You Don’t Really Need The Money

The government may have eased the restrictions on 401 withdrawals, but you should only take advantage of this if you absolutely need the money. Taking money from your retirement account sets you back. That forces you to save more money per month going forward in order to afford to retire according to your original schedule.

Say you have $25,000 saved for retirement and you’re hoping to get to $1 million. If you’re 35 and hope to retire at 65, you must save about $653 per month, assuming you earn a 7% average annual rate of return. Now let’s say you withdraw $5,000 this year, leaving you with only $20,000 in your retirement savings. If you still want to have $1 million by 65, you must save about $753 per month — $100 more — every year thereafter to have enough. It’s doable, but you can save yourself a lot of hassle by just leaving your retirement savings alone if you don’t actually need the money.

Roll Your Assets Into A New Employer Plan

If youre changing jobs, you can roll your old 401 account assets into your new employers plan . This option maintains the accounts tax-advantaged status. Find out if your new plan accepts rollovers and if there is a waiting period to move the money. If you have Roth assets in your old 401, make sure your new plan can accommodate them. Also, review the differences in investment options and fees between your old and new employers 401 plans.

How Do You Withdraw Money From A 401 After Retirement

To withdraw money from your 401 after retirement, you’ll need to contact your plan administrator. Depending on your company’s rules, you may be able to take your distributions as an annuity, periodic or non-periodic withdrawals, or in a lump sum. Your plan administrator will let you know which options are available to you. You can typically have funds deposited into an account or have your plan send you a check.

Don’t Miss: How Do You Take Money Out Of 401k

Rollover Money: An Easy Option

If youre still working and you cant get money out of your 401 with any of the techniques above, there might be another approach. If you ever made rollover contributions to your 401 into your existing 401, for example), you might be able to take those funds back out. You wont have access to your entire 401 account balance, but you might get a nice chunk of change outat any time, for any reason. Employers are often unaware of this option, so you may need to ask your employer to do some research with your Plan Administrator.

Again, you may have to pay income taxes and tax penalties, and youre raiding your retirement savings, so only use this option when you have no other choice.

Understanding The Rules For 401 Withdrawal After 59 1/2

-

Waives the 10% early withdrawal penalty

-

Allows retirees to forgo taking Required Minimum Distributions from a 401 in 2020.

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½. Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

Read Also: Should I Do Roth Or Traditional 401k

If You Dont Qualify Through The Cares Act

If you dont qualify for special accommodation through the CARES Act, then you will have to pay a 10% penalty on withdrawals from your 401 as well as income taxes on amounts you take out. With a traditional 401 loan, on the other hand, you may be limited to borrowing just 50% of your vested funds or $50,000, whichever is less.

However, you should note that the IRS extends other hardship distribution categories you may qualify for if youre struggling financially . You can read about all applicable hardship distribution requirements on the IRS website.

How To Protect Your 401k From A Stock Market Crash

Are you riding your retirement on the success of the stock market? If so, its understandable that youre worried about what a crash could mean for your 401k.

If thats you and youre wondering how to protect your 401kfrom a stock market crash, Ive got good news for you:

You dont have to worry.

The stock market is volatile, but you can minimize that risk with the right investing strategy.

If you invest your money the right way, you can not only protect your retirement but also experience even greater returns so your retirement can be even sweeter. Ill show you how to take advantage of stock market volatility, which includes a stock market crash, so you can profit from the fluctuations instead of watching your portfolio take a plunge.

Are you with me?

Don’t Miss: What Should I Do With My Old Company 401k

Invest In High Cash Companies

Some companies are in a far better position to survive and thrive in a stock crash than others. In particular, companies with a lot of money grow and make more money in a crash.

For instance, Warren Buffetts Berkshire Hathaway expanded during the stock market crash of 2008. In fact, Berkshire Hathaway bought the Burlington Northern Santa Fe Railroad for $26 billion in cash and stock in 2009. Berkshire could buy them because it had lots of cash.

Hence, investing in companies with large amounts of cash on hand is a great way to protect your portfolio from a market crash. You can learn how much cash a company has by checking its balance sheet. Companies list cash as cash and equivalents, short-term investments, or cash and short-term investments in their balance sheets.

Currently, companies with a lot of cash include:

- Berkshire Hathaway

- Banks. Notably, big banks like Goldman Sachs

- Wells Fargo

Concentrating your investments in high-cash industries like finance and technology is one way to protect yourself from crash effects. Moreover, avoiding low cash companies like retailers is a good way to protect your funds.

Finally, a simple rule of thumb you can follow is to only invest in companies with at least $20 billion in cash. Such companies are more likely to profit and grow during a crisis. Stock Rover provides a 10-year history and cash forecasting data for all stocks on the USA and Canada stock exchanges.

How To Cash Out Your 401k And What To Consider

4-minute readMay 18, 2021

One of the surest ways to create a comfortable retirement for yourself is to begin saving early on in your career. A 401 plan a type of financial contribution plan which allows you to put a percentage of your salary into an account whose investment gains remain tax-free until funds are withdrawn presents one of the most popular vehicles for doing so. Even better, employers will often match the amount of money set aside up to a certain amount, effectively guaranteeing you free income.

However, in the event that access to money is needed, especially in the wake of a large or unexpected expense, its not uncommon to wonder how to cash out your 401 as well. Here, well take a closer look at the process of cashing out a 401 early, how long it takes to get access to money, and the pros and cons of doing so, including how much early withdrawal before retirement may cost you.

Recommended Reading: How To See How Much 401k You Have

When Can I Withdraw From My 401 Before Retirement But Without Tax Penalties

You don’t have to be in retirement to start withdrawing money from your 401. However, there are penalties involved depending on your age. If you wait until after you are 59 1/2, you can withdraw without any penalties. If you can’t wait until you are 59 1/2, then you will experience a 10% penalty on the amount withdrawn.

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Read Also: How Does Taking Money Out Of 401k Work

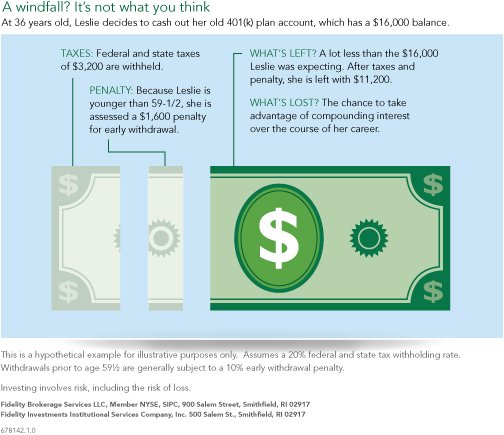

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

How 401 Hardship Withdrawals Work

A hardship withdrawal is an emergency removal of funds from a retirement plan, sought in response to what the IRS terms “an immediate and heavy financial need.” It’s actually up to the individual plan administrator whether to allow such withdrawals or not. Manythough not allmajor employers do this, provided that employees meet specific guidelines and present evidence of the hardship to them.

According to IRS rules, a hardship withdrawal lets you pull money out of the account without paying the usual 10% early withdrawal penalty charged to individuals under age 59½. The table below summarizes when you owe a penalty and when you do not:

A 401 hardship withdrawal isn’t the same as a 401 loan, mind you. There are a number of differences, the most notable one being that hardship withdrawals usually do not allow money to be paid back into the account. You will be able to keep contributing new funds to the account, however.

Recommended Reading: How To Recover 401k From Old Job

Youll Still Need To Be Mindful Of Taxes

Youll still owe income tax on your distribution from any tax-deferred retirement account. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.

Also worth noting: The income can be claimed all at once in 2020 for tax purposes, or spread evenly over the next three years. In many cases, dividing it evenly over three years may result in a better tax situation, as its less likely to bump you into a higher tax bracket in any single year.

If your income is expected to be lower in 2020 than the subsequent two years, though, it could make sense to claim all of the income on your 2020 tax return. Not only might this minimize the effective tax rate you pay on this income, but youll also have two years to pay back the distribution and ultimately get a refund.

Keep in mind that if you have a Roth IRA, it may still be a better choice for withdrawals than your 401 or IRA. Thats because savers can always withdraw contributions from their Roth IRA penalty- and tax-free.

Retirement Withdrawal Calculator Insights

There are two sides to the retirement planning equation saving and spending.

The asset accumulation phase leads up to your retirement date followed by the decumulation phase where you spend down those assets to support living expenses in retirement.

The truth is retirement income planning is one of the most complex and controversial aspects in financial planning. There are so many different models with each being dependent on assumptions chosen, portfolio assets, and risk tolerance.

- For example, dividend growth stocks have the potential to provide inflation adjusting income and capital growth, but they will also deliver increased volatility and risk of permanent loss in the wrong market conditions.

- A bond portfolio will provide stable, reliable income, but the income and assets will erode in purchasing power over time due to inflation.

- Traditional fixed annuities can provide a floor of reliable income that you can never outlive and a potentially higher safe withdrawal rate than bonds or stocks alone can provide, but the downside is loss of liquidity and a potentially smaller estate for your heirs.

In short, there is no sure-fire solution to retirement income planning that solves all problems. Each strategy results in tradeoffs between risk and required income goals. No single retirement withdrawal calculator can model all spending alternatives effectively.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Also Check: What Is Max Amount To Contribute To 401k

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Also Check: How To Withdraw Money From My Fidelity 401k

You May Need To Take Money Out Of A 401 Here’s What You Need To Know

401s are incentivized plans to help Americans save for retirement. The government provides tax breaks to encourage you to contribute, but it also enforces certain rules to discourage you from taking distributions before retirement. In some cases, breaking those rules and taking distributions early can cost you a 10% penalty in addition to the ordinary income taxes you’ll owe on withdrawn funds.

Let’s look at all the approved ways you can take money out of a 401 and look into the penalties you’ll incur if your early distributions don’t fall within one of those exceptions.

If Youve Already Taken A Withdrawal Or Loan You Can Recover

Stay calm and make steady progress toward recovery. It can be done. Build up a cushion of at least three to nine months of your income. No matter what incremental amount you save to get there, Poorman says, the key detail is consistency and regularity. For instance, have the sum automatically deposited to a savings account so you cant skip it.

Scale back daily expenses. Keep your compact car with 120,000 miles and drive it less often to your favorite steakhouse or fashion boutique.

Save aggressively to your 401 plan as soon as possible and stay on track. Bump up your 401 contribution 1% annually, until you maximize your retirement savings. Sock away the money earned from any job promotion or raise.

Also Check: How To Grow 401k Fast