Use A Robs To Finance Your Business

The second option you have for using a 401 to start a business is called ROBS, which, as we mentioned earlier, stands for rollovers as business startups. ROBS gives you another way to access retirement funds from a 401, IRA, or another eligible retirement account without having to pay income taxes and early withdrawal penalties.

Compared to a 401 loan, a ROBS offers more flexibility for entrepreneurs because theres no obligation that you have to remain employed in order to use this financing option. In fact, with a ROBS, you cannot use a retirement account from a current employer. This being said, however, doing a ROBS is also more complicated than taking a loan from your retirement plan.

To explain, with a ROBS, you first have to structure your business as a C-corporation. Then, you have to set up a new retirement plan under the C-corp. At that point, you can rollover the funds from your existing retirement plan into the new companyâs retirement plan. Finally, your new corporation sells stock to the retirement plan, and the company uses the proceeds from the sale as a source of capitalâwith one catchâyou canât pay ownersâ salaries from these funds.

Withdrawal Taxes And Early Distributions

You might find yourself in a situation where you need the money in your 401 before you reach 59 1/2 years of age. The account is designed to be part of your retirement plan, but circumstances come up where you cant avoid dipping into the money for other reasons. Down payments, emergency medical bills and education costs are a few examples of expenses some people pay with 401 funds.

If this is the case for you, expect to pay a 10% penalty fee. This is on top of the income tax youll pay for withdrawing the funds. Remember, even if its paying for an emergency, its still counted for tax purposes as income. Youll want to run the numbers, adding the tax and penalty tax, to see if it makes sense to pull money out early. Its also important to factor in the opportunity cost of pulling your investments out of the market.

In some cases, there is an exception to the 10% additional tax. The IRS lists the circumstances where the tax doesnt apply. Losing your job at 55, or starting a SOSEPP plan are two examples. Youll still be on the hook for income taxes, of course.

Given the tax hit and opportunity cost of early withdrawals, its not ideal solution. Before you commit to a penalized withdrawal, consider if borrowing the money from your 401 might be a better solution.

Early Withdrawal // 11 Ways To Cash Out Without Penalty

If you are in financial need, it might seem extremely tempting to simply withdraw some money from your 401, IRA, or other retirement account to cover the need. However, that withdrawal generally comes with a heavy penalty of 10% of the withdrawal amount. Retirement accounts are intended to be used for retirement, so the IRS imposes this penalty to discourage you from withdrawing money from your retirement savings. But what if you are in a true financial hardship? When can you withdraw from your 401 without this penalty? In some cases, you might be able to take some cash from your 401 without a penalty. Here is everything you need to know about early withdrawals from your 401 plus some ways that you can cash out without a penalty.

You May Like: How Does A 401k Retirement Plan Work

What Are The Penalties For Withdrawing From My 401 Before Age 59

Unless you fall into one of the special exemption categories, you will pay a penalty of 10% of the amount of funds you withdraw. This can get quite pricey and really cut into your retirement savings. If you must make a withdrawal before reaching retirement age, then make sure you check the list of exemptions to the penalty. If you can qualify under one of the exemptions, then you will not be forced to pay this extra penalty.

Taxes On Rolling Over A 401 Account

There are a few instances where you may want to transfer funds from an employers 401 into another account. The most common situation is when you leave an employer and want to transfer funds from your previous employer into your new employers 401, or into your own individual retirement account .

Whenever you withdraw money from a 401, you have 60 days to put the money into another tax-deferred retirement plan. If you transfer the money within 60 days, you will not have to pay any taxes or penalties on your withdrawals. You will need to say on your tax return that you made a transfer, but you wont pay anything. If you dont make the transfer within 60 days, the money you withdrew will add to your gross income and you will have to pay income tax on it. You will also pay any applicable penalties if you withdraw before age 59.5.

If you dont want to worry about missing the 60-day deadline, you can make a direct 401 rollover. This means the money goes directly from one custodian provider) to another without ever being in your hands.

Finally, note that if youre rolling over a 401 into a Roth IRA, youll need to pay the full income tax on the rolled-over amount. However, theres no 10% penalty for doing this before age 59.5.

You May Like: What Is The Difference Between A Pension And A 401k

Irs Favorable Determination Letter

Providers and promoters of ROBS court prospective business owners, sometimes by requesting a Favorable Determination Letter from the IRS. The FDL is a way that providers try to assure a client that the IRS approves of the clients ROBS plan. The IRS typically issues a letter, but its based on acceptable compliance of the clients ROBS plan. This letter is neither a blanket approval of the plan nor legal protection if the plan is incorrectly set up or administered.

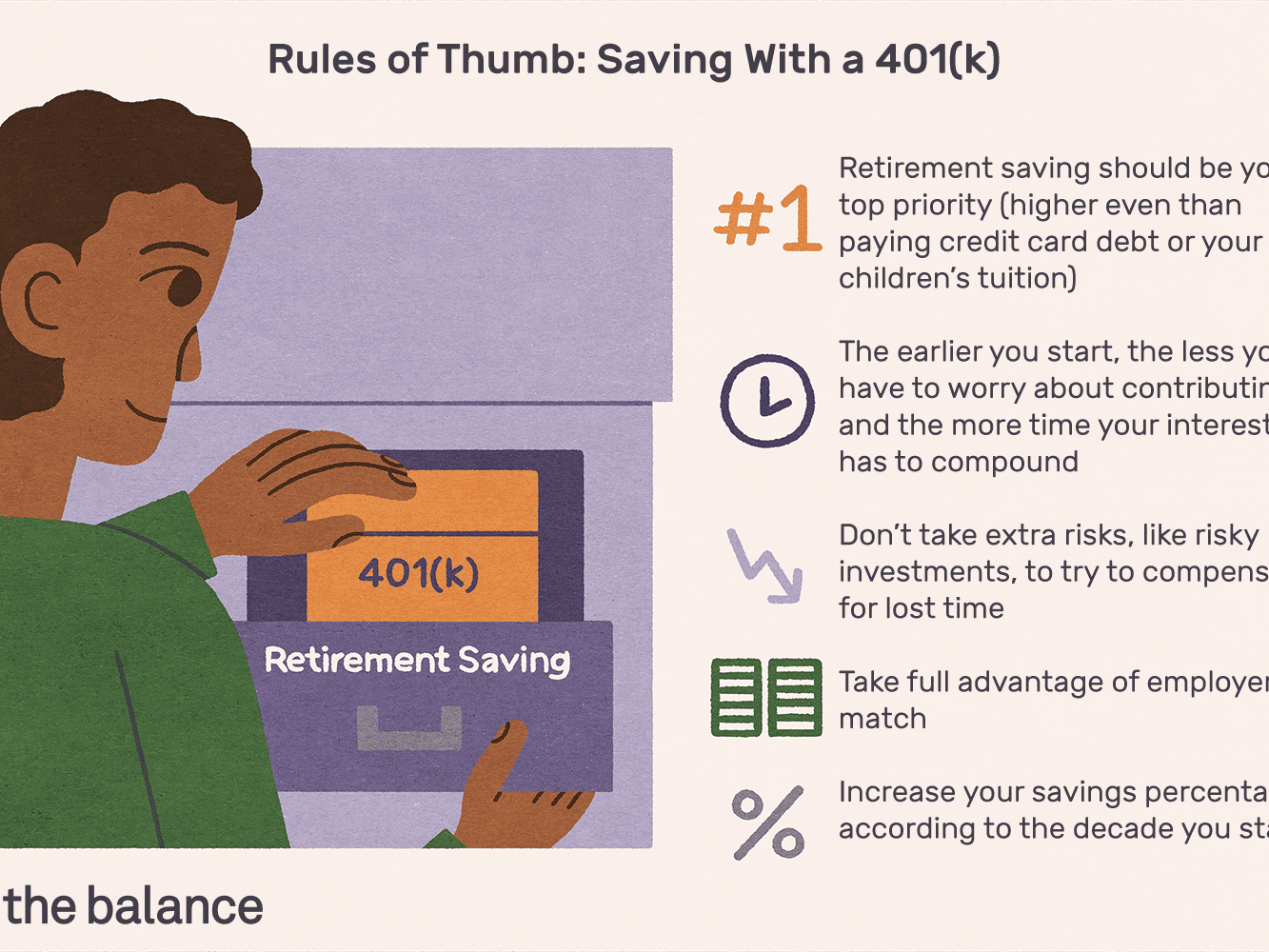

Tips To Help You Plan For Retirement

- Want to create a financial plan that grows your money and provides for a secure retirement? You might benefit from talking to a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Your retirement plan should account for medical expenses. One option to help you plan for medical costs is a health savings account . HSAs are tax-deferred just like 401 plans. However, you dont have to pay any income taxes on withdrawals from an HSA as long as you use the withdrawals for medical expenses. Check out our guide to HSAs and whether you should consider one.

Also Check: How To Buy Gold In Your 401k

Should You Cash Out Your 401k

The typical financial advice works something like this. You give all your money to big banks and Wall Street and then sit tight a few decades.

After 30 years or so you can have access to your money but only in small increments.

The most common retirement plan used today is the 401, which might not be the retirement solution it is propped up to be.

Even Ted Benna, the man known as the father of the 401k , strongly disapproves of what it has turned into.

So, the question becomes, should you cash our your 401?

The decision to do so is not as straight forward as a simple yes or no answer.

Just know, there are disadvantages as well as some advantages, to cashing out of your 401k early. We touch on the top 10 pros and cons below.

Retirement Savings Can Benefit

As you make loan repayments to your 401 account, they usually are allocated back into your portfolio’s investments. You will repay the account a bit more than you borrowed from it, and the difference is called “interest.” The loan produces no impact on your retirement if any lost investment earnings match the “interest” paid ini.e., earnings opportunities are offset dollar-for-dollar by interest payments.

If the interest paid exceeds any lost investment earnings, taking a 401 loan can actually increase your retirement savings progress. Keep in mind, however, that this will proportionally reduce your personal savings.

Don’t Miss: How Much Is The Maximum Contribution To 401k

Loans To Purchase A Home

Regulations require 401 plan loans to be repaid on an amortizing basis over not more than five years unless the loan is used to purchase a primary residence. Longer payback periods are allowed for these particular loans. The IRS doesn’t specify how long, though, so it’s something to work out with your plan administrator. And ask whether you get an extra year because of the CARES bill.

Also, remember that CARES extended the amount participants can borrow from their plans to $100,000. Previously, the maximum amount that participants may borrow from their plan is 50% of the vested account balance or $50,000, whichever is less. If the vested account balance is less than $10,000, you can still borrow up to $10,000.

Borrowing from a 401 to completely finance a residential purchase may not be as attractive as taking out a mortgage loan. Plan loans do not offer tax deductions for interest payments, as do most types of mortgages. And, while withdrawing and repaying within five years is fine in the usual scheme of 401 things, the impact on your retirement progress for a loan that has to be paid back over many years can be significant.

If you do need a sizable sum to purchase a house and want to use 401 funds, you might consider a hardship withdrawal instead of, or in addition to, the loan. But you will owe income tax on the withdrawal and, if the amount is more than $10,000, a 10% penalty as well.

Employee Plans Robs Project

EP initiated a ROBS project in 2009 to:

- Define traits of compliant versus noncompliant ROBS plans,

- Identify ROBS plans that are noncompliant and take action to correct them, and

- Use results to design compliance strategies focusing on identified issues and trends .

Using compliance checks, we initially focused on companies that sponsored a plan and received a DL but didnt file a Form 5500, Annual Return/Report of Employee Benefit Plan, or Form 5500-EZ, Annual Return of One-Participant Retirement Plan PDF, and/or Form 1120, U.S. Corporation Income Tax Return.

Our contact letter to plan sponsors asked questions about the ROBS plans recordkeeping and information reporting requirements, including:

- the plans current status

- plan contribution history

- stock valuation and stock purchases

- general information about the business itself

- why no Form 5500 or 5500-EZ and/or Form 1120 were filed

The plan sponsor can also furnish any other documents or materials that they believe would be helpful for us to review as part of the compliance check.

Don’t Miss: Can Anyone Open A 401k

What Are The Cost And Terms Of A 401 Loan

In most cases, the interest rate on a 401 business loan or other retirement plan loan is 1% plus the prime rate. The time to pay back this loan is usually 5 years, on par with a medium-term loan. Additionally, there might also be modest issuance or administration fees associated with a 401 loan, but these go to the provider . The specific details of your loan will vary based on your plan administrators rules.

This being said, the largest cost of a 401 loan is the lost opportunity from borrowing the funds, instead of keeping them in your retirement account. For instance, say the average return on your retirement account is 10% but the interest rate on your plan loan is 6%. This 4% difference can easily add up to thousands of dollars over time that youre losing by borrowing from your retirement savings. If, however, you believe that your business profits will counteract that loss, then the loan might be worthwhile.

Moreover, theres another important qualification of a 401 loan to keep in mind: If youre using an employer-sponsored retirement plan and lose your job , the entire balance plus interest is due within 60 days. If you cant pay back the money you borrowed in this very short period of time, the loan goes into default.

No More Creditor Protection

Once youve squared away how long it takes to cash out your 401, its time to think about consequences. The first is the loss of protection against creditors. If youre cashing out because creditors may come knocking, this is something you need to consider. Employer-sponsored 401 plans are often protected against creditors, bankruptcy proceedings, and civil lawsuits. Once youve cashed the funds out, theyll be subject to action along with your other assets.

But before you assume this could be a problem, check to make sure your plan isnt vulnerable for other reasons. If youre in the process of divorcing or are already divorced, the other party could be able to snag a portion of the funds under a qualified domestic relations order. Funds in a 401 can also be seized to pay tax debts and federal penalties.

Plan for a better future

Get an affordable, professionally prepared retirement plan today.

You May Like: What Year Did 401k Start

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Make Extra Payments On Your Student Loans Whenever You Can

Just because youre making your own money, are able to make all your payments on time, and are watching your income grow, do not think youre out of the danger zone just yet.

Until youre able to pay off your loans, you should always be finding ways to make extra payments, so that if tomorrow your world crumbles, you wont find yourself with collections agencies harassing you, making your failure even more unbearable.

I am currently paying $550 a month on my loans, even though my minimum is $200. I have a variable interest rate which Ive seen increase already since I left my day job, so I am trying to get these paid off faster.

Don’t Miss: Can I Invest In 401k And Ira

The Basics Of 401 Withdrawal Taxes

If you are wondering whether your 401 withdrawals are taxed, the short answer is yes your 401 distributions are likely taxable.

This may come as a surprise, because there is some confusion around how retirement accounts work. People often refer to retirement accounts like 401s as tax-advantaged, or tax-deferred. This means investments within your 401 or IRA grow tax-free. Unlike taxable investment accounts, you wont be charged income tax or capital gains tax as your 401 account grows each year.

As an example, if you earn $1,500 before taxes per paycheck, and you contribute $300 of that money to your 401, then you will only be taxed on $1,200. For reference, 401 account holders can contribute up to $19,500 in 2021 , and $26,000 for those 50 and older.

This tax advantage, however, changes once an account holder starts receiving distributions from the 401. As you pull money out, youll owe income taxes on the funds. Some 401 plans will automatically withhold 20% or so of your account to pay for taxes. Youll want to check with your plan provider to see how your particular 401 works.

Wondering when you can start cashing out? Once you reach age 59.5 you can withdraw money from your 401. If you dont need the money yet, you can wait until you reach age 72 to withdraw funds. However, once you reach 72, its no longer a choice to withdraw from your 401, its mandatory. The IRS has defined required minimum distributions for certain retirement accounts, including 401s.

Considering A Cashout Take These Steps

1. Talk to a tax professional.

Go armed with the exact balance in your account and as detailed of a set of current financial records as possible!

We would not have proceeded with this cashout without the guidance and counsel of our accountant. The hour-long consultation we paid for allowed her to forecast our income for the year, the total money we would need to withhold for taxes and how we could best put ourselves in a good position overall She recalculated our estimated-tax payments, made suggestions on what to withhold at the time of the cashout, and more.

This was well worth the $55 for the consultation. To be radically clear we would not have proceeded with the cashout if wed gotten a red flag from our accountant, who Ive worked with for more than a decade and who I trust implicitly. If you dont have such a relationship, this is a little harder, but still VERY MUCH a must-do.

2. Dont let the money touch your general fund.

ANY time we get any kind of windfall money really, any type of lump sum, whether a tax refund, a large gift, a bonus, etc. we make sure it goes directly into our savings account. If it sits in checking, even for a week or two, its way too easy to nickel-and-dime it away with an extra lunch out here or an extra pair of shoes there!

3. Have a specific plan in place to rebuild or build a retirement savings/income account.

Not needing or wanting a 401, in our case, is definitively not the same as not wanting to retire!

Also Check: Can You Get A Loan Using Your 401k As Collateral