You Might Want A Roth Account

If your 401 plan doesnt provide a Roth 401 option, you might choose to roll your retirement savings into a Roth IRA. Advantages of a 401-to-Roth IRA rollover include:

Avoiding Roth IRA income restrictions. Even if your annual income is above the thresholds for Roth IRA contributions, youre still allowed to roll your 401 savings into a Roth IRA. This move is commonly referred to as a backdoor Roth IRA conversion, and it can grant you the benefits of tax-free withdrawals in retirement.

No required minimum distributions . With a 401or even a traditional IRAyoure subject to RMDs, or the mandated annual withdrawals from your retirement savings once you reach age 72. Roth IRAs are free of RMDs, providing you with more control over your retirement savings.

Tax-free withdrawals in retirement. When you roll over a traditional 401 into a Roth IRA, youll probably end up paying some taxes on the amount youre converting. But these taxes may be less than what youd pay if you took regular withdrawals from a traditional 401 in retirement.

Access to additional death benefits. Because there are no lifetime distribution requirements, you can pass down your Roth IRA to your heirsalthough beneficiaries need to draw down the account within 10 years.

Henderson cautions that you must be aware of the immediate tax consequences when you roll your money from a 401 to a Roth account.

Q I Retired From My Job On April 3 2020 I Have A 401 With This Employer With A Balance Of Approximately $600000 Should I Rollover The 401 Into An Ira Or Leave It Where It Is Retired

A. Congratulations on your retirement.

There are many reasons why someone may leave their 401 in place after leaving a job.

The perception of lower costs is one of the main reasons.

But theres been a lot of questions surrounding the lack of transparency of 401 plan fees.

Some 401 plan costs are actually quite high, said Matthew DeFelice, a certified financial planner with U.S. Financial Services in Fairfield.

I think its worth looking at the internal fund fees expense ratios on the investments in your 401 and comparing them to what similar investments may cost in an IRA, he said. This will require a bit of research on your part, but its worthwhile to take the time to do it so you know what you are dealing with.

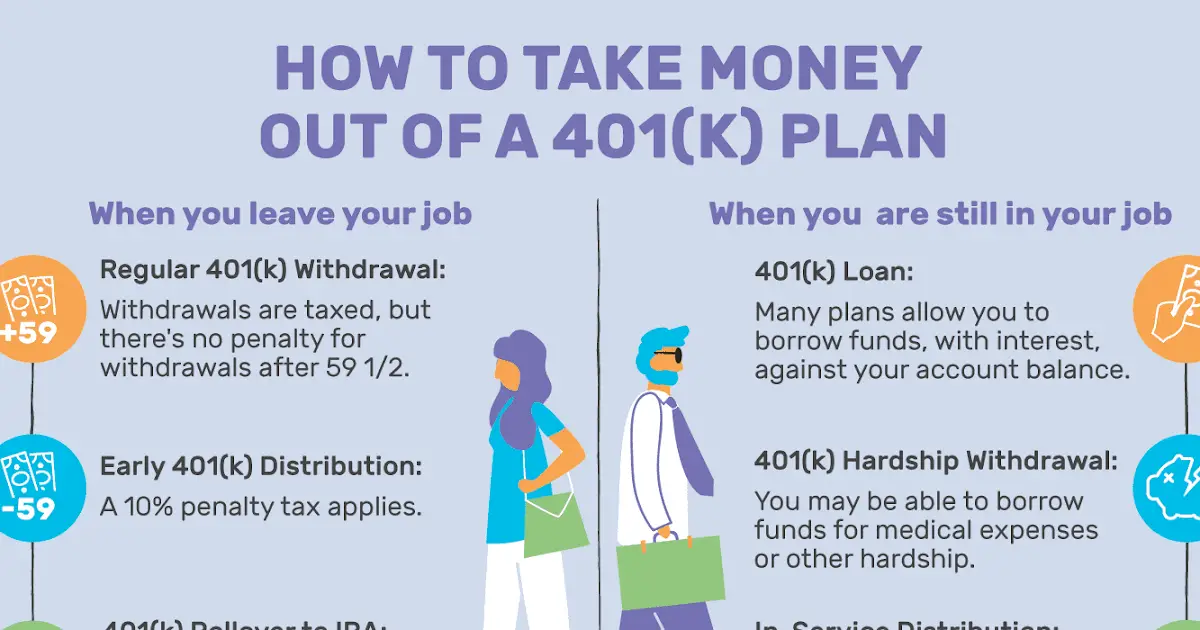

Arguably the best reason for keeping assets in a 401 plan whether thats rolling it into your new employers 401 or keeping your old one applies only if youre planning to retire between ages 55 and 59 ½, DeFelice said.

In general, you must pay a 10% early withdrawal penalty if you take money out of your 401 or IRA before you reach age 59½, DeFelice said.

There is, however, an important exception for 401 plans: Workers who leave their jobs in the calendar year they turn 55 or later can take penalty-free withdrawals from that employers 401 plan, he said.

But if you roll that money into an IRA, youll have to wait until youre 59½ to avoid the penalty unless you qualify for one of a handful of exceptions, he said.

Email your questions to

Fewer Rules More Freedom

Every company has different rules and leeway in its 401 plan, making it difficult to understand and regulate. However, you can count on every broker following the same rules with an IRA because the Internal Revenue Service mandates standardized regulations. The IRS plays a different role with your 401: 20% of all distributions from a 401 must be withheld for federal taxes. Whereas with an IRA, you have the option to have no tax withheld when you take a distribution.

The bottom line is, if your employer sponsors a 401 investment opportunity, seize it! If you have money in a 401 from a previous employer, roll it to an IRA! Regardless of your circumstances, investing in your future is always a good idea. Learn more about all of your retirement investment options by visiting RitaUS.org.

You May Like: Why Cant I Take Money Out Of My 401k

You May Be Charged Lower Fees

In 2016, a comprehensive study of annual fees by Employee Fiduciary found that the average 401 participant paid 2.2% of their balance as administrative and fund fees. While some plans had combined fund and administrative fees as low as 0.2%, others charged as much as 5%.

Check with your old 401 provider to see what fees you may owe them annually. By comparing fees, you can figure out if you would save money with an IRA rollover.

While youll probably never be able to escape fund expense ratios, you can minimize or completely eliminate most administrative fees by moving from a 401 to an IRA. An IRA may also afford you better access to more low-cost funds, like index funds.

How Long Does It Take To Rollover A 401 To An Ira

How long does it take to rollover 401 to an IRA? Find out the rollover rules for moving funds from a 401 to IRA, including the time limits and costs involved.

If you are changing jobs, one of the considerations you should make is what to do with your 401 plan. Do you cash it or roll it over to an individual retirement account ? While cashing it out is an option, you will get a lower payout after tax and penalty deductions. Your best bet is to move funds to an IRA.

A 401 rollover to an IRA takes 60 days to complete. Once you receive a 401 check with your balance, you have 60 days to deposit the funds in the IRA account. If you choose a direct custodian-to-custodian transfer, it can take up to two weeks for the 401 to IRA rollover to complete.

Generally, when choosing what to do with your 401 money, remember the IRS wants the retirement money to remain in a retirement account. If you cash it out or do an early withdrawal, the distribution will be subjected to ordinary income taxes and penalties. However, moving funds from a 401 to an IRA keeps the funds intact as long as you observe the 60-day deadline.

Also Check: How To Recover 401k From Old Job

Transferring Your Old 401 Funds Into A New 401 Isn’t Always Possible

Rolling over into a new 401 is not always possible or as easy as rolling over into an IRA. The new company youre going to might not offer a 401 or have restrictions on rolling over 401 accounts from previous employers. There can also be a lag before you start a new job and when a 401 account is made available to you at that new job.

If it is possible then its definitely worth considering. Just be aware that youll eventually need to roll over into an IRA when you leave the new employer, or down the line.

IRAs on the other hand, are never tied to your employer. Rolling your 401 over into an IRA allows you to continue growing your retirement savings in a tax-effective way, while also giving you more control over your investments.

How Much Does It Cost To Roll Over A 401 To An Ira

If you do the process correctly, there should be few or no costs associated with rolling over a 401 to an IRA. Some 401 administrators may charge a transfer fee or an account closure fee, which is usually under $100.

Because moving your money from a 401 to an IRA allows you to avoid the 10% early withdrawal penalty that results if you withdraw money from a 401 before 59 1/2, it’s a far better option if you can’t keep your money invested in an old employer’s plan or move it to a 401 at your new company.

You should consider whether rolling over a 401 to an IRA is a better option than either leaving it invested when you leave your job or moving the money to your new employer’s retirement plan. If you can avoid 401 management fees and gain access to investments with lower expense ratios, an IRA may be a cheaper account option.

Also Check: How To Open A Solo 401k

There Are Tax Consequences For 401 Rollovers To A Roth Ira

If you roll your 401 into a Roth IRA, you will have to pay taxes on that money. Unlike a pre-tax 401 and traditional IRA accounts, a Roth IRA is a post-tax account. This means that you pay taxes on the funds before you put them in the Roth IRA. A big advantage of the Roth IRA over the traditional IRA is that you can make withdrawals without paying additional taxes since the money has already been taxed.

Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employers plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So let’s look at a few of the pros and cons of consolidating them into one IRA with one institution.

You May Like: How Do You Take Money Out Of 401k

Drawbacks Of Keeping Your 401 With A Former Employer

There are potential drawbacks to this strategy, which may lead you to roll over your account into a new plan.

Multiple accounts to manage: Keeping your 401 with your former company means youll have more than one retirement account to track. For some investors, that may be one too many accounts to juggle.

Contributions end: While the money in your old 401 will continue to grow tax-deferred, you will no longer be able to contribute to the account.

Communication: You may be out of the loop about important updates concerning your account if information about your former employers plan is distributed via company email.

Higher fees: Its possible that fees and expenses attached to your former employers plan are higher than what is offered by your new company. Remember to check the fee disclosure notice of any plan that youre in or thinking of joining.

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

If You Have Company Stock

Some retirement savers hold company stock in their 401 alongside other investments. In that situation, if you roll over all those assets to an IRA, you lose the potential to get a more favorable tax treatment on any growth those shares had while in your 401.

It gets a bit confusing, but the idea is that if the company stock has unrealized gains, you transfer it to a brokerage account instead of rolling it over to the IRA along with your other 401 assets. Upon transferring, you are taxed on the cost basis .

However, when you then sell the shares from your brokerage account whether immediately or down the road any growth the stock experienced inside the 401 would be taxed at long-term capital gains rates . This could be less than the ordinary-income tax treatment you’d face if the stock went into a rollover IRA and then were withdrawn.

Here’s an example: If the cost basis of your company stock is $10,000 and the gains on it were $20,000, you would pay ordinary taxes on the $10,000 when you transfer the shares to a brokerage account.

The $20,000 in gains, however, would be taxed at long-term rates once the stock is sold. Any further growth from the point of transfer to sale would be taxed as either short- or long-term gains, depending on how long you held it before selling.

“It’s a complex transaction, and if done incorrectly, the strategy loses its tax advantage,” said CFP Melissa Brennan, a financial planner with ARS Private Wealth in Houston.

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

Not All Iras Are Created Equal

There are two types of IRA accountsa traditional IRA and the Roth IRA. There aren’t any tax consequences if you roll your 401 into a traditional IRA, which is funded with pre-tax money like a 401. There are tax consequences if you roll over into Roth IRA, which is funded with post-tax dollars.

Transferring funds from your 401 into a traditional IRA can be done directly by your retirement plan administrator. You can also choose to withdrawal your 401 funds and deposit them yourself in an IRA. In that case, you will have to do so within 60 days or else face tax consequences.

With a traditional IRA, you can contribute up to $6,000 per year or up to $7,000 if you are age 50 or older. Any amount you roll over into an IRA from your 401 or another IRA doesnt count towards the contribution limits. You dont have to pay taxes on the money in a traditional IRA until you decide to withdraw it.

What Are The Contribution Limits Of An Ira Rollover

There are no contribution limits to an IRA rollover. If youve been working at a particular company for 10 years and have accumulated a huge nest egg for your tax-free retirement, you can roll all of it into an IRA.

Remember, however, that there are time limits. In most cases, you can only do one rollover per year per account. Additionally, if you are doing an indirect rollover you are limited by a 60-day window to execute the rollover to avoid having it treated as taxable income.

Tips For 401 Rollovers

- Need more help deciding whether to roll over your 401? Consider working with a financial advisor to solidify your retirement plan. SmartAssets financial advisor tool can match you with up to three local financial advisors, and you can choose the one who is best for you. If youre ready, get started now.

- Compare the fees of various plans by locating their fee disclosure notices. Youll want to pay attention to asset-based fees and administrative fees.

- Your 401 may include shares of company stock. If you want to estimate your tax liability when rolling it over, SmartAssets capital gains tax calculator and income tax calculator can help you figure it out.