When Am I Eligible For A 401 Distribution

In general, you cant take a distribution from your 401 account until one of the following events occurs:

- You die, become disabled, or otherwise terminate employment

However, a 401 plan can also permit distributions while you are still employed. These in-service distributions are subject to the following conditions:

- 401 deferrals , safe harbor contributions, QNECs and QMACs cant be distributed until age 59.5

- Non-safe harbor employer match and profit sharing contributions can be distributed at any age.

- Employee rollover and voluntary contributions can be distributed at any time.

- 401 deferrals , non-safe harbor contributions, rollovers and voluntary contributions can be withdrawn in a hardship distribution at any time.

To find the in-service distribution rules applicable to our 401 plan, check your plans Summary Plan Description .

Other Considerations For Required Minimum Distributions

Your 401k administrator might calculate your RMD, but its your ultimate responsibility to make sure the calculation is accurate. Note that you can withdraw more than your required minimum, but you cant apply the excess funds to your following years RMD.

If you own more than one 401k, you must calculate the RMD amount for each account. You can, however, withdraw your RMD amount from a single account. If you own different types of accounts, such as one IRA and one 401k, you must take RMDs from each one.

You might consider opting for a systematic withdrawal plan. SWPs provide income in the form of monthly, quarterly or annual withdrawals from 401k plans, which you can schedule to meet your RMD obligations.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

You May Like: How To Set Up A 401k Account

Tax Implications Of Cashing Out A 401 After Leaving A Job

The following are some tax rules regarding your old 401:

-

When you leave your 401 account with your old employer, you wont need to pay taxes until you choose to withdraw the funds.

-

Even when you roll over your old 401 account to your new employer, you need not pay any taxes.

-

At the time of your 401 distributions, you will be liable to pay income tax at the prevailing rates applicable for such distribution.

-

If you havent reached the age of 59 ½ years at the time of distribution, you may be liable to pay a premature withdrawal penalty of 10%, subject to certain exceptions.

-

Distributions from a designated Roth account are tax-free after you reach the age of 59 ½ years, provided your account is at least five years old.

Although legally, you have every right to liquidate your old 401 account and cash out the entire funds, doing so would reduce your savings for the retired life. Additionally, the distributions will add up to your annual taxable income.

Need further help? Talk to our experts for professional advice on anything and everything related to 401.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment advising, and integration with leading payroll providers.

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Recommended Reading: How To Open A Solo 401k

Rollovers From Your 401 Plan

A rollover occurs when you receive a distribution of cash or other assets from one qualified retirement plan and contribute all or part of the distribution within 60 days to another qualified retirement plan or traditional IRA. This transaction is not taxable however, it is reportable on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. PDF and your federal tax return. You can roll over most distributions except:

- A distribution that is one of a series of payments based on life expectancy or paid over a period of ten years or more,

- A required minimum distribution,

- A hardship distribution, or

- Dividends on employer securities.

Any taxable amount that is not rolled over must be included in income in the year you receive it. If the distribution is paid to you, you have 60 days from the date you receive it to roll it over. Any taxable distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll the distribution over later. If the distribution is rolled over, and you want to defer tax on the entire taxable portion, you will have to add funds from other sources equal to the amount withheld. You can choose to have your 401 plan transfer a distribution directly to another eligible plan or to an IRA. Under this option, no taxes are withheld.

Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

Don’t Miss: How To Get Your 401k Without Penalty

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

How Long Will $500000 Last In Retirement

If you’ve saved $500,000 for retirement and withdraw $20,000 per year, it will probably last you 25 years. Of course, it will last longer if you expect an annual return from investing your money or if you withdraw less per year.

If you have $500,000 saved up, then youre able to withdraw more each year compared to having $300,000. If you manage to stick to withdrawing $20,000 per year you’ll be withdrawing 4% of your savings per year.

This might be enough income for some, but if you are hoping to withdraw more each month you’ll likely have to dip further into your retirement savings or invest that money in the hope that it will increase in value. In the past had you invested in the stock market in the past you’d have gained a return to the tune of 7% per year. Use a calculator like this one and you’ll find that you could have withdrawn $3,250 a month and had your retirement savings last thirty years and two months.

Read Also: How To Know If You Have A 401k

How Rmds Affect Roth Accounts

You aren’trequired to take minimum distributions from a Roth IRA because you paid taxes on your contributions at the time you made themRoth IRA contributions are made with “after-tax” dollars. You’re required to take RMDs from other types of Roth accounts, however, because you got a tax break for those contributions.

IRS rules require that you take RMDs from Roth 401s at retirement, as opposed to Roth IRAs, but you can roll your Roth 401 into your Roth IRA to avoid this requirement.

Your beneficiaries must take RMDs from inherited Roth IRAs. They can’t let the funds grow tax-free forever. They must start taking a specified amount out each year.

Although you can’t roll your required minimum distribution to a Roth IRA, you can distribute funds from your IRA “in kind.” This means you distribute shares of an investment instead of cash. Those funds then remain invested in a brokerage account.

Just Because You Can Cash Out Your 401 Doesnt Mean You Should

Technically, yes: After youve left your employer, you can ask your plan administrator for a cash withdrawal from your old 401. Theyll close your account and mail you a check.

But you should rarelyif everdo this until youre at least 59 ½ years old!

Let me say this again: As tempting as it may be to cash out an old 401, its a poor financial decision. Thats because, in the eyes of the IRS, cashing out your 401 before you are 59 ½ is considered an early withdrawal and is subject to a 10% penalty on top of regular income taxes. Oh, yes, thats another thing: Since the 401 is funded with pre-tax money, you also have to pay taxes on it when you cash out.

In most cases, your plan administrator will mail you a check for 70% of your 401 balance. Thats your balance minus 10% for the withdrawal penalty and 20% to cover federal income taxes .

Its financially prudent to save for retirement and leave that money invested. But paying the 10% early withdrawal penalty is just dumb money its equivalent to taking money youve earned and tossing it out the window.

You May Like: How Do I Cash Out My 401k Early

Special Considerations For Withdrawals

The greatest benefit of taking a lump-sum distribution from your 401 planeither at retirement or upon leaving an employeris the ability to access all of your retirement savings at once. The money is not restricted, which means you can use it as you see fit. You can even reinvest it in a broader range of investments than those offered within the 401.

Since contributions to a 401 are tax-deferred, investment growth is not subject to capital gains tax each year. Once a lump-sum distribution is made, however, you lose the ability to earn on a tax-deferred basis, which could lead to lower investment returns over time.

Tax withholding on pre-tax 401 balances may not be enough to cover your total tax liability in the year when you receive your distribution, depending on your income tax bracket. Unless you can minimize taxes on 401 withdrawals, a large tax bill further eats away at the lump sum you receive.

Finally, having access to your full account balance all at once presents a much greater temptation to spend. Failure in the self-control department could mean less money in retirement. You are better off avoiding temptation in the first place by having the funds directly deposited in an IRA or your new employer’s 401 if that is permitted.

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Read Also: How To Withdraw Money From My Fidelity 401k

Are There Penalties For Not Taking My Rmd

The penalty for not taking a required minimum distribution is a tax of 50% on any amounts that were not withdrawn in time. The penalty can be waived, however, if you can establish that you failed to take the RMD due to reasonable error and that you’ve taken steps to correct the situation. You can file Form 5329 with the IRS to request a waiver from the penalty, along with a letter explaining what went wrong.

How Are Distributions Of Roth 401 Deferrals Taxed

Because Roth 401 deferrals are contributed to your account on an after-tax basis, they are never taxable upon distribution. Their earnings can also be distributed tax-free when theyre part of a qualified distribution. A qualified distribution is one that occurs 1) at least five years after the year you made your first Roth deferral and 2) after the date you:

- Attain age 59½,

- Become disabled, or

- Die

If you withdraw Roth 401 deferrals as part of a non-qualified distribution, their earnings are taxable at applicable Federal and state rates and may be subject to the 10% premature distribution penalty.

Recommended Reading: How To Lower 401k Contribution Fidelity

Dont Forget About Taxes

Finally, as you tote up your retirement savings, remember that not all of that money is yours to keep. When you make withdrawals from a traditional 401-type plan or traditional IRA, the IRS will tax you at your rate for ordinary income .

So if youre in the 22% bracket, for example, every $1,000 you withdraw will net you just $780. You may want to strategize to hold onto more of your retirement fundsfor instance, by moving to a tax-friendly state.

Taxes On A Traditional 401

For the tax year 2020, for example, payable on May 17, 2021, a married couple who files jointly and earns $80,000 together would pay 10% tax on the first $19,400 of income, 12% on the next $59,550, and 22% on the remaining $1,050. If the couple’s income rose enough that it entered the next tax bracket, some of the additional income could be taxed at the next highest incremental rate of 24%.

That upward creep in the tax rate makes it important to consider how 401 withdrawals, which are required after you turn 72, may affect your tax bill once they’re added to other income. “Taxes on your 401 distributions are important,” says Curtis Sheldon, CFP®, president of C.L. Sheldon & Company LLC in Alexandria, Va. “But what is more important is, ‘What will your 401 distributions do to your other taxes and fees?'”

Sheldon cites the taxation of Social Security benefits as an example. Normally, Social Security retirement benefits aren’t subject to income tax unless the recipient’s overall annual income exceeds a certain amount. A sizable 401 distribution could push someone’s income over that limit, causing a large chunk of Social Security benefits to become taxable when they would have been untaxed without the distribution being made. If your annual income exceeds $34,000 , 85% of Social Security benefits may be taxed.

Such an example underlines the importance of paying close attention to when and how you withdraw money from your 401.

Recommended Reading: How To Collect My 401k Money

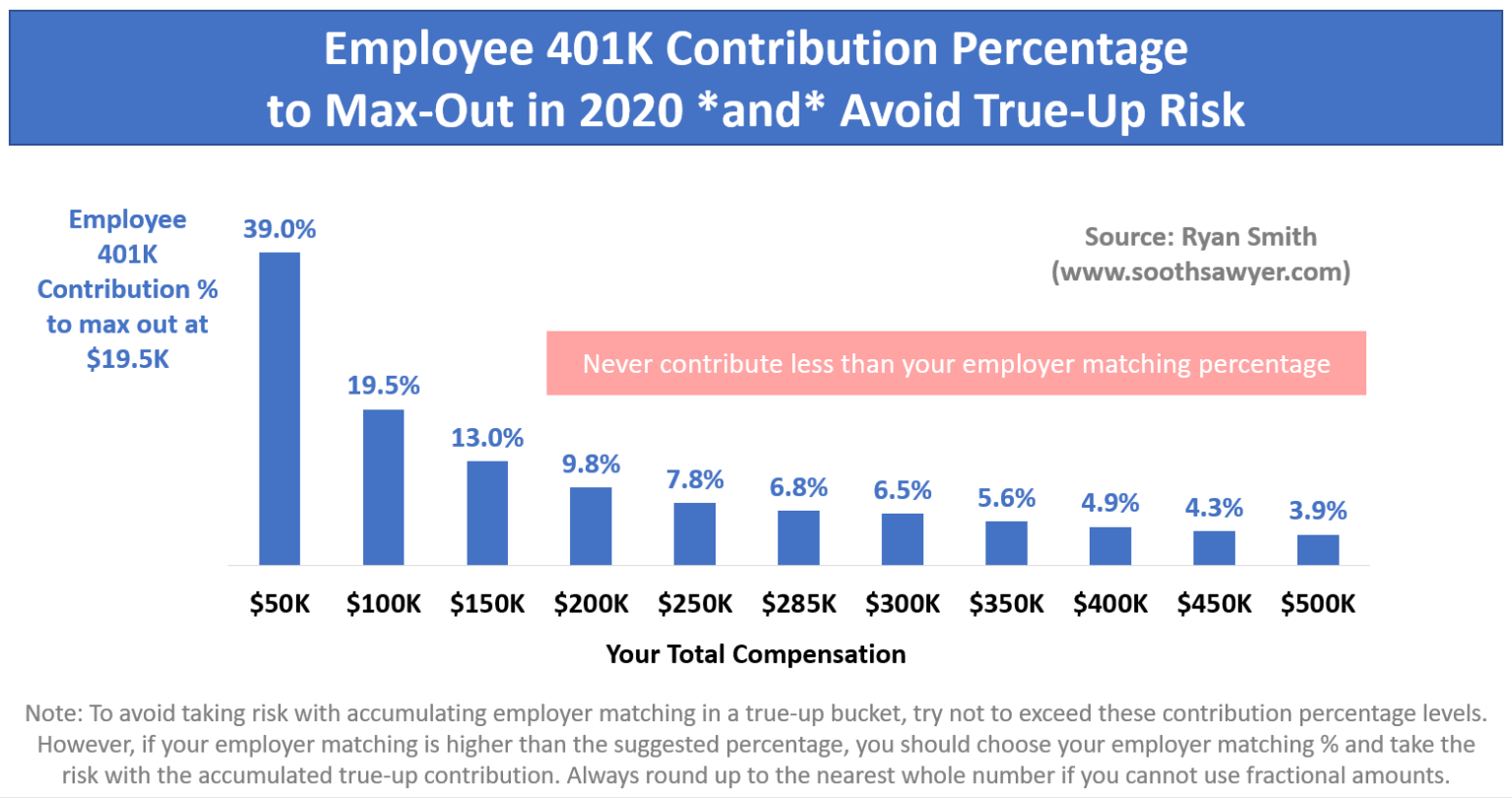

A Tax Savings Example

Assume you make $50,000 per year. You decide to put 5% of your pay, or $2,500 a year, into your 401 plan. You’ll have $104.17 taken out of each paycheck before taxes have been applied if you get paid twice a month. This money goes into your plan.

The earned income you report on your tax return at the end of the year will be $47,500 instead of $50,000, because you get to reduce your earned income by the amount you put in. The $2,500 you put into the plan means $625 less in federal taxes paid if you’re in the 25% tax bracket. Saving $2,500 for retirement therefore only costs you $1,875.

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

Recommended Reading: Can You Have A Roth Ira And A 401k

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.