Your 401 Plan Is Tied To Your Employer

You cannot have a 401 on your own they’re only available through your employer. Most 401 plans have a vesting period of a certain number of years of employment. If you work for your employer for the entire vesting period, all the money in the 401 is yours if you leave. If you leave before you’re fully vested, you can take any contributions you made and the interest applicable to those contributions with you, but you’ll only get a percentage of the employer matching contributions in the account.

Can You Roll An Ira Into A 401

posted on

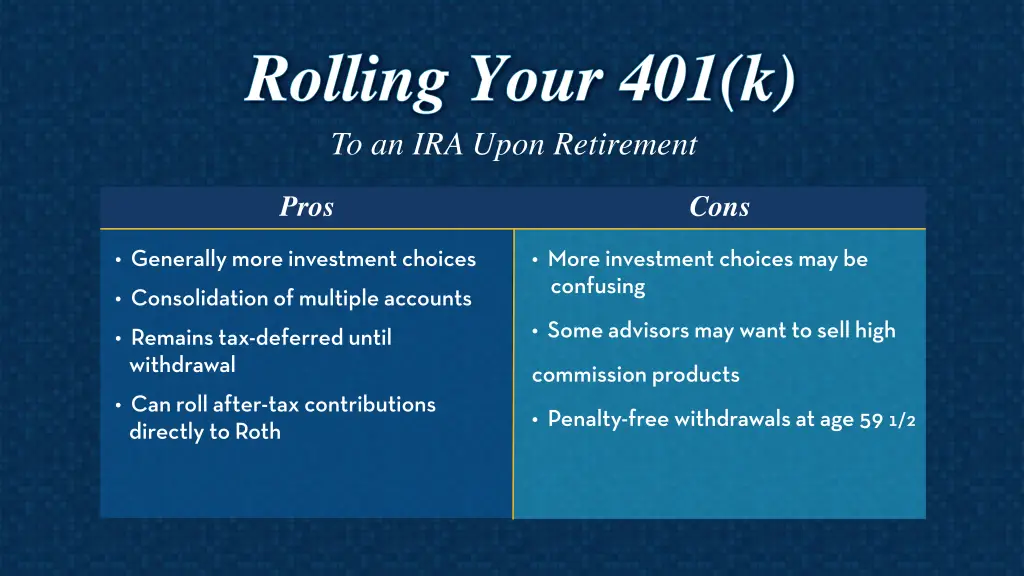

If you have multiple retirement accounts, you can often move money between them without tax consequences, and you might want to combine accounts for several reasons. The most common move is to roll from your 401 to an IRA, but its also possible to do the opposite: You can roll a pretax IRA into a 401.

There are pros and cons to everything, and that includes moving an IRA into your 401 or 403b. You might like the investment choices better, or your employers retirement plan might have less expensive investments. Simplifying is another reason to transfer IRAs to a 401: Clean up those old accounts instead of spending mental energy and time to keep track of multiple accounts.

What Are The Tax Implications Of A 401 Rollover

When completing a 401 Rollover into an IRA, an individual may or may not have to pay taxes on the rollover. In most cases, 401 Rollover tax comes into play when the pre-tax funds from the 401 are being rolled over into a Roth IRA instead of a Traditional IRA because a Roth IRA is funded with post-tax earnings. A 401 account is a pre-tax account. The employer takes funds out of your check for your 401 before deductions and taxes. This reduces the overall taxable income and defers taxation until you start taking withdraws from the account.

Read Also: How To Transfer 401k To Bank Account

Tax Consequences Of A 401

As mentioned above, you generally wont have to pay any taxes on your 401-to-IRA rollover. The only time youll have to deal with taxes is if you have a traditional IRA and want to roll over to a Roth IRA.

One other tax consideration: You can choose to do a direct or indirect rollover. For a direct rollover, your old plan sends the money directly into your new IRA. In an indirect rollover, your old plan sends you a check with the cash and withholds 20% of your funds. These withheld funds are a taxable distribution unless you make up the difference out of pocket. Youll likely have to pay a 10% fine for the early withdrawal. This rule only applies if the check is sent directly to you, though. It doesnt matter if your old plan sends you a check to forward to your new IRA.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Also Check: What Is Max Amount To Contribute To 401k

Ira Rollover Rules To Consider

What sort of rollover you can do depends on the type of workplace plan the money’s coming from, and the sort of retirement account it’s going to.

If you’re considering a rollover IRA, keep these other factors in mind:

- The Employee Retirement Income Security Act protects 401s and other employer-sponsored plans from creditors. In general, IRAs don’t offer the same level of protection.

- Under the Coronavirus Aid, Relief, and Economic Security Act, you can withdraw up to $100,000 from your employer-sponsored plan during 2020 without penalty if you have been affected by COVID-19. If you think you might need funds, keeping the 401 might be the better course.

Rolling Over To A New 401

If youre moving to a different employer that also offers a 401, then you might consider rolling your balance over to the new company. The benefit of this option is the simplicity youll have just one retirement account to keep track of, rather than multiple accounts.

In most cases, this type of rollover can be as easy as filling out a few online forms, and the companies that manage your 401s can usually take care of things on their end.

This process is most frequently initiated by paperwork from the receiving 401 plan, Deering says. For example, if my 401 was at T. Rowe Price and I wanted to roll over an older 401 plan I had at Fidelity, I would contact T. Rowe Price to get their rollover paperwork and submit it to Fidelity to make the check distribution.

You May Like: How Do I Know Where My 401k Is

Tips For Retirement Investing

- Consider finding a financial advisor to steer you in the right direction in terms of savings and investments. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- When youre starting to plan for retirement, you should consider the tax laws of the state you live in. Some have retirement tax laws that are very friendly for retirees, but others dont. Knowing what the laws apply to your state, or to a state you hope to move to, is key to getting ahead on retirement planning.

What Is An Ira Rollover

A rollover is simply the act of taking the money from one tax-exempt retirement account and moving it to a different one. You can roll over funds from a 401 to an IRA, or from an IRA to another IRA. You can either do a direct rollover, where your 401 plan sends the money directly to your IRA, or you can do it indirectly, where you make the withdrawal yourself and deposit the funds into the IRA yourself. If you choose an indirect rollover, you have to move the money into the IRA within 60 days.

Read Also: How Can I Invest My 401k

Tread Carefully With Company Stock

Some retirement savers hold company stock in their 401 alongside their other investments. In that situation, if you roll over all your 401 assets to an IRA, you lose the potential to get a more favorable tax treatment on any growth those shares had while in your 401.

It gets a bit confusing, but the idea is that if the company stock has unrealized gains, you transfer it to a brokerage account instead of rolling it over to the IRA along with your other 401 assets. Upon transferring, you are taxed on the cost basis .

It’s a complex transaction, and if done incorrectly, the strategy loses its tax advantage.Melisssa BrennanFinancial planner with ARS Private Wealth

However, when you then sell the shares from your brokerage account whether immediately or down the road any growth the stock experienced inside the 401 would be taxed at long-term capital gains rates . This could be less than the ordinary-income tax treatment you’d face if the stock went into a rollover IRA and then were withdrawn.

Here’s an example: If the cost basis of your company stock is $10,000 and the gains on it were $20,000, you would pay ordinary taxes on the $10,000 when you transfer the shares to a brokerage account.

The $20,000 in gains, however, would be taxed at long-term rates once the stock is sold. Any further growth from the point of transfer to sale would be taxed as either short- or long-term gains, depending on how long you held it before selling.

Why Transfer An Ira To A 401

A reverse rollover will not be right for everyone. It depends on the terms of the 401 and whether you’ll be better off putting as much money as possible into the workplace plan or keeping the funds split between a 401 and an IRA. There are several things you might consider:

- Streamlining your accounts: Some people like having all their retirement money in one place because it’s much easier to monitor and organize that way. By consolidating your IRA funds into your 401, you get to keep an eye on your retirement savings in one statement.

- Taking early or late retirement: You can’t take money out of an IRA before age 59 1/2 without paying a 10 percent penalty on top of any taxes you’d normally pay, so it can be expensive to access your money. Some employer plans, on the other hand, let you take penalty-free withdrawals at age 55, instead of having to wait until the IRS-mandated retirement age of 59 1/2. So if you’re thinking about early retirement, it may be sensible to move your money to a 401. Bear in mind, too, that if your money is held in a traditional IRA, you have to start taking Required Minimum Distributions from age 70 1/2 no matter what. You don’t take RMDs from a 401 until you actually retire, which is a boon for your finances if you wish to retire later.

References

Don’t Miss: How Do You Max Out Your 401k

Tax Consequences Of The One

Beginning in 2015, if you receive a distribution from an IRA of previously untaxed amounts:

- you must include the amounts in gross income if you made an IRA-to-IRA rollover in the preceding 12 months , and

- you may be subject to the 10% early withdrawal tax on the amounts you include in gross income.

Additionally, if you pay the distributed amounts into another IRA, the amounts may be:

- taxed at 6% per year as long as they remain in the IRA.

Two: Convert Your Traditional Ira To A Roth Ira

No doubt, there are significant advantages to moving your 401 money to a Roth IRA. But, as noted earlier, it will be a taxable event. You will owe taxes not only on your contributions and your companys contributions if it has a matching program, but also on your earnings, which include capital gains and dividends. This bump in income could boost you to a much higher income bracket so that you are paying more tax than if you left the money in a traditional IRA and paid taxes as you made withdrawals in retirement.

Because the taxation of your money is changing, the switch from a traditional IRA to a Roth is called a conversion rather than a rollover. More importantly, it is a permanent process. So you should make sure this is what you really want to do before you do it.

Don’t Miss: Can I Manage My Own 401k

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Rolling Over Your 401 To An Ira

Another option when you leave a job is to roll your 401 balance into an IRA or individual retirement account. An IRA is also a tax-advantaged retirement account, but rather than being sponsored by an employer, its self-directed.

One of the primary reasons someone might choose to roll their 401 into an IRA is the wider variety of investments available, says Lazetta Rainey Braxton, a certified financial planner and the co-founder of the financial planning firm 2050 Wealth Partners,

With the rollover IRA, you have more options in terms of what you can invest in, whereas with an employer 401, its the employers responsibility to figure out what the investment menu is, Braxton says.

If you already have an IRA, then you can often roll your 401 balance into your existing account. If you dont already have an IRA, then youll have to open one before you can initiate the transfer.

Once you have an IRA, contact your former 401 plan administrator and let them know youd like to roll the balance over. They may require paperwork completed by either you or your IRA provider.

The rollover will happen in one of two ways:

Read Also: Should I Use My 401k To Pay Off Debt

Fees Can Be Another Source Of Conflict

Fees and expenses are a key potential source of conflict.

Financial institutions must be careful not to use quotas, bonuses, prizes or performance standards as incentives that … are likely to encourage investment professionals to make recommendations that are not in retirement investors best interest, the department said. Investment companies including brokerages, banks and insurers “should aim to eliminate such conflicts to the extent possible, not create them.

As an example provided by the department, suppose you want to roll $100,000 from your 401 into an IRA, and suppose that an investment company affiliated with your adviser pays him or her 1% annually to steer you into its investments. Assume, further, that this fee difference cuts your average return to 5% annually from what would have been 6% otherwise. Over 10 years, at 5%, your initial $100,000 balance would grow to $163,000, compared to the $179,000 it would have risen to if earning the full 6%.

In other words, that extra percentage point in fees would cost you $16,000, and as more time passes, that 1% difference in fees gets magnified, the department said. During the next 10 years, your IRA would lose out on another $39,000.

The new guidelines still allow 12b-1 fees, commissions and other costly means of compensation, but advisers acting as fiduciaries will need to demonstrate how their rollover recommendations are still in a client’s best interest, Norris said.

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Also Check: How Long Does A 401k Rollover Take

What Is A 401

Many employers offer 401 retirement plans for their employees. With the 401, funds are taken from your paycheck before taxes are calculated and put in a separate retirement fund. This reduces your taxable income, so you pay fewer taxes each paycheck than you would if the money was still there.

Some companies offer matching contributions to 401 retirement accounts. For example, if you contribute 3 percent of your paycheck to a 401, your company will throw in another 3 percent. Company matching funds usually aren’t directly available to you until you are vested with the company. The amount of time required for an employee to become vested in a company retirement plan can differ from employer to employer.

For example, say you contribute $100 every paycheck to your 401 and your employer matches that contribution. Employees with the company are vested after five years. Three years into your job, you decide to leave. Over the years, your 401 has grown to $5,200 from your contribution and the company match. Since you are leaving before the five-year vesting period, you only get half, or $2,600, of that retirement account. To get the full amount, you would need to stay at least five years at that employer.

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover Chart PDF summarizes allowable rollover transactions.

Recommended Reading: How To Take Money From 401k Without Penalty