What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Calculate How Much Of Your Retirement Is At Risk

Having a 401k is crucial for your financial future, and the government tries to reinforce that for your best interest. To encourage people to save, anyone who withdraws their 401k early pays a 10 percent penalty fee. When, or if, you go to withdraw your earnings early, you may have to pay taxes on the amount you withdraw. Your tax rates will depend on federal income and state taxes where you reside.

Say youre in your early twenties and you have 40 years until youd like to retire. You decide to take out $10,000 to put towards your student loans. Your federal tax rate is 10 percent and your state tax is four percent. With the 10 percent penalty fee, federal tax, and state tax, you would receive $7,600 of your $10,000 withdrawal. The extra $2,400 expense would be paid in taxes and penalties.

The bottom line: No matter how much you withdraw early from your 401k, you will face significant fees. These fees include federal taxes, state taxes, and penalty fees.

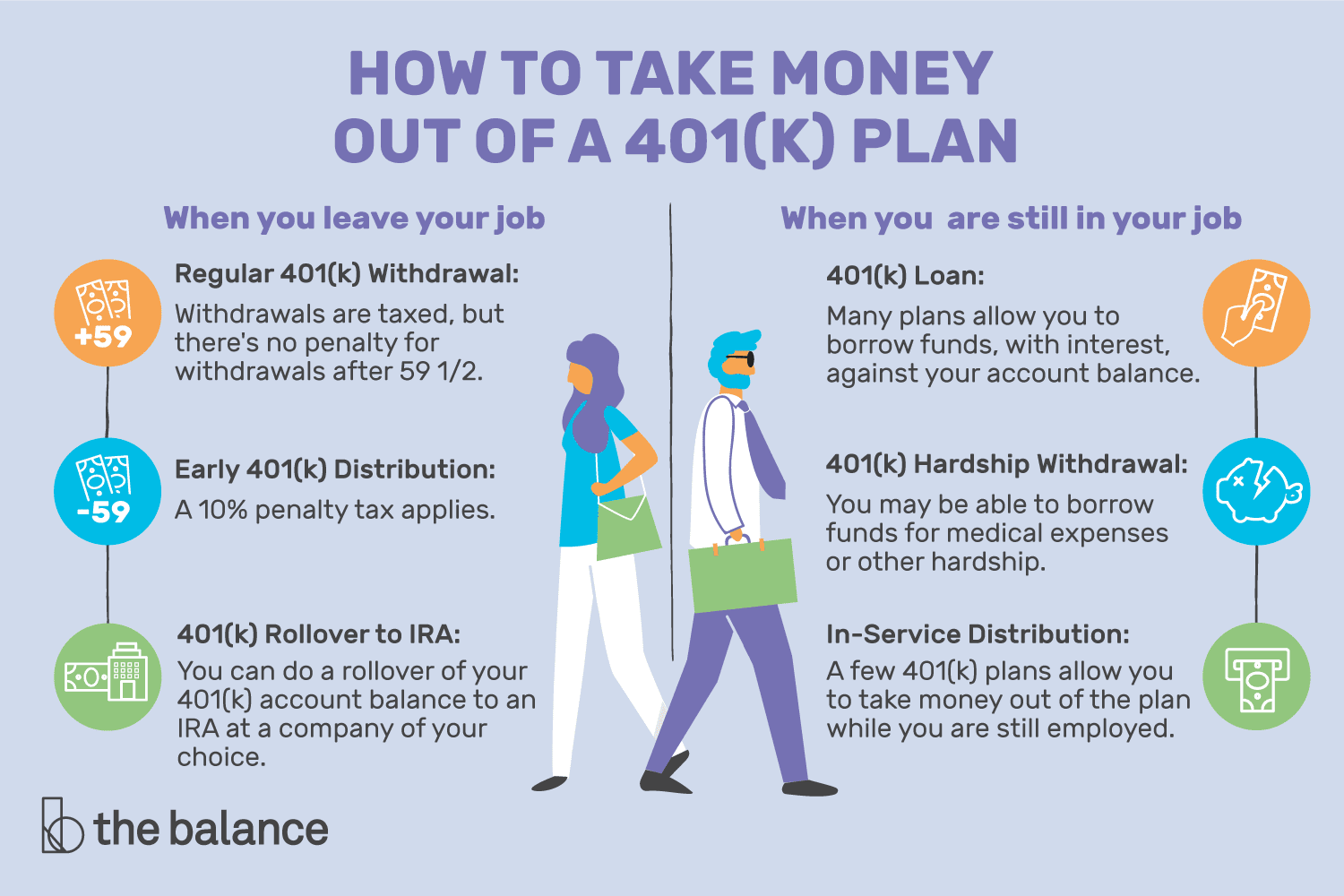

Withdrawals Before Age 59 1/2

Any withdrawal made from your 401 will be treated as taxable income and subject to income taxes in the year in which you made it, before or after retirement. But you’ll also be subject to a 10% early distribution penalty if you’re younger than age 59 1/2 at the time you take the withdrawal.

These taxes and penalties can add up and can nearly cut the value of your original withdrawal in half in some cases.

You can avoid these taxes and the penalty with a trustee-to-trustee transfer. This involves rolling over some or all of your 401 assets into another qualified account. You might consider a 401 loan if you want to access your account’s assets because of financial hardship.

You can take a penalty-free withdrawal from your 401 before reaching age 59 1/2 for a few reasons, however:

- You pass away, and the account’s balance is withdrawn by your beneficiary.

- You become disabled.

- You begin “substantially equal periodic” withdrawals.

- Your withdrawal is the result of a Qualified Domestic Relations Order after a divorce.

- You’re at least 55 years old and have been laid off, fired, or quit your job, otherwise known as the “Rule of 55.”

Your distributions will still be taxed if you take the money for any of these reasons, but at least you’ll dodge the extra 10% penalty.

Also Check: How To Pull From 401k

Retirement Account Withdrawal Comparison

So which is best? This depends on what accounts you have and how much you have contributed to them. But in general, youll be assessed fewer taxes and penalties if you withdraw money for your down payment from a Roth before a traditional IRA, and from either of those before a 401k. Whether a 401k loan is better than an IRA withdrawal depends on how large it is and whether it will affect your ability to qualify for the amount and type of mortgage you want.

- Contributions in Your Roth IRA: No income tax due, will not owe 10% penalty.

- Earnings in Your Roth IRA up to $10,000 for the Purchase of a First Home: No income tax due, will not owe 10% penalty.

- Small 401k Loan: Will not owe income tax or penalty. Monthly payments will be small and will have a minimal affect on mortgage qualification.

- Any Withdrawal From a Traditional IRA, SEP-IRA, or SIMPLE IRA up to $10,000 for the Purchase of a First Home: Income tax due, will not owe 10% penalty

- Earnings in Your Roth IRA Over $10,000 for the Purchase of a First Home: Income tax due, will owe 10% penalty.

- Any Withdrawal From a Traditional IRA, SEP-IRA, or SIMPLE IRA Over $10,000: Income tax due, will owe 10% penalty

- Large 401k Loan : Will not owe income tax or penalty. Monthly payments can be large and substantially affect mortgage qualification.

- 401k Withdrawal of Any Amount: Will owe income tax and 10% penalty.

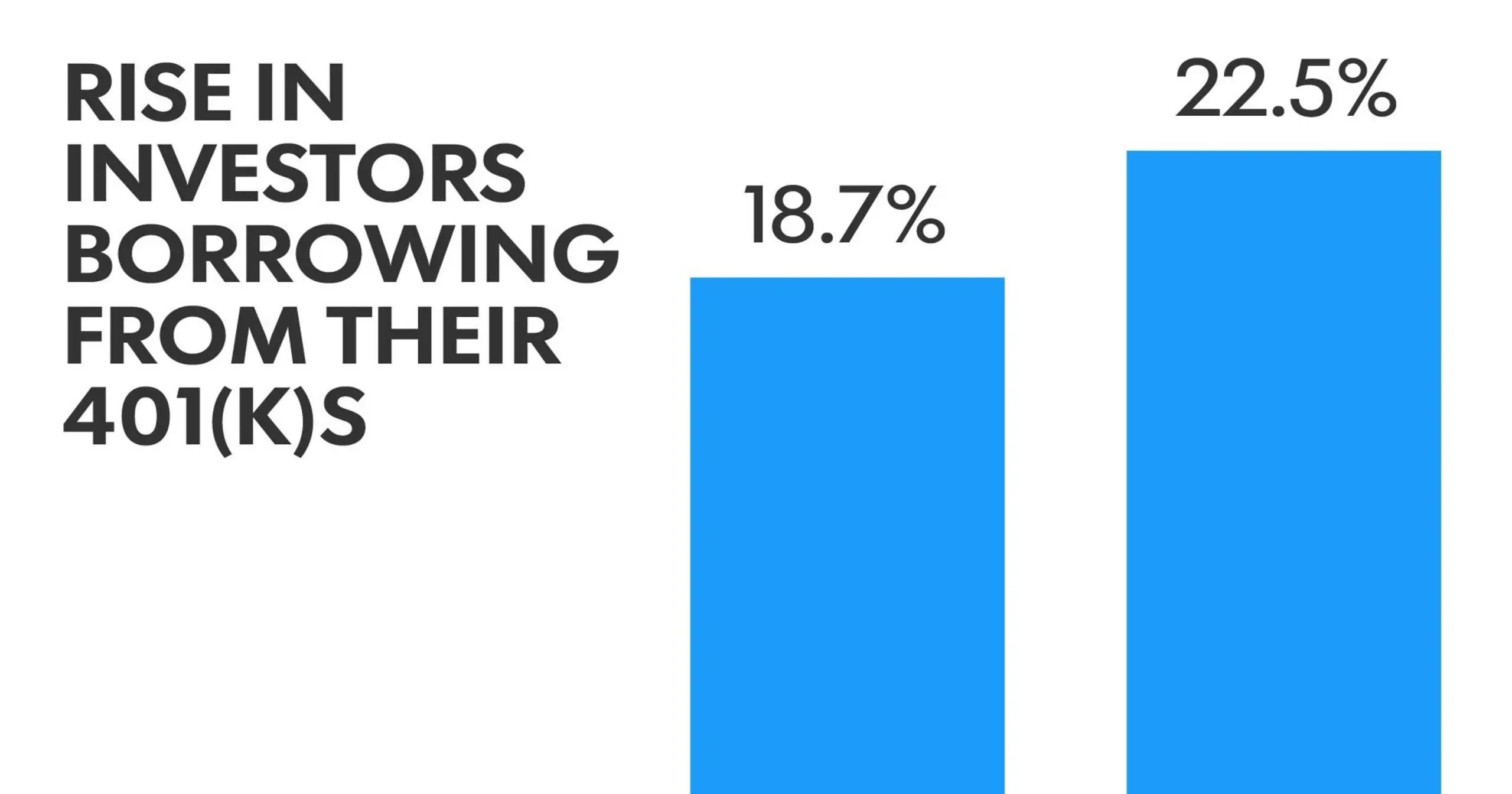

Borrowing Against Your 401

So can you use your 401 to buy a house, and more importantly, should you? Yes, the money is technically yours so you can use it for anything you want or need it for, including as a 401 first-time home buyer.

While you can withdraw your money from the 401 plan in some cases, such as financial hardship, it can be more financially advantageous to borrow instead. But you do need to be aware of some of the potential downsides. Here are some questions to ask:

Read Also: Why Cant I Take Money Out Of My 401k

How To Avoid Cashing Out Your 401

Your 401 isnt there for emergencies or vacations or paying down debtits there for retirement. When you borrow money from your 401 even just one time, you might turn your future retirement into one big emergency. And thats not okay!

Thats why we want you to have a fully funded emergency fund in placebefore you start investing in a 401 or other retirement accounts. When you have a big pile of cash available at a moments notice, it can turn a major emergency into a minor inconvenienceand itll keep you from even thinking about touching your 401.

If you havent saved an emergency fund with 36 months of expenses, stop saving for retirement until you do!

And, by the way: Going on a family vacation or renovating your kitchen is not an emergency! If you know you have some major purchases or a vacation on the horizon, open up a sinking fund and set aside some money each month until you can pay for them with cash.

The only reason you should even think about taking money out of your 401 is to avoid bankruptcy or foreclosure. Otherwise, your 401 is off-limits until retirement. Period!

Alternatives To Using A 401 For A Home Purchase

You may not need a 401 loan or withdrawal to begin with. If your mortgage lender allows it, you can make adown payment of less than 20%. While a 20% down payment is standard, you only have to pay your minimum down payment. If your down payment is less than 20%, you get charged monthlyPrivate Mortage Insurancepremiums until you own 20% of your homes equity. Generally, paying for these premiums is better than taking money from your 401.

Before using your retirement funds to pay for a down payment, consider any alternatives you have available:

1. Savings and Investment Accounts

Check any liquid assets you have available. Before getting a mortgage, make sure your income supports themonthly mortgage paymentsand that you have savings for emergencies. Checkhow much house can i afford calculatorto help you determine your affordability.

2. Federal and State Government First-Time Home Buyer Programs

The federal government has manyfirst-time home buyer programswith lower minimum down payments and down payment assistance programs. You should also check with your states local housing authority because each state has unique first-time home buyer programs.

3. Family and Friends

Getting a family gift can help you secure a down payment without having to take on unnecessary debt or compromise your retirement funds. This family gift cannot be a loan.

4. Personal Loans

5. IRA

6. 401 Loan or 401 Withdrawal

Recommended Reading: Can I Buy Individual Stocks In My 401k

Borrow Against Your 401

Borrowing from your 401 is generally the more advantageous option if you want to tap your plan for a down payment.

If your employers plan allows employees to take out loans against their 401 accounts, youll typically be able to borrow up to 50% of your vested account balance or $50,000, whichever is less.

Tip:

Youll then have to make more or less equal payments at least quarterly, with interest until youve repaid the loan. Youll typically need to repay it within five years.

Upsides

- Wont affect your credit

Downsides

Learn More: 401 Loans: Should You Borrow Against Your Retirement?

Can You Take Out Money From 401k To Buy A House

4.7/5401kPurchase a HouseYou can401k401kwillyou401kpurchasing

Similarly, you may ask, is it a good idea to use 401k to buy a house?

Earnings in Your Roth IRA up to $10,000 for the Purchase of a First Home: No income tax due, will not owe 10% penalty. Large 401k Loan : Will not owe income tax or penalty. Monthly payments can be large and substantially affect mortgage qualification.

Furthermore, can you withdraw from 401k without penalty? If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year.

Additionally, can you withdraw from a 401k to buy a house?

You can use 401 funds to buy a home, either by taking a loan from the account or by withdrawing money from the account. A 401 loan is limited in size and must be repaid , but it does not incur income taxes or tax penalties.

Is it better to take a loan or withdrawal from 401k?

Suppose that instead of taking a withdrawal you choose to borrow from your 401. Because it’s a loan and not a withdrawal you won’t pay taxes on it. But there will be an interest rate applied to the loan. It is likely that your 401 loan will have a lower interest rate than what you’re paying on your credit cards.

Read Also: How Do I Transfer My 401k To A Roth Ira

Benefits Of Borrowing From Your 401k To Buy A Home

The great thing about 401k loans is that they dont count towards your debt-to-income ratio. Using a 401k loan to finance your down payment can put you in a more favorable position for financing your mortgage. And, these loans are not reported to the credit bureaus, so they dont impact your credit score. It can also be beneficial to borrow from your 401k as a first time home buyer in order to make a higher down payment, especially in a competitive housing market. That said, you should consider the monthly payments on your 401k loan along with your monthly mortgage payment to ensure that these payments are within your budget.

How Long Do You Have To Repay A 401 Loan

You generally have up to five years to repay your 401 loan, and you must make at least quarterly repayments. You may be able to get longer loans under special circumstances, like when you use a 401 loan for your primary residence. Your employer may set different terms for any of the above, so make sure to check with your plan administrator before you withdraw money from your 401.

Regardless of the requirements of your plan and company, you may choose to make more frequent repayments or to borrow money for a shorter amount of time. Paying off a 401 early minimizes the opportunity cost of having money not compound in your retirement accounts. It also helps protect you from the consequences of not repaying a 401 loan if you suddenly lose your job.

Remember: Your company determines when you must repay your 401 loan by if youre no longer employed. While your company may allow repayment up until you file taxes for the current year, you must repay your loan by then. Otherwise, you may owe taxes or an early withdrawal penalty on the amount you borrowed.

Also Check: How Do You Take Money Out Of 401k

Ask For Money From The Seller

Whether or not you decide to pull from your 401 for your home purchase, if you truly feel that youre unable to afford the upfront costs of buying a home, it may be a good idea to ask for money from the seller. In this scenario, the seller will pay for a portion of your closing costs upfront and raise the sale price of the home accordingly, which will allow you to pay for your closing cost overtime in the form of a slightly- higher mortgage payment.

While this may sound like a good deal, its important to note that its usually not recommended to go this route unless its absolutely necessary. Often, asking for a seller concession makes your offer appear weaker in the eyes of the seller and may make you less competitive in a hot market.

When A 401 Loan Makes Sense

When you mustfind the cash for a serious short-term liquidity need, a loan from your 401 plan probably is one of the first places you should look. Let’s define short-term as being roughly a year or less. Let’s define “serious liquidity need” as a serious one-time demand for funds or a lump-sum cash payment.

Kathryn B. Hauer, MBA, CFP®, a financial planner with Wilson David Investment Advisors and author of Financial Advice for Blue Collar America put it this way: “Lets face it, in the real world, sometimes people need money. Borrowing from your 401 can be financially smarter than taking out a cripplingly high-interest title loan, pawn, or payday loanor even a more reasonable personal loan. It will cost you less in the long run.”

Why is your 401 an attractive source for short-term loans? Because it can be the quickest, simplest, lowest-cost way to get the cash you need. Receiving a loan from your 401 is not a taxable event unless the loan limits and repayment rules are violated, and it has no impact on your .

Assuming you pay back a short-term loan on schedule, it usually will have little effect on your retirement savings progress. In fact, in some cases, it can even have a positive impact. Let’s dig a little deeper to explain why.

You May Like: What Happens When You Roll Over 401k To Ira

How Much Can You Borrow From Your 401

In general, you can borrow the greater of $10,000 or 50% of your vested account balance up to $50,000. You are limited to the balance in your current companys 401, not the collective balance of all of your retirement accounts. You may, however, be able to roll over funds into your current 401 to increase the amount you can borrow. You are limited to borrowing from the assets in your current employers 401 plan.

Why This Is Usually A Bad Idea

In a perfect world, you never touch retirement savings until you retire. Taking it out before then not only reduces your savings, it robs you of years of compound interest. If you are 35 today, taking $10,000 out of a retirement account would leave you short $68,000 when you retire, assuming a 6% average annual return.

Then there are the fees. If you are saving in a tax deferred account, like an IRA or 401-type plan, and are under age 59.5, you have to pay tax on what you take out and a 10% penalty. Taking money out of your account is like locking in a 10% market dropforever. It is made even worse by the fact that people tend to draw down their accounts when there is a recession and the stock market is reeling, effectively locking in even worse returns. But sometimes its justified.

Recommended Reading: How To Recover 401k From Old Job

Change Your Spending Habits

With a budget in place, youll see how much more you need or which expenses you can cut. You probably dont need a latte from Starbucks every morning, or you can pack your lunch instead of eating out every day. Rethink your spending habits, and youll discover ways you can save extra bucks to pay off your debt.

Still Not Sure Ask A Financial Advisor

For most home buyers, withdrawing or borrowing from 401retirement funds to make a down payment on a house is short-sighted.

But your personal finances may create an exception. For somepeople, a hardship withdrawal or 401 loan could be a sensible solution.

A financial planner can help you weigh your current accountbalance against your long-term financial goals so you can better decide how toproceed.

Consider using a Roth IRA instead

If you decide to use retirement funds to help buy a home, considerusing money saved in a Roth IRA instead of a 401 or traditional IRA. BecauseRoth IRA contributions have already been taxed, youll have an easier timeaccessing this money.

Also, since money in your IRA isnt connected to your employer, youwont face a faster repayment period if you change jobs.

Also Check: How To Open A Solo 401k