How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Can You Open A Joint 401 As A Married Couple

While it is possible for married couples to open a joint bank account, you cannot open a joint 401 even if you are a couple. IRS rules require that retirement accounts such as 401s and IRAs be individually-owned, and you cannot co-own your spouseâs 401 account or move funds between the retirement accounts.

Spouses suffer no harm in maintaining their own retirement account. The two 401s can grow in tandem by choosing investments that meet their financial goals. The goal of the spouses should be to create a diversified portfolio comprising a mix of short-term and long-term assets.

However, it is possible to have joint taxable investment accounts as a couple. For example, you can open a joint brokerage account as a married couple to buy and sell securities such as stocks, bonds, and ETFs. A brokerage account has various pros such as no income limits, tax benefits, and no funding restrictions, which make it more flexible than a 401 account. On the downside, brokerage accounts may have higher fees and higher risks than a traditional retirement account.

What Is The Maximum An Employer Can Contribute To Your 401 In 2021

One of the best things about a 401 is that most employers offer some kind of match on your contributions, usually up to a certain percentage of your salary. In fact, about 86% of companies with a 401 plan provide a match on employee contributions.2 And the average employer 401 match is around 4.5% of your salary.3 Thats great news for you. After all, an employer match is basically free money!

But there is a limit on how much you and your employer can put in together. Between you and your employer, the maximum that can be put into your 401 in 2021 is $58,000 .4

Read Also: How Do You Take Money Out Of 401k

Other Important Financial Goals To Consider

Based on your own unique financial situation, you should keep a few other things in mind as you decide how much to contribute to your 401:

- Do you have a formal estate plan with wills and other critical papers ?

- Can you cover health care expenses? If you have a high-deductible health plan with a health savings account combo, make sure you are putting enough into your HSA to cover medical expensesboth now and in the future.

- Do you have proper disability insurance coverage to protect you and your family if you miss work for six months or more?

- If you’re nearing retirement, do you have long-term care plans in place?

What Happens If Your 401 Plan Fails The Test

This is where the situation gets a bit ugly. The test can be performed within 2 ½ months into the new year to make the determination. Theyll then have to take action to correct it within the calendar year. If the plan fails the test, your excess contribution will be returned to you. Youll lose the tax deduction, but youll get your money back and life will go on.

Theres a bit of a complication here too. The excess contribution to the plan during the last tax year will be refunded the following year as taxable income to the HCE. That means that when you get your excess contribution refund, youll need to put money aside to cover the tax liability.

Better yet, make an estimated tax payment to avoid penalties and interest. Thatll be important if the excess refunded is many thousands of dollars. What happens if the problem isnt identified and corrected within that time frame? It gets really ugly.

The 401 plans cash or deferred arrangement will no longer be qualified, and the entire plan may lose its tax-qualified status.

Theres a bit more to this, but Im not going to go any further. This is just to give you an idea as to how serious the IRS is about an HCE 401. If you are a small business owner, and theres even a slight chance you might be bumping up against HCE limits, consult with a CPA.

You May Like: How To Avoid Penalty On 401k Withdrawal

Review The Irs Limits For 2021

The IRS has announced the 2021 contribution limits for retirement savings accounts, including contribution limits for 401, 403, and most 457 plans, as well as income limits for IRA contribution deductibility. Contribution limits for Health Savings Accounts have also been announced. Please review an overview of the limits below.

What’s The Total 401 Contribution Limit For 2020

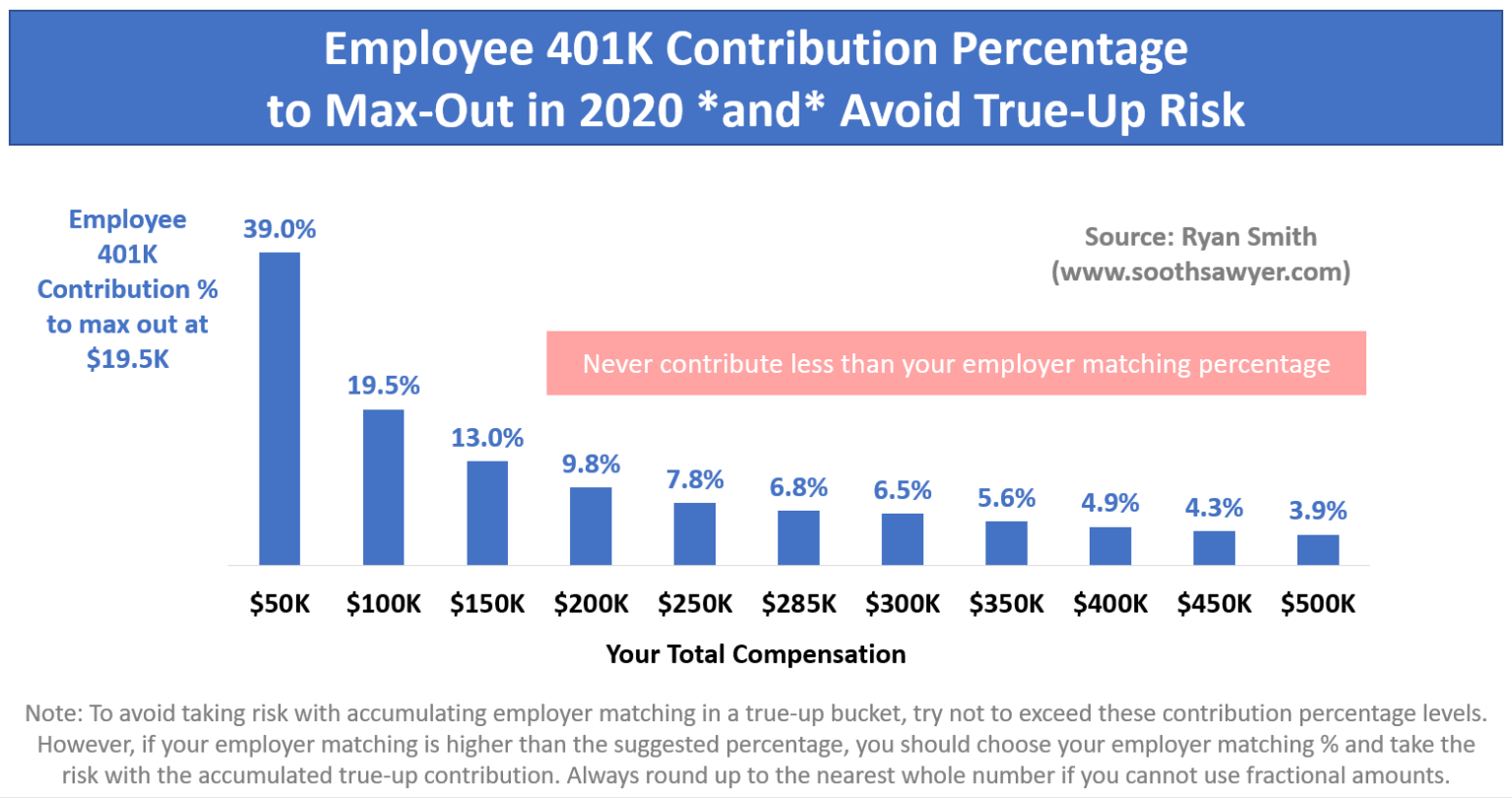

The contribution limit for employees in 2020 was $19,500. However, there is no limit to the percentage of gross income an employee makes. The $19,500 is the same limit whether an employee made $30,000 in 2020 or if they made $100,000.

Additionally, the IRS limited the number of total contributions that can be made towards a 401. While individuals could contribute $19,500, the total amount couldnât exceed $57,000. This means that both employee contributions and employer matching contributions couldnât exceed $57,000.

Don’t Miss: How To Transfer 401k From Fidelity To Vanguard

Consider A Financial Advisor

Its okay to admit that youre in over your head with personal finance. After all, youre not a Wall Street investor just an average worker trying to maximize your investments.

If you dont have the time or energy to put in the real work that it takes to own your finances, consider working with a financial advisor either through an automated index fund, robo advisor account, or an actual human. These services can help you navigate the complexities of investing and make the right decisions either with you or on your behalf.

Can I Have A 401 And An Ira

Yes. IRAs make a great supplement to retirement savings in addition to a 401 if youre contributing enough to receive a full match from your employer, or youre planning on maxing out your 401. If you dont receive a match on your 401 or it has narrow investment options or high fees, it may be a good idea to invest primarily in an IRA. The annual contribution limit for an IRA in 2021 is $6,000, or $7,000 if youre 50 or older.

» Ready to try an IRA? Check out our list of the best IRA accounts

Read Also: How To Recover 401k From Old Job

Solo 401 Contribution Limits

For those who donât work for a company, whether self-employed, a business owner, or a freelancer, a solo 401 is an excellent alternative to a traditional 401.

The IRS caps your total solo 401 contributions to $58,000 for 2020 and 2021. The elective deferral limit as the employee is $19,500. If you are over 50, an additional $6,500 catch-up contribution is permissible.

The most your employer’s nonelective contribution can be is 25% of your compensation from the business, or until you reach $58,000 total, whichever is less.

The IRS has a helpful example to illustrate how this works:

âBen, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.â

Keep in mind that if your business is a side-business, these limits are tied to the person, not the account. If you participate in a 401 with another company, these limits apply to contributions you make to that account as well.

Tags

How To Invest 401 Money

Youll also need to decide how to invest your 401 money. One option, which most 401 plans offer, is target-date funds. You pick a fund with a calendar year closest to your desired retirement year the fund automatically shifts its asset allocation, from growth to income, as your target date gets nearer.

These funds also have model portfolios you can choose from and online tools to help you assess how much risk you want to take. You can also decide which fund choices would match up best with your desired level of risk.

Read Also: How To Make 401k Grow Faster

Contributed Too Much To Your 401 Heres What To Do

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

If youve discovered you overcontributed to your employer-sponsored 401 plan first of all, congrats on maxing out tax-free contributions to your retirement savings. That habit will pay off down the line.

But the clock is ticking to notify your plan administrator and correct the problem before April 15. If you don’t act, the worst-case scenario is that you may be taxed twice on the amount above the contribution limit of $19,500 for 2021 .

“Who wants to pay taxes on any amount twice, right?” says Denise Appleby of Appleby Retirement Consulting, an Atlanta firm that helps companies administer employer retirement plans.

Heres what you should do to correct the problem, and how to avoid in the future.

Total Annual 401 Contribution Limits

Total contribution limits for 2021 are the following:

- $58,000 total annual 401 if you are age 49 or younger

- $64,500 total annual 401 if you are age 50 or older

The dollar amounts listed above are the total maximum amount that can be contributed. This number is a combination of both your own and your employers contributions.

In some cases, you can contribute additional amounts to other types of plans these may include a 457 plan, Roth IRA, or traditional IRA. It all depends on your income and the types of plans available to you.

Also Check: When Leaving A Company What To Do With 401k

Contribution Limits For 2020

The maximum amount workers can contribute to a 401 for 2020 is $500 higher than it was in 2019it’s now up to $19,500 if you’re younger than age 50. If you’re age 50 and older, you can add an extra $6,500 per year in “catch-up” contributions, bringing your total 401 contributions for 2020 to $26,000. Contributions to a 401 are generally due by the end of the calendar year.

A traditional 401 is an employer-based retirement savings account that you fund through payroll deductions before taxes have been taken out. Those contributions lower your taxable income and help cut your tax bill. For example, if your monthly income is $5,000 and you contribute $1,000 of that to your 401, only $4,000 of your paycheck will be subject to tax. While the money is in your account, it is sheltered from taxes as it grows.

The money can usually be invested in a variety of stock funds and bond funds. The average 401 plan offers 19 funds, and typically nearly half of plan assets are invested in U.S. stock funds and target-date funds, the latter of which can change their asset allocation to become more conservative over time. s for more on where to invest your retirement savings.)

What Is A 401

A 401 is a retirement savings plan some employers offer their team as a financial benefit for working at the company. The employee volunteers to deduct a certain amount from their paycheck to go toward their 401 savings account each pay period. Employees usually choose how much theyd like to deduct from their paycheck, but often have a limit on how much theyre allowed to contribute.

Employers can offer a traditional or Roth 401 plan. For traditional plans, 401 withdrawals are taxed at the employees current income tax rate. Roth 401 withdrawals arent taxable if the 401 account is five years or older and the employee is over 59 years old.

There are certain regulations to follow when it comes to how much and how often an employee can withdraw these funds for their 401. Many employers use 401s as an employee benefit for working at the company and as an incentive to keep long-term employees. Some employers require employees to work at a company for a certain amount of time before they can start depositing their paycheck money toward a 401.

Related:401 Providers: Best Practices in Selecting a Company

Also Check: Can You Roll A Traditional 401k Into A Roth Ira

A High Bar For Maxing Retirement

In 2021, if your adjusted gross income exceeds $125,000 and you’re single , you won’t be able to contribute the full amount directly to your Roth IRA.

As an alternative, these savers can consider using a strategy known as the “backdoor Roth,” where they make a non-deductible contribution with after-tax dollars to a traditional IRA and then convert it to a Roth.

They could also direct money to a Roth 401 plan at work, provided their employer offers it.

There’s a tax benefit to sprinkling some of your cash across Roth, tax-deferred accounts and taxable brokerage accounts: You’re diversifying your tax treatment, which can help you manage your tax bill in retirement.

“Most people would simply save some money in both the tax-deferred and tax-free accounts,” Stolz said. “We don’t know what the future tax brackets will be, but you’re adding some opportunity to get tax favorable treatment across your portfolio.”

An Ira Might Be A Better Option

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2021 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to what’s available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. fee analyzer.) If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

Also Check: How To Pull From 401k

Heres What To Do Before Filing Your Taxes

Contact your employer or plan administrator. Some lingo can be helpful here: Tell your plan administrator youve made an “excess deferral.” For example, if you overcontributed by $1,000, that amount needs to be paid to you before April 15.

The plan administrator is required to return the excess funds to you as a “corrective distribution” plus calculate and return additional earnings and reissue paperwork that corrects the 401 overcontribution. “That takes time, and sometimes companies can move slowly doing this,” Appleby says.

Correcting an excess contribution takes time, and companies can move slowly doing this.

Get a new W-2 and pay taxes. The returned excess contribution will be added to your total taxable wages for the previous year, so an amended W-2 will be issued. Your tax bill will rise relative to the amount of the excess 401 contribution.

Handling excess earnings. Any income earned from the excess contribution will count on your tax bill, which is due the following April. Youll receive a Form 1099-R at the end of the tax year in which the earnings were paid back to you.

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the “Calculate” or “Recalculate” button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

- Years invested

- Your initial balance

You may change any of these values.

Using the calculator

In the following boxes, you’ll need to enter:

Salary

- Your expected annual pay increases, if any.

- How frequently you are paid by your employer.

Contribution

- The amount of your current contribution rate .

- The proposed new amount of your contribution rate. Be sure to verify the maximum contribution rate allowable under your plan. Also, pre-tax contributions are subject to the annual IRS dollar limit.

Pre-tax Contribution Limits 401, 403 and 457 plans |

|

|---|---|

| 2020 | |

| After 2020 | May be indexed annually in $500 increments |

Employer Match

Investment

- The length of time that you anticipate you will invest this money.

- The amount of your current account balance.

- Your hypothetical assumed annual rate of return.

You May Like: How Do I Invest In My 401k