Building The Fund Lineup

When we say fund lineup, were referring to the menu of investment options that are available to plan participants. Getting this right is arguably the most important part of building a successful 401 plan.

Having risky, poorly-performing, or unnecessarily expensive mutual funds can significantly limit the amount your employees have in their accounts come retirement. It may even expose you to costly lawsuits.

If you feel any uncertainty around how to build an optimal 401 fund lineup thatll protect you from costly lawsuits, consider hiring an advisor. Not only do the good ones take this off your plate, but theyll even assume legal responsibility for it as well!

To Add The New Payroll Items To The Employee Record:

| NOTE: Percentage calculation method will not account for 125 plan deductions. To account for 125 plan differences, use a set $ amount rather than percentage calculation method. |

Tax Benefits Of A 401k Catch

Contributions to a traditional 401k directly reduce the savers taxable income .

Since catch-up contributions are extra savings on top of regular contributions, you can get an even bigger tax deduction in the current year.

For example, consider a 55 year old with a $100,000 pre-tax salary who contributes the maximum annual limit to their 401k in 2022, plus $2,000 in catch-up contributions. Their taxable income would drop to $77,500. As a single filer, that brings their top tax rate from 24% to 22% for the year. When you add in other deductions, such as the standard deduction, taxable income is reduced even further.

Making extra pre-tax contributions to a 401k means that your full dollar has the opportunity to grow in the market and compound. You wont pay income taxes until you withdraw the money later.

Read More: Understanding 401k Withdrawal Rules

Also Check: How To Get Your 401k Out

Transfer Funds From Current Employer 401k That We Rolled Over From Another Employer 401k Question:

Good question, and yes those funds from the former employer 401k that are currently held in the existing employer 401k can certainly be transferred to the solo 401k plan as long as the current employers plan allows for it. It is a tricky situation because even though the rules allow for it, the current employer can restrict the transfer of funds transferred into the plan from a former employer 401k plan. We strongly recommend getting a copy of the existing employers 401k plan Basic Plan Document or Summary Plan Description Agreement as specific language will be embedded in these documents regarding this topic. We will gladly review those documents for you once you obtain them from your current employer 401k provider.

Determine A 401k Provider

Determining a 401k provider may not be as difficult as it sounds. You may be thinking of reaching out to various financial institutions for their advice but consider first what youre looking for in a provider and ask these questions:

- Whats Your Investment Lineup Like? How many funds do you offer? How diversified is the portfolio and how well has it done previously? Best to ask these tough questions now, and see how the answers stack up to their competitors.

- What Are the Total Fees? Perhaps the funds the institution you are considering look attractive. But how much will the investing, record keeping and administration expenses cost you and your employees? Are there any surprise service fees or occasional costs that if you dont ask about now youll only find out about later? Great returns could be offset by heavy fees. Ask exactly what this is going to cost from month to month.

- How Easy Is the Administration of the Plan? How easy will this plan be to administer to your employees? Will it require a lot of day to day management or will it practically run itself? Will your employees be able to access their plans online? What digital tools will the institution offer that will help you and your employees get the information they need, or navigate the site?

Also Check: Is Rolling Over 401k To Ira Taxable

How Do I Set Up A Small Business 401

If youre ready to set up your small business 401, these are the four steps youll need to take.

For small businesses that are ready to help their employees save for retirement, the IRS website covers the actions you need to set up a 401 plan. In case you dont speak in tax code, heres a more approachable step-by-step guide.

Rules Change Regarding Offering Solo 401k Plan To Par

QUESTION 5: Have the rules changed for 2020 regarding whether I can still fund my solo 401k if I have two part-time employees that work less than 1000 hrs/year, but more than 500 hrs/year? Would I have to open up retirement accounts for them?

ANSWER: In short yes resulting from the SECURE Act, but it would be for those part-time employees who satisfy the new rule by 2024. Effective for tax year 2021 , solo 401k plans will need to be offered to part-time employees who have three consecutive 12-month periods of 500 hours of service and who satisfy the plans minimum age requirement. Hours of service during 12-month periods beginning before January 1, 2021, are not taken into account for this rule. We are waiting for the IRS to release more guidance on this new rule in 2020. See Section 112 of the ACT for more information.

Last Weeks Most Popular Solo 401k FAQs

Don’t Miss: How To Set Up A 401k Without Employer

Types Of Retirement Plans

There are many resources for small businesses looking to set up a retirement plan for their employees. The first step in finding the right type of plan for your business is understanding the different retirement plan options available to you. There are two primary structures your plan can follow: defined benefit plans and defined contribution plans.

- Defined benefit plans. These plans offer employees a defined monthly or yearly amount during retirement. You can, for example, set up a plan where an employee receives $100 per month during retirement. Companies will typically set up arrangements where employees receive a certain percentage of their former salary per year.

- Defined contribution plans. Unlike the defined benefit plans, defined contribution plans dont have a specified monthly or yearly amount for employees to receive. Instead, both the employee and the employer can contribute to these types of plans. Money is usually invested on behalf of the employee, and the employee will receive access to the funds in retirement.

Some popular retirement plan options that fall under these two categories include:

Make sure you explore all your options before going out on your own to set up your businesss retirement plan.

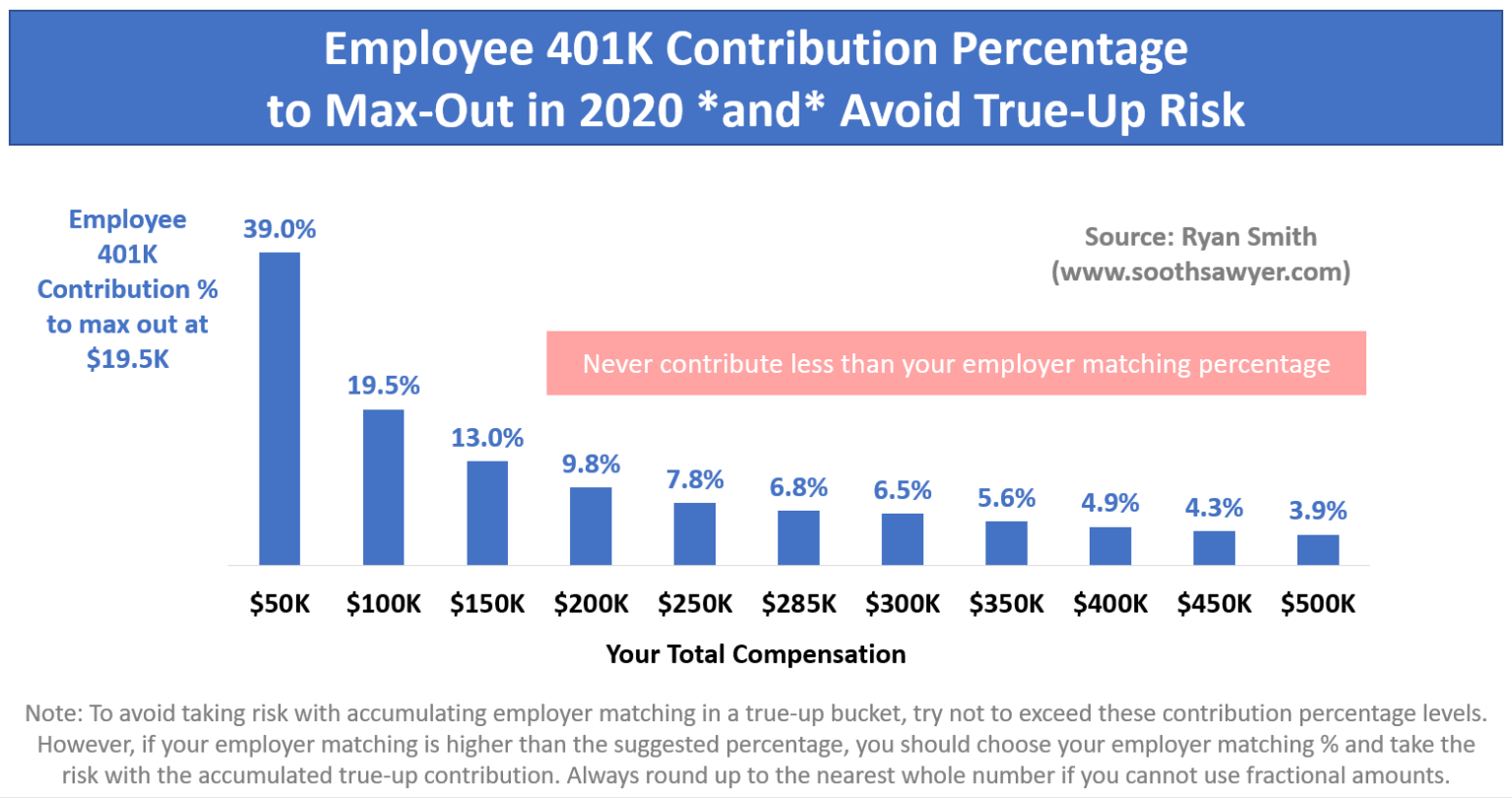

Take Full Advantage Of The Company Match

The first place to look in your 401 information is your employer match. Employers typically match 3% to 6% of your salary, but that is contingent on your own contribution. Generally, employers match 50% or 100% of your contribution up to the salary limit. Hint: you should always contribute at least up to your employer match, your net worth depends on it.

For example, lets look at someone who earns $50,000 per year and has a 50% match up to 3% of their annual salary. To take full advantage of the employer match, the employee must contribute 6% of their salary, or $3,000 per year, to get the full employer match of $1,500. That $1,500 is like free money from your employer, so this person should be absolutely sure they are saving enough to get that full 3% match.

Combined, that is like contributing 9%, or $4,500 per year, to their 401. That is likely not enough to maintain the same standard of living in retirement, but it is a great start and more than what the average person is doing. Assuming a biweekly pay schedule with 26 annual pay periods, that contribution is only $115 per payday, and that $115 has a tax advantage. Not a bad deal to get $1,500 in free money for retirement.

Read Also: How To Rollover My 401k To New Employer

Common Questions Plan Participants May Ask Employers About A New 401 Plan:

- What other plans were considered? How does this choice compare?

- When can I start contributing?

- What affect will this have on my taxes?

- Does the company match contributions? How does that work? What is the limit?

- What are the investment options? Can I manage my own investments?

- How often can I change my investment and contribution options?

- Can I access my plan online?

- When can I withdraw money? Can I make an emergency withdrawal from my plan?

How Will You Allocate Your Assets

Whether you have only a few mutual funds to choose from or an entire brokerage window, allocating your assets well is the key to weathering inevitable market fluctuations and coming out with the nest egg you need.

While we cant offer specific investment advice, heres how to research your investment options:

- Look for low fees. Youre already paying an annual fee for your 401 account, so you want to keep other expenses, such as trading fees and commissions, as low as possible. Choosing investments with low expense ratios will keep more of your money in the market.

- Research historical performance. Although nobody can predict the future, looking at how an asset has performed historically can be a good indicator of how it will continue to behave in the future.

- Youve heard it before, but well say it again: diversify, diversify, diversify. The old adage about having all your eggs in one basket is true, so choose as many different types of assets as possible. You can buy different types of securities and diversify their types . Doing so will help you avoid a catastrophic loss in the case of a crash or recession.

Don’t Miss: What Is Max Amount To Contribute To 401k

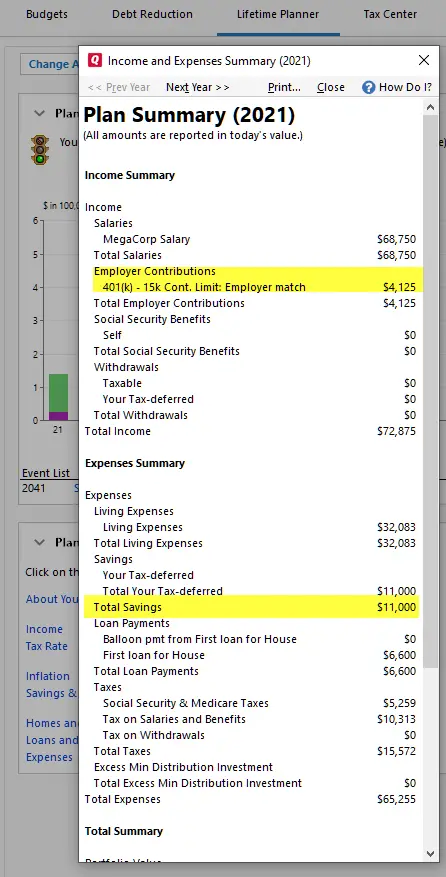

Contribute Enough To Get Any Employer Match

Even the priciest 401 plan can have some redeeming qualities. Free money via an employer match is one of them. Contributing enough money to get the match is the bare minimum level of participation to shoot for. Beyond that, it depends on the quality of the plan.

A standard employer match is 50% or 100% of your contributions, up to a limit, often 3% to 6% of your salary. Note that matching contributions may be subject to a vesting period, which means that leaving the company before matching contributions are vested means leaving that money behind. Any money you contribute to the plan will always be yours to keep.

If your company retirement plan offers a suitable array of low-cost investment choices and has low administrative fees, maxing out contributions in a 401 makes sense. It also ensures you get the most value out of the perks of tax-free investment growth and, depending on the type of account or the Roth version), either upfront or back-end tax savings.

Drawbacks To A Solo 401

A solo 401 may not be right for small businesses that plan to expand and hire employees in the near-term, since doing so would likely result in plan ineligibility. In addition, calculating profit-sharing contributions for sole proprietorships and partnerships tends to be complex because it requires modified net profits. The formula for this calculation is available in IRS Publication 560.

Also Check: What Is A 401k Profit Sharing Plan

Choose A Plan For Your Employees

Once you’ve chosen a retirement services provider, it’s time to decide on a plan that fits both your business and your employees’ needs. Options available to employers regardless of size, including businesses with only one employee, include:

1. A traditional 401 plan, which is the most flexible option. Employers can make contributions for all participants, match employees’ deferrals, do both, or neither.

2. The safe harbor 401 plan, which has several variations and requires the company to make a mandatory contribution to the plan participants. The contributions benefit the company, the business owner, and highly compensated employees by giving them greater ability to maximize salary deferrals.

3. An automatic enrollment 401 plan, which allows you to automatically enroll employees and place deductions from their salaries in certain default investments, unless employees elect otherwise. This arrangement encourages workers to participate in the company 401 plan and increase their retirement savings, which also benefits business owners. Automatic enrollment plans may also contain a safe harbor provision.

Create A Plan Document

A 401 plan document is a legally binding financial agreement that outlines the terms of your companys 401 offerings. If you are outsourcing your retirement plan to a financial institution, they will usually provide the plan document. It should follow the guidelines set in the Internal Revenue Code and include information on:

- Employment eligibility

- The system for making contributions

- How funds will be distributed

Consider consulting with a tax professional for help on creating a compliant 401 plan document that meets all of your needs as an employer.

Recommended Reading: How To Find Out If You Have A 401k Account

Be Prepared For The Large Plan Audit

Once the number of employees in your plan passes the 100 mark, you may have to undergo an annual 401 audit. As anyone whos ever been through one will tell you, these are a huge hassle that are costly and can eat up a ton of time. So our advice? Be sure to partner with a 401 provider that takes point on 401 audits.

How A Roth 401 Works

Like Roth IRAs, Roth 401s are funded with after-tax dollars. You don’t get any tax benefit for the money you put into the Roth 401, but when you begin to take distributions from the account, that money will be tax-free, as long as you meet certain conditions, such as holding the account for at least five years and being 59½ or older.

Traditional 401s, on the other hand, are funded with pretax dollars, providing you with an upfront tax break. But any distributions from the account will be taxed as ordinary income.

This basic difference can make the Roth 401 a good choice if you expect to be in a higher tax bracket when you retire than when you opened the account. That could be the case, for example, if you’re relatively early in your career or if tax rates shoot up substantially in the future.

Also Check: When Can I Borrow From My 401k

Choose An Account Type

Traditional 401s are standard at workplaces, but more employers are adding the Roth 401 option, too.

As with Roth IRAs versus traditional IRAs, the main difference between the two types of plans is when you get your tax break:

-

The regular 401 offers it upfront since the money is automatically taken out of your paycheck before the IRS takes its cut . Youll pay income taxes down the road when you start making withdrawals in retirement.

-

Contributions to a Roth 401 are made with post-tax dollars , but qualified withdrawals are tax-free

-

Investment earnings within both types of 401s are not taxed

Another upside to the Roth 401 is that, unlike a Roth IRA, there are no income restrictions to limit how much you can contribute.

The IRS allows you to stash savings in both a traditional 401 and Roth 401, which can add tax diversification to your portfolio, as long as you dont exceed the annual maximum contribution limits .

Solo And 401 Rules When You Have Employees And Multiple Businesses

A 401 is a great benefit normally associated with large companies where the employee makes contributions and the employer offers a match. The contribution limits are high and can allow for significant tax deferral on the income you earn each year. What a lot of people may not know is that you dont have to be a large company to have a 401 plan. In fact, you can be the only employee in your own business and have a retirement plan.

If it is just you in your business, your company can start a retirement plan known as a solo 401. The solo 401 allows you to adopt a retirement plan and make personal as well as company contributions to the plan for yourself and any of the owners of the company.

- You must have a business generating ordinary income to make to have a 401 plan.

- You can personally contribute up to $19,000 to the plan.

- Your company can contribute up to 25% of the income it pays you.

- For 2019 the total max 401 contribution is $56,000.

The 401 plan can be self-directed, which means you can invest the funds in almost any opportunity you find . The 401 also has a loan provision allowing you to borrow funds from the plan and use them for anything you want.

What If I have Multiple Businesses With Only Employees in Some?

Controlled Group Rules

| 100% |

Don’t Miss: How To Find 401k Account Number

What Is A 401 Plan

A 401 plan is a type of IRS-approved retirement plan that allows employees to contribute pretax amounts to individual retirement accounts. Employers also can contribute to employee accounts, often by matching employee contributions, up to a certain percentage.

You can choose from several types of small-business 401 plans and other varieties of retirement plans. Get help from a retirement plan advisor to select the best one for your business.