The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Assess Your Risk Tolerance

Risk can be defined as the chance of losing money on your investment. You lose money on an asset if it drops in market value. A mutual fund has lost value if you purchased it for $100, and it’s worth $99 a year later. But it might gain back the dollar it lost and more in the next year.

Risk tolerance is how much loss you can tolerate before you feel the need to sell the investment. Your age also plays a role. You have more time to recover if an investment performs poorly if you’re younger and have many years left until retirement. You’ll want to take less risk as you get closer to retirement age.

Investments are rated at low, medium, or high risk, depending on the assets from which they’re derived. They’re also rated for risk by their past financial performance.

It’s key to know your risk tolerance and to learn all you can about your 401 before you choose the investments that are right for you.

Plan managers create 401 plans from different types of investments to give you options from which to choose. One of the common problems with these plans is that many people don’t know how to decide which types of strategies are best for them. They don’t know how their risk tolerance and age can affect their choices.

Knowing your risk tolerance and a bit about the investment will help you decide how much you want to save. It will guide you to a point where you’re comfortable allocating your money.

Spread 401 Money Equally Across Available Options

Most 401 plans offer some version of the choices described above. If they dont, a fourth way to allocate your 401 money is to spread it out equally across all available choices. This will often result in a well-balanced portfolio. For example, if your 401 offers 10 choices, put 10% of your money in each.

Or, pick one fund from each category, such as one fund from the large-cap category, one from the small-cap category, one from international stock, one from bonds, and one that is a money market or stable value fund. In this scenario, youd put 20% of your 401 money in each fund.

This method works if there are a limited set of options, but requires much more time and research there are an array of options. In addition, it’s not as fail-safe as the first three because the asset mix may not be suitable for your retirement goals, and you have to rebalance the portfolio to maintain a certain percentage of each asset category over time.

When possible, it is always recommended that you complete an online risk questionnaire or consult a knowledgeable investment professional before haphazardly choosing stock investments that may lose you money.

Don’t Miss: How To Transfer Roth 401k To Roth Ira

How Qlacs Can Help You Invest For Retirement

Many retirement investors worry about outliving their retirement savings. A qualified longevity annuity contract is an annuity contract designed specifically to ensure you get regular income payments in the later stages of life.

Normally, you have to start taking withdrawals from tax-advantaged retirement accounts when you turn 72. These payments are called required minimum distributions . QLACs help you extend RMD deadlines to age 85. In addition to ensuring the longevity of your retirement investments, this delay can also help decrease your tax liability and keep your medicare premiums lower.

In 2020, youre allowed to use the lesser of 25% of your retirement account or $135,000 to buy a QLAC that pays out indefinitely. While QLACs can be beneficial because of the certainty of income they provide, they can also be risky. You may not live to see all of your retirement money used, and you essentially lock yourself out of accessing a portion of your retirement funds in exchange for their guaranteed payments.

As you plan your retirement, be sure to talk with a financial advisor who can help you make the most of your retirement investing scheme.

The Problem With A 401k

Now, Im not the biggest fan of 401ks for a couple of reasons.

For one, they afford you practically ZERO control over your investments.

If you do have any sort of control over where your money goes, its usually limited to which fund to choose from. Funds are baskets of stocks that typically dont even beat the market when it comes to returns. Plus, they normally have high fees, which means you not only make less than you would make if you invested on your own but youre also charged a fee on your investments.

The problem is that you cant invest in individual stocks through a 401k, and as Rule #1 investors know, investing in individual stocks of incredible companies is the best way to make returns on your money.

So, thats my beef with 401ks. They restrict the type of investments you can make so you miss out on the opportunity to choose investments that are more profitable. However, that doesnt mean they are bad. A 401k has its benefits too.

Also Check: How Do I Transfer 401k To New Employer

Supplement Your 401 With A Roth Ira

Some employer 401s suffer from a lack of investment options. This is where an individual retirement account comes in handy.

And if your employer doesnt match contributions, you might choose to forgo your 401 altogether, says Ned Gandevani, program coordinator and professor in the masters of science in finance program at the New England College of Business. When theres no contribution from your employer towards your plan, theres no need to invest in it. By investing in a restricted plan, you end up paying too much with no benefits from your employer.

Example: How Much You Need To Save Each Month If You Start To Save For Retirement Early

Suppose you plan to retire in 20 years. You want to save $75,000 for your retirement. You’re earning an annual interest rate of 5% compounded on your savings.

Compare how much you’d have to save each month if you start to save now or in 10 years. When you have 20 years to save instead of 10 years, you have to put $14,160 less into the bank to reach your goal. This is because you earn more money in interest the longer you save. In this example, you earn $14,020 more in interest when you have 20 years to save than when you have 10 years to save.

Table 1: Compare how much you’d have to save each month if you start to save now or 10 years| Years you have to save | How much you need to save per month | Amount saved |

|---|

Note: the numbers are calculated using the Ontario Securities Commissions Compound Interest Calculator.

You May Like: How Much In 401k To Retire

How Much Should I Invest

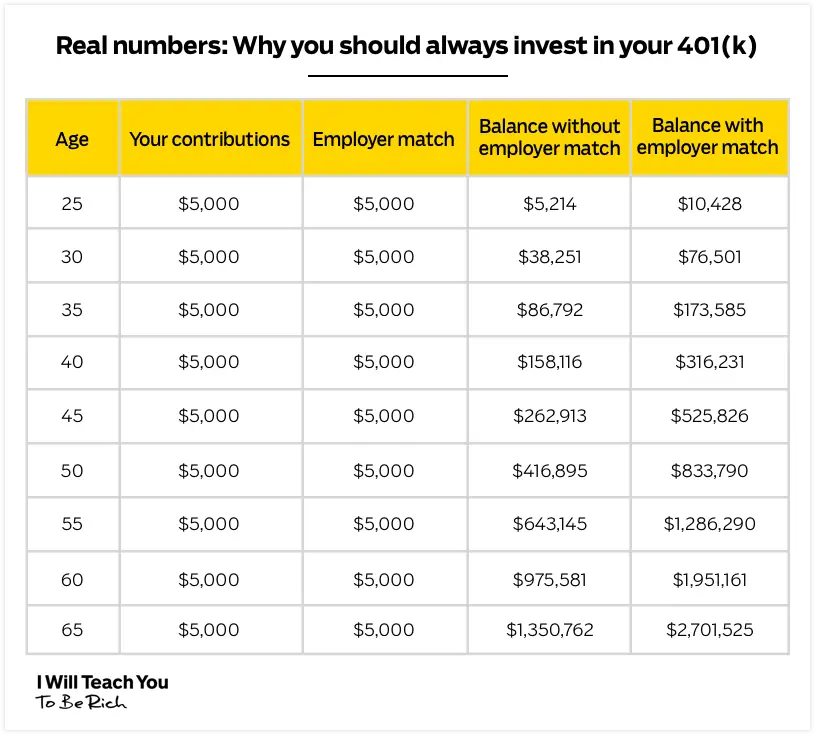

If you are many years from retirement and struggling with the here-and-now, you may think a 401 plan just isn’t a priority. But the combination of an employer match and a tax benefit make it irresistible.

When youre just starting out, the achievable goal might be a minimum payment to your 401 plan. That minimum should be the amount that qualifies you for the full match from your employer. To get the full tax savings, you need to contribute the yearly maximum contribution.

But Avoid Being Too Aggressive

If you have a long time horizon, it can be smart to get aggressive with your portfolio, but those closer to retirement should be careful, too. For retirees and near-retirees, it may be time to shift into preserving your assets rather than trying to play catch-up.

Yet many are focused on growing their assets including aggressive investment strategies rather than preserving their assets against sudden market downturns, says David Potter, former spokesperson for MassMutual Financial, citing the companys research. Many people may be taking more risk than they realize.

Potter suggests that investors reevaluate their portfolio regularly to consider how they would fare if the market declined significantly.

Typically, financial professionals recommend that retirement savers dial back their exposure to stocks as they get within five years of retirement and within the first five years after retiring, he says. A steep market downturn of 20 percent or more during those periods could irreversibly reduce your income in retirement.

Heres how to tell if your portfolio is too aggressive.

Don’t Miss: Can You Roll A 401k Into A Roth

How To Invest For Retirement In Your 20s 30s And 40s

In this in-depth guide on how to invest for retirement, youll learn:

- Why retirement investing is different from other types of investing.

- How to determine the amount of money you need for retirement.

- How to choose the best retirement plan.

- The best asset allocation for retirement investing.

- Tips for building, growing and managing your retirement portfolio.

Jump To

How Do I Retire Without 401k

How to Save for Retirement Without a 401

Don’t Miss: How Do I Transfer My 401k To A Roth Ira

Types Of 401 Investments

The most common type of investment choice offered by a 401 plan is the mutual fund. Mutual funds can offer built-in diversification and professional management, and can be designed to meet a wide variety of investment objectives. Be mindful that investing in a mutual fund involves certain risks, including the possibility that you may lose money.

Your 401 plan may offer other types of investments. Some of the more common ones include:

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account Certain Options Can Make You Much Richer

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

You May Like: Can I Manage My Own 401k

Managing Your 401 For Maximum Returns

Investing in a 401 plan is one of many popular methods that can help you build a secure retirement. Many have enjoyed long and comfortable retirements by starting to save early in their lives and maximizing their employer match.

Here are some tips for maximizing your 401 investment results by managing the plan over time.

What Happens If I Have Unclaimed 401 Funds From A Previous Job

The majority of unclaimed money comes from brokerage, checking, and savings accounts, along with annuities, 401s, and Individual Retirement Accounts. Once an account is considered inactive or dormant for a period of time , companies are required by law to mail abandoned funds to the owners last known address. If theyre returned, or the owner cant be reached, the assets must be relinquished to the state.

You May Like: How Do I Know If I Have A 401k

How Much Should I Contribute To My 401

The general rule of thumb is to aim to invest 15% of your gross income into your 401, including your employer match. But the exact target for you depends on your life stage, investing goals, and the aggressiveness of your portfolio. You also may want to combine a 401 with other retirement investment accounts such as a Roth 401 for tax strategy. Talk to an advisor to discuss the right investment plan for you.

Calculate Your Risk Tolerance

All investing is risky and returns are never guaranteed, but it can actually be more risky to keep too much of your savings in cash, thanks to inflation.

Still, you don’t want to go all in on one stock or investment, particularly if a rocky market makes you uneasy and anxious, or likely to do something drastic, like pull your money out of your account.

You’ll want to determine an appropriate asset allocation, or how much of your investments will be in stocks and how much will be in “safer” investments, like bonds. Stocks have the potential for greater returns, but can be more volatile than bonds. Bonds are more stable, but offer potentially lower returns over time.

Financial advisors often recommend using the following formula to determine your asset allocation: 110 minus your age equals the percentage of your portfolio that should be invested in equities, while the rest should be in bonds.

But think about your investing horizon. If you have decades until you’re going to retire , then you can afford a bit more risk. You might choose an 80-20 stock mix for now. When you’re older, you’ll start scaling that back, depending on your goals and, again, your appetite for risk. Experts suggest checking that your investments are properly aligned with your risk tolerance each year and rebalancing as necessary, though how often you actually do will vary based on personal preference.

Read Also: Can I Roll My Roth 401k Into A Roth Ira

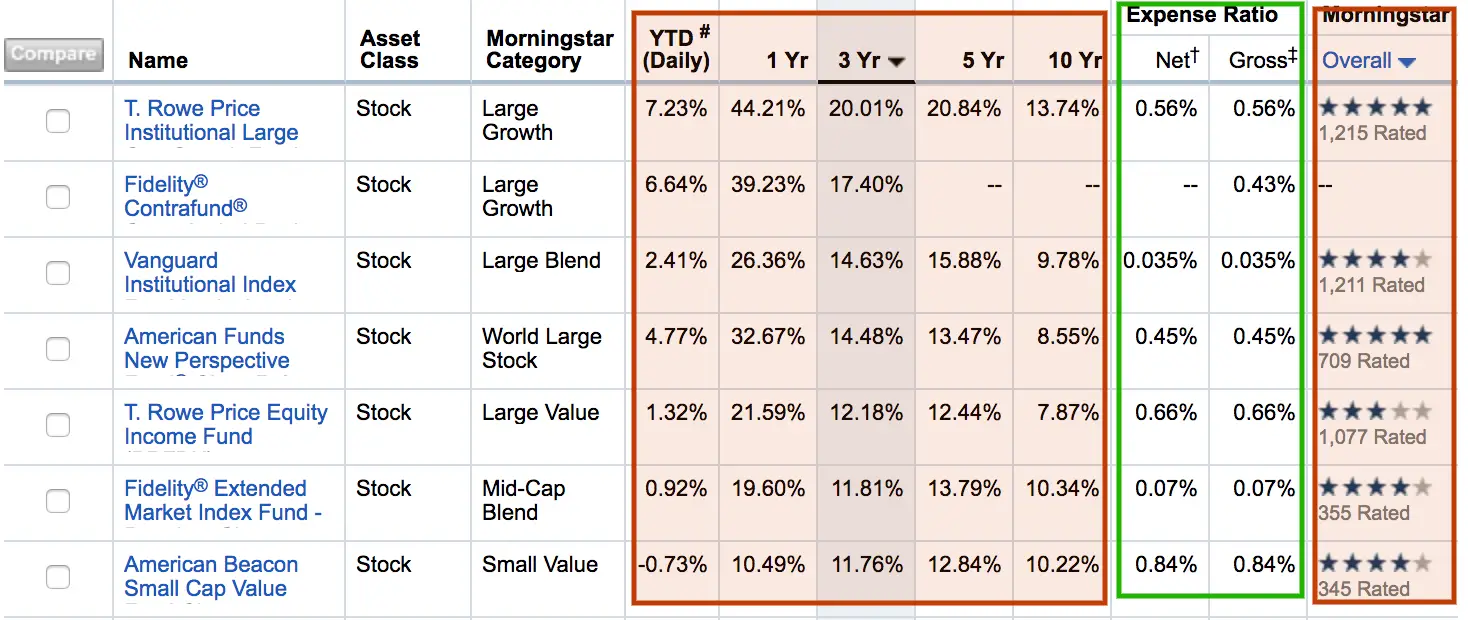

Avoid Choosing Funds With High Fees

It costs money to run a 401 plan. The fees generally come out of your investment returns. Consider the following example posted by the Department of Labor.

Say you start with a 401 balance of $25,000 that generates a 7% average annual return over the next 35 years. If you pay 0.5% in annual fees and expenses, your account will grow to $227,000. However, increase the fees and expenses to 1.5% and you’ll end up with only $163,000effectively handing over an additional $64,000 to pay administrators and investment companies.

You cant avoid all of the fees and costs associated with your 401 plan. They are determined by the deal your employer made with the financial services company that manages the plan. The Department of Labor has rules that require workers be given information on fees and charges so they can make informed investment decisions.

Basically, the business of running your 401 generates two sets of billsplan expenses, which you cannot avoid, and fund fees, which hinge on the investments you choose. The former pays for the administrative work of tending to the retirement plan itself, including keeping track of contributions and participants. The latter includes everything from trading commissions to paying portfolio managers’ salaries to pull the levers and make decisions.

Invest In Real Estate

Real estate could be a good place to tap into if you are looking to diversify your portfolio. There are a couple options. If you want to get hands-on, you can buy a home and rent it out, flip houses, or rent out your existing home. Or if you dont want to be quite so involved, investing in Real Estate Investment Trusts is another option.

If you are buying a property, experts advise you put the down payment funds in a fairly liquid account, so that its immediately available when you need to make a purchase.

Whichever way you choose to invest in real estate, you want to keep up with the latest economic trends, especially the real estate market.

Unlike many other highly liquid investments, properties cannot be bought and sold for profit in a heartbeat. You want to set aside cash for other life expenses before jumping into real estate, because you are likely to hold the property for a long time.

Best for: Investors with a large sum of cash to cover a down payment and those who understand the real estate market.

You May Like: How To Avoid Penalty On 401k Withdrawal

Know When It Pays To Be Bolder

If you have a guaranteed source of income such as a pension or annuities, treat those holdings as if they were bonds, says David Littell, professor of taxation at The American College of Financial Services.

When you combine those with your 401, your overall allocation might be more risk-averse than you expected. This means you might want to consider a more aggressive asset mix in your 401 than would be suitable for someone who only has a 401. You might say you should keep it all in stocks because your total allocation is still pretty conservative, Littell says.

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

Recommended Reading: How Much Money Should I Put In My 401k