Max Out Your Contribution

While that sounds like a lot of money from a 4% contribution, it may not be enough to sustain the lifestyle you want in retirement. Based on the often-used “4% rule” for retirement and using our preceding example, a $900,000 nest egg would safely produce $36,000 in annual income in retirement. Withdrawing any more than this greatly increases the chances you’ll eventually run out of money. Even when you factor in Social Security, it might not be enough.

Fortunately, you can save more than your employer is willing to match — a lot more, in most cases. For the 2020 and 2021 tax years, the IRS allows you to funnel up to $19,500 of your compensation into your 401.

One popular strategy is to increase your contributions by 1% per year until you hit the maximum amount you’re comfortable with saving. Any small increase can make a big difference. Returning to our example, consider how small increases in elective contributions affect retirement savings in the long run.

| Your Contribution |

|---|

| $1,351,305 |

Assumes $60,000 starting salary and 2% annual salary increases. Also assumes 7% annual investment returns.

There are even more opportunities to invest beyond a 401, such as an IRA. However, you should be sure to capture your employer match on your 401 first.

Distribution Of Excess Contributions

If you do exceed your contribution limits, to avoid double taxation, contact your plan administrator and ask them to distribute any excess amounts. The plan should distribute the excess contribution to you by April 15 of the following year . For information about taxes on excess contributions, see What Happens When an Employee has Elective Deferrals in Excess of the Limits?

When deciding from which plan to request a distribution of excess contributions keep in mind:

- getting the maximum matching contribution that may be offered

- type of investments

Make Savings A Priority

Keep your eye on your dreams. Do the best you can to get to at least 15%. Of course, it may not be possible to hit that target every year. You may have more pressing financial demandschildren, parents, a leaky roof, a lost job, or other needs. But try not to forget about your futuremake your retirement a priority too.

You May Like: Can I Rollover 401k To Ira While Still Employed

Employers Have A Higher Contribution Ceiling

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $58,000 in 2021, up from $57,000 in 2020. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $290,000. Even at that level, the employer would have to contribute a hefty amount to reach the $58,000 limit.

How To Get Money Out Of Your 401

Your 401 money is meant for retirement. It’s not easy to take money out while you’re still working, without incurring a steep financial loss. The account is structured that way on purpose you let the money grow for your future use.

There are certain circumstances under which you can take funds out of your 401 without paying any penalty. You’ll still need to pay income taxes on the money, since it most likely went into your account on a pre-tax basis.

You can start taking withdrawals once you reach 59 1/2 years of age. You can also take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday. This is known as the IRS Rule of 55.

Don’t Miss: How Is 401k Paid Out

How Do I Complete A Rollover

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

Also Check: Should I Rollover My 401k When I Retire

When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

Everything You Need To Know About 401k Contribution Limits For :

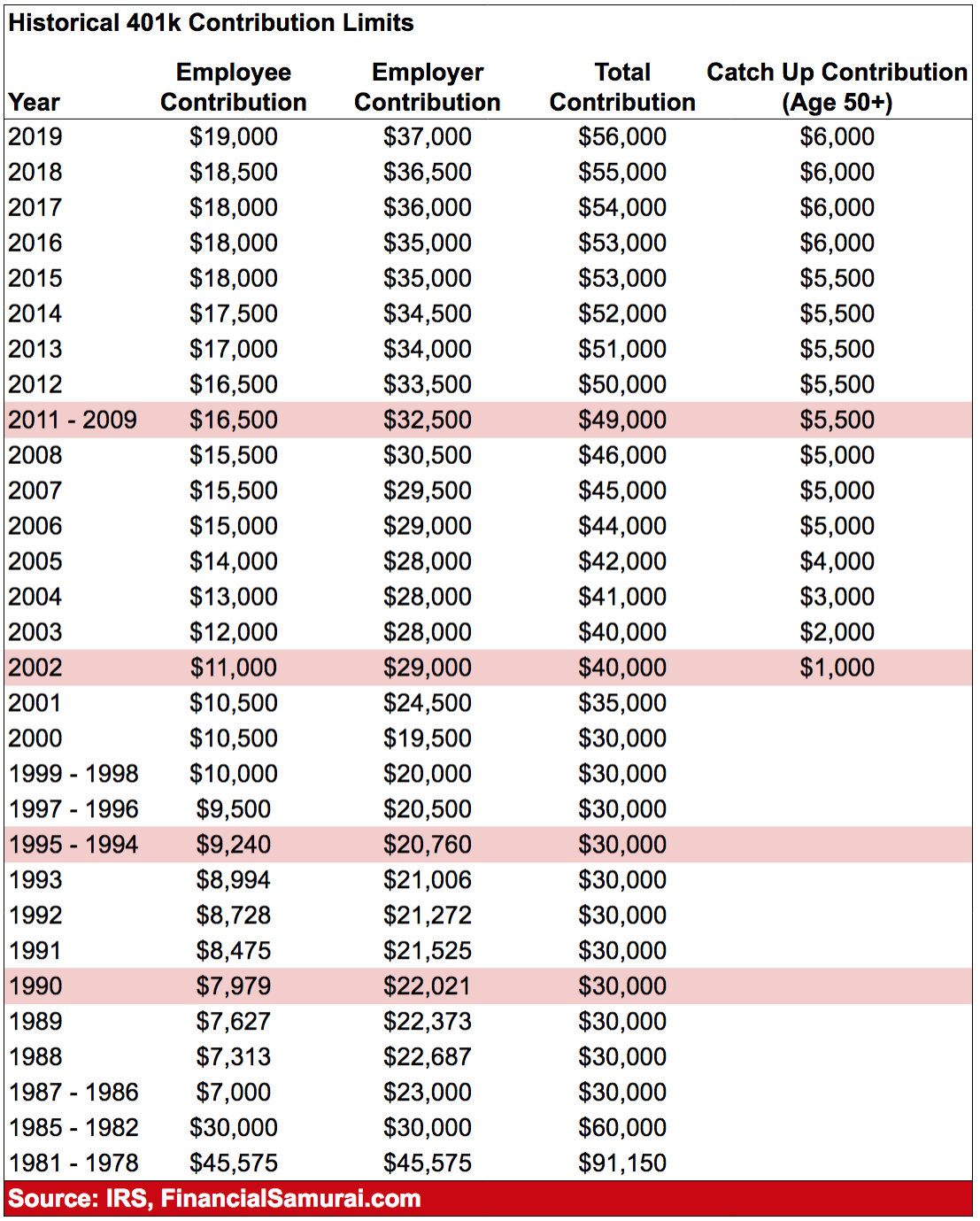

The chart below shows the base 401 maximum contribution, the catch-up contribution for employees ages 50 and older, and the maximum allocation from all tax-sheltered retirement plans, from 2009 to 2020.

As you can see, the rate of increase over the past eleven years has typically moved at a snails pace. There has been only a $3,000 increase in the maximum contribution since 2009, and an even smaller increase in the catch-up contribution over the same space of time.

And as you can also see, contribution limits have stagnated in the past, such as 2009 through 2011, when they remain at $16,500 for three years in a row. Even more obvious is the lack of increase in the catch-up contribution for a full six years, when the amount remained at $5,500 from 2009 through 2014.

From 2009 through 2021, the maximum increased from $49,000 to $58,000. Thats an increase of $9,000 over 10 years, which works out to be over 2% per year.

| Year | |

|---|---|

| $5,500 | $49,000 |

For each year, the maximum allocation is increased by the amount of the allowable catch-up contribution . For example, for 2021, the maximum allocation is $63,500. That is the maximum allocation of $57,000, plus the $6,500 catch-up contribution.

Also Check: How To Collect My 401k Money

But How Much Is Enough

Our rule of thumb: Aim to save at least 15% of your pre-tax income1 each year, which includes any employer match. That’s assuming you save for retirement from age 25 to age 67. Together with other steps, that should help ensure you have enough income to maintain your current lifestyle in retirement.

How did we come up with 15%? First, we had to understand how much people generally spend in retirement. After analyzing enormous amounts of national spending data, we concluded that most people will need somewhere between 55% and 80% of their preretirement income to maintain their lifestyle in retirement.1

Not all of that money will need to come from your savings, however. Some will likely come from Social Security. So, we did the math and found that most people will need to generate about 45% of their retirement income from savings. And saving 15% each year, from age 25 to age 67, should get you there. If you are lucky enough to have a pension, your target savings rate may be lower.

Here’s a hypothetical example. Consider Joanna, age 25, who earns $54,000 a year. We assume her income grows 1.5% a year to about $100,000 by the time she is 67 and ready to retire. To maintain her preretirement lifestyle throughout retirement, we estimate that about $45,000 each year , or 45% of her $100,000 preretirement income, needs to come from her savings.

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

For 2017, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $99,000 but less than $119,000 for a married couple filing a joint return or a qualifying widow,

- More than $62,000 but less than $72,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

Don’t Miss: How To Make 401k Grow Faster

Financial Samurai 401k Savings By Age Guide

From the results, we can see that even after 38 years of consistent saving, youll only have around $1,000,000 to $5,000,000 in your 401k in a realistic cycle of bull and bear markets. In other words, I believe everybody should become 401k millionaires by 60.

If youre just starting your 401 savings journey, you could get lucky and achieve the high end column with consistent 8%+ annual growth and company profit sharing after 38 years. After all, the maximum 401 contributions will be much higher over the next 38 years than the previous 38 years.

But its most likely that most people reading this article should follow the middle-to-low end columns as a 401 savings guide. The median age in America is roughly 36. Meanwhile, the median age of a Financial Samurai reader is closer to 38.

Making Your Retirement Savings Last

One of the most important keys to making your retirement savings last is to set a budget in retirement. You need to strictly stick to your budget since you are living on a fixed amount of money during retirement.

If you find your your savings are not sufficient to support your current budget then here are some additional strategies to stretch your retirement savings.

Need more help in figuring out how much money you’ll need in retirement, and how to build that wealth to achieve retirement? Our course shows you how to lay the foundation and framework for financial independence so you can start living according to your values.

Read Also: How Much Do You Get From 401k

Key Limit Remains Unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The additional catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

Details on these and other retirement-related cost-of-living adjustments for 2020 are in Notice 2019-59 PDF, available on IRS.gov.

Updates To Income Limits For Roth Ira Contributions

If youre already contributing to an employer-sponsored plan, like a 401, you can also contribute to a traditional IRA. But there are restrictions on what you can deduct from your taxes, based on your income. For 2021, those income ranges increased . Depending how much money you make, you may be able to deduct more of your IRA contributions from your taxes.

While traditional IRAs arent subject to income limits, Roth IRAs are. That limit increased for 2021.

| Account | |||

|---|---|---|---|

| Helps you invest for retirement with pre-tax deposits. | Income limitNone | Tax deduction limitsYou may take full, partial, or no deduction based on your income level and retirement plan. | |

| Roth IRA | Funded with after-tax dollars, but your eventual qualified withdrawals may be tax-free. | Income limit | Tax deduction limitsNot deductible |

For more information about IRA tax deduction limits, check out the IRS parameters for those who are covered or arent covered by a retirement plan at work.

You May Like: How Do I Find Out Where My Old 401k Is

Types Of 401 Contributions That The Irs Allows

Many 401 plans allow you to put money into your plan in all of the following ways:

- 401 pretax contributions: Money is put in on a tax-deferred basis. That means that it’s subtracted from your taxable income for the year. Youll pay tax on it when you withdraw it.

- Roth 401 contribution : Money goes in after taxes are paid. All of the gain is tax-free you pay no tax when you withdraw it.

- After-tax 401 contributions: Money goes in after taxes are paid, which means that it won’t reduce your annual taxable income. But you will not pay taxes on the amount when you withdraw it. You might have tax due, at your ordinary income-tax rate, on any interest that’s accumulated tax-deferred on the amount. You can avoid this by rolling over the sum into a Roth IRA.

How Much Should You Contribute To Your 401

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2019 is $19,000, and those age 50 or older can contribute an extra $6,000. In 2020, you can contribute a maximum of $19,500. Those age 50 or older will be able to contribute an additional $6,500. However, you can use our 401 calculator to figure out how much you can expect to earn based on any contribution amount you choose.

Don’t Miss: Can You Roll A 401k Into A Roth

When You Can Withdraw Money From A 401

You generally must be at least 59 1/2 to withdraw money from your 401 without owing a 10% penalty. The early-withdrawal penalty doesn’t apply, though, if you are age 55 or older in the year you leave your employer.

Your withdrawals will be subject to ordinary income tax. And once you reach age 72, you’ll be obligated to take required minimum distributions. One exception: If you’re still working when you hit that age and you don’t own 5% or more of the company you’re working for, you don’t have to take an RMD from the 401 that you have through that job.

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path. Below is a chart that shows the maximum 401k contributions in 2021 by employee and employer.

After you contribut a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.

Just imagine 30 years from now, the government deciding to raise penalty free 401k withdrawal to age 75 from 59.5? Unfortunately, you need the money at age 60. Because you withdraw, the government imposes a 30% penalty on top of the taxes you have to pay. Dont think it cant happen. Expect it to happen!

Also Check: How Do I Cash Out My 401k Early

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover Chart PDF summarizes allowable rollover transactions.