What Do I Request On The Call

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider. It often means the check is made out in the name of that IRA provider but for the benefit of you. This is generally the simplest approach. Your 401 provider will usually ask you for the name and mailing address of your new IRA provider and your new IRA account number. We also recommend that you take this opportunity to update your mailing address since they may have an old address for you. Thats because youll be sent additional documents, including a tax-related document known as a 1099-R that tells the IRS youre doing a tax-free rollover.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

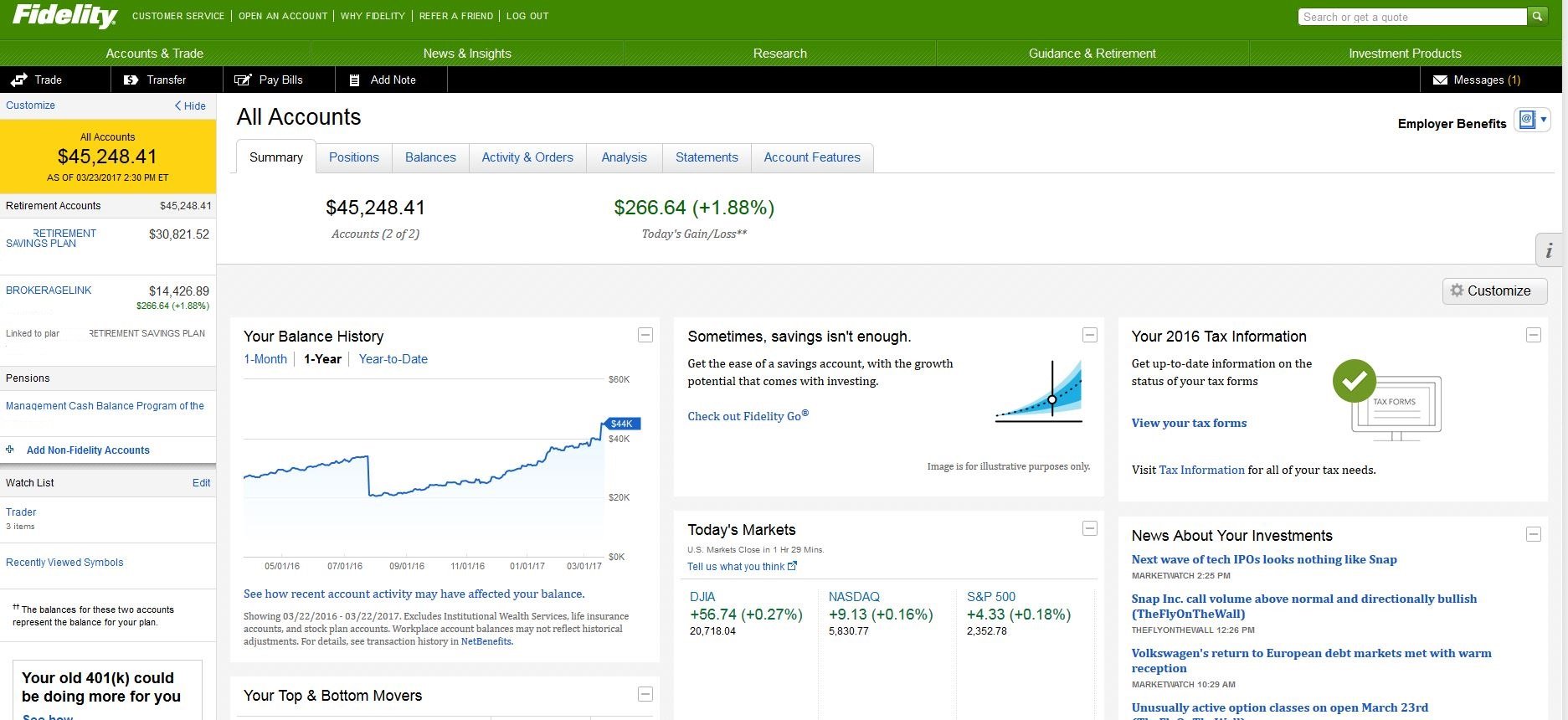

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

If I Choose A Direct Rollover To An Ira Or A New Plan Will I Receive Any Kind Of Confirmation

You will receive a Form 1099-R from your old plans provider indicating you initiated a direct rollover. Since there is no federal income tax withheld, your entire balance will be rolled over and youll continue benefiting from the tax advantages. If you roll over your money into an IRA, you will receive a Form 5498 and an account confirmation from the IRA trustee or custodian. If you roll over your money into a new plan, ask your employer if you will receive confirmation.

Also Check: How To Open A 401k Plan

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

If I Make Contributions To My Rollover Ira Can I Still Roll The Ira Into An Employer Plan

You may be able to transfer your IRA balance into your new plan if the new plan accepts rollovers from IRAs. Before rolling your money into a new plan, you should compare the plans investment options and withdrawal rules with those of your IRA. You may give up some flexibility or face stricter requirements if you make the move.

If you rolled after-tax deferrals from an employers plan into a traditional IRA, you may not subsequently roll those after-tax deferrals to another employers retirement plan.

Read Also: What Happens To Your 401k When You Die

Who Is Charles Schwab Best For

When looking for companies like Charles Schwab, the first comparison that comes to mind is the number of retail locations. Here, even industry titan like Fidelity simply cannot compare.

Namely, Charles Schwab has as many as 360 retail locations, while Fidelity only has around 200. Of course, with a greater number of offices comes better coverage.

Another thing at the top of the pro list for Charles Schwab is that the platforms interface is highly customizable. This allows the user to personalize the dashboard and optimize it for their own use. In other words, it offers more value to intermediate users.

Schwab StreetSmart Edge is another great reason to pick this platform over its competitor. The real-time quotes-and-trading platform provides users with an incredible level of insight. It helps out with research, finding investment opportunities, analysis, placing trades, and even account management.

The platform also offers access to a number of sophisticated analytical tools, which can support your trading quite a bit.

I Want To Roll My Retirement Assets From An Employers Plan To Another Retirement Account How Do I Do That And What Are My Options

If you received distribution forms from your employer, complete them using the accompanying instructions. If you need forms, contact your benefits department to obtain them. You may also be able to download forms by logging in to your plan account. If the institution holding the funds will accept our paperwork, you may complete our rollover form.

You can roll over your retirement plan assets into an IRA or move them into a new employers plan.

If you want to roll over into an IRA, any money in a Roth 401 or Roth 403 account will be rolled over into a Roth IRA. Non-Roth accounts can be rolled over into a traditional IRA or Roth IRA. Rollovers to Roth IRAs from non-Roth accounts are taxable. If you want to roll over your money into your new employers plan, ask your new employer if youre eligible and if the plan accepts rollovers. You cant roll over money from Roth accounts into plans that dont offer the Roth option.

Talk to your financial professional about the best option for your situation. They will be able to assist with obtaining and completing the appropriate forms.

Also Check: How To Transfer 401k When Changing Jobs

Confirm A Few Key Details About Your Adp 401

First, get together any information you have on your ADP 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

Find Out Where Your Money Is Held

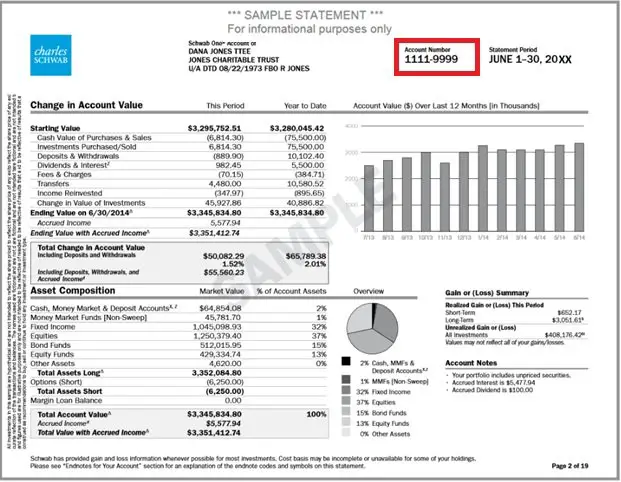

The first step is to figure out exactly where the funds in your 401 account are currently being held. To find out, look at your 401 statement, either online or on a paper statement if you receive them in the mail. On the statement, youll see a company name, such as Fidelity or Vanguard. This is the name of the company where your money is actually being held, called the custodian.

You May Like: Can You Roll A 401k Into A Roth

Rolling Over To Your New Employer’s 401

If your new employer has a plan that allows immediate rollovers, and you like the ease of having a plan administrator manage your money, consider this step instead of opening an IRA. Also, if you plan to continue to work after age 70½, you may be able to delay taking distributions on funds that are in your current employer’s 401 plan.

The benefits are the same as they are in keeping your 401 with your previous employer, except that you will be able to make further investments in the plan as long as you remain in your new job.

Procedure. Speak to your new employer’s HR department or plan administrator to see whether the company offers this option and how you can arrange the shift.

Look Out For Your Check In The Mail And Deposit Into Your New Account

ADP will only distribute your 401 funds directly to you, using the mailing address they have on file for your account. Once you get the check, its then up to you to deposit that check with your new IRA provider.

There are a few ways you can deposit your check depending on the provider:

- Mobile deposit the easiest option is to check your providers mobile app to see if they have a mobile deposit option. Not all providers provide this option but its worth checking. Mobile deposits are the quickest option and typically take 3-5 business days to show up in your account.

- Deposit in person at a local branch if your provider has a physical branch near by, you can also deposit the check in person. Checks deposited in person typically take 3-5 business days to show up in your account.

- Send the check by mail you can also send the check by mail to the provider using the address you previously looked up. Funds that are mailed can take up to 15 business days to show up in your account.

You May Like: How Do I Use My 401k To Start A Business

A Rollover Of Retirement Plan Assets To An Ira Is Not Your Only Option

A rollover of retirement plan assets to an IRA is not your only option. Carefully consider all of your available options which may include but not be limited to keeping your assets in your former employer’s plan rolling over assets to a new employer’s plan or taking a cash distribution . Prior to a decision, be sure to understand the benefits and limitations of your available options and consider factors such as differences in investment related expenses, plan or account fees, available investment options, distribution options, legal and creditor protections, the availability of loan provisions, tax treatment, and other concerns specific to your individual circumstances.

How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

Also Check: How To Check My Walmart 401k

Are Roth Iras Tax Deductible

Contributions to Roth IRAs are not deductible the year you make them: they consist of after-tax money. That is why you dont pay taxes on the funds when you withdraw themyour tax bill has already been paid. However, you may be eligible for a tax credit of 10% to 50% on the amount contributed to a Roth IRA.

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Don’t Miss: How To Pull 401k Early

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

Rolling The Assets Into An Ira Or Roth Ira

Moving your funds to an IRA is the route financial experts advise in most instances. “Now you’re in charge and you have more investment flexibility,” said Smith. Try not to go it alone, he advises. “Once you roll the money over, it’s you making the decisions, but getting a financial professional should be the first step.”

Your first decision: whether to open a traditional IRA or a Roth.

Traditional IRA. The main benefit of a traditional IRA is that your investment is tax-deductible now you put pre-tax money into an IRA, and those contributions are not part of your taxable income. If you have a traditional 401, those contributions were also made pre-tax and the transfer is simple. The main disadvantage is that you have to pay taxes on the money and its earnings later, when you withdraw them. You are also required to take an annual minimum distribution starting at age 70½, whether if you’re still working or not.

Roth IRA. Contributions to a Roth IRA are made with post-tax income money you have already paid taxes on. For that reason, when you withdraw it later neither what you contributed nor what it earned is taxable you will pay no taxes on your withdrawals. Investing in a Roth means you think the tax rates will go up later, said Rain. “If you think taxes will increase before you retire, you can pay now and let the money sit. When you need it, it is tax-free,” said Rain.

Also Check: What Is Ira And 401k

If I Roll My Account Into An American Funds Ira What Sales Charges Or Account Fees Will I Have To Pay

It depends. Generally, an amount already invested in American Funds can be rolled over into an American Funds IRA without paying any up-front sales charges. Any amount held in investments other than American Funds is subject to applicable sales charges.

A one-time $10 setup fee will be deducted from your account when you open an American Funds IRA. There is also an annual custodian fee .

How Do I Choose An Ira Provider

Many financial institutions offer IRAs, including brokerage firms, banks, and newer fintech companies. In order to pick the best account for you, theres one up-front question to answer:

Do you want to make your own investment decisions, or would you rather have the investing decisions made for you so you can just set-it-and-forget-it?

If you want to make your own decisions, then what youll want is a self-directed IRA. That allows you to make your own trading decisions and invest in whichever financial securities youd like.

The key features to compare when choosing among self-directed IRAs include:

- What do you want to invest in? The exact investment options among IRA providers varies. Most of them allow you to invest in stocks, ETFs and options. Other specialized IRA providers will let you invest in private assets and cryptocurrency.

- Access to research and data. Some brokers provide access to premium research and data. If youre a more hands-on investor, this might be important to you.

- Ease of use while user interfaces are getting better across the board, newer fintech providers tend to be more popular with those who really value an intuitive app experience.

The key features to compare when choosing an automated account include:

Get matched with an IRA provider based on your preferences! If you choose to do an 401-to-IRA rollover, well match you with a provider based on your preferences as part of our rollover process.

Also Check: How To See How Much 401k You Have