Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

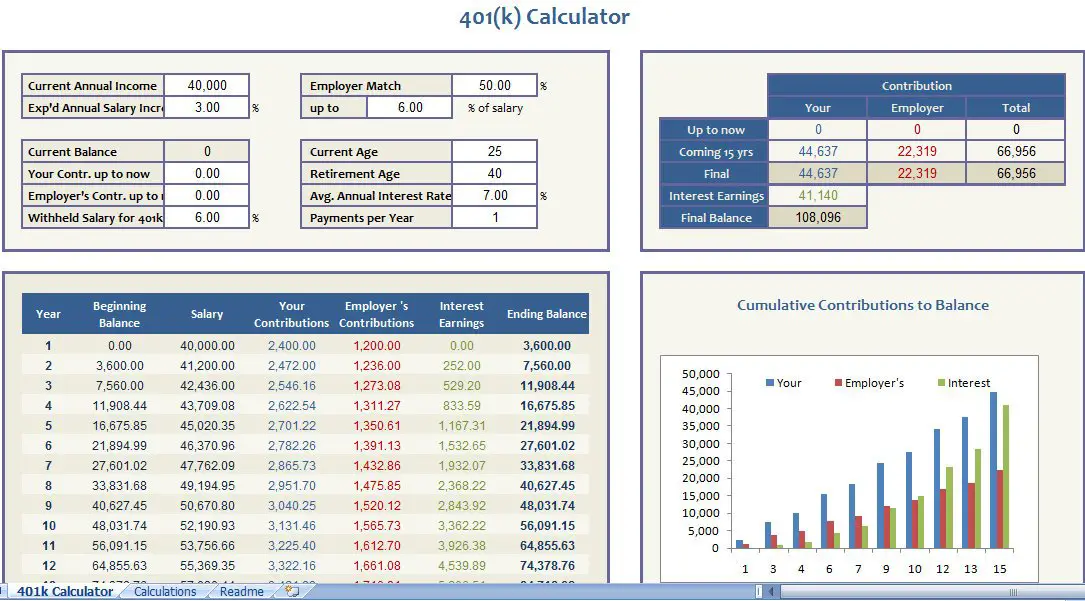

Variables To Consider And Not

To many, what matters most is getting a ballpark figure of how much money they will have when they hit their 60s a simple and matter-of-fact figure in dollars!

While there are only four input variables in this calculator, its important to consider how you arrive at each variable. For example, when figuring out your total monthly contributions, include:

- Your average monthly contributions.

- Your employers average monthly contributions sometimes called a match.

- Any catch-up contributions in order to reach your desired future goal.

- Limitations due to being a highly-compensated employee.

Only focus on the variables presented in this calculator. Never go into the details of something that is completely out of your control like inflation, salary growth, changes in federal law, or changes in employment policies.

This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. It simulates that if you contribute X that youll end up with Y in a future date, without unnecessary complication.

Simply take a few moments to run a couple of scenarios and figure out how much you should be contributing toward your 401k preparing now will result in a more rewarding retirement later.

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your company’s HR department or plan administrator to see if it’s an option for you.

If it is and you decide it’s your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don’t handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers don’t allow you to transfer money out of your 401 if you’re a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

Also Check: Can I Open A 401k Without An Employer

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

How Long Will It Take For My Check To Come In The Mail

You are here: Check orders received before 1pm EST will be mailed the same day theyre submitted, Monday to Friday. Typical USPS priority delivery times are between 4-6 business days.

Can a 55 year old withdraw from a 401k plan?

Most 401 plans do not allow regular withdrawals at age 55 while you are still working for the company.

Also Check: How To Get A Hardship Loan From My 401k

Search Databases For Unclaimed Assets

If you still cant find information on your lost 401 plans, you can also try searching one of the publicly available databases for unclaimed assets. The National Registry of Unclaimed Retirement Benefits is a good place to start. By entering your Social Security number, you can quickly see if there are any unclaimed retirement funds that belong to you. The money may still be held in the employers plan, or the company may have opened a special IRA account in your name to hold the funds.

You can also search using the National Association of Unclaimed Property Administrators site, which will help you track down unclaimed money you may be owed, not limited to retirement assets. Be sure to check in each state you have lived or worked. The site processes tens of millions of requests each year and has helped return more than $3 billion in unclaimed assets annually.

How Can Plan Sponsors Deal With Uncashed / Stale

There are solutions that can a) proactively minimize the uncashed check problem to begin with, and b) deal with uncashed distribution checks that do occur.

Proactive Solutions that Minimize the Uncashed Distribution Check Problem:

- For all separated participants with less than $5,000, implement an automatic rollover program. Importantly, be sure to include accounts with less than $1,000 in the automatic rollover program, as many plans elect to cash out these participants, unwittingly creating an even larger problem with uncashed distribution checks.

- Periodically update your records for lost or missing participants. Many separated participants do not maintain current information. A cost-efficient participant location service can increase the odds that mailed, physical distribution checks will reach their intended destination.

Solutions that Address Uncashed Distribution Checks:

- For uncashed distribution checks less than $5,000, work with an automatic rollover service provider to roll over their funds to a safe harbor IRA, established in the name of the participant. Upon opening and funding of the safe harbor IRA, your plan will be deemed to have fulfilled its fiduciary responsibilities. Ongoing, the automatic rollover service provider should continue to perform searches in order to re-unite the participant or their beneficiary with the retirement savings.

Read Also: Do I Have A 401k Out There

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If you’re rolling over pre-tax assets, you’ll need a rollover IRA or a traditional IRA.

- If you’re rolling over Roth assets, you’ll need a Roth IRA.

- If you’re rolling over both types of assets, you’ll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

You’ll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that you’re still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesn’t match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Bank of America Corporation Report, T. Rowe Price – Get T. Rowe Price Group Inc. Report, Vanguard, Charles Schwab – Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

Recommended Reading: Can You Have A Traditional Ira And 401k

Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Also Check: What Should I Invest In 401k

Find 401 Plan Information Through The Labor Department

Another option is to find plan information through the Department of Labors website. By locating the companys Form 5500, an annual report required to be filed for employee benefit plans, you should be able to find contact information and who the plans administrator was during your employment.

You may also be able to find information on lost accounts through FreeERISA. You must register to use the site, but it is free to search once youve set up your account.

Recommended Reading: How To Pull Out Your 401k Early

How Do I Find Out About Deceased Fathers Accounts 401k Retirement

- Posted on Jan 17, 2012

In order to be considered your fathers heir, you are going to have to start some sort of heirship proceeding in North Carolina where at the end of the day, you are declared the sole heir of your fathers estate. Before even going to that expense, I would see what kind of assets he has. Some private investigators do this type of work. There used to be a web site.. www.missingmoney.com that would search all the states unclaimed property databases for a specific name to see if something was being held. In any case you are going to want to talk to a local probate attorney and get some ideas on which way to head.

Hope this helps. If you think this post was helpful, please check the asnwer was a good answer tab below.Thanks.Mr. Geffen is licensed to practice law throughout the state of Texas with an office in Dallas. He is authorized to handle IRS matters throughout the United States and is licensed to practice in US Tax Court as well as The Court of Claims.This answer is provided as a public service and as a general response to a general question, it is not meant, and should not be relied upon as specific legal advice, nor does it create an attorney-client relationship.

How Much Do You Need To Retire Comfortably

How much you need to retire comfortably isnt black-and-white because the cost of living looks different for each individual. Consider what it takes to live comfortably and maintain your lifestyle. Many experts suggest that youll need roughly 80 percent of your salary after retirement to avoid making sacrifices.

Dont Miss: Whats The Best 401k Investments

You May Like: How To Opt Out Of 401k Fidelity

Amount And Status Of Your Payment

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending the payment.

If you are sent a plus-up Economic Impact Payment after your 2020 tax return is processed:

- The amount of your initial third payment will no longer show in your online account. You will only see the amount of your plus-up payment.

- The status of your initial third payment will no longer show in Get My Payment. You will only see the status of your plus-up payment.

Inherited 401 Distribution Options

You have the following choices for withdrawing funds from your inherited 401. They are discussed in detail below.

Recommended Reading: How To Enroll In 401k

Verifying Rollover Contributions To Plans

A retirement plan isnt required to accept rollover contributions from other plans or IRAs, but if it does, the incoming funds must:

- be permissible rolloversPDF allowed by the plan document,

- come from a qualified plan or IRA,

- be the type of funds eligible to be rolled over, and

- be paid into the new plan no later than 60 days after the employee receives the funds from the old plan or IRA.

The plan administrator should take reasonable steps to evaluate whether these conditions are met. If the funds are coming directly from the old plan or IRA trustee for example, via a check made out to the new plan then there is no 60-day requirement. If the funds were paid to the individual, the plan administrator should ask the individual to certify that the distribution was received not more than 60 days before the date of the rollover. If the rollover contribution is late, the plan administrator can accept the contribution if the individual has a waiver from the IRS or self-certifies under Revenue Procedure 2020-46.

How Can I Find My Old 401 Account

Ask previous employers whether theyre maintaining any accounts in your name. If the company no longer exists, contact the plan administrator. If you dont know the name of the plan administrator, search the Department of Labor website for the companys Form 5500 , which will list their contact information. You might also check the states unclaimed property database via the National Association of Unclaimed Property Administrators .

Darin Bostic, a Schwab financial planner, points out that the best way to keep track of your funds is not to lose them in the first place. Consolidating similar accounts, such as old and new brokerage or IRAs, can help you keep track of your savings, says Darin.

Whats more, consolidation helps ensure your assets are working in harmony toward your long-term goals. Its difficult to follow a comprehensive investment strategy when your money is spread out all over the place.

Recommended Reading: Does Fidelity Offer A Solo 401k

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Also Check: How To Rollover Fidelity 401k To Vanguard

I Cant Find My 401 Now What

Editorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

Were all chasing the almighty dollar, but sometimes we leave behind a few hard-earned ones along the way.

In fact, billions of dollars are left in forgotten 401 plans in the United States that are waiting to be claimed by their rightful owners.

If youre in search of your old 401, here are some tips on how you can track it down.

Don’t Miss: Can I Open A 401k For Myself

Transfer To A Retirement Plan Account With Principal

Simplify your retirement planning with one website, one statement and one dedicated team. If you’re joining a company that offers a retirement plan, your savings stay invested and you can continue to make ongoing contributions to help you save for your future.

Log in to your account or call us at 800-547-7754 and our retirement specialists can help you get the process started.