Do Not Leave It With Your Old Employer

While leaving money behind in a former employers 401 might be the easiest thing to do, its not always the best option. One of the main benefits of a 401 plan is an employer match if the company offers one. Once you leave a job where you have a 401, you no longer receive the companys contribution or match. 401 plans tend to have high fees, limited investment options, and strict withdrawal rules. If the old 401 was rolled over to a different vehicle like a traditional or Roth IRA, you may have more control over the investment strategy.

And 403 Contributions And Withdrawals

Many of the contribution and withdrawal rules for 401 and 403 accounts are similar, and the annual contribution limits are typically the same for both. These limits are reviewed annually. Both types of retirement plans offer tax-deferred savings and earnings, which means no taxes are paid when contributions are made. Instead, taxes are paid on contributions and any related earnings when investors withdraw their funds. In some cases, companies may offer a Roth option, in which contributions are taxed but earnings and distributions are not.

The rules around withdrawals from 401 and 403 accounts are also similar, as distributions can only be taken under very limited circumstances until you reach the age of 59 ½. Withdrawals made before the age of 59 ½ may be subject to a 10% tax penalty, and all distributions are subject to regular income tax. Note that both savings plans have required minimum distributions after the age of 70 ½.

| 2016 |

Wealthfront Advisers LLC is an SEC-registered investment adviser and a wholly owned subsidiary of Wealthfront Corporation . Please see our Full Disclosure for important details.

Wealthfront Software LLC provides a financial planning service tool designed to aid Wealthfront Advisers’ clients in preparing for their financial futures by allowing them to personalize their assumptions for their financial planning goals. Wealthfront is a wholly owned subsidiary of Wealthfront Corporation, and an affiliate of Wealthfront Advisers.

Employer Frequently Asked Questions About The Nc 401 Plan Nc 457 Plan And Nc 403 Program

The North Carolina Supplemental Retirement Plans consist of the NC 401 Plan , the NC 457 Plan , and the NC 403 Program .

The NC 401 Plan is a tax-qualified, defined contribution plan under Section 401 of the Internal Revenue Code. The NC 457 Plan is an eligible defined contribution plan under Section 457 of the Internal Revenue Code. The NC 401 Plan and the NC 457 Plan are single plans that are sponsored by the State of North Carolina and that have multiple participating employers. The NC 403 Program allows school districts and community colleges, as 403 plan sponsors, to utilize the investments and recordkeeping services offered by the program. The NC 401 and NC 457 Plans and the NC 403 Program are administered by the Department of State Treasurer and the Supplemental Retirement Board of Trustees.

To compare the plans, please refer to the Plan Comparison Chart and the summaries of the NC 401 Plan,NC 457 Plan, and NC 403 Program.

If you have questions about the plans, you can:

- Contact your Retirement Education Counselor or

- Email Prudential Retirement at or

As a participating employer in the NC 401 Plan, NC 457 Plan, and/or NC 403 Program, your responsibilities include:

Don’t Miss: Should I Pay Someone To Manage My 401k

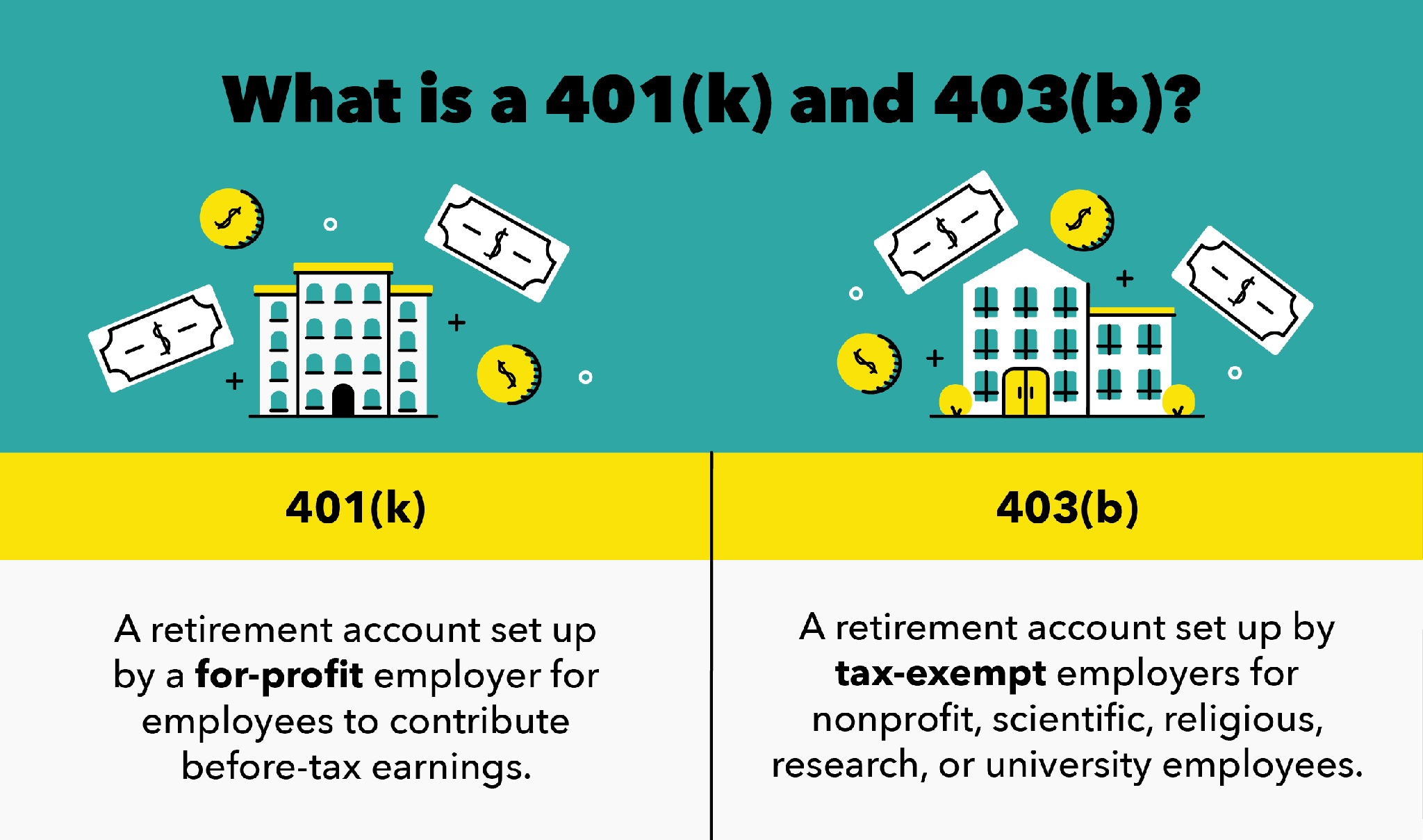

What Is A 403

403 plans are tax-deferred retirement accounts for schools and universities, churches and non-profit organizations. As with 401 plans, can choose to save in a traditional 403 and a Roth 403, depending on whether you want your tax break now or in retirement.

With a traditional 403, you deduct contributions from your taxable income now and pay taxes on withdrawals in retirement. With a Roth 403, you pay income taxes now and arent taxed in retirement.

In either case, contributions grow tax-free while theyre in the account, and youll typically owe income taxes on money that hasnt been taxed beforeas well as a 10% penaltyon withdrawals before age 59 ½. 403 contributions can generally be invested in mutual funds or annuities, though these options are normally more limited than those of 401s.

Employer contributions are possible with 403 accounts, although theyre less common than with 401s because employers must abide by the Employee Retirement Income Security Act . This regulation set stringent minimum standards for employer retirement plans, and many non-profits opt out of ERISA and the employer contributions it allows.

If your employer complies with ERISA and offers employer 403 contributions, you may face a vesting period. This, however, is normally shorter than 401 vesting periods.

Traditional Vs Roth 401/403 Analyzer

Which option is best for you?

If your 401 or 403 retirement plan accepts both traditional and Roth contributions, you have two ways to save for your retirement. Both offer federal income tax advantages.

Traditional accounts provide a tax break now. Traditional 401/403 contributions are not taxed at the time of investment. Instead, taxes are paid on withdrawals, including any earnings. Getting a tax break at the time of investment will leave more money in your pocket now money that you can invest, save or spend.

Roth accounts provide a tax advantage later. Roth 401/403 contributions are made with money thats already been taxed, so you wont have to pay taxes on qualified withdrawals, including earnings.

Enter your personal information to compare the results of traditional before-tax savings and Roth after-tax savings. Click on each question for help and additional information.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional or and should be read carefully before investing.

Copyright 2021 American Funds Distributors, Inc.

Recommended Reading: When Changing Jobs What To Do With 401k

What Is A 401 Plan

For-profit companies can sponsor 401 plans that allow their employees to make tax-deferred contributions for retirement. Employees can make pre-tax or post-tax contributions up to a contribution cap amount established by the IRS every year. That cap is $19,500 in 2021 for employees under the age of 50. Employees who are 50 years or older can make an additional catch-up contribution of up to $6,500.

Employers can also make contributions or add options to their employees 401 accounts, but they are not required to do so. These options include matching contributions, non-elective contributions, and profit-sharing features. Employers may make contributions to incentivize long-term employment. They also receive a tax benefit for the contributions they make to your account because the IRS considers 401s to be qualified plans. Employers can also permit their employees to borrow from their own 401s, up to the lesser of 50% of their account or $50,000, provided that the loan is repaid within five years. Nearly 50% of companies in the United States offered their employees 401s by 1983, and todays 401 accounts hold over $4.8 trillion.

When you leave an employer, your 401 comes with you. You can roll it over into your new 401 with your new employer or convert it to a traditional or Roth IRA, a 457 plan, a 403 plan, or a SEP IRA.

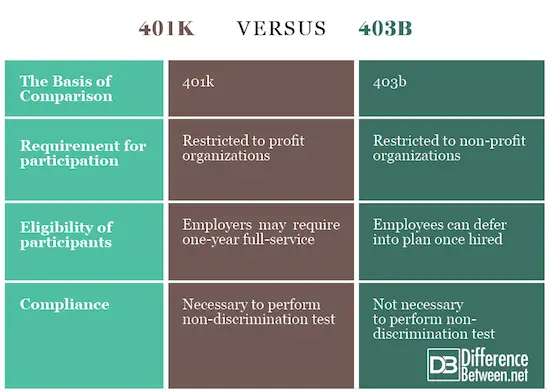

Differences Between 401 And 403 Plans

401 and 403 plans have a lot in common, but heres what sets them apart:

- Eligibility: 401 plans are offered by for-profit companies, and 403 plans are offered by tax-exempt organizations, such as hospitals, schools, universities, nonprofits and religious organizations.

- Investment Options: 403 plans only offer mutual funds and annuities, but 401 plans offer mutual funds, annuities, stocks and bonds. Because 401 plans are more expensive for the company, they usually offer a wider range and sometimes better quality of investment options.

- Employer Match: Both plans allow for employer matching, but fewer employers offer matches with their 403 plans. If an employer who offers a 403 does offer a match, they have to comply with regulations created by ERISAthe Employee Retirement Income Security Actwhich was passed in 1974.3 Most employers want to avoid these regulations because they cost time and money.

- Cost: 403 plans have lower administrative costs because the government doesnt want to place extra burdens on nonprofit organizations. 401 plans are more expensive for employers. But dont worrythis doesnt really affect you as the employee.

Don’t Miss: How Much Should I Have In My 401k At 55

Which Type Of Retirement Account Do I Need

A variety of factors determine this.

If you intend to retire early or if your employer offers matching funds, you should enroll in a 401 plan before doing anything else. However, each account type has numerous advantages and disadvantages that should be considered to make the best decision moving forward.

It also depends on how much money you need to save each month to meet your long-term retirement goals.

If youre unsure, consult with an investment professional or learn more about the various types of accounts available before making any hasty decisions without all of the necessary information.

What Are Some Common Fees Associated With Using A Prepaid Debit Card

- Transaction fee: It’s common to pay a transaction fee with prepaid debit cards especially those issued by banks outside of your home country. This is typically around $0.50 per purchase made abroad.

- Loading fee: Prepaid travel cards usually come with a loading fee, which is paid every time you add money to your card. This means that if you plan on using the same prepaid debit card for an extended period while traveling abroad, it’s best to load up the card before leaving.

- Withdrawal fee: Most prepaid debit cards have a withdrawal fee, which is usually around $0.50-$0.75 per ATM transaction. However, some banks do waive this fee for their own ATMs so check with your issuer and bank location before using an ATM!

Don’t Miss: How To Borrow Money From Your 401k Plan

Vs 401 Contribution Limits

Contribution limits for both 401 and 403 plans is $19,500 for 2020 and 2021.

If your employer offers a match for your retirement account, the maximum contribution it’s $58,000 per year, or $64,500 if you include catch-up contributions.

Catch-up contributions help older individuals who may have missed a few years of contributions enjoy the tax benefits provided by employer-sponsored retirement accounts.

The IRS provides this example to help detail the benefit of catch up contributions,

“If Joe Saver, who’s over 50, has only one employer in 2020 and participates in that employer’s 401 plan, the plan would have to permit catch-up contributions before he could defer the maximum of $26,000 for 2020 . If the plan didn’t permit catch-up contributions, the most Joe could defer would be $19,500. However, if Joe participates in two 401 plans, each maintained by an unrelated employer, he can defer a total of $26,000 even if neither plan has catch-up provisions. Of course, Joe couldn’t defer more than $19,500 under either plan, and he would be responsible for monitoring his own contributions.”

What Happens If The Market Crashes

Facing market volatility can be scary, but it is all part of the normal economic cycle. In 2020 we experienced a major market dip, and many people felt inclined to either pull the money out of their 401 or stop contributing to the plan. If you are fortunate to have stability during economic hardships, there are certainly ways for you to optimize your 401 without having to make drastic changes. If you have a long-term plan and are still able to contribute to your retirement, we typically encourage you to still do so, as down markets often represent good buying opportunities through dollar-cost averaging. Your 401 will be in good shape to take advantage of the recovering markets if you periodically rebalance your portfolio.

Also Check: Can I Cancel My 401k And Cash Out

What Counts As A Break In My Employment

- If you worked 1,000 hours or more in a year, that year normally will count toward vesting.

- If you worked 501-999 hours in a year, that year normally will not count toward vesting. However, it also will not count as a break in service.

- If you worked fewer than 501 hours in a year, that year normally will not count toward vesting and in certain circumstances can result in losing credit for previous years of service toward vesting.

You Mentioned A Plan Document A Few Times Does That Mean 403 Plans Are Required To Have Written Plan Documents Like 401 Plans

Yes. The IRS issued regulations, effective in 2009, that made it clear for the first time that all 403 plans are required to maintain written plan documents regardless of whether or not other compliance rules apply. The deadline for existing 403 plans to have a document in place and executed was December 31, 2009 however, there was no formal process in place for the IRS to approve 403 documents, so there has been a general good faith compliance standard in place.

Fast forward to 2017, and that all changes with the creation of a pre-approved plan document program. Similar to 401 plans, there are now IRS-approved prototype and volume submitter documents available to 403 plans. All pre-existing plans have until April 30, 2020 to adopt one of these documents.

Read Also: What Happens To My 401k After I Quit

Plan Vs 401 Plan // Whats The Difference

When it comes to retirement planning, all the options available out there can get confusing. There are many plans out there, but do you really know the difference between a 401k, 403b, 457b, 401a, and all the others? You are not alone as most people have trouble when it comes to comparing all the different retirement plans that might be available. Luckily, we are here to help! If you are choosing between a 403b vs 401k, then you are in the right place. We will tell you everything that you need to know about both plans as well as the key differences between the two. Keep reading to learn more about these two plan types.

Ok What About Employer Contributions

Again, 401 and 403 plans are on similar ground both can allow for employer matching or nonelective contributions. Those contributions can follow a set formula, or they can be at the employers discretion. The maximum contribution limits are also generally the same.

There is one notable exception. Sponsors of 403 plans have the unique option to provide additional benefits to terminated participants. These post-severance nonelective contributions are based on compensation earned during the participant’s most recent one-year period of full-time service. While subject to the regular annual additions limit, these special contributions can be made for up to five years immediately following a participants severance from employment.

Also Check: Should I Rollover My Old 401k To An Ira

Why Should I Choose One Over The Other

401k and 403 accounts both allow you to save for retirement tax-free, but they have different features that may make one more appealing than the other.

For example, if your income is greater than $18,000 , it is most likely preferable to contribute to a Roth 401k account.

If you have an old employer-sponsored retirement plan, you might want to consider rolling your funds into a new one so that the tax advantages of opening these accounts last as long as possible.

In addition to deciding which type of account is best for you, consider how much money and time it would take to manage your retirement account daily. If it takes too much time, you might want to consider hiring an investment professional or using Robo-advisor software to help you save for the future.

Required Minimum Distribution Options For 401 And 403 Plans

Largely, minimum distributions are the same for both 401 plans and 403 plans – but there are some variances.

For example, both 401 and 403 plans require plan participants to begin taking minimum distributions out at age 70 and a half. The required distributions must begin once the account holder is age 70 ½, regardless of whether the plan participant is retired.

For 403 plans, since the cash taken out is after-tax money, required minimum distributions will not boost your taxable income. Additionally, any missed required minimum distributions for both 401 and 403 plans will trigger a 50% tax penalty of the distribution amount.

Read Also: How To Set Up 401k In Quickbooks

Differences Between 401k And 403 Plans

As I mentioned previously, the main difference between the two is the employer sponsoring the plans: 401k plans are offered by private, for-profit companies, while 403 plans are only available to nonprofit organizations and government employers. In addition to the employer demographics for both retirement accounts, 401k and 403 plans can have varying costs and investment choices.

How Can I Withdraw From My 403 Without A Penalty

The best way to withdraw money from my 403 without a penalty is to wait until you are 591/2 years old when you are eligible to take distributions for retirement.

Even if you are not retired, the IRS dictates that you must take out money once you turn 72 years old. These withdrawals are known as required minimum distributions .

There are a few unique situations where you can take money out of your 403 plan early, set that as a tax-free loan against your 403 balance. However, you are required to pay it back and make payments back into your account until the balance is paid off.

Similarly, the CARES act allowed owners of certain 401 and 403 plans to take an early distribution of up to $100,000 to help pay for coronavirus pandemic-related expenses and hardships. This stipulation also required participants to pay back the early distributions but gave them up to three years to do so.

As you can see, there are plenty of similarities between 403 and 401 accounts. They are both excellent retirement savings vehicles, and your employer generally has the ultimate decision between which plans are available to you.

If you work for a for-profit company, you will most likely have access to a 401 account. If you are in a not-for-profit for tax-exempt industry, you will most likely contribute to a 403 account.

Recommended Reading: Is An Annuity A 401k