Can I Cash My Check With My Social Security Card

A Social Security card isnt a valid form of ID for check cashing. While many grocery stores, check cashing stores, and other check cashing locations may require a valid Social Security number or individual taxpayer identification number in order to cash a check, they always require a form of photo ID as well.

How To Access My 401k Online

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab or Vanguard. You should be able to log into your 401K account online through the website of the broker your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

Life Insurance Needs Estimator

-

For COVID-19 vaccination information, .

How do I enroll for Optional and/or Dependent Life Insurance?

You can enroll for or increase your optional and/or dependent term life insurance any time of the year by visiting the WIRE or Walmart One benefits page . However, if you enroll for or increase your amount after you are first eligible, you will be required to provide proof of good health for yourself and/or your spouse/partner.

How do I check the status of my Proof of Good Health application?

If you have completed a Proof of Good Health application, you can check the status of that application by visiting The Prudential benefits portal link opens in new window . The Walmart control number is 43939.

How do I change my beneficiary?

You can change your beneficiary on the WIRE or by visiting Walmart One benefits page .

How do I continue coverage for my dependents or myself, if my group coverage ends?

If you or your dependents are no longer eligible to receive life insurance benefits through Walmart Stores, Inc., you may be eligible to continue some or all of your coverage depending on the terms of the Booklet-Certificate. You must request the continuation coverage and pay the first premium within 31 days of the date your group coverage ends. Special rules apply to residents of MN.

How do I contact Prudential?

You may contact Prudential toll free at 877.740.2116.

Also Check: Can You Have A Solo 401k And An Employer 401k

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

Walmarts 401 Contribution Matching

Like many companies, Walmart offers an employer contribution to help boost its employees retirement savings. Walmart has a generous contribution match It promises to match its employees 401 contributions dollar for dollar, up to 6% of their pre-tax income.

When compared to other companies, Walmarts 6% contribution match really stands out. According to a 2020 study, the majority of companies offer a match between 3% and 5%, with the average match being 4.5% of income.

Walmart doesnt just have a better 401 match than most companies. It also beats out some of its biggest competitors. For example, Target offers its employees a match of up to 5% of their income. And Amazons employer match tops out at just 2% of an employees income.

Walmart also has an excellent vesting policy for its 401 plan. Many companies have an extended vesting schedule, meaning employees have to work at the company for a specific amount of time before they qualify for their employer match. But Walmarts employees are immediately 100% vested in the 401 plan for both their contributions and the company match.

You May Like: How To Open A Solo 401k

How Do I Track Down An Old 401k

Tracking Down Missing Mystery MoneyStart with Your Old Employer. Contact the 401 Plan Administrator. Check the National Registry of Unclaimed Retirement Benefits. Determine if Your 401 Account was Rolled Over to a Default IRA or Missing Participant IRA Search the Abandoned Plan Database.Jan 22, 2021

What Bank Will Cash A Social Security Check

Cash your Social Security check at a local bank that you have an account with. If you dont have an account with a local bank, visit a local bank to apply for one. This can be a checking account or a savings account. As a courtesy, most banks will not charge current customers a fee to cash Social Security checks.

You May Like: When Leaving A Company What To Do With 401k

Walmart Inc 401k Rating By Brightscope

https://www.brightscope.com/401k-rating/331263/Walmart-Inc/335998/Walmart-401k-Plan/

Walmart 401k Plan is a defined contribution plan with a profit-sharing component, Walmart 401k Plan currently has over 1655000 active participants and over $30.2B in plan assets. A final rule would take care of one item being considered in legislation Company Info: About Us · Newsroom · Careers · Contact · Blog.

How Should You Invest

When you sign up for Walmarts 401 plan, youll have a few decisions to make. First, youll have to decide whether to contribute to a traditional or Roth 401.

When you contribute to a traditional 401, you contribute with pre-tax dollars. As a result, you reduce your taxable income and therefore, your tax burden for the current year. The money grows tax-deferred in your 401, and youll pay income taxes on the money you withdraw during retirement.

In the case of a Roth 401, on the other hand, you contribute with after-tax dollars. The downside is that you dont reduce your taxable income with your contributions. However, the money grows tax-free in your account, and you can withdraw without paying taxes during retirement.

When it comes to choosing between traditional or Roth contributions, consider your income today and what you expect it to be in the future. In general, a traditional 401 is better for people who expect their tax rate to be lower during retirement, while a Roth 401 is better for those who expect their tax rate to be higher during retirement.

Unfortunately, Walmart doesnt currently offer Roth conversions. So if you change your mind later, you may have to utilize a Roth IRA later to convert your money.

The other decision youll have to make when you sign up is what you want to invest in. As we mentioned, you have two options: You can either invest in the offered target-date funds or choose your own funds.

Don’t Miss: Can An Llc Have A Solo 401k

How Much Should You Contribute

Walmarts 401 plan allows employees to start contributing with as little as 1% of their salary and can contribute up to 50%. With such a wide range to choose from, how do you decide what the right contribution is?

First, try to contribute at least enough to take advantage of Walmarts 6% employer match. After all, its literally free money. If you contribute $3,000 to your 401 plan, Walmart will fully match that amount, as long as it doesnt exceed 6% of your income. Think of it as a guaranteed 100% return on your investment.

Even though Walmart doesnt match contributions above 6% of your pay, you may still want to contribute more. With your employer match, youre essentially contributing 12% of your income to your 401 plan each year. But depending on your situation, that may not be enough for a comfortable retirement.

The Personal Capital Retirement Planner can help you figure out how much you should be saving for retirement based on your current retirement savings and your desired income during retirement.

Remember, you can contribute up to $19,500 to your 401 plan each year. And if youve maxed out your 401 contributions, you can also contribute up to $6,000 to an individual retirement account . Depending on your income, you may be able to contribute to only a traditional IRA or either a traditional or Roth IRA.

What Happens If I Have Unclaimed 401 Funds From A Previous Job

The majority of unclaimed money comes from brokerage, checking, and savings accounts, along with annuities, 401s, and Individual Retirement Accounts. Once an account is considered inactive or dormant for a period of time , companies are required by law to mail abandoned funds to the owners last known address. If theyre returned, or the owner cant be reached, the assets must be relinquished to the state.

You May Like: How To Transfer Your 401k To Another Company

How Can I Find My Old 401 Account

Ask previous employers whether theyre maintaining any accounts in your name. If the company no longer exists, contact the plan administrator. If you dont know the name of the plan administrator, search the Department of Labor website for the companys Form 5500 , which will list their contact information. You might also check the states unclaimed property database via the National Association of Unclaimed Property Administrators .

Darin Bostic, a Schwab financial planner, points out that the best way to keep track of your funds is not to lose them in the first place. Consolidating similar accounts, such as old and new brokerage or IRAs, can help you keep track of your savings, says Darin.

Whats more, consolidation helps ensure your assets are working in harmony toward your long-term goals. Its difficult to follow a comprehensive investment strategy when your money is spread out all over the place.

How To Check 401 Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

Recommended Reading: How Much Money Should I Put In My 401k

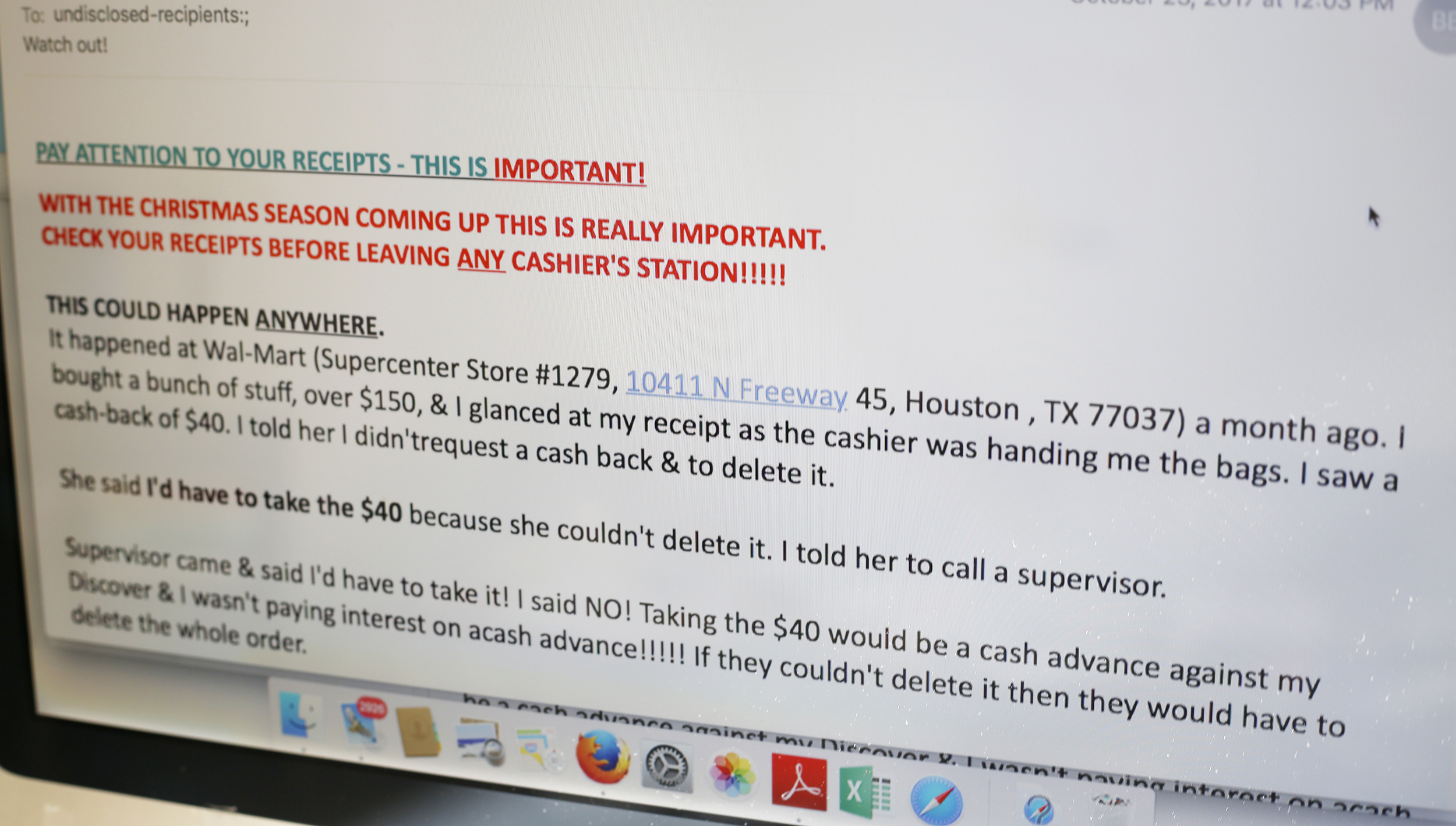

Will Walmart Cash 401k Checks

Walmart already cashes payroll, government and tax refund checks. Now, the retailer will cash more types of pre-printed checks including rebate, student loan, 401k, retirement, loan, IRA, pension, expense, insurance and MoneyGram money orders. The designated lanes will be for check and card cashing only.

Do I Have A 401k I Don’t Know About

If you think that you may have enrolled in a 401K plan with a previous employer, but youre not quite sure, there are a few ways to find out if you did.

The easiest way is to contact the HR department of your former employer and ask them whether you ever contributed to a 401K while in their employment. Youll need to give them your personal details along with the dates that you worked for them, so keep this information to hand.

If your old employer has since gone bust or you cant remember which companies youve worked for in the past, check the National Registry of Unclaimed Retirement Benefits website. Youll be able to see whether youve been listed on their database by your old employer as someone with unclaimed retirement plan funds.

If you havent been listed on the National Registry of Unclaimed Retirement Benefits database, there are a couple more options to explore. Visit NAUPA or missingmoney.comwhere you can search by state based on where youve lived or worked to find out whether any unclaimed assets belong to you.

You May Like: How To Transfer 401k From Old Job

When Can You Lose The Rights Over Your 401

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Most individuals that have 401 plans know the basics, your employer withholds pretax dollars from your paycheck and deposits the money into an account where you can invest it. You get to decide what percentage of your paycheck goes toward your 401, and your employer might make matching contributions. The money grows tax-deferred until retirement when youre required to withdraw a certain amount every year and pay taxes on it.

People generally dont know as much about 401 rights, howeverespecially for rare situations. Two of those situations include leaving the company and borrowing from your account.

How Can I Access My 401k Early

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year.

Also Check: How Much Does A 401k Cost A Small Business

Your 401 Plan When You Change Employers

Your employer can remove money from your 401 after you leave the company, but only under certain circumstances, as the Internal Revenue Service explains.

If your balance is less than $1,000, your employer can cut you a check for the balance. Should this happen, rush to move your money into an individual retirement account . You typically have just 60 days to do so or it will be considered a withdrawal and you will have to pay penalties and taxes on it. Note that the check will already have taxes taken out. You can reimburse your account when you reopen it.

If your balance is $1,000 to $5,000, your employer can move the money into an IRA of the companys choice.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

You May Like: How To Withdraw My 401k From Fidelity

How Many Occurrences Are Allowed At Walmart

4.5 occurrencesYou are only allowed 4.5 occurrences in a six month period. If you reach 5 occurrences, you will be automatically terminated from the company. Remember, Walmart doesnt coach or write up employees based on attendance. It is your responsibility to keep up with how many occurrences you have.

What Happens When You Borrow

The rules about 401 plans can seem confusing to workers. While employers aren’t required to offer the plans at all, if they do, they are required to do certain things but also have discretion over how they run the plan in other ways. One choice they have is whether to offer 401 loans at all. If they do, they also have some control over which rules to apply to repayment.

According to Michelle Smalenberger, CFP, Your employer may refuse to let you contribute while repaying a loan. Smalenberger is the cofounder of Financial Design Studio, a fee-only financial planning and wealth management firm. When an employer chooses what plan they will offer or make available to their employees, they have to choose which provisions they will allow.

If you cant contribute while repaying, remember that your employer is giving you a benefit by allowing the loan from the plan in the first place, Smalenberger adds.

And if you cant make contributions while youre repaying your loan, be aware that a higher amount of your paycheck will go to income taxes until you resume contributions.

If your employer does allow plan loans, the most you can borrow is the lesser of $50,000 or half the present value of the vested balance of your account, minus any existing plan loans. You must repay the loan within five years. And taking a loan puts you at risk of facing the obligation to repay it within a narrow time limit, typically 60 days or less, if you are laid off or quit.

You May Like: What Is The Tax Rate On 401k Withdrawals