Private And Public Sector

Youll often hear 401k plans referred to as private sector plans, and pension plans referred to as public sector plans. This is not technically correct. A private employer can provide either a 401k or a pension plan, or both. A public employer can provide either. They usually do not provide both.

You may hear these terms because it is more common for private employers to offer the 401k, and it is more common for public employers to provide the pension. But, again, either type of employer can offer either type of retirement plan.

Can My Pension Be Taken Away

Most pension plans have a vesting period which means that the money accumulated in your account after you reach that length of employment cannot be taken away. Some plans are vested after 12 months and some as long as 3 or 5 years. Some plans are fully vested, meaning that you would receive 100% of the balance in your account if you leave the company, while others are only vested at a certain percentage. If the investments in the account perform poorly, it is possible that your benefits could be reduced, but most private plans are insured by the PBGC to prevent that from happening.

What Are Some Drawbacks Of A Pension

One major drawback is that not many employers offer pension plans today. Another drawback is that you cannot control how much money you save for retirement. The benefits that you will receive are spelled out in your plan documentation, and they usually depend on your salary and the years of service you have with your employer. You cannot choose to save more in order to get a larger payout during retirement because your employer has full control over the plan and the investment choices.

You May Like: How To Rollover Fidelity 401k To Vanguard

How 401 Plans Work

A 401 plan is normally offered by government agencies, educational institutions, and nonprofit organizations, rather than by corporations. These plans are usually custom-designed and can be offered to key employees as an added incentive to stay with the organization. The employee contribution amounts are normally set by the employer, and the employer is required to contribute to the plan, as well. Contributions can be either pre- or post-tax.

Educational institutions often offer a related plan called a 403 plan.

Because the sponsoring employer establishes the contribution and vesting schedules in a 401, these plans can be set up in ways that encourage employees to stay. Employee participation is often mandatory. If employees leave, they can usually withdraw their vested money by rolling it over into another qualified retirement savings plan or by purchasing an annuity.

The plan’s investment choices are determined by the employer and tend to be limited. Government-sponsored 401 plans, in particular, may include only the safest, most conservative investment options.

How Much Will You Receive With A Pension Plan

The pension amount can depend on a few things:

- The plan

- How many years you worked at the company

- Your average salary at the end of your tenure

- A multiplier.

For example, an employer may have a plan with a 2% multiplier. Someone who worked for the company for 20 years and had an average salary during the last three years of $90,000 might receive 20 x 90,000 x .02 = 36,000 per year. Or $3,000 each month for the rest of their life.

Similar to Social Security payments, your payment amount may increase the longer you wait to start collecting your pension. There may also be an option to receive a lump sum upfront rather than a monthly payment. Or to get a lower payment with a guarantee that your spouse will receive payments after you pass.

Recommended Reading: Can You Have A Solo 401k And An Employer 401k

How Much Do You Need For Retirement

With a 401, the burden of saving for retirement shifts from the employer to the employee. But how much money do we need? While financial experts routinely toss around figures that range between $1 million and $2 million, the amount we need to save depends greatly on the lifestyle we hope to lead.

New York Life is here to help you learn more about Guaranteed Lifetime Income Annuities or other retirement options.

The Main Distinction Involves The Kinds Of Employers Who Offer Them

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

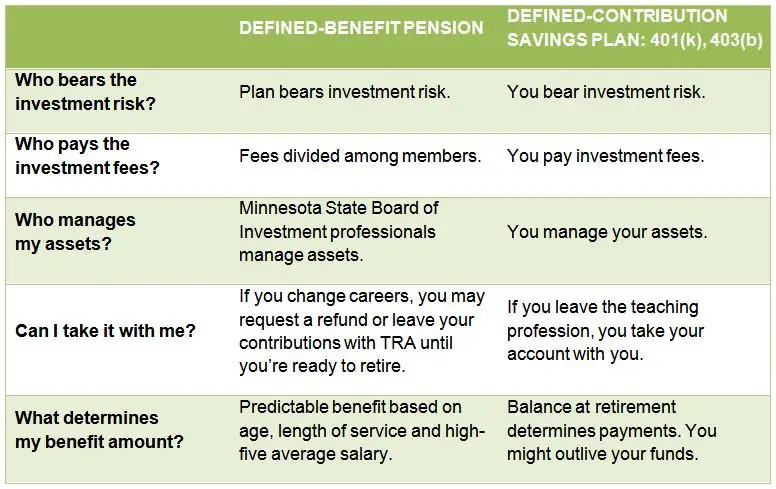

The two primary types of defined-contribution retirement savings plans offered by employers are 401 plans and 401 plans. They take their names from Section 401 of the United States Internal Revenue Code, which defines them.

The principal differences between a 401 plan and a 401 plan are first in the types of employers that offer them and then in several key provisions regarding contributions and investment choices.

Also Check: Why Cant I Take Money Out Of My 401k

Should I Cash Out My Pension

Wondering if you should cash out your pension in a lump sum? If your company declared bankruptcy, you changed jobs, youre going into early retirement, or you just want more control over your own retirement savings with a 401, cashing out your pension with a lump sum is a great option for you.

As you know, once a person reaches retirement, theyre offered monthly pension paymentsfor the rest of their lifetime. But if you die, your spouse will be left without that consistent income. Thats why we recommend taking the lump sum instead of the guaranteed lifelong paymentsbecause our lives arent really guaranteed. And if you want to leave behind a financial legacy to your kids and grandkids, a pension plan wont help.

Heres the downside: If you cash it out before youre eligible, youll pay quite a bit in taxes. So if you dont need the money right now, your best option is to roll those funds into an individual retirement account . With that option, you wont pay taxes on it. And if theres a reason you need to get to that money, you can pull it out.

Dave Ramsey recommends investing into an IRA that has good growth stock mutual funds with long, boring track records. Youll want to look for four different types: growth, growth and income, aggressive growth, and international.

About the author

Ramsey Solutions

The Secure Act And Annuities In 401 Plans

However, with the Setting Every Community Up for Retirement Enhancement Act, employees may see more annuity options offered in their 401 plans. This is because the SECURE Act eliminates many of the barriers that previously discouraged employers from offering annuities as part of their retirement plan options.

Additionally, under Section 109 of the SECURE Act, annuity plans offered in a 401 are now portable. This means that if the annuity plan is discontinued as an investment option, participants can transfer their annuity to another employer-sponsored retirement plan or IRA, thereby eliminating the need to liquidate the annuity and pay surrender charges and fees.

Also Check: Should I Rollover My 401k When I Retire

Legal Differences Between 401 And 403 Plans

Notably, 403 plans do not have to comply with many of the regulations in the Employee Retirement Income Security Act , which governs qualified, tax-deferred retirement investments, including 401s and 403s. For example, 403s are exempt from nondiscrimination testing. Done annually, this testing is designed to prevent management-level or “highly compensated” employees from receiving a disproportionate amount of benefits from a given plan.

The reason for this and other exemptions is a long-standing Department of Labor regulation, under which 403 plans are not technically labeled as employer-sponsored as long as the employer does not fund contributions. However, if an employer does make contributions to employee 403 accounts, they are subject to the same ERISA guidelines and reporting requirements as those who offer 401 plans.

Additionally, investment funds are required to qualify as a registered investment company under the 1940 Securities and Exchange Act to be included in a 403 plan. This is not the case for 401 investment options.

Types Of Defined Contribution Plans

There are four major types of defined contribution plans:

Profit Sharing Plans . A portion of the companys profits is deposited in this qualified retirement account every quarter. The employee is responsible for managing the investment of the funds in this type of account.

401 Plans. The employee is responsible for making pre-tax contributions from their paycheck. The funds grow tax-deferred. Some employers offer matching funds or a profit-sharing plan to supplement their 401. Other employers do not contribute at all. The employee manages the investment of funds in this account.

Employee StockOwnership Plans. The employer regularly purchases securities in the companyon the employees behalf. The companys stock performance determines the valueof the funds in this type of account.

Money Purchase Plans. The employer contributes a set dollar amount every year into the employees retirement fund. The amount is usually equal to a percentage of the employees salary. If the company is unprofitable, the contribution must still be made.

Don’t Miss: How To Lower 401k Contribution Fidelity

Guaranteed Retirement Income Without A Pension

Although pensions are in decline, there are still several ways to add guaranteed income to your retirement plan. For starters, you can begin receiving Social Security benefits as early as 62 . Social Security will pay you for life, but it probably wonât cover all your needs in retirement. But you have options.

An annuity, which can provide guaranteed, lifetime income, is another product thatâs a good substitute for a pension. There are several types you can choose from, tailored for your life stage. Lastly, the cash value of permanent life insurance can also serve as a source of safe income.

People may bemoan the decline of the pension, but that doesnât mean a 401 is an inferior substitute for long-term financial health. Today, there are many financial options that can replicate the steady, reliable attributes of a pension.

The primary purpose of permanent life insurance is to provide a death benefit. Using permanent life insurance accumulated value to supplement retirement income will reduce the death benefit and may affect other aspects of the policy.

Recommended Reading

Your Retirement Is Portable With A 401

Pension benefits are based on your salary and tenure with the company. Pensions typically use either cliff vesting or graded vesting to determine access to your benefits . With cliff vesting, after you stay with the company a certain time , you earn 100% access to your pension benefits. With graded vesting, after you’ve been with the company for three years, you start gaining access to pension benefits at a rate of 20% per year. By the end of your seventh year, you’ll be 100% vested.

Unfortunately for this system, job-hopping is the norm these days, and people rarely stay with the same employer for more than three years, let alone seven. Worse, even if you stay long enough to fully vest, your pension benefits will be based on your earnings from that employer, so if you stay only a few years, the resulting benefits will be pretty minimal.

401 accounts work differently. Any contributions you make to your plan are always 100% vested, and when you leave your employer, your contributions still belong to you. You can leave them invested or choose to roll them over into your new employer’s 401 or into an IRA. While employer matching contributions may be subject to a vesting schedule similar to that of a pension, most of your retirement money comes with you when you switch jobs, even if you’ve been with your company for only a short time.

You May Like: How Much Does A 401k Cost A Small Business

What Is The Difference Between A Pension And A 401k

At some point in your adult life, youll start thinking about how youll be able to pay for your living expenses once you retire. But have you ever really given some thought to this question? Do you have enough money to live off when you retire? Should you opt for a pension or a 401?

There are quite a number of things to consider before an employee selects which retirement plan to fund. Before deciding how to save their hard-earned income, its important for employees to know the answer to the question: Whats the difference between a pension and a 401 plan?

Contributing To A 401

For 2020 and 2021, employees can defer up to $19,500 of their salary pre-tax. Employees who are 50 or older can put in an additional $6,500. On top of employee contributions, many employers provide a match.

Many employers match 100% of employee contributions up to 3% of salary. So if you make $40,000 per year and contribute 3%, youd put in $1,200 and your employer would kick in another $1,200.

Most people cant afford to contribute the maximum amount to their 401. But you should try to contribute enough to get your employer match otherwise youre missing out on free money.

Most employer-sponsored 401 plans include access to online tools to help you determine how to invest. Target funds allow you to set it and forget it based on your risk tolerance, age and other factors.

Recommended Reading: Can You Buy A House With 401k

Pension Plan Vs 401 // Whats The Difference & How To Choose

Saving for retirement can be a daunting task, but knowing what options are available is a great first step. You might hear the terms 401k, pension plan, defined benefit plan, or defined contribution plan and start to feel overwhelmed. What do they all mean and how do you select the one that is right for you? Thankfully, all these terms are not that complicated at their most basic level. While we will leave your investment strategies up to you and your financial planner, this article should explain everything you need to know about the differences between a pension plan and 401. You will know what all those fancy words mean, and you will be ready to start putting money away in your retirement account.

The Bottom Line: Is A 401 Or A Pension Plan Better

It is difficult to say whether one plan is better than the other. Many people would argue that a traditional pension plan is better because it is fully funded by your employer, although these plans are becoming more difficult to find in the private sector. Pension plans today are more common in the public sector like government jobs, but a 401 can help you achieve your goals just as well. In fact, some people choose to use both types of plans because their employer match into their 401 is like free money. Whichever plan you choose, just remember to begin saving early and often and make smart investment decisions. When you reach retirement age, you will be glad you did!

Recommended Reading: How To Transfer 401k From Old Job

What Is A Pension

With a pension, your employer guarantees you a regular monthly payment, starting at retirement and lasting for the rest of your life. Depending on your plan, a portion of these benefits may continue for a spouse or beneficiary after you die. Typically, you have to work for the employer for a set number of years before youre fully vested, or eligible to receive the full pension amount.

With pensions, your employer takes on all of the risk for providing you with income in retirement. They put away money for you each year you work as well as manage any investments over the lifetime of your pension account. You receive a certain payment regardless of how your pensions investments perform. Youll receive the same amount whether the markets are up or down.

Pension Vs : At A Glance

A 401 and a pension are both a type of retirement plan. However, they vary greatly in how money is placed into each plan and how that money is handled. Pensions place much of the responsibility into the employer’s hands, while 401 plans require employees to take a more active role in planning and saving for retirement while lowering the cost for the employer.

- A pension is an employer-funded retirement plan that your employer invests and provides monthly payouts to you in retirement.

- A 401 is an employer-sponsored retirement plan that you control and contribute your money to.

Quick tip: Always check whether your employer or a potential employer offers a retirement savings plan. There could be free money available to you.

You May Like: When Can You Take Out 401k

Are Pensions Better Than A 401

The reliable pension plan was once a staple retirement benefit in corporate America.

American Express offered the first private sector pension plan in the U.S. way back in 1875, and popularity of this benefit peaked sometime in the 1970s when nearly 50 percent of private sector employees in the U.S. had access to a pension. In 2019, only 16 percent of private industry workers had access to such a benefit, according to the Bureau of Labor Statistics.

Pensions, or defined benefit plans, are valued for their steady income and baked-in guarantees. In short, an employer agrees to pay its workers a steady income â based on total years of service â for the rest of their lives in retirement. In that way, employees are rewarded for sticking with the company for the long-term. Today, only 16 percent of private industry workers have access to such a benefit.

But are pensions better than a 401? Is salt better than pepper? Or left better than right? It’s hard to say which is better because theyâre just different. Instead, it makes more sense to focus on their unique attributes and the role they can serve in a financial plan. A pension and 401 are both financial tools, but neither is an entire retirement plan.