Tips On Growing Your Retirement Savings

- A financial advisor can help you allocate your 401 and IRA accounts as one portfolio to maximize the growth of your retirement savings. Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- When youre shopping around for an IRA, you should open one with a financial institution that offers robust funds and low fees. To help narrow down your choices, we published a report on the best IRAs in the market today.

- Do you need help setting up and planning your retirement goals? SmartAssets retirement calculator can help you figure out how much you will need to retire comfortably.

Plans For Canadian Residents

More and more Canadians are working remotely for companies based in the United States, and are finding that participation in their employer’s 401 plan might not be in their best interests, at least from a tax perspective.

Most of us are aware of the benefits of 401 savings programs, but if you are a Canadian resident, there are certain negative aspects you should know about. You need to weigh the pros and cons to decide if you should be involved in a 401. You might prefer to put your money into another type of retirement vehicle, like a Canadian RRSP.

401 plans can have some very tangible benefits, such as:

- Convenienceit’s easier to save for retirement when contributions are deducted from pay at source

- Employer contributions to the plan equal free moneyusually a good thing

- Professional investment management and administration

- Deferment of U.S. tax on contributions and

- Ability to contribute more to a 401 than to an IRA.

401 problems for residents of Canada can include:

- Exposure to currency fluctuations and

- Double taxation of contributed amounts.

Currency Fluctuations

Of course the U.S. dollar could strengthen and you could recover losses or make gains, but it is impossible to predict the future. Anyone who thinks they know in advance which way the rates are going to go is probably delusional . Do you want to expose your retirement savings to this uncertainty?

Potential for Double Taxation

Strategies to Ponder

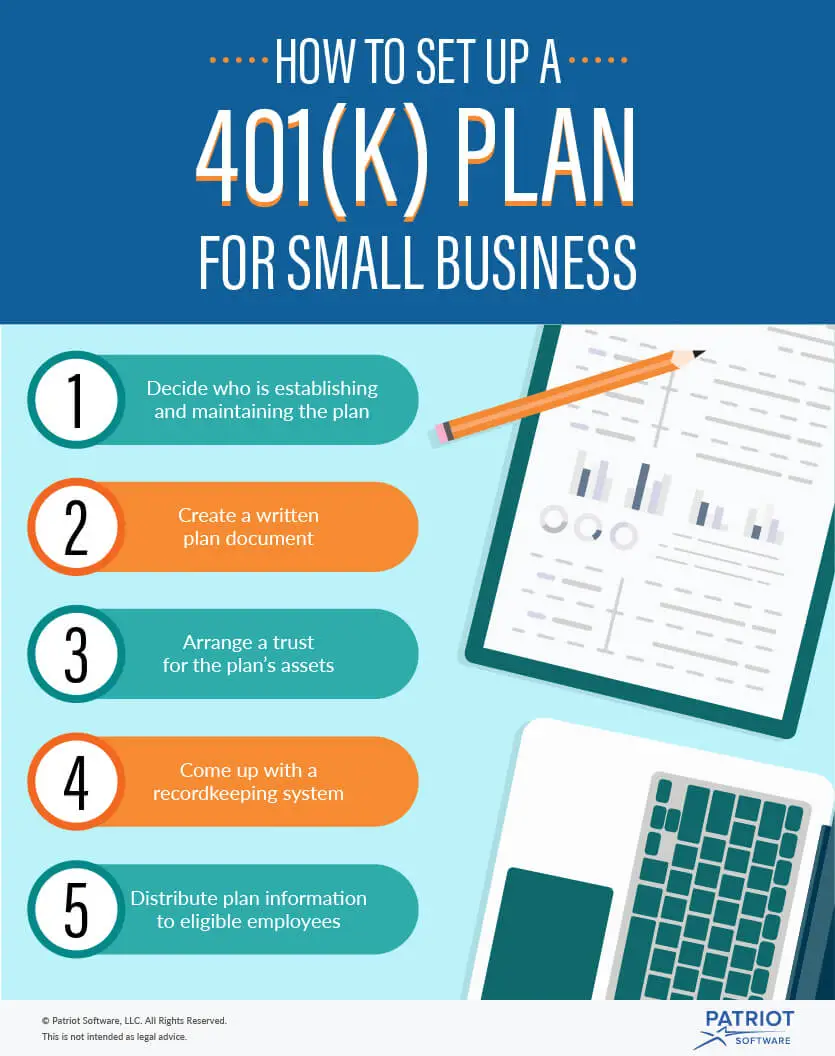

Managing 401 Plans For A Small Business

Setting up a 401 can be complicated, but you don’t have to do it alone. Look for a provider with an excellent track record that can help you get started, manage your plan, and even share ideas and guidance to maximize the value to you and your employees. Doing so can go a long way in ensuring an ongoing, positive benefit for years to come.

You May Like: How To Cash Out 401k

Can I Retire At 55 With $300000

Probably not. At the age of 55, you wont be eligible for Social Security so youll be entirely dependent on that $300,000. If you apply the 4% rule, youll have an income of just $12,000 a year. If you can live on $1,000 a month, perhaps by moving to a place with a very low cost of living, then you can retire. More realistically though, youll have to top up that income with at least part-time work.

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

Read Also: How To Transfer 401k From Old Employer

Can I Open A Roth Ira If I Am Self Employed

An IRA seems to be the easiest way for people who are self -employed to start saving for retirement. There are no special filing requirements, and you can use them whether you have employees or not. One note: The Roth IRA has an income limit for eligibility people who earn too much cannot contribute.

Can you open a Roth IRA if you have a business? Traditional IRA or Roth IRA The above three accounts are specifically for small business owners. You can also simply open a personal IRA or a Roth IRA account. The contribution limit for this account is low, but you can pair it with a SEP or SIMPLE IRA account for maximum savings.

See Our Complete Guide To The Best Retirement Plan For Independent Workers

- Individual 401 plans allow you to start taking deductions after you turn 59.5 years old.

- You cannot employ any full-time employees and have a solo 401.

- In 2021, an employee can contribute up to $19,500 in one year, assuming you’re under 50 years old.

- Annual or maintenance fees for solo 401 plans usually run between $20 and $200, and they are tax deductible.

The number of people who run their own business continues to trend up. The most recent data from the Bureau of Labor Statistics found that 9.6 million people worked for themselves in 2016. That is projected to increase to 10.3 million by 2026.

Working for yourself may give you the ability to make more money than you would working for someone else, but it also means you need to have your own retirement plan in place. One of the most popular retirement plans for independent workers is a self-employed 401. We spoke to two financial experts to find out how these retirement plans work.

Logan Allec, CPA and owner of the personal finance site Money Done Right, and Adam Bergman, a trained tax attorney and president of IRA Financial Trust and IRA Financial Group, offered their insights about these plans, including the maximum contributions, taxes, investments and fees.

Editor’s note: Looking for the right employee retirement plan for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Don’t Miss: Is Rolling Over A 401k Taxable

Alternatives To A Solo 401

There are basically two options in addition to the solo 401 for freelancers and independent contractors who want to save for retirement and get the tax advantages that go with these IRS-approved choices:

- The , for Simplified Employee Pension, is designed to be an easy, flexible option for small businesses with employees. It works much like a traditional IRA but has higher contribution limits. The limits are the same as for the Solo 401: $58,000 for 2021 and $61,000 for 2022. However, your contribution cannot exceed 25% of your net adjusted income. You may not find that adequate for your goals. No catch-up contribution is allowed for those age 50 and older. No Roth option is available. A SEP IRA can be opened through any brokerage or bank.

- The Keogh Plan is open to sole proprietors, partnerships, and limited liability companies and is often used as a profit-sharing vehicle for professional practices such as doctors’ and lawyers’ groups. It has the same contribution limits as the SEP IRA and the Simple 401 but poses a greater administrative burden. There is no Roth option.

Another option, the SIMPLE IRA, is designed for businesses with 100 or fewer employees. It is open to sole proprietors but has a lower contribution limit than the Solo 401 or the SEP IRA. The maximum contribution is up to 3% of salary plus $13,500 in 2021 (rising to $14,000 in 2022. There is no Roth option.

Withdrawing From A 401

Withdrawing from your 401 often comes with complex rules, and doing so without incurring heavy penalties requires meeting certain age requirements.

- Withdrawing from a traditional 401

- After 59.5: Withdrawals are considered part of your income, so these will be taxed at your federal tax-bracket rate. Some states will also tax your withdrawals. After age 72, you must take required minimum distributions based on the IRS Uniform Lifetime Table.

- Before 59.5: Your withdrawals will be taxed as ordinary income plus a 10% early withdrawal penalty. The IRS also takes an automatic 20% early withdrawal withholding.

The good news is that for some needs you can borrow money from your 401 and avoid penalties. Read the rules for 401 loans here.

Also Check: How To Get Old 401k Money

Safe Harbor 401 Plans

A safe harbor 401 plan is a special type of retirement plan that automatically passes the nondiscrimination test. This means that you dont have to pass an ADP and ACP test each year like you do with a traditional 401 plan.

Safe harbor 401 plans are popular with small businesses because employers can avoid the time and money it takes to pass nondiscrimination tests each year. But theres one caveat: you are required to contribute to an employees safe harbor retirement plan.

With a safe harbor plan, you must contribute to an employees 401, regardless of their title, compensation, or length of service.

Get more facts about safe harbor 401 plans below:

- Who can offer a safe harbor plan:

- Businesses of any size can offer a safe harbor 401 plan

What Paperwork You Need To Fill Out To Open Your Account

I was surprised at how much paperwork is required to open a solo 401k account. Youd think it would be simple, with very common forms to fill out. However, its completely the opposite. It becomes even more challenging if you add a Roth solo 401k, and you have to do double the paperwork if youre adding a spouse to your plan.

When opening your solo 401k plan, you will need to create the following documents. You will need to create separate plan documents for both your Traditional and Roth Solo 401ks. They are both considered separate plans for tax purposes.

Plan Documents For Traditional Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Plan Documents For Roth Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Required Documents For Individual

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

When youre done with all these documents, youll have two solo 401k plans, and 4 accounts .

Recommended Reading: How To Find Out What You Have In Your 401k

Also Check: Can I Rollover A 401k To A 403b

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

Best For Low Fees: Charles Schwab

Charles Schwab

The Individual 401 Plan from Charles Schwab is our top choice for low fees. The account has no opening or maintenance fees as well as no commission trades for stocks or ETFs and over 4,000 no-load, no-transaction-fee mutual funds. Customers can also use its robo-advisor, Schwab Intelligent Portfolios, with no extra fees.

-

Accounts are free to open and charge no recurring fees

-

Access to trade stocks, ETFs, and thousands of mutual funds for free

-

Option for a no-cost robo-advisor

-

No solo 401 loans

-

High fees for some mutual fund trades and broker-assisted trades

Charles Schwab is our top choice for low fees in a solo 401 plan. Schwabs version charges no recurring fees and no setup fees. It offers commission-free trades for all stocks and ETFs as well as over 4,200 no-transaction-fee funds on the Schwab OneSource funds list. While Schwab offers excellent customer service, be aware that automated phone trades cost $5 and broker-assisted trades cost $25 each. However, many customers could use this account without paying any fees.

Schwabs Solo 401 doesnt offer 401 loans. Its active investment platform may not satiate all expert investors, and its active charting and analysis tools lag behind some other brokerage platforms for active traders. However, the pending integration of TD Ameritrade will bring the coveted thinkorswim platform under the Schwab umbrella, which is something active traders at Schwab can look forward to.

Read Also: What Does Rollover Mean In 401k

How Do You Set Up A Roth Ira

You can set up a Roth IRA with any institution that offers the account type, such as a bank, stockbroker, or life insurance company. Once you find the provider that best suits your needs, youll need to provide personal information . Then, youll choose the type of IRA you want, verify your identity, create log-in credentials, and direct how youll fund the account.

What Is The Difference Between A Traditional And Roth 401 Plan

There are two common kinds of 401 plans: traditional and Roth. These plans have some similarities: They are subject to the same annual contribution limit and may offer the same investment options. However, traditional and Roth 401 plans differ in terms of the tax benefits they offer.

|

Traditional |

|

|

Subject to income tax |

Tax-free after age 59 ½* |

*Only if the distribution satisfies certain conditions, for example that it has been at least five years since the first Roth contribution, or that the participant is disabled.

IRS.gov. Data as of Dec. 2020.

A traditional 401 plan is sometimes referred to as a pre-tax 401 plan. You contribute to the plan with before-tax dollars. Because you dont pay taxes on the money you put into the plan, you must pay taxes when you withdraw it. This structure could be an advantage if youre in a high tax bracket today but expect to be in a lower one when retired.

With a Roth 401 plan, the opposite is true. You save after-tax dollars in the account. Because youve already paid taxes on what youre saving, your withdrawals are considered qualified distributions and wont be taxed as long as you meet both of the following criteria:

- Youve had the account for at least five years.

- You begin to make withdrawals either after youve turned 59½ or due to disability.

Don’t Miss: Can I Have 2 401k Plans

What If My Spouse Owns His/her Own Business

If your spouse owns part of the business, he or she can set up a separate Solo 401k. In most cases, this is not necessary but there can be reasons to make this selection. Your spouse might need different plan documents to ensure IRS compliance, future amendments, restatements, and updates to his or her plan, or have other unique requirements. Your spouse or you might also have legal reasons why a separate Solo 401k plan is preferred.

A time when a spouse might consider a separate Solo 401k plan is if they have their own sole proprietorship . They have a separate employer identification number and operate the business independent from your business. There can be intermingled business relationships but the businesses are separate entities.

Read Also: How To Borrow Money From Your 401k Plan

Opening A Roth Ira For Your Spouse

If one spouse doesnt have earned income but the other does and you file a joint tax return, both can open separate IRAs in their names under the spousal Roth IRA rules. Your contribution limit will then increase to either double the annual IRA contribution limit or your joint taxable income, whichever is less.

For example, if you are 45, make $175,000 per year, and your spouse doesnt work, you could open two Roth IRAs and contribute $6,000 to each account each year, for a total of $12,000 in annual contributions.

If your Roth IRA contribution is limited because of your income, that limit would apply to the spousal Roth IRA as well.

Also Check: How Should I Invest My 401k

While You Can’t Invest In A 401 That Isn’t Sponsored By Your Employer There Are A Couple Of Exceptions To The Rule

Photo: 401kcalculator.org via Flickr.

A 401 is the most common type of retirement plan private-sector employers offer. However, many employers don’t offer a 401, or any type of retirement plan at all. If you are in this group, can you still take advantage of the many benefits of a 401?

The short answer: not really By definition, a 401 is an employer-sponsored retirement plan designed to encourage employees to save money for retirement and employers to help them do it. So to take advantage of this type of an account, you need to have an employer, and the employer needs to be the sponsor of the plan.

Some specific rules:

- You can’t invest in a 401 if you’re unemployed.

- You can’t invest in a 401 if your employer doesn’t offer one, or you don’t meet the qualifications for your employer’s plan .

- You can’t invest in an employer’s 401 if you aren’t that employer’s employee.

But just as with many other topics in finance, there are exceptions. Here are two major exceptions to the 401 rules.

Exception 1: You are the employerIf your income comes from self-employment, you can start a retirement savings account known as a Solo 401 or Individual 401.

Essentially, this gives you all the benefits of an employer-sponsored 401, as well as the ability to invest in any stocks, bonds, or mutual funds you want — not just in a small, specific basket of funds such as those that most employer-sponsored 401 plans offer.