Penalties On Early 401 Withdrawals

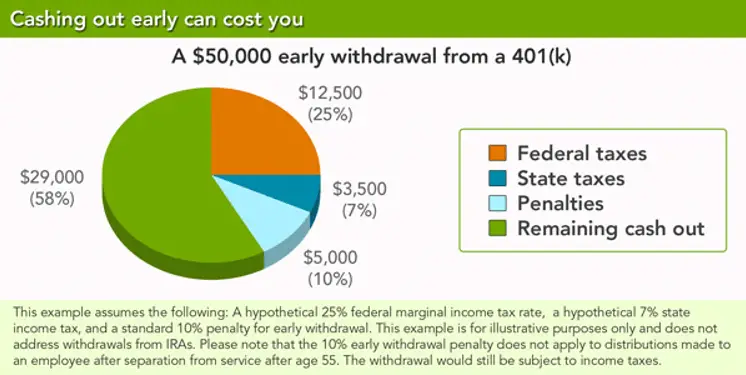

Cashing out a 401 early, before you are 59 and ½ years of age, will lead to a 401 early withdrawal penalty. The IRS will charge you 10% of whatever you take out, unless you qualify for an exception.

The government does this to encourage people to save up for their own retirements. That said, it can still be galling if you really need the money now. It is still a good idea to examine your options and see if there is another way to get money that is more affordable and does not impact your retirement a Certified Financial Planner® can help walk through all of your options.

If you are wondering how to take money out of your 401 without paying the notorious 401 tax penalty, youre not alone. Many people find themselves in situations where they need to make a 401 early withdrawal.

If you really need it, there are some qualified exceptions to the 401 early withdrawal penalty. If you are covered by one of these exceptions, cashing out your 401 early is permissible, and you will not pay the 10% penalty.

Plan for a better future

Get an affordable, professionally prepared retirement plan today.

Down Payment Gifts And Loans From Family

Its not uncommon for first-time home buyers to get help from family members. Of all home buyers ages 28 and younger , 28% used a gift from a relative or friend to make a down payment, according to a 2019 report from the National Association of Realtors. Of all buyers ages 29 to 38, 21% used a gift.

Down payment gifts are acceptable to lenders. But applying a gift toward a down payment involves more than depositing a check.

Garrett Clayton, CEO of AmCap Mortgage in Houston, says that receiving a gift toward a down payment takes a full circle of documentation to satisfy a mortgage lenders requirements. The donors will have to verify in writing not only that they made the gift, but that they also have the financial ability to make such a donation. That will require them to provide bank statements as proof, along with a letter confirming that the donation is a gift and not a loan.

The donors will have to verify in writing not only that they made the gift, but that they have the financial ability to make such a donation.

From a lender perspective, if it is something that will be required to be paid back, then we would need to take those terms of repayment into the calculation of the borrowers ratio, to make sure they still qualify, Clayton says.

Planning Out The Timing Of Your Withdrawals

The timing of your early withdrawals is important, says Dave Lowell, certified financial planner and founder of Up Your Money Game.

If you were employed for most of the year and had a relatively high income, then it makes sense to not withdraw money under the rule of 55 in that calendar year, since it will add to your total income for the year and possibly result in you moving to a higher marginal tax bracket, Lowell says.

The better strategy in that scenario may be to use other savings or take withdrawals from after-tax investments until the next calendar rolls around. This may result in your taxable income being much lower.

Also Check: How To Know If You Have A 401k

How 401 Hardship Withdrawals Work

The IRS allows anyone to take penalty-free withdrawals if they have an “immediate and heavy financial need.” You can use the money to cover your needs or those of someone else.

You may qualify for a hardship withdrawal if the funds go to:

- Pay for certain medical expenses

- Buy a primary residence

- Cover college tuition, fees, room, and board

- Prevent eviction or foreclosure

- Pay for burial and funeral expenses

- Make necessary home repairs after a disaster

How Can I Get My 401 Money Without Paying Taxes

How can I get my 401 money without paying taxes? Find out the exact strategies you can use to reduce or eliminate the tax burden on your 401 withdrawals.

When you take money from a traditional 401, the IRS subjects the distributions to ordinary income tax. The amount of tax you pay depends on your tax bracket, and you can expect to pay a higher tax for a higher distribution. You may also be required to pay a 10% penalty on the distribution if you are below 59 ½ years.

You can rollover your 401 into an IRA or a new employerâs 401 without paying income taxes on your 401 money. If you have $1000 to $5000 or more when you leave your job, you can rollover over the funds into a new retirement plan without paying taxes. Other options that you can use to avoid paying taxes include taking a 401 loan instead of a 401 withdrawal, donating to charity, or making Roth contributions.

If you want to get your 401 without paying taxes, there are certain strategies you can use to avoid or reduce your tax bill. Read on to find out how to avoid taxes on 401k withdrawals when the IRS wants a cut of your distributions.

Don’t Miss: How Do I Transfer 401k To New Employer

No : Ira Withdrawal For Disability

Unfortunately, many of my clients have had to take early distributions from their IRAs due to disability. If you become disabled, you may be eligible for Social Security Disability Insurance and/or Supplemental Security Income benefits, but most SSDI recipients receive between $800 and $1,800 per month. The average monthly benefit for 2021 is only $1,277. Anything is better than nothing, but if youre a business owner, youre probably used to taking home significantly more than that.

Therefore, if you become disabled AND you have a physician who signs off on the severity of your condition, you could take money out of your IRA, penalty-free, to supplement your SSDI income. While I hope you never have to use this option, at least you know its a possibility.

How Does A Cares Act 401k Withdrawal Work

Plan participants should speak to their plan administrator to ask about the process for requesting a 401k or IRA withdrawal. The participant may need to complete a withdrawal form and provide documentation to substantiate the nature of their hardship.

The request will need to be approved by either a committee or a designated person responsible for making hardship-withdrawal decisions. If the participant qualifies for a hardship withdrawal based on IRS regulations, the plan administrator will process the request. Depending on the plan administrator, approving and processing the hardship request can take several weeks. For that reason, a hardship withdrawal may not be a great option for the most time-sensitive financial needs.

If the participant doesnt qualify for the distribution, the administrator will deny the request and notify the participant.

Prior to the CARES Act, plans would automatically withhold 20% of early withdrawals for tax purposes. The CARES Act eliminated the 20% automatic withholding on 401k withdrawals. However, participants may want to avoid spending the full amount withdrawn in order to have funds available to cover the tax bill later.

You May Like: How Do I Transfer My 401k To A Roth Ira

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Also Check: Can I Roll My Roth 401k Into A Roth Ira

Avoiding The 10% Early Withdrawal Penalty

The most common of the penalties is a 10% early withdrawal tax on money taken out of your 401 before you turn 59 1/2 years old. That penalty is in addition to the standard federal income tax that would be withheld, as well as the state levy if you live in a state with an income tax. However, some exceptions apply.

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

Don’t Miss: How Much Money Should I Put In My 401k

Home Equity Loan Or Home Equity Line Of Credit

A home equity loan or home equity line of credit could be a smarter way to get cash for your large purchase.

Common sense financial planning would generally not endorse taking on new debt, but it may be better in the long run than withdrawing money from a 401k plan.

Thats because over time, the returns on the stock market are usually higher than the interest rates on home equity loans.

As long as you are in position to pay back loans and get a favorable interest rate, its better to consider borrowing from a bank than from your future self in the form of a 401k withdrawal or loan.

HELs and HELOCs are loans that use your home equity for collateral. Because theyre secured by your house, they tend to have low interest rates.

Currently, home equity lines of credit come with variable interest rates of about 5 percent, and the fixed rates for home equity loans are slightly higher. Both are lower than stock market returns in a typical year.

When you factor in the 10 percent tax penalty and the potential loss of capital gains incurred by withdrawing from a 401k, many people would be better off getting a home equity line of credit or loan.

Keep in mind, however, that interest rates have been on the rise and market returns have been volatile. So there is some risk to using a HELOC for your purchase.

How To Avoid The Early Withdrawal Penalty

There are a few exceptions to the age 59½ minimum. The IRS offers penalty-free withdrawals under special circumstances related to death, disability, medical expenses, child support, spousal support and military active duty, says Bryan Stiger, CFP, a financial advisor at Betterments 401.

If you dont meet any of those qualifications, you arent entirely out of luck, though. Youve got a couple of options that may let you make penalty-free withdrawals, if youre slightly younger than retirement age or plan your withdrawals methodically.

If youre between age 55 and 59 ½ and you lose your job, the IRS will allow you to withdraw from your 401 plan penalty-free. This is called the Rule of 55, and it applies to everyone within this age group who loses a job, no matter whether youre fired, laid off or voluntarily quit. Stiger says. To qualify for the Rule of 55, the 401 you hope to take withdrawals from must be at the company youve just parted ways with. Note that the Rule of 55 does not apply to IRAs.

There is also the Substantially Equal Periodic Payment exemption, or an IRS Section 72 distribution, say Stiger. With SEPP you can take substantially equal payments from your 401 based on life expectancy. Unlike the Rule of 55, you may use SEPPs to tap an IRA early.

Also Check: How Do You Take Money Out Of 401k

A 401 Loan Or An Early Withdrawal

Retirement accounts, including 401 plans, are designed to help people save for retirement. As such, the tax code incentivizes saving by offering tax benefits for contributions and usually penalizing those who withdraw money before the age of 59½.

However, if you really need to access the money, you can often do so with a loan or an early withdrawal from your 401 just remain mindful of the tax implications for doing so.

What Are The Penalties For Withdrawing From My 401 Before Age 59

Unless you fall into one of the special exemption categories, you will pay a penalty of 10% of the amount of funds you withdraw. This can get quite pricey and really cut into your retirement savings. If you must make a withdrawal before reaching retirement age, then make sure you check the list of exemptions to the penalty. If you can qualify under one of the exemptions, then you will not be forced to pay this extra penalty.

Read Also: How To Take Out 401k Money For House

Crowdfunding A Down Payment

Sites like FeatherTheNest.com and HomeFundIt.com let you build an online profile and raise money for a down payment.

FeatherTheNest works like a gift registry where contributions to your down payment can be funneled into a linked bank account. The service seems particularly suited for engaged couples and newlyweds.

CMG Financial, a mortgage-banking firm, provides the HomeFundIt service. To use HomeFundIt, you have to get prequalified for a mortgage from CMG Financial first. Then you can use its crowdfunding tool to raise money for a down payment. You also have an opportunity for a $1,500 closing costs grant with free home buyer education.

The drawbacks: Watch out for fees or obligations when using a crowdfunding strategy. The transaction and credit card processing fees for FeatherTheNest total 7.9% plus 30 cents on each donation. HomeFundIt doesnt charge fees, but you can’t shop around for a mortgage lender you must use CMG Financial.

Can You Avoid The 10% Early Retirement Penalty 10 Possible Ways

Not surprisingly, people want to make sure they have the income to last throughout their lifetimes. If you plan well, you could theoretically retire at age 55, 50, 45 or sooner. Maybe youve sold your business for profit, youve maximized your retirement account contributions for years, youve invested in non-qualified accounts, and you own multiple rental properties. At that point, you could take a blended distribution from various accounts and investments so that your money continues to grow tax-sensitive to you. However, if you take distributions from your retirement accounts before age 59 ½, many times, you will owe the IRS a 10% early distribution penalty. Sometimes, though, the government will waive that 10% early retirement penalty if certain conditions are met.

Let me explain.

Follow Along With The Financially Simple Podcast!

Podcast Time Index for How to Retire Before 59.5 and Not Pay 10% Penalty

- 01:07 How Do I Take Income From My Retirement Accounts?

- 04:06 The 59 ½ Rule

- 04:48 IRA Withdrawal for Medical Expenses

- 06:31 IRA Withdrawal to Pay for Health Insurance

- 07:50 IRA Withdrawal for a 1st Time Home Purchase

- 08:35 If You Are Disabled

- 09:06 The 72 T Calculation

- 10:58 Leave The Money in The 401K

- 11:38 401K Loan

- 13:27 ROTH IRAs

- 15:58 Wrap Up

Also Check: How To Grow 401k Fast

Series Of Substantially Equal Periodic Payments

This is the classic Section 72t ) method for early withdrawal exceptions to the penalty. Essentially you agree to continue taking the same amount from your plan for the greater of five years or until you reach age 59½. There are three methods of SOSEPP:

7. Required Minimum Distribution method uses the IRS RMD table to determine your Equal Payments.

8. Fixed Amortization method in this method, you calculate your Equal Payment based on one of three life expectancy tables published by the IRS.

9. Fixed Annuitization method this method uses an annuitization factor published by the IRS to determine your Equal Payments.

Section 72 provides additional methods for premature distribution exceptions which can occur before leaving employment :

10. High Unreimbursed Medical Expenses for yourself, your spouse, or your qualified dependent. If you face these expenses, you may be allowed to withdraw a limited amount without penalty.

11. Corrective Distributions of Excess Contributions under certain conditions, when excess contributions are made to an account these can be returned without penalty.

12. IRS Levy when the IRS levies an account for unpaid taxes and/or penalties, this distribution is generally not subject to penalty.

And lastly, here are a few additional ways that you can withdraw your 401k funds without penalty:

Originally by Financial Ducks In A Row, 1/20/20

RELATED TOPICS