be paying payroll taxes or making 401 contributions. You may also spend less on things like gas and clothing, because youre no longer working. The actual amount youll need in order to replace your working income depends on how frugal or luxurious you want your retirement to be.

How Much Will You Need In Retirement

The sum youll need to retire is a highly personal question but needs careful consideration.

I believe retirement is a financial number versus a retirement age. Assess how much you need in your retirement account to live at least 20 years in retirement without having to go back to work to pay your bills, says Shaquana Watson-Harkness, personal finance coach and founder of Dollars Makes Cents, an online debt management and investing training course.

Rita-Soledad Fernández Paulino, a NextAdvisor contributor and creator of Wealth Para Todos, told us how she calculates her financial independence number using Trinity Studys 4% rule. According to the 4% rule, you can estimate how much money youll need to live on during retirement using this quick calculation:

Annual Expenses x 25 = Nest Egg .

For example, if your annual expenses are $40,000, multiply that by 25 for a total of $1M the amount youd need to retire, based on the 4% rule above.

If youre already freezing up thinking about million-dollar sums, remember youre not solely responsible for saving up this much on your own. The market, through compound interest, will do most of the heavy lifting for you, especially if you invest early and let your portfolio grow for decades.

Thats why starting early is so important.

Also Check: When Leaving A Company What To Do With 401k

How Much Should I Put Into My 401 Out Of Each Paycheck

Aiming to put at least 15% of each paycheck into your 401 as long as you can still comfortably afford your living expenses is an excellent start on your way to saving for retirement. It’s suggested that if you can’t meet this amount, aim for the minimum amount to where your employer will match your 401 investment.

Why Is A 401k A Bad Idea

Theres more than a few reasons that I think 401s are a bad idea, including that you give up control of your money, have extremely limited investment options, cant access your funds until youre 59.5 or older, are not paid income distributions on your investments, and dont benefit from them during the most

Recommended Reading: How To Recover 401k From Old Job

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Here’s How Much You Should Put In Your 401 Each Month To Retire With $2 Million

Experts often recommend saving up $1 million before you retire. But for many people, even $1 million may not be enough, thanks in part to longer life expectancies and disappearing pensions.

For those looking to give their retirement plan a boost, CNBC calculated how much you need to put into your 401 each month in order to reach $2 million by age 65, depending on when you start saving. Most financial planners suggest you put away anywhere between 10% and 15% of your gross salary for retirement, so CNBC also calculated the salary youd need to earn in order to save $2 million without putting away more than 15% of your income.

Its worth noting that 401 plans come with contribution limits: In 2019, you can invest up to $19,000 in your account, up from $18,500 in 2018.

Its also important to remember that investing through a 401 or other retirement savings account should be seen as a long-term plan. Its impossible to predict future market returns, and investors should expect to experience both rises and dips in the market.

While these calculations dont take into account the many ups and downs people experience over their lives, such as pay increases, periods of unemployment or sudden financial windfalls or losses, it can be helpful to get a sense of what you should be saving to build a substantial retirement fund.

Heres how much you need to put away to save $2 million by age 65.

Read Also: How To Pull From 401k

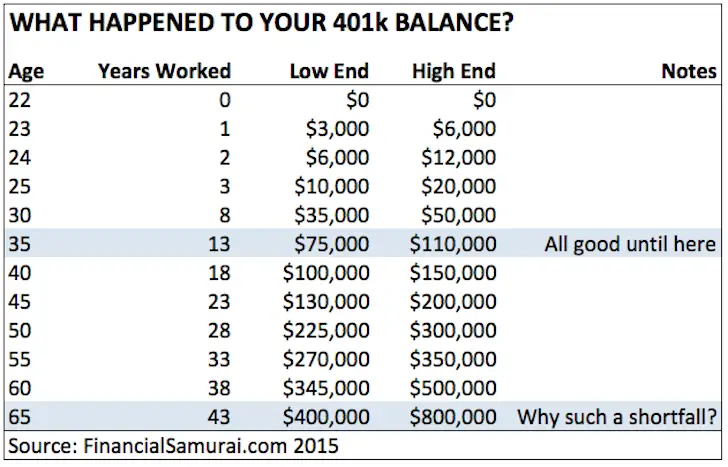

Is Your 401k Savings On Track

Have you met your mark? If you arent there yet, dont panic. These are just rules of thumb. That means they only give you a rough estimate of what you should ideally have by the time you hit these ages. They do not take into account your individual income and experiences or other investments you might have in play.

In reality, theres no one hard answer to how much you should have in your 401k and anyone who tells you otherwise is either lying to you or just doesnt know much about finance. We could pull up a bunch of figures and show you how much someone in their 20s or 30s is saving but that would be a complete waste of time for two reasons:

1. Its impossible to compare two investors fairly. Everyone has their own unique savings situation. Thats why itd just be dumb to compare the Ph.D. student saddled with thousands in student loan debt with the trust fund baby who just snagged a cushy six-figure corporate gig the first month out of college. Theyre both going to save very differently, so its not worth comparing.

2. Most people arent financially prepared for retirement. The American Institute of CPAs recently released a study that found that nearly half of all Americans arent sure if theyll be able to afford retirement. Thats even scarier when you consider the fact that many people underestimate how much theyll need for a comfortable retirement.

Vs Roth : How Are They Different

The biggest difference between a traditional 401 and a Roth 401 is how the money you contribute is taxed. Taxes can be kind of confusing , so lets start with a simple definition and then well dive into the details.

A Roth 401 is a post-tax retirement savings account. That means your contributions have already been taxed before they enter your Roth account.

On the other hand, a traditional 401 is a pretax savings account. When you invest in a traditional 401, your contributions go in before theyre taxed, which makes your taxable income lower.

Roth 401 vs. Traditional 401: Pros and Cons

| Contributions | Contributions are made with after-tax dollars . | Contributions are made with pre-tax dollars . |

| Withdrawals | The money you put in and its growth are not taxed. However, your employer match is subject to taxes. | All withdrawals will be taxed at your ordinary income tax rate. Most state income taxes apply too. |

| Access | If youve held the account for at least five years, you can start taking money out once you are age 59 1/2. You or your beneficiaries can also receive distributions due to disability or death. | You can start receiving distributions at age 59 1/2, no matter how long youve had your 401. You or your beneficiaries can also receive distributions due to disability or death. |

Read Also: How Do I Invest In My 401k

Where To Invest If You Don’t Have A 401

Don’t worry if your employer doesn’t offer a 401 there are still ways you can save for retirement on your own.

Many big banks and brokerages offer Individual Retirement Accounts, or IRAs, that allow you to put your retirement money into a range of investments, such as individual stocks, bonds, index funds, mutual funds and CDs. Just like with a 401, you can set up automatic contributions into your IRA from a checking or savings account.

When shopping around for an IRA, choose an account that has no minimum deposits, offers commission-free trading and provides a variety of investment options. Taking these factors into account, Select narrowed down our favorites for every type of retirement saver.

Contribution Limits In 2020 And 2021

For 2021, the 401 limit for employee salary deferrals is $19,500, which is the same amount as the 401 2020 limit. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $58,000 in 2021, up from $57,000 in 2020.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $180,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | none |

Recommended Reading: How To Withdraw My 401k From Fidelity

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

You May Like: How To Find My 401k Money

Can You Retire On A Million Dollars

These days, thanks to cost-of-living increases and lifestyle changes, retiring on $1 million isnt as carefree. Though it does not provide for the sumptuous lifestyle of years past, having $1 million for retirement is still a blessing. Many retirees rely on Social Security benefits for at least 50% of their income.

Can You Retire 2 Million

You can retire comfortably on only two million dollars for sure. All you need to do is have your investments match inflation each year. With inflation running at roughly 2% a year, 2% should be your annual retirement withdrawal rate if you want to keep most of your principal. Saving for retirement is addicting.

Recommended Reading: Can I Buy Individual Stocks In My 401k

How Much Should I Have In My 401k Balance By Age

Most people have a different definition of a comfortable living, so addressing how much you should have in your 401k is not a simple black and white answer this amount will vary based on age, lifestyle, and finances. However, as a good rule of thumb, many experts recommend saving one year of salary for every five years of age.

While personal savings is personal, the idea of a nest egg will make you contemplate what your financial future holds. Retirement might seem like a long way down the road, but time flies faster than we realize. If youre fortunate to have an employer who offers a 401k account, consider taking advantage and start saving for retirement as early as possible.

Leverage Other Types Of Accounts

A 401k should make up one piece of your overall retirement account. Its not the only place you should be allocating money. In addition to having a 401k or Roth 401k, you should also be leveraging traditional IRAs and/or Roth IRAs.

Its also a good idea to have a long-term savings account on hand that you add money to periodically. Look for a high-yield savings account from an online-only bank or a money market account that can provide strong savings rates along with flexibility.

This is important for capitalizing on opportunities that can set you up for more success in retirement. For example, you may find an attractive rental property that you want to buy and then flip for profit. This requires having immediate access to capital. You dont want to start tapping into retirement accounts early or youll wind up paying heavy fees and taxes.

Read Also: How To Know If You Have A 401k

When Does It Make Sense To Contribute To A 401

401 plans are meant to help employees and the self-employed save for retirement. The assumption is that if you’re saving for retirement, your financial needs have been met. As such, you should only contribute to your 401 plan if:

- You have an emergency fund:This might be a savings account or another deposit account. Having an emergency fund with enough money to cover three to six months’ worth of expenses can help you avoid the need to take distributions from your 401. If you do that, it can increase your tax bill in the current year if it’s a traditional 401. You also may incur an early withdrawal penalty of 10% if you are not yet 59 1/2 years old.

- You have enough insurance coverage in place:This includes health insurance, property/casualty insurance, and life insurance.

- You have a plan for paying down debt: If you have debt with high interest rates, you may want to pay it down before putting a lot of your money toward retirement. But even if you’re working on paying down debt, it’s still important to save for the future. do both.

Remember: Your 401 contributions are for retirement. That means that money is not for emergencies, a new car, or anything else. If you don’t already have the short-term reserves to pay for these expenses, you could put your money into more liquid deposit accounts. That way, you can readily withdraw from them when the need arises.