How To Locate A 401 From A Previous Job

If youre trying to locate an old 401 plan from a previous job, youre not alone. Not by a long shot. Roughly $850 million in plan assets owned by 33,000 employees are orphaned each year, held by a financial institution without an employer to oversee the plan . Thats a lot of money being left on the tableroughly two percent of all 401 plan assets.

The good news is that the Department of Labor has established rules for protecting money put into a 401, so the money isnt necessarily lostjust waiting for someone to claim it. However, that doesnt mean your old 401 account will always be easy to track down. It may take some digging, but there are a variety of ways you can find it.

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Also Check: Can They Take Your 401k If You File Chapter 7

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

How Retirement Benefits Can Go Missing

Its rare for a person to stay with one company an entire career. Additionally, some companies go out of business after several years of successful operations. With both people and companies in constant transition, it is common for people to lose track of their accrued retirement benefits. Whats more, people might know they have retirement benefits available to them but not know how to find what they have.

For example, lets say a person worked for a company from ages 25 to 35, but now is 45. The company the person worked for over a decade ago has gone under. That money is still completely their own, it just might be challenging to find them.

You May Like: Can You Roll A 401k Into An Existing Roth Ira

Contact The 401 Plan Administrator

If your employer is no longer around, try getting in touch with the plan administrator, which may be listed on an old statement.

If youre unable to find an old statement, you still may be able to find the administrator by searching for the retirement plans tax return, known as Form 5500.

You can find a 5500s by the searching the name of your former employer at www.efast.dol.gov.

If you locate a Form 5500 for an old plan, it should have the contact information on it.

Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Recommended Reading: What To Do With Old 401k Account

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

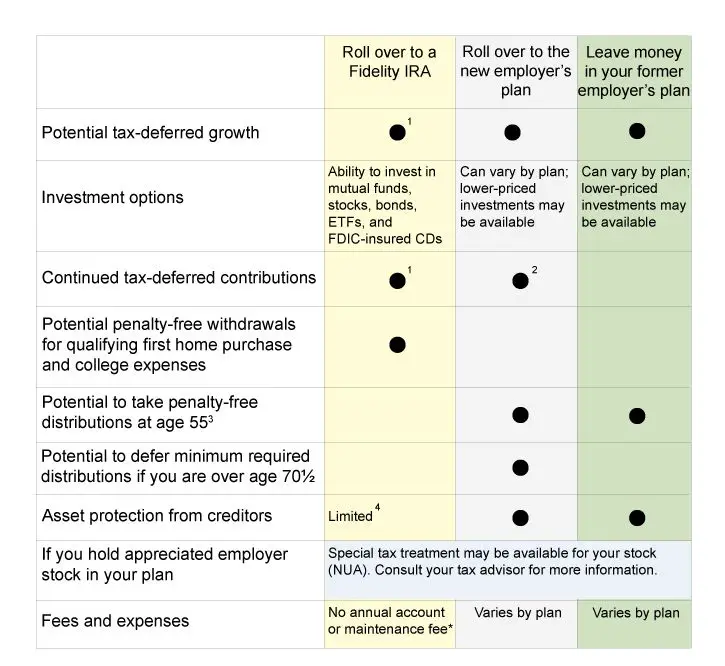

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

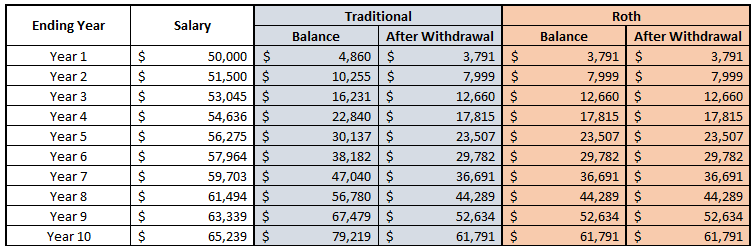

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

Don’t Miss: Can I Get My Own 401k Plan

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

S To Find Your Old 401

Its not all that uncommon to lose a 401 especially if you didnt have much invested to begin with. Its possible you were automatically enrolled in a 401 by your old employer and didnt know the account existed. Or maybe you got caught up in the process of switching jobs and forgot to tie up loose ends.

Whatever the case, you can rest assured that your retirement funds arent gone, and youre entitled to them. Its a simple matter of tracking them down and you can start by contacting your old employer.

1. Contact your old employer

Start your search by reaching out to the human resources department of your previous employer. If you dont have HRs email address or phone number on hand, reach out to any company employees youre still in touch with to request the information.

In most cases, it shouldnt be too hard to reconnect with your old employer, but if your company merged with another firm or went out of business, you may need to move on to step two.

2. Speak to the plan administrator

Now lets say you havent had much luck reaching your old company. The next point of contact will be the plan administrator, which is the investment company responsible for managing the investments in your old 401 account.

3. Search national databases

If you follow these steps and still come up short, try a national database. There are numerous sites and services designed to connect former employees with lost retirement savings.

Read Also: How Do I Check My 401k For Walmart

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Roll Over The Old 401 Account Into An Ira

This will likely be the best option for most people because the IRA is attached to you instead of your employer, making it less likely that youll lose track of the account again. An IRA also comes with a much wider selection of investments than most 401 plans. Youll be able to choose from individual stocks as well as mutual funds, ETFs and more.

If you dont already have an IRA, youll need to set up an account before you roll over your 401. The process is fairly straightforward and you can open an IRA through most online brokers.

You May Like: How Much Is The Max You Can Contribute To 401k

Ways To Dig Up An Old 401 Account

Before we play “lost and found” with your old 401 plan, know that even though you can’t find your 401 account , your plan money is federally protected.

That’s right. By law, nobody can access, steal or otherwise make off with your 401 funds while they’ve gone missing.

With Uncle Sam at your back, use these tips and strategies to find a lost 401 account.

Reference An Old Statement

Because companies reorganize, merge, get acquired, or go out of business every day, its possible that your former employer is no longer around. In that case, try to locate a lost 401k plan statement and look for contact information for the plan administrator. If you dont have an old statement, reach out to former coworkers and ask if they have an old statement.

Read Also: Does 401k Limit Include Match

Don’t Miss: Can You Transfer Your 401k To Another Company

How Do Smaller Businesses Operate A 401

Small employers dont have the resources to staff a competent HR team that understands the complexities of the 401 ecosystem, says Peter Nerone, Compliance Officer at MM Ascend Life Investor Services, LLC in Cincinnati. Small employers also face challenges allowing the key employees to make adequate contributions due to the various coverage and contribution testing protocols.

But the biggest potential issue for small company plans might come from a source you least expect: you.

If youve already demonstrated an aptitude for all things entrepreneurial, that means youre used to flying solo. You may even prefer to work alone. Once you bring on employees, though, your status changes. You need to be aware of and follow rules that are designed to protect employees. This is most true for retirement plans.

This might not strike your fancy, but dont worry. As they say, Theres an app for that.

How To Find Old 401 And Pension Accounts

The challenge will be finding that money and claiming it. If youve worked a dozen jobs and are now in your fifties and looking forward to retirement, theres a good chance youll struggle to remember everywhere you worked. But how do you find old 401 and Pension Accounts?

You might remember carrying bags in a hotel one summer but you might also struggle to remember the name of the hotel or when exactly you were there.

The good news is that you dont have to try to remember every place youve ever worked and that might have given you pension payments.

Recommended Reading: Can I Use My 401k To Buy A Second Home

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Find Lost 401k: How To Find Out If You Have Lost Or Forgotten Retirement Accounts

Here is a guide for how to find lost money a lost 401k or other unclaimed retirement benefits.

Finding a lost 401k or other retirement account is more tedious than metal detector treasure hunting,but perhaps more rewarding.

A few years ago, I received a strange notice in the mail: a former employer was discontinuing their retirement plan and I had 30 days to either roll my balance into a different account or receive a distribution from the plan. This sort of thing happens quite often when people change jobs and leave their retirement account in the old employers plan. The strange thing about this notice was, I had no idea Id been participating in the plan while I worked there!

Could the same thing have happened to you? If youre looking for ways to increase your retirement savings, you just may want to look for lost or forgotten retirement accounts.

Recommended Reading: Can I Transfer My Roth Ira To My 401k

Recommended Reading: How To Calculate Company 401k Match

Contact Your Previous Employer For Information About Your Old 401

Permitting that your previous employer is still in operation, you can reach out to them directly. Typically, the human resources department will have information on your account or point you in the right direction.

Most companies try to reach out by sending mail regarding your account when you leave the company. If you moved when you changed jobs, you might have missed those notifications. If the company did not hear from you for an extended period, it might have transferred your funds to a separate, unmanaged account.

Government And Military Pension Resource

Depending on your role in the military, some pensions are available to both veterans and their survivors. Be sure to refer to the U.S. Department of Veterans Affairs website for more information.

- Department of Veteran Affairs: If you or your deceased spouse is a veteran, you can find information on your pension at the VAs pension website.

- State government websites: If you were an employee of your state or local government, be sure to check your states government website to search for information regarding your pension.

- Federal and military resources: Other government employees and military members can find information regarding federal and military pensions through the Thrift Savings Plan, Department of Defense and Office of Personnel Management websites.

Read Also: How To View My 401k

A National Database To Find Forgotten 401s And Pensions Could Be On The Way But Savers Should Take Action Now To Locate Any Missing Retirement Accounts

Getty Images

At a time when many Americans are worried that they wont have enough money to retire comfortably, thousands have lost track of billions of dollars in savings.

There are more than 24 million forgotten 401 accounts containing some $1.35 trillion in assets, according to a report from Capitalize, which helps workers roll over their retirement plans when they change jobs. Companies are also holding on to billions in unpaid pension payments earned by former employees.

The problem is so widespread that Congress is considering legislation to address it. SECURE Act 2.0, which includes a wide range of benefits and protections for retirement savers , would create a national online lost-and-found database to help people track down these orphaned plans.

Brian Stivers, owner of Stivers Financial Services, in Knoxville, Tenn., says he typically meets one to two new clients a month who are in this situation. Most of the time, theyve changed jobs and forgotten about an old plan, usually because it had a small balance. Retirement plans are also misplaced when one spouse dies and the survivor is unaware of accounts with his or her former employers.