Federal Insurance For Private Pensions

If your company runs into financial problems, you’re likely to still get your pension.

-

Insures most private-sector defined-benefit pensions. These are plans that typically pay a certain amount each month after you retire.

-

Covers most cash-balance plans. Those are defined-benefit pensions that allow you to take a lump-sum distribution.

-

Does not cover government and military pensions, 401k plans, IRAs, and certain others.

How To Calculate Your Average 401k Balance

A 401k account is a largely preferred option for retirement savings. It gives you the option of saving your money and investing a large sum each year, which may be used as a corpus once you retire and have no financial stability. At the moment, the current maximum amount that workers under the age of 50 may save each year is $18,500. For workers above the age of 50, the catch-up option gives even greater amounts for saving in the 401k account.

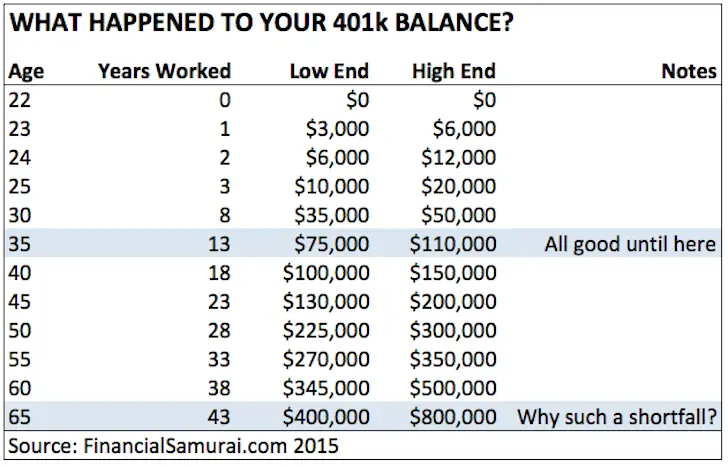

Taking 2017 into consideration, the average 401k balance of a person in savings was around $103,866. However, when the median balance was considered, it only amounted to $26,331 which implies that most Americans have saved much lesser than the average as a whole.

Use your age and other factors for evaluating your average 401k balanceTo use a 401k retirement calculator, the most important feature is to consider your age. Other important factors are the amount your employer matches up to, the time period you have been employed and of course, your salary. The thumb rule that some investors suggest is saving half of your annual salary for retirement until you reach the age of 30. The average contribution rates as per your age which may help you get an estimate on the 401k retirement calculator are:

The Secret Life Of Fees In Your 401k

A few years ago, I mentioned that I used a target-date index fund in my 401K. A reader came out and bashed me pretty hard for that move, saying I was overpaying to save for my retirement. I was frazzled, not because of the comment, but because it was really hard for me to figure out how much I was actually paying in fees and defend my position.

For the next couple of weeks, I went on a mission to discover how much I was actually paying in fees to invest in my 401K. The results were not that bad compared to the other choices in my 401K plan. However, I was disappointed that it was so hard to determine. Thanks to some nice folks in the Get Rich Slowly forums for helping me weed through all the fee details.

If you have a 401K its possible that youve wondered the same thing: How much of a cut are these guys taking? And, when is it worth stopping my contributions to a 401K to start investing in a Roth IRA with lower fees?

Now there is a group determined to shed some light on the secret world of 401K fees. They are called BrightScope. I spoke with the co-founder and CEO of BrightScope, Mike Alfred. He shared with me some interesting stats, plus the basics of what BrightScope does.

Also Check: Should I Move My 401k To Bonds 2020

Vested Versus Unvested Balances

The vested portion of your 401 plan is the portion that you get to take with you if you stopped working for the company. You are always fully vested in the contributions that you make to your 401 plan, so dont stop making contributions because you dont know how long youre going to remain with the company. But, if youre not vested when you leave, a portion or all of the contributions your employer made on your behalf could be lost.

Find Lost 401k: How To Find Out If You Have Lost Or Forgotten Retirement Accounts

Here is a guide for how to find lost money a lost 401k or other unclaimed retirement benefits.

Finding a lost 401k or other retirement account is more tedious than metal detector treasure hunting,but perhaps more rewarding.

A few years ago, I received a strange notice in the mail: a former employer was discontinuing their retirement plan and I had 30 days to either roll my balance into a different account or receive a distribution from the plan. This sort of thing happens quite often when people change jobs and leave their retirement account in the old employers plan. The strange thing about this notice was, I had no idea Id been participating in the plan while I worked there!

Could the same thing have happened to you? If youre looking for ways to increase your retirement savings, you just may want to look for lost or forgotten retirement accounts.

Read Also: When Do You Need A 401k Audit

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Come To Terms With Risk

Some people think investing is too risky, but the risk is actually in holding cash. Thats right: Youll lose money if you dont invest your retirement savings.

Lets say you have $10,000. Uninvested, it could be worth less than half that in 30 years, factoring in inflation. But invest 401 money at a 7% return, and youll have over $75,000 by the time you retire and thats with no further contributions. calculator to do the math.)

Clearly youre better off putting your cash to work. But how?

The answer is a careful asset allocation, the process of deciding where your money will be invested. Asset allocation spreads out risk. Stocks often called equities are the riskiest way to invest bonds and other fixed-income investments are the least risky. Just as you wouldnt park your life savings in cash, you wouldnt bet it all on a spectacular return from a startup IPO.

Instead, you want a road map that allows for the appropriate amount of risk and keeps you pointed in the right long-term direction.

You May Like: How To Manage Your 401k Yourself

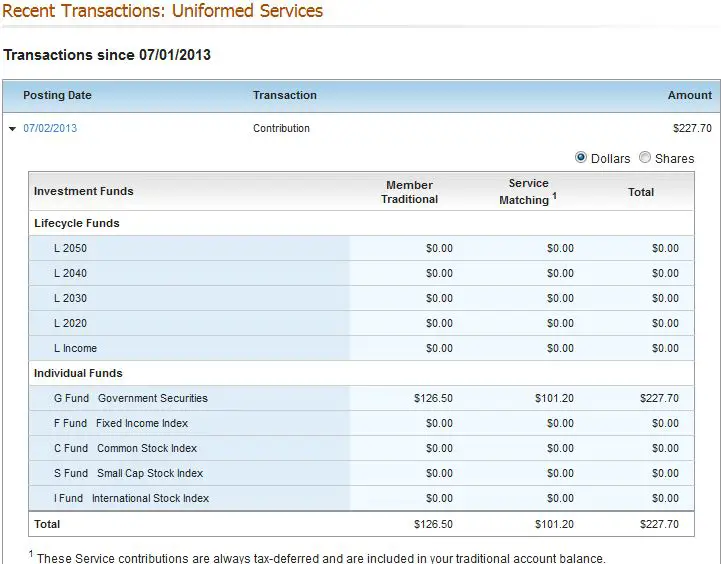

Messages And Contribution Source Details In Your 401 Statement

Your 401 statement may include an important message from your provider, which will be located in the Message Board section or similar. Your statement should also include a breakdown of where your account funds came from and your vesting for each source, in the Contribution Source Details section. This breakdown usually includes your salary reduction , employer match, rollover funds , and Roth funds .

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

Don’t Miss: How To Max Out 401k Calculator

Do I Have A 401k I Don’t Know About

If you think that you may have enrolled in a 401K plan with a previous employer, but youre not quite sure, there are a few ways to find out if you did.

The easiest way is to contact the HR department of your former employer and ask them whether you ever contributed to a 401K while in their employment. Youll need to give them your personal details along with the dates that you worked for them, so keep this information to hand.

If your old employer has since gone bust or you cant remember which companies youve worked for in the past, check the National Registry of Unclaimed Retirement Benefits website. Youll be able to see whether youve been listed on their database by your old employer as someone with unclaimed retirement plan funds.

If you havent been listed on the National Registry of Unclaimed Retirement Benefits database, there are a couple more options to explore. Visit NAUPA or missingmoney.comwhere you can search by state based on where youve lived or worked to find out whether any unclaimed assets belong to you.

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

Also Check: What Is The Difference Between A Pension And A 401k

Don’t Be Forced Out Of A 401 From Your Former Job

When you change jobs and abandon vested amounts in your 401, your former employer has to follow IRS rules and plan provisions for dealing with your account balance. Pursuant to these guidelines, the 401 plan may have a force-out provision. That means when your vested balance is less than $5,000, you can be forced to take your money out of the plan.

Your former employer is required to give you advance notice of this rule so you can decide what to do with the money. Your choices are to cash out your account and receive a check, or roll your account balance into an IRA or your new employers plan.

What happens if you fail to respond to the notice? If your vested balance is more than $1,000, your former employer must transfer the money to an IRA. For balances under $1,000, you will either get a check or your former employee will open an IRA on your behalf.

Neither outcome is optimal, according to a report by the U.S. Government Accountability Office. If you receive the money, youll owe federal income tax. When the balance is transferred to an IRA, account fees may outpace investment returns and your balance will be eroded over time.

Protecting assets you worked for and earned is always a smart move. Consult your tax professional for assistance.

How Much Retirement Savings Should You Have

There’s no magic savings number that’ll guarantee you financial security in retirement. A good rule of thumb is to stash away enough cash so that by the time you leave the workforce for good, you have 10 to 12 times your ending salary on hand in savings.

But remember, that’s the total you should be aiming for at the time of your retirement. And so if you’re 30 years old and are sitting on a retirement plan balance of $33,472, or something in that vicinity, you may not be in such poor shape.

On the other hand, if you earn a salary of $80,000 a year and you’re already in your 50s, that $33,472 becomes problematic if it reflects your balance. In that case, you might really consider making major lifestyle changes that allow you to pump more money into your retirement plan. Those could include downsizing your home, spending a lot less on leisure, and working a second job.

Don’t Miss: Should I Do Roth Or Traditional 401k

How Is Fers Calculated For A Retired Postal Worker

Multiply your three-year average by 1 percent for each year of service if you are retiring after less than 20 years. So, if you worked for 10 years and your three-year high average was $30,000 a year, then your FERS earnings will be 10 percent of that average$3,000 a year.

CSRS and FERS Handbook for Personnel and Payroll Offices, Chapter 40. The Postal Service ensures that retirement information and counseling are made available to Postal Service employees.

Automatic USPS retirement kicks in at age 65, but there are retirement plans in place under both the Civil Service Retirement System and Federal Employment Retirement System that affect pay.

Civil Service Retirement System. If you started working for the Post Office before 1984, you probably fall under the Civil Service Retirement System, unless you voluntarily switched to the newer Federal Employees Retirement System.

How Do Benefits Work And How Can I Qualify

While you work, you pay Social Security taxes. This tax money goes into a trust fund that pays benefits to:

-

Those who are currently retired

-

To people with disabilities

-

To the surviving spouses and children of workers who have died

Each year you work, youll get credits to help you become eligible for benefits when its time for you to retire. Find all the benefits Social Security Administration offers.

There are four main types of benefits that the SSA offers:

Recommended Reading: How To Roll Your 401k From Previous Employer

Free Ways To Find Unclaimed Money

If you think you have unclaimed money or that a relative does, one of the best steps is running through old financial statements to see if you can find evidence of it. That could be useful if the relative has passed on and you dont know where to begin. If you discover an account such as a 401 or IRA, you can contact the plans administrator and go from there.

But many times, the process is more complicated. Here are the places to go next.

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Recommended Reading: How To Get My 401k Early

What Is Unclaimed Money

Unclaimed money is money that oftentimes has simply been forgotten about, in one way or another, and tends to wind up being held at a state agency until it is rightfully claimed. Accounts may be considered unclaimed or abandoned in as short as a year called the dormancy period if theyve been unused or the institution has been unable to contact the account owner.

After the dormancy period and efforts to find the rightful owner have been made, the institution can declare it unclaimed and send the money to state agencies in charge of unclaimed money. As part of this process, the institution has to include any identifying information it has.

Financial accounts can often be forgotten about, especially during the inheritance process. If all a decedents accounts are not listed during the process of estate planning, it can be very easy for an heir to overlook an account. The account may then sit dormant for years, if not decades, accumulating interest, dividends or capital gains.

Many types of unclaimed accounts exist, including:

- Retirement accounts, such as 401, 403 and IRAs.

- Insurance accounts or annuities.

- Forgotten savings bonds.

- Accounts from bank or credit union failures.

Unclaimed money can also take other forms, so if you know theres money out there with your name on it , youll need to contact the right agency.

Other Common Types Of Vesting

Aside from 401s, employers may offer other forms of compensation that also follow vesting schedules, such as pensions and stock options. These tend to work a little bit differently than vested contributions, but both pensions and stock options may vest immediately or by following a cliff or graded vesting schedule.

Recommended Reading: Can I Borrow From My 401k