Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether you’re a “manage it for me” type or a DIY type.

-

If you’re not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

Fidelity And/or Vanguard To Tiaa

Transfer funds from Fidelity and/or Vanguard fund into a TIAA fund

How To Rollover A 401k To Vanguard

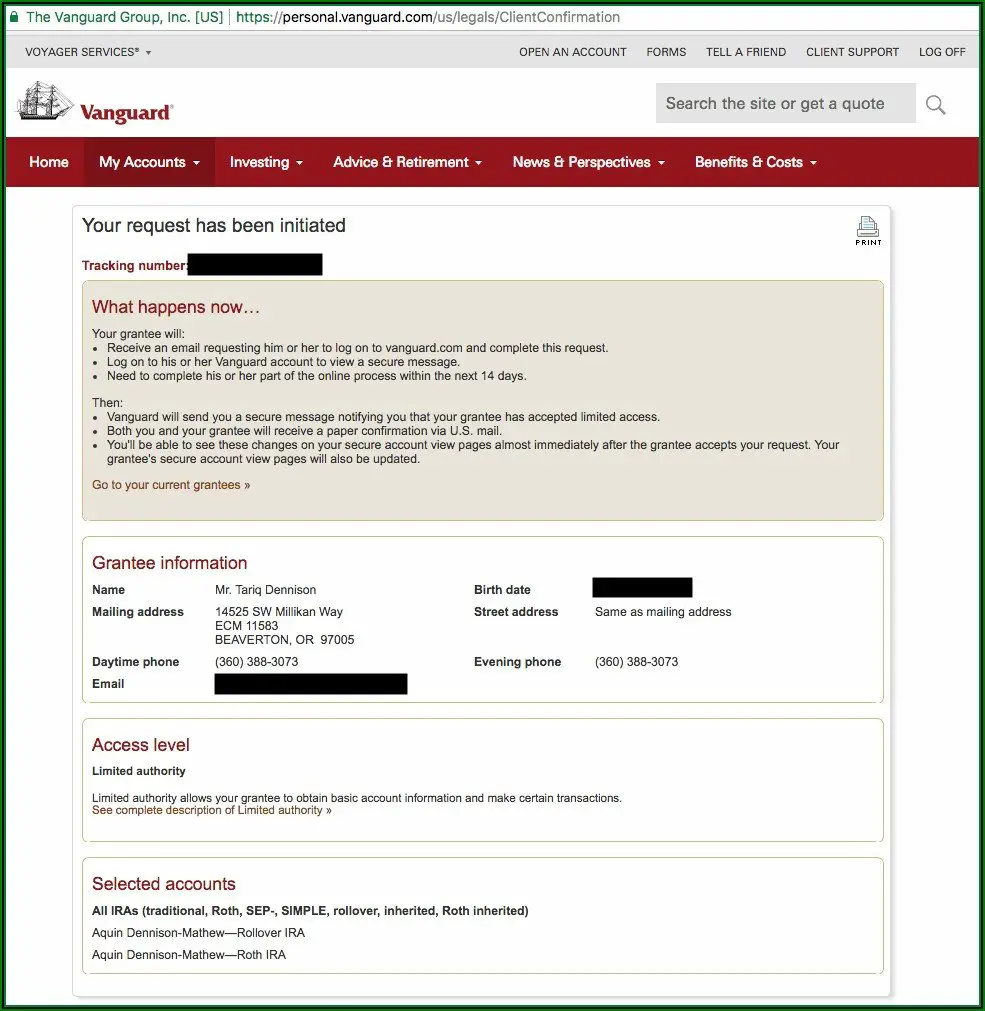

About 5 seconds after I saw how much I would save by rolling over my 401k to Vanguard, I got to work. I called Vanguard at 888-499-970 to initiate the transfer. Although they offer instructions on how to do this online, it can be easy to make a mistake that can cost thousands. I wanted to have a professional direct the transfer so that it was done correctly.

I could have called Merrill Lynch for assistance transferring my 401k, but I find the company receiving my business tends to be easier to work with than the company Im leaving.

The representative from Vanguard had clearly been through this before. She was friendly, precise and professional. We bridged Merrill Lynch into the call, and within 20 minutes had the transfer underway. All I had to do was verify my identity by providing my SSN, employer start date, and employer termination date to Merrill Lynch to validate my account and begin the asset transfer. From there I gave permission to the Vanguard representative to handle the rest. Easy peasy.

8 days after our call the funds were deposited into my Vanguard account. All of this cost me about 45 minutes and a $26 account termination fee from Merrill Lynch. For a savings of over $260,000, the time and money were well worth it!

Don’t Miss: Can Anyone Open A 401k

My Experience Rolling Over To Vanguard

Like many, I have been with several employers since I finished school and started in the workforce. And because I have always been pretty good about contributing to my retirement accounts, at one point I had a Roth IRA, two 401ks, a 457b and my own individual stock account. Trying to manage so many accounts was daunting, so I ended up doing what a lot of us do ignoring them and just letting things sit. While this isnt terrible it goes against the idea of rebalancing and diversifying your portfolio. So, after reading my brothers blog for the last year, I was finally motivated to try to consolidate the accounts so I could take a more active role in managing my portfolio.

I chose Vanguard basically because I had heard a lot of good things about their no/low load funds and good performance. I started by calling the number on their Personal Investors website, quickly got through to a live person and explained that I wanted to rollover my IRA from a former employer to Vanguard. I was transferred to a concierge transfer specialist who then walked me through the process of creating an account online, which took about 5 minutes. He also verified that I wanted to do a rollover IRA and asked what type of investments I wanted to place the money in once it reached Vanguard. I opted for a money market holding fund until I could do more research on their offerings.

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why it’s also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

Recommended Reading: Can You Roll A 401k Into A Roth

Consider Mobile Check Deposit

If you’re already a Vanguard client and you’re registered for online access, remember that you can use our mobile check deposit option offered through the Vanguard app. It’s faster than mailing a check!

When you’re logged on and using the app, just tap the Mobile check option under the main menu and then follow the instructions. Learn more about mobile check deposit

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Don’t Miss: How To Find My 401k Money

The Tax Withholding Complication

Unless youre planning to actually liquidate your plan distribution, you should always go with either the direct rollover method or the trustee-to-trustee method. In my opinion, the trustee-to-trustee method is the simplest, since the funds are transferred directly and immediately from one plan to another. Theres no possibility of human error, that might cause you to miss the 60-day deadline.

But if for any reason you have taxes withheld from your transfer, theres a major complication. The amount of tax withheld from the distribution means that less than 100% is available to be transferred to the new plan.

Lets say you transfer $50,000 from an employer-sponsored plan to an IRA. The plan administrator is required to withhold 20%, or $10,000.

For tax purposes, the full $50,000 will be taxable. But you will only receive $40,000, due to the withholding.

If youre going to take the distribution and keep it, theres no problem. The taxes for the distribution will already have been withheld.

However, if you ultimately plan the roll the funds over into a new plan, youll only have $40,000 distributed to make the transfer. That will leave you with one of two choices:

Cashing Out: The Last Resort

Avoid this option except in true emergencies. First, you will be taxed on the money. In addition, if you’re no longer going to be working, you need to be 55 to avoid paying an additional 10% penalty. If you’re still working, you must wait to access the money without penalty until age 59½.

Most advisors say that if you must use the money, withdraw only what you need until you can find another income stream. Move the rest to an IRA or similar tax-advantaged retirement plan.

Also Check: How To Make 401k Grow Faster

Comparing Vanguard And Fidelity

Vanguard and Fidelity are two of the largest employer retirement plan administrators. Both are also popular with individual investors looking to own low-cost index funds.

Vanguard popularized the passive investing craze. But Fidelity has created a portfolio of passively managed index funds to compete.

Fidelity has aggressively lowered minimum investments and expense ratios to attract new customers.

Both companies now have complimentary index funds to satisfy the needs of everyone. But there are notable differences with the funds and platforms.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How Do I Know If I Have A 401k

Confirm A Few Key Details About Your 401 Plan

First, get together any information you have on your old 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following three items:

Why Rollover A 401k

For me the decision was simple. I prefer the low cost Vanguard funds over Fidelity funds. Fidelity does offer some really low cost index funds, but Vanguard offers a wider variety of funds with rock-bottom expense ratios.

In addition, by moving funds over to Vanguard, I can qualify for even lower fees and more exclusive customer service. In addition to a standard account, Vanguard offers what it calls Voyager, Voyager Select and Flagship accounts. To qualify, however, you must have minimum account balances. By moving more money over to Vanguard, its easier to qualify for a higher level of service. Here are the requirements of each account type and what they offer:

Don’t Miss: How To Know If You Have A 401k

Who Should Use Vanguard

Vanguard built a reputation as a platform that creates and offers low-fee mutual funds and exchange-traded funds. This makes it a good brokerage for clients who want to make basic investments and not think too much about them.

In addition, if you want low-cost funds, Vanguard has also grown to offer stocks and bonds. Though, trading these individual equities is much more limited.

Vanguard might also make sense for clients who want to open an IRA and manage it in a very hands-off manner.

At its core, the brokerage is designed for investors who want a simple and straightforward experience. Its accounts and tools are easy to use, and its website boasts a number of educational resources. This makes it extremely welcoming to beginners.

Vanguard Vs Fidelity Iras: The Biggest Differences

When it comes to IRAs, Vanguard and Fidelity are neck and neck in many areas. Both offer traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and many other retirement accounts for individuals and small businesses. The two platforms also give investors the option to manage eligible IRAs on their own or utilize automated portfolios and/or advisor assistance.

Fidelity, however, has a wider range of IRA options. Unlike Vanguard, Fidelity offers a Roth IRA account for minors. The brokerage could also suit those in search of lower costs, mainly because most of its index mutual funds have no minimum requirements .

Vanguard’s advisor-assisted, automated investing account has Fidelity’s equivalent account beat when it comes to advisory fees, but Fidelity is still hard to pass up on the account minimum end.

| Vanguard |

|

Yes Fidelity Go and Fidelity Personalized Planning and Advice |

Read Also: How To Diversify 401k Portfolio

How Do I Avoid Tax On Ira Withdrawals

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Also Check: How Do I Use My 401k To Start A Business

Ira Rollovers Are Big Business

Although it would be nice to roll over my 401 to Vanguard, they don’t offer anything in terms of rollover bonuses. Companies like Fidelity offer up to $600 just for rolling over your 401. Their funds might not be as inexpensive as Vanguard but they’re not that far off.

One thing to watch out for though is that some of these companies charge large fees to close IRAs. I still have $200 left in a TD Ameritrade Roth IRA because I refuse to pay $150 to close my account. I don’t know if I would recommend rolling over to one of these companies but the bonuses definitely make it tempting.

How Do You Find Your Expense Ratios

There are lots of companies that sponsor 401ks , and the steps to find the expense ratio are different for each of them. Generally you can find it by signing into your account online, and find the fund youve selected. Once you find the fund, you will see the expense ratio in the details of the fund.

Account -> Fund -> Expense Ratio

It took me about 15 minutes to find the funds and corresponding expense ratios in two different accounts. Remember that the 15 minutes it took to find the expense ratios, then plug them into the calculator above is how I found out I could save 6 figures in fees.

Heres where I found the expense ratios within my Roth IRA at Vanguard and my 401k at Merrill Lynch. Keep in mind that the funds in my account may be different than yours.

Merrill Lynch was a little more complicated. After signing in and selecting my 401k plan, I had to find the Average annual total returns tab under Investment Choices and Selection.

Don’t Miss: How Do You Take Money Out Of 401k

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.