Can Anybody Cash Out A 401 K Early

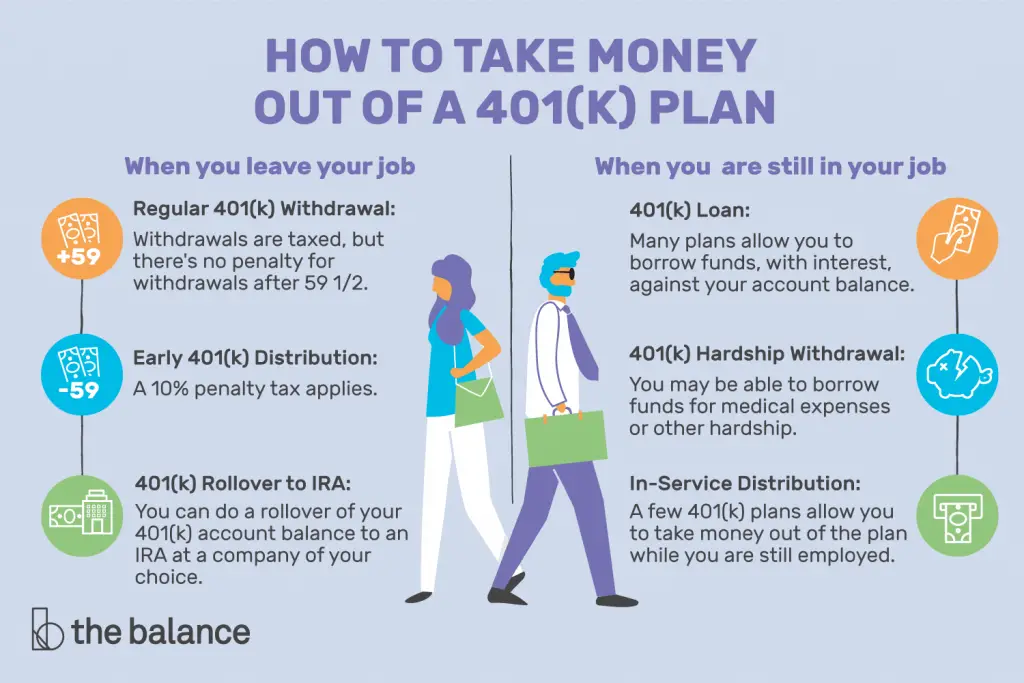

If you resign early, you might want to cash out your 401 k. However, you might face a financial penalty for doing so. If you haven’t reached retirement age, you can often expect to be charged 10% plus ordinary income tax on the amount in your 401 k for an early withdrawal. If you think you might want to take your 401 k money out of the IRA early, you should discuss this with your current employer.

Be Smart With Your 401

Opening a 401 is a smart step on the road to a comfortable retirement, but it’s not quite as simple as signing some papers and setting aside a percentage of your paycheck. You have to understand the rules, choose your investments wisely, and continue to maintain your plan for as long as you own it. If you do that, you can feel confident that you’re giving yourself the best shot at a secure retirement.

What Are Alternatives

Because withdrawing or borrowing from your 401 has drawbacks, it’s a good idea to look at other options and only use your retirement savings as a last resort.

A few possible alternatives to consider include:

- Using HSA savings, if it’s a qualified medical expense

- Tapping into emergency savings

- Transferring higher interest credit card balances to a new lower interest credit card

- Using other non-retirement savings, such as checking, savings, and brokerage accounts

- Using a home equity line of credit or a personal loan3

- Withdrawing from a Roth IRAthese withdrawals are usually tax- and penalty-free

Read Also: How Can I Find An Old 401k Account

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Recommended Reading: Can I Use 401k Money To Start A Business

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

Penalties And Taxes On Cashing Out A 401k

When you complete a 401k cash out, you will need to pay an early withdrawal penalty and 401k taxes on your withdrawal. The 401k early withdrawal penalty is 10% of the amount that you withdraw. You will also be taxed at your normal income rate on the amount that you withdraw. Most plans will withhold 20% of the amount that you withdraw and send it to the IRS to help cover the costs and will send you a 1099-R form. If your tax rate is higher than 10%, then you will need to be prepared to pay additional money when you file your taxes. It is important to be prepared for this possibility.

You May Like: How To Get The Money From Your 401k

Roll Over Your Assets To An Ira

For more retirement investment options and to maintain the tax-advantaged status of the account, roll your old 401 into an individual retirement account . You will have greater flexibility over access to your savings .1 Before-tax assets can roll over to a Traditional IRA while Roth assets can roll directly to a Roth IRA. Review the differences in investment options and fees between an IRA and your old and new employers 401 plans.

How Do You Open A 401

Do the following to open your 401:

Recommended Reading: How To Find A Deceased Person’s 401k

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

You May Like: Is A Rollover From A 401k To An Ira Taxable

Alternatives To Cashing Out A 401k

It is highly recommended that you never take a 401k cash out. The money is there to secure your financial independence in retirement. Thats only possible if its allowed to grow to meet your income needs. Cashing out just $10,000 at the age of 40 years old will cost you over $60,000 by the time you reach 60 years old assuming a 33% tax bracket and 7% annual return. Taxes and withdrawal penalties would cost you an immediate $4,300 of that amount.

If you need money, there are alternatives to cashing out a 401k. These options are available while you are still working with the employer that manages the 401k.

- Consider a home equity line of credit or other low-interest loan before cashing out a 401k plan. Personal loans and other types can carry high interest rates but may still cost less than the taxes and penalties youll pay on a 401k cash out

- Go into emergency spending mode. Cut out all non-essential spending for a few months before considering cashing out a 401k. Talk with your creditors to get extensions where you can and avoid digging yourself deeper in debt

- Borrow or withdraw from Roth IRAs first. You may still be jeopardizing your retirement goals but youve already paid taxes on money contributed to a Roth account so it may ultimately be cheaper than a 401k cash out

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Also Check: Is It Good To Invest In 401k

Can I Take Out Money From 401k

The answer is that you likely can take money from your 401k. There is a great deal of information to address on which option is best for you. Another question to consider is if there are options outside of your 401k that are available to you. With so many options and so much information, it doesnt take long to feel discouraged on which option is best for you. The good news is one of our experienced Financial Guides can unpack this information and help make an unbiased decision that works for you.

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59½ is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

Don’t Miss: What To Do With 401k When You Quit

What The Hell Is A Roth Ira Conversion

OK, Ill tell you! Stop yelling at me!

Anyway, a Roth IRA Conversion is money taken from your Traditional IRA and then transferred over, or converted, into your Roth IRA. Now remember that Traditional IRA contributions are tax-deductible, so when you do a conversion, the amount gets added to your taxable income. So its kinda sorta like a withdrawal, in that you want to do it slowly enough so that you dont get hit with a tax bill, only instead of withdrawing into your checking account, it goes into your Roth IRA.

Which is great, since you can withdraw from your Roth IRA tax-free and penalty-free, but only after 5 years. Note that each withdrawal has its own 5-year countdown. So a withdrawal done in 2000 would only be available for withdrawal in 2005, a withdrawal done in 2001 would only be available in 2006, and so on.

Now you might be thinking thats great, but this is for Traditional IRAs. What does this have to do with 401s?

Well, its true that you cant do a conversion from a 401. BUT, you CAN perform whats called a 401 rollover, and transfer your balance from a 401 into a Traditional IRA. The IRS allows you to do this because if you leave your employer, they want to give you a way regain control over your retirement savings in case you left on bad terms, or the employer goes bankrupt. AND because this is going from a tax-deferred account to another tax-deferred account, a 401 rollover is completely tax-free.

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Read Also: How To Open A 401k With Fidelity

So Whats Right For You

Use this chart to help see which options match your wants and needs.

Investment and Insurance Products are:

- Not insured by the Federal Deposit Insurance Corporation or Any Federal Government Agency.

- Not a Deposit, Obligation of, or Guaranteed by any Bank or Banking Affiliate.

- May Lose Value, Including Possible Loss of the Principal Amount Invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the members of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754, member SIPC. Principal Life and Principal Securities are members of Principal Financial Group®, Des Moines, IA 50392.

Substantially Equal Period Payments

Substantially equal period payments SEPPs) can also be a good option to rely on when you need to cash out some money from your 401, but without paying the penalty fee. These withdrawals cannot be done if you are still working for the employer that sponsors your 401 plan, but if you get the funds out through an IRA, then you can make these withdrawals at any time you want.

If you need money in the short term, the SEPP may not be an ideal choice to go for. Once you start making payments for this kind of withdrawal, you can expect to have to pay for at least five years on it, or until you hit 59 and a half whichever comes first.

If you dont make these payments, the penalty for early withdrawal will apply, and youll also be asked to pay interest on the deferred penalties over the past couple of tax years.

There are two exceptions to this rule. The first exception is when the taxpayer dies, allowing for beneficiary withdrawals. The second exception is when the taxpayer becomes disabled permanently.

The withdrawal and payments will be calculated through methods approved by the IRS. You may get fixed annuitization, fixed amortization, or required minimum distribution. Each will allow you to withdraw different amounts, so you can choose just the one you need.

You May Like: How To Transfer 401k From Adp To Fidelity

Roll Your Money To An Ira

Transfer your money into an Individual Retirement Account .

- Your savings stay invested, with similar tax advantages

- You have access to a wide range of investment options

- You can roll in retirement savings from other jobs

- You can keep contributing money to the account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

Can I Take All My Money Out Of My 401 When I Retire

You are free to empty your 401 as soon as you reach age 59½or 55, in some cases. Its also possible to cash out before, although doing so would normally trigger a 10% early withdrawal penalty.

If you want to cash out everything, you can opt for a lump-sum payment. Think carefully before taking this approach, though. Withdrawing your savings all at once could result in a hefty tax bill and, if not managed wisely, leave you living in severe poverty later on in retirement.

Also Check: Is There A Limit On 401k Contributions