Accessibility Of 401 Funds

The 401 plan has some great features, such as tax-deferred status, matching contributions and catch-up provisions for older savers. That said, one of their drawbacks is lack of accessibility. The structure of a 401 account is different from that of a traditional individual retirement account .

While an IRA is held in the name of the account holder, a 401 account is held in the name of an individual’s employer on the individual’s behalf. The specific 401 plan offered through the employer governs the circumstances under which individuals can withdraw money from the account, and many employers only allow early withdrawals in the event of severe financial hardship. This basic structural fact regarding 401 accounts is one of the main factors that present obstacles to using account funds as collateral for a loan.

One of the other primary reasons stems from the fact that these accounts are specifically protected from creditors by the Employee Retirement Income Security Act, or ERISA. Therefore, if a 401 were used as collateral for a loan, the creditor would have no means of collecting from the account in the event the borrower defaulted on the loan payments.

Compare Multiple Options Before Borrowing From Retirement Savings

Taking a loan from your 401 is essentially borrowing from your future self. Even if you pay off your 401 loan with no issues, you could end up with less money during retirement due to the loss of compounding interest over the five years it takes you to repay the loan.

This reduction in retirement assets could become even worse if youre terminated before fully paying off the loan or unable to continue making loan payments.

This is why its important to compare all of your loan options before deciding to borrow from your retirement savings vehicle. Though the interest rate and fees might seem initially higher on a personal loan or other alternative, the cost to your future could be much lower.

Tip:

If youre struggling to get approved for a personal loan, consider applying with a cosigner. Not all lenders allow cosigners on personal loans, but some do. Even if you dont need a cosigner to qualify, having one could get you a lower interest rate than youd get on your own.

If you decide to take out a personal loan, remember to consider as many lenders as you can to find a loan that suits your needs. This is easy with Credible: You can compare your prequalified rates from multiple lenders in two minutes without affecting your credit.

Ready to find your personal loan?Credible makes it easy to find the right loan for you.

Other Alternatives To A 401 Loan

Borrowing from yourself may be a simple option, but its probably not your only option. Here are a few other places to find money.

Use your savings. Your emergency cash or other savings can be crucial right now and why you have emergency savings in the first place. Always try to find the best rate on an online savings account so that youre earning the highest amount on your funds.

Take out a personal loan. Personal loan terms could be easier for you to repay without having to jeopardize your retirement funds. Depending on your lender, you can get your money within a day or so. 401 loans might not be as immediate.

Try a HELOC. A home equity line of credit, or HELOC, is a good option if you own your home and have enough equity to borrow against. You can take out what you need, when you need it, up to the limit youre approved for. As revolving credit, its similar to a credit card and the cash is there when you need it.

Get a home equity loan. This type of loan can usually get you a lower interest rate, but keep in mind that your home is used as collateral. This is an installment loan, not revolving credit like a HELOC, so its good if you know exactly how much you need and what it will be used for. While easier to get, make sure you can pay this loan back or risk going into default on your home.

Don’t Miss: How To Check If You Have A 401k

Borrowing Against Your 401

So can you use your 401 to buy a house, and more importantly, should you? Yes, the money is technically yours so you can use it for anything you want or need it for, including as a 401 first-time home buyer.

While you can withdraw your money from the 401 plan in some cases, such as financial hardship, it can be more financially advantageous to borrow instead. But you do need to be aware of some of the potential downsides. Here are some questions to ask.

Borrowing From Your Esop

It is theoretically possible for you to borrow directly from the plan in an arrangement similar to a 401 loan. However, this is not true of all plans. It is, furthermore, unusual for ESOP plans to contain significant cash assets with which to make employee loans, as they by definition contain mostly shares of stock. Each company sets the terms and conditions of its own ESOP plans, within the guidelines of federal law. Not every company permits employees to use their ESOPs as collateral. Check with your plan administrator to see if your plan documents permit you to borrow against your ESOP and under what conditions.

Don’t Miss: How To Transfer 401k From Charles Schwab To Fidelity

Pledging A Qualified Plan

The rules for pledging a qualified plan — that is, using it as collateral — are set down in IRS Regulation 1.401-13. Under this regulation, you can pledge the accrued nonforfeitable benefit of your account if your qualified retirement plan allows loans and the loan or pledge is not made to a disqualified person. The IRS’s definition of disqualified persons includes those controlling or providing services to the plan, the employer, an employee organization with members covered by the plan, majority stockholders of the employer and family members of disqualified persons. Certain exceptions allow loans and pledges to disqualified persons who are plan participants or beneficiaries.

You Can Still Grow Your Nest Egg

ROBS is also a tool for building your retirement assets. While using ROBS does mean youre taking money out of your retirement accounts, it also means putting cash back in. As you work within your business and pay yourself a salary, youll also be contributing a percentage of that salary into a 401, just like you do when youre an employee at any other company. This means your retirement assets will continue to grow as you build your business.

You May Like: Should I Keep My 401k Or Rollover To Ira

How To Use Collateral To Secure A Business Loan

If you need a loan to kick-start your business growth, you have several options. But first, you need to decide whether you want to apply for a loan secured against collateral or an unsecured business loan.

Loans secured by collateral have a range of advantages:

- Higher chance of qualifying

- Better payment terms

- Lower interest rates

On the other hand, unsecured loans arent as paperwork-intensive but do have strict qualifying criteria. The main advantage is that your asset wont be in jeopardy if youre unable to keep up with your payments.

The process of applying for a secured loan can be daunting for someone who hasnt done it before. Here are a few tips that can increase your chances of a successful application.

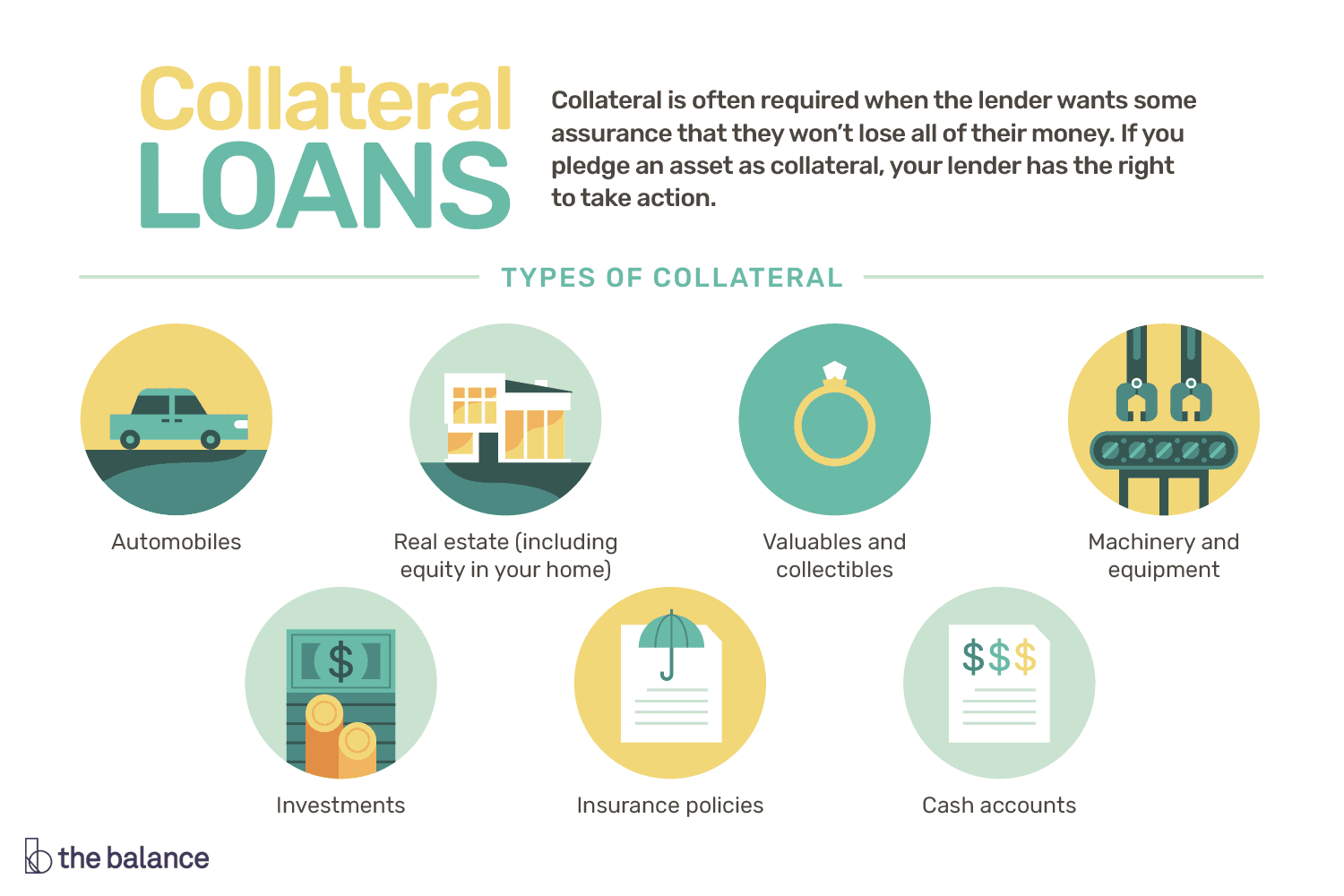

Find Out What You Can Use As Collateral

When you apply for financing, the lenders first consideration is your ability to pay back the loan. Backing your loan with collateral helps them ensure repayment.

Most traditional lenders have similar definitions regarding what constitutes collateral. There are the assets you own outright and the assets that still have loans against them. If you have a loan secured against your home, the lender will often want to refinance the debt.

The lender gains ownership of your collateral if you default on payment, so its important to understand your options. Here are some examples of collateral you can use to secure a loan:

Don’t Miss: How Long To Transfer 401k To Ira

Advantages Of A 401 Loan

- Ability to get quick access to cash

- Tax-free and penalty free use of cash

- Low interest rate Prime Interest Rate iscurrently 4.25% much less than a credit card or pay day loan

- Interest is being paid back to your plan helpingincrease the value of your plan. Forexample, a $50,000 loan at 4.25% interest will give your 401 plan an extra $5,764.68

- Ability to pay a higher interest rate on loanallowing one to increase value of 401k plan while gaining ability to use loanfunds for any personal purpose.

- Flexible options in case of missed payments

Donât Miss: Can I Roll My Roth 401k Into A Roth Ira

Loans To Purchase A Home

Regulations require 401 plan loans to be repaid on an amortizing basis over not more than five years unless the loan is used to purchase a primary residence. Longer payback periods are allowed for these particular loans. The IRS doesn’t specify how long, though, so it’s something to work out with your plan administrator. And ask whether you get an extra year because of the CARES bill.

Also, remember that CARES extended the amount participants can borrow from their plans to $100,000. Previously, the maximum amount that participants may borrow from their plan is 50% of the vested account balance or $50,000, whichever is less. If the vested account balance is less than $10,000, you can still borrow up to $10,000.

Borrowing from a 401 to completely finance a residential purchase may not be as attractive as taking out a mortgage loan. Plan loans do not offer tax deductions for interest payments, as do most types of mortgages. And, while withdrawing and repaying within five years is fine in the usual scheme of 401 things, the impact on your retirement progress for a loan that has to be paid back over many years can be significant.

If you do need a sizable sum to purchase a house and want to use 401 funds, you might consider a hardship withdrawal instead of, or in addition to, the loan. But you will owe income tax on the withdrawal and, if the amount is more than $10,000, a 10% penalty as well.

Recommended Reading: How To Find My 401k Balance

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

Also Check: How Do You Take A Loan Out Of Your 401k

Borrowing Against 401k Question:

My Solo 401k funds are in a brokerage account at Fidelity. This is a great option for me as I have a strong comfort level with Fidelity as I have had a brokerage account there for years. On occasion, I will tap a line of a credit secured by my brokerage account. This is a great option for me because I can access extra cash quickly without having to liquidate my investment portfolio. Can I borrow against my Fidelity Solo 401k brokerage account?

How Coronavirus Has Affected 401 Loans

The CARES Act, which was signed into law on March 27, 2020, made some changes to 401 loan options that were only in effect for the 2020 calendar year.

Borrowers negatively impacted by the COVID-19 pandemic were eligible for certain benefits on 401 loans, including:

- Maximum loan amount: Qualified borrowers could take up to 100% or $100,000 of the vested balance whichever was less through Sept. 22, 2020.

- Repayment term: Borrowers who took out a loan on or after March 27, 2020, and had payments due between March 27, 2020, and Dec. 31, 2020, could have payments postponed for up to one year.

However, these provisions of the CARES Act have now expired, and all new 401 loans must follow the original rules and guidelines.

Check Out: Emergency Loans: How to Get a Personal Loan Fast

Read Also: Is It A Good Idea To Borrow From Your 401k

No Interest No Collateral No Credit Score

401 business financing is an ideal method if you dont want to go into debt, dont qualify for a loan, or just dont have the cash on hand to start or purchase a business. Unlike other types of funding methods, your credit score, past experience, or on hand collateral play no role in eligibility. Instead, the main factors are the type of retirement account or IRA) and the amount of money you have in it .

Those Who Can Pay Themselves Back

Its not free money. You have to pay it back or risk getting hit with a hefty tax bill, says Jeff Levine, of Nerds Eye View, an online news source that caters to financial planners.

Someone who may not be able to pay it back should think a little harder about whether they should tap into their retirement assets or not, Pfau says.

Another thing to keep in mind is how close you are to retirement. For many people, this could force them into an early retirement. Borrowing from their 401 may just be a way of actually starting to take distributions for retirement earlier, Pfau says. You just have to recognize the trade-offs, like not having as much money for retirement down the road.

Don’t Miss: Why Choose A Roth Ira Over A 401k

Qualifying For Robs Business Financing

There are no collateral or minimum credit score requirements to be approved for ROBS funding, so using your retirement funds as the down payment on a business loan is fast and easy. ROBS requirements include:

- Having at least $50,000 in one a pre-tax retirement account, including 401s, traditional IRAs, TSPs, 403s, Keoghs or SEPs.

- The company funded must be an active, operating company. In other words, ROBS cannot fund a passive investment

- The owner of the retirement funds must be an active employee of the new corporation, working in whatever capacity they see fit.

Assess The Risks Thoroughly

Once you have a loan offer, its a good idea to run it past an independent financial advisor. Understand the risks fully before you commit because youre effectively signing over your asset to the bank until youve repaid the loan in full.

What will your business do if the lender takes that asset? You and your financial advisor should make a plan for the worst-case scenario. Weigh the risks against the benefits and consider alternative funding methods at the same time.

You May Like: When Can I Set Up A Solo 401k

Alternatives To Using Your 401 To Buy A House

Many homebuyers assume they need a 20%down payment, which can make it seem nearly impossible to save enough cash tobuy a house.

But home buyers no longer need 20%down.

In fact, theres a long list of low- and no-down payment home loans that can lower the barrier to homeownership.

Some of the most popular low-downpayment mortgages are:

- FHAloans allow as little as 3.5% down andonly require a 580 credit score

- Conventional97 loans start at 3% down and require a 620+credit score

- VAloans available to veterans and servicemembers with 0% down

- USDAloans can be used in certain rural areaswith 0% down

- HomeReady and Home Possible loans only require 3% down and have flexible requirementsfor first time home buyers who have little cash

But what if you dont have a 3%down payment? After all, 3% of $300,000 is $9,000 thats still a lot ofmoney.

If you need help making your downpayment, there are other places to turn before your 401. For example:

Most of these programs are specifically designed for first-time, lower-income, or lower-credit home buyers. So if youre having trouble saving for a down payment for any of these reasons, theres a good chance you could qualify.

Can You Pay Off A 401 Loan Early

Yes, loans from a 401 plan can be repaid early with no prepayment penalty. Many plans offer the option of repaying loans through regular payroll deductions, which can be increased to pay off the loan sooner than the five-year requirement. Remember that those payments are made with after-tax dollars unlike contributions, which are made before taxes.

Recommended Reading: What Percentage Of 401k Is Required Minimum Distribution

Types Of Collateral You Can Use

Several types of collateral can be used for a secured personal loan. Your options may include:

- Cash in a savings account

- Cash in a certificate of deposit account

- Car

- What penalties there are for late payments or an early payoff.

- How much the monthly payments will be.

- What happens to your collateral if you can’t repay the loan.