The Ultimate Guide To The Solo 401 Written By A Cpa Who Has One

We may receive a commission if you sign up or purchase through links on this page. Here’s more information.

Many self-employed business owners wrongly assume that their retirement options are more limited than those available to employees of large corporations, who often have access to an employer-sponsored 401.

Well, entrepreneurs of America, I have some good news for you: as the owner of your own business, you can contribute to your own solo 401 also known as an individual 401 and the contribution limits are even greater than what a corporate employee would have.

This being said, the solo 401 rules can be a little complicated, but thankfully I have put together this guide for you.

Lets start with the basics.

Why You Should Open An Individual 401 Now

Tweet This

Opening a Solo 401 now could help lower your taxes and leave more time for wine tasting and wine… drinking.

Getty

For years the SEP IRA has been the go-to easy retirement account for the self-employed to save for the future and cut their tax bills in one place. 401 plans were mostly for large corporations with the budget to run a retirement plan. Im here to tell you that times have changed. The Solo 401 also known as an Indy K or Individual 401, is the new king of self-employed retirement plans.

If your business is making less than $220,000 you will likely be able to contribute more to a Solo 401 than your old school SEP IRA. In case you didnt know, more retirement contributions mean more tax deductions. The more tax deductions, the lower your tax bill. I would be remiss if I didnt point out that more contributions should also equate to more retirement income when the time comes.

What has Changed?

The cost to open and maintain a small business 401 has dropped drastically over the past few years. In the past, the SEP IRA was easier and cheaper to open. While this may still be the case today, but the gap has narrowed. Any extra hassle or cost is more than offset by the potential to contribute more money pre-tax to an Individual 401. Opening a solo 401 may require a few extra signatures, and making contributions as both the employee and employer. Often this just means two separate checks.

Do You Qualify for the Solo 401?

Getty

Contribution Limits to a SEP IRA:

Third Party Solo 401k Providers

If you need something a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you’d consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you’re looking for with options

We’re not going to go in-depth on these providers because this section effectively becomes al-la-carte with what you can get and pay for. I just wanted to list some of the most popular third party plan providers that you can reference in your search for the best plan.

Remember, just because you go with a third party provider also doesn’t mean you can’t invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity’s investment choices, but your options are created by the plan, and NOT Fidelity.

Also, you can use these plans to execute a Mega Backdoor Roth IRA. In fact, several of these companies specifically advertise that they offer it.

This isn’t an exhaustive list. There are also local firms in most areas that can create 401k plan documentation as well.

Read Also: How Many Loans Can I Take From My 401k

Individual 401k Contribution Calculation For An S Or C Corporation Or An Llc Taxed As A Corporation

- Employee Salary Deferral Contribution: In 2021, 100% of compensation up to the maximum of $19,500 or $26,000 if age 50 or older can be contributed to an Individual 401k..

- Employer Profit Sharing Contribution: A profit sharing contribution up to 25% of compensation can be contributed into an Individual 401k.

View examples of Individual 401k Contribution Limits for an S or C corporation or an LLC taxed as a corporation.

What Happens To My Individual 401k If I Hire Full

Then you will need to convert your Individual 401k into a traditional corporate 401k plan. If you anticipate hiring W-2 employees with more than 1000 hours of service in a calendar year in the future, then an Individual 401k may not be the appropriate retirement plan for you. Speak with a BCM financial advisor to learn more about your retirement options.

You May Like: Can I Switch My 401k To A Roth Ira

Rollover Or Distribute The Plans Assets

You can rollover your planâs funds into another qualified retirement account such as an IRA. This is generally not a taxable event. You will need to notify the IRS when you file taxes for the year in which you do the rollover. This strategy is preferred by those who own alternative assets.

Or, you can distribute funds from your plan. Distributing assets may be a taxable event. If distributed funds are not pre-taxed, you will owe taxes. And, if you are under the age of 59.5, you may owe a 10% early withdrawal penalty. You should discuss this option with your CPA. They will be able to calculate what you may owe on the distribution. You or your CPA need to file Form 1099-R within 12 months of terminating the plan.

Both An Employee And Self

You can be an employee of a business and also be separately self-employed. In this case, you are still eligible to establish a Solo 401 for your own business, even if you may also be participating in a 401 or other retirement plan through your primary employment. In such cases, your ability to make employee contributions will be capped at the overall limit of $19,500 if you are under age 50 or $26,000 if you are 50 or older. Your business that sponsors the Solo 401 can make a profit sharing employer contribution up to the plan maximum, independent of the other employer plan, however.

Also Check: How To Take Out A 401k Loan Fidelity

Who Is Eligible For An Individual 401k

An owner only business, an owner and spouse business and partnerships are eligible for an Individual 401k. Independent contractors, self employed individuals and small business owners frequently setup Individual 401k plans.

The business owner must have the presence of self employed activity which generally would include ownership and operation of the business. It is generally believed that the IRS will consider you eligible for an Individual 401k if the business being conducted is a legitimate business that is run with the intention of generating profits.

When Are Contribution Deadlines For A One

You must establish an owner-only 401 plan by the last day of your business tax year, but no later than Dec. 31 of the year for which contributions will be made. For 2022, you must have established your one-person 401 plan by December 31, 2021 and make your employee contribution elections by the end of the calendar year. Employer contributions must be made by the due date of your business tax return plus extension.

You May Like: How Do You Roll A 401k Into An Ira

Employer Component: Employer Nonelective Contribution

The second component of solo 401 contributions is the nonelective contribution available to you as your own employer.

This contribution amount is based on a percentage of your earned income:

- Corporation shareholder-owners can contribute up to 25% of their W-2 wages.

- Sole proprietors can generally contribute up to 20% of their earned income.

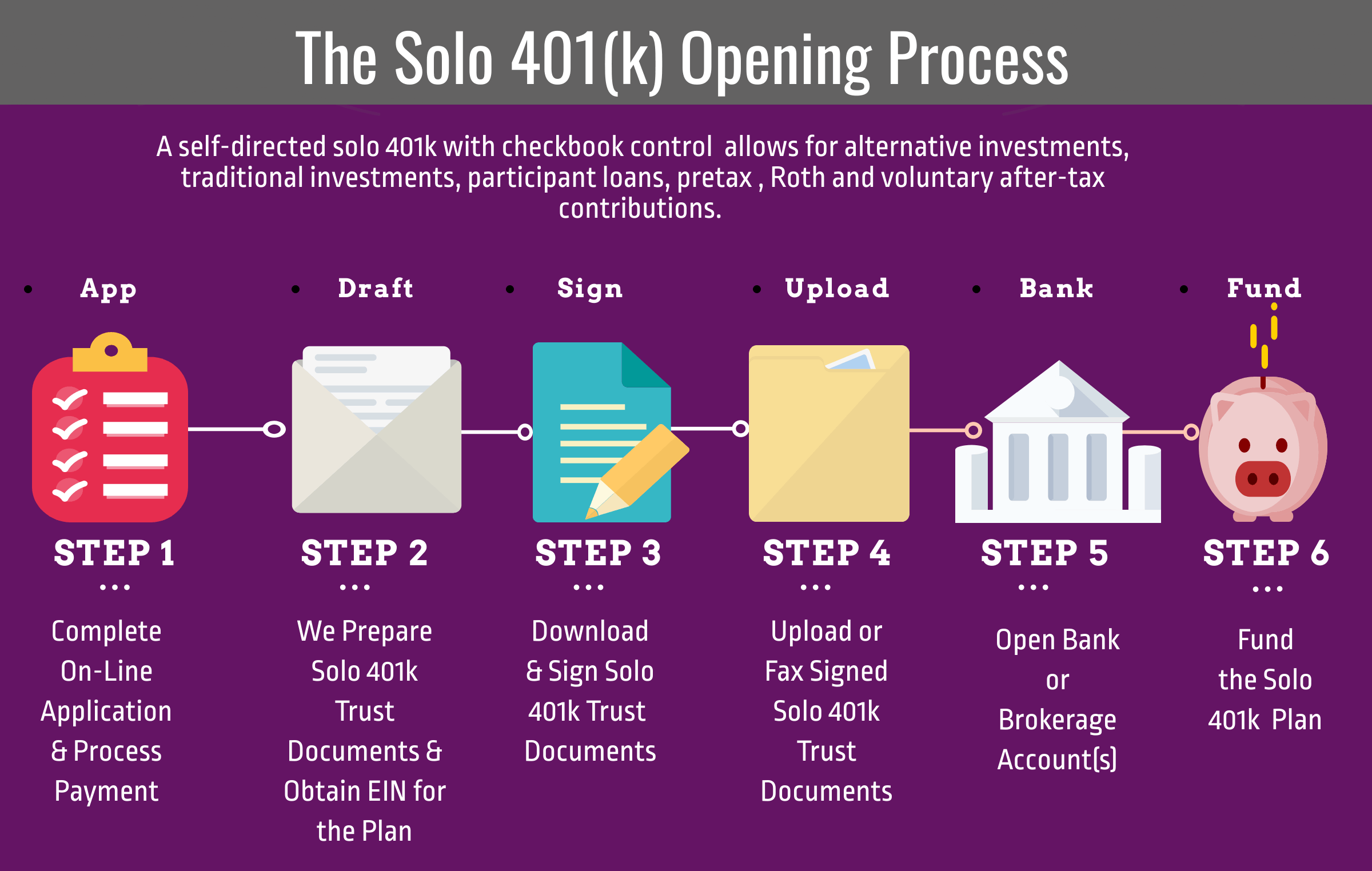

How To Open A Solo 401

You can open a solo 401 at most online brokers and traditional brokers or directly through a financial services company. You’ll want to do some research ahead of time to identify the best solo 401 company for you.

You’ll need an employer identification number to get started with the enrollment process. If you don’t have one already, you can apply online directly to the IRS.

The rest of the documentation will be provided by the broker or financial services company you choose for the account.

You May Like: How To Find My 401k Balance

How Can I Set Up An Owner

You can open a solo 401 plan at most financial institutions. In general, you’ll need the following to set up your plan:

- Your Employer Identification Number

- A completed application and plan adoption agreement, available from your provider

- Choose the investments offered by your provider

- You may also need to complete certain paperwork as required by the Internal Revenue Service , such as Form 5500-SF if you have $250,000 or more in the plan at the end of the year

Your plan must be established by Dec. 31 if you want to make a contribution this year. See below for more details about contribution deadlines.

How Do I Maximize Individual 401 Contributions

The Individual 401 plan allows participants under 50 years old to defer through salary withholding $18,500 in 2018 per person. Participants 50 years old and over can contribute an additional $6,000. Employers can contribute up to 25% of each employees compensation to the Individual 401 plan, up to a combined maximum of $55,000. This maximum increases to $61,000 for participants over 50 years old . More details and guidelines can be found on the IRS website at .

Individual 401 plans do not need to file a 5500 IRS tax form unless their total plan assets are over $250,000. Many Solo 401 plans do not hire a third party administrator until theyre required to file the Form 5500. The complexities of these small 401 plans are much smaller with only one or two participants, which reduce the need to have a TPA until youre required to file the Form 5500. Its a good idea to discuss the tax implications with your CPA or financial advisor.

Recently Individual 401 plans have become popular with oil and gas consultants. There are other tax deductions and retirement strategies to take advantage of beyond an Individual 401 plan. We can help if youre looking to set up an Individual 401 / Solo 401, or if you have a 401 from a previous employer that youd like to rollover to an IRA! Colorado Financial Management has been assisting clients with retirement and 401 solutions for over 20 years.

Recommended Reading: What Employees Can Be Excluded From A 401k Plan

Can I Have A Sep Ira And A Roth Ira

You can combine a SEP IRA with a traditional or Roth IRA. If youre an employee who is covered by a SEP IRA, employer contributions dont reduce the amount you can contribute to an IRA for yourself, but the amount of your traditional IRA contribution that you can deduct may be reduced at certain higher income levels, due to the combination of both plans.

Mom And Brothers Participation Question:

Yes provided they are all owner-employees in the S-corp with not other full-time W-2 common-law employees. The S-corp would sponsor the solo 401k plan and all 5 would participate in the same solo 401k plan. Each participant would separately hold their retirement funds in participant accounts. Lastly, when it comes time to determine if a Form 5500-EZ will need to be filed for the plan, all of the participants balances will need to be added up and if the combined value exceeds $250,000, a Form 5500-ez will need to be filed each year by 07/31.

Recommended Reading: How To Rollover 401k To Charles Schwab

Rule # 3 Employer Contributions Are 20% Of Net Earnings From Self

When calculating the employer contribution for a SEP-IRA or an Individual 401, you use your net earnings from self-employment. This includes any amount used for an employee contribution, but excludes the amount used for S Corp distributions and the amount used for the employer half of the payroll taxes .

The employer contribution in an individual 401 and a SEP-IRA is exactly the same , but since you can also make an employee contribution into an individual 401 money isn’t included in the backdoor Roth pro-rata calculation), a 401 is generally the better option for the self-employed, even if it is slightly more complicated to open .

What Is A Backdoor Roth

Roth IRA back is not the official type of personal pension account. Instead, it is an unofficial name for the Internal Revenue Service an approved method for high-income taxpayers to invest in Roth, even if their income exceeds the IRSs regular contribution to Roth. .

Is Roth Back A Good Idea? Backdoor Roth IRAs deserve consideration for your retirement savings, especially if you are a high-income person. Replacing a Roth Backdoor may be something to consider if: You have already expanded your other retirement storage options. Read also : The Big Apple Joins a Small Crowd, With Possible Headaches for Local Employers | Seyfarth Shaw LLP. Are you ready to leave Roth money for at least five years

Don’t Miss: What Is Max Amount To Contribute To 401k

Sole Proprietor / Independent Contractor:

In the case of a sole proprietor or independent contractor , you have earned income from performing personal services and report the income to the IRS on Schedule C, line 31, or Schedule F in the case of farmers and ranchers. Each of these schedules are attachments to IRS Form 1040. An owner of a sole proprietorship is the eligible participant under the employer solo 401k plan. The employer of these individuals is the sole proprietorship . See IRC 401 and IRC 401.

What Is The Deadline To Make Salary Deferrals Into The Individual 401k

Sole proprietorship, partnership or a LLC taxed as a sole proprietorship – The deadline for depositing salary deferrals into the Individual 401k is generally the personal tax filing deadline April 15 .

S corporation, C corporation or a LLC taxed as a corporation The salary deferral contribution must be made into your Individual 401k within 15 days of the period in which you are paying yourself. For example, 401k salary deferral contributions made at the end of a calendar year on December 31 need to be deposited into the Individual 401k by January 15 at the latest.

You May Like: How Do I Find My 401k Account Number

What To Look For In A Solo 401k

Going through the process of shopping around for a solo 401k provider, I’ve learned a lot about what to look for. There are a lot of options and nuances that you should look for when shopping for a 401k. Many of the “free” providers offer simple generic plans, and if those don’t work for you, you can have a third party provider create a custom 401k plan for your business, which you can then take to a brokerage.

Whoa, that sounds confusing, and it can be. So let’s look at the major options that you need to consider when selecting a solo 401k provider.

- Does the 401k provider offer both Roth and Traditional contributions?

- Does the 401k provider offer after-tax contributions to do a mega backdoor Roth IRA.

- Does the 401k provider offer loans from the plan?

- What types of investment options are allowed in the plan?

- Does the provider allow rollovers into the plan and rollovers out of the plan?

- The costs to maintain the plan

- The costs to invest within the plan

Based on your wants and needs, there are a lot of things to compare when shopping for a solo 401k provider. Let’s compare some of the main firms that offer solo 401ks. We’re going to start with the 5 major firms that provide Prototype Plans. These are the “free” plans that the companies advertise.

What Are The Tax Benefits Of A Solo 401

Solo 401s share the same tax benefits as their traditional 401 counterparts.

You can elect to contribute pre-tax earnings to your Solo 401 and pay taxes when you distribute your funds during retirement. In turn, youâll lower your immediate income tax obligation.

Or, you can choose to contribute after-tax earnings into a Roth Solo 401, then your distributions during retirement would be tax-free.

Additionally, any matching contributions you make as your employer are tax-deductible for your business, lowering its tax obligation as well.

Don’t Miss: When Can You Start Withdrawing From 401k

Employee Component: Elective Deferral

Now that weve defined earned income for contribution limit purposes, we can get into the math.

The first component of solo 401 contributions is the elective deferral available to you as your own employee.

For 2020, you can contribute up 100% of your earned income as an employee up to:

- $19,500 for those under 50 years of age as of December 31, 2020, or

- $26,000 for those 50 years of age or older as of December 31, 2020.

It is important to note that if your self-employment income is a side hustle, and if you contribute to your 401 plan through your day job, then you must reduce the employee elective deferral amounts above by any amounts you have contributed to your corporate 401 plan through your employer.

What if you contribute more than is allowed? If you make a mistake and contribute more than the allowable amounts, you can withdraw the excess by April 15, 2021, without penalty, though you will still be subject to tax on any earnings on those overcontributions.