If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

Should You Borrow From Retirement To Buy A Home

Buying a home is one of the most expensive purchases youll ever make. Its so expensive that over 90% of buyers actually take out a mortgage and finance their home. They cant afford to pay cash.

Getting a mortgage is pretty normal actually. There are some unique cases where buyers are super frugal and save for several years to buy a home in cash. Or they may live in a lower cost of living area that makes it more possible.

The rest of us are stuck with trying our luck with a mortgage lender. Plus, coming up with a decent down payment.

A good rule of thumb is to put at least 20% down on your home but even that can be a huge sum of money depending on the home youre trying to buy.

If the home you want costs $250,000, youd have to put $50,000 down to honor the 20% rule. Whether youre aiming to put 20% down or not, coming up with your down payment money may be stressful.

One option some people take is borrowing from their retirement savings to buy their home.

Also Check: Should I Roll My 401k Into An Annuity

Disadvantages Of 401 Loans

- Opportunity CostThe money you borrow will not benefit from the potentially higher returns of your 401 investments. Additionally, many people who take loans also stop contributing. This means the further loss of potential earnings and any matching contributions.

- Risk of Job LossA 401 loan not paid is deemed a distribution, subject to income taxes and a 10% penalty tax if you are under age 59½. Should you switch jobs or get laid off, your 401 loan becomes immediately due. If you do not have the cash to pay the balance, it will have tax consequences.

- Red Flag AlertBorrowing from retirement savings to fund current expenditures could be a red flag. It may be a sign of overspending. You may save money by paying off your high-interest credit-card balances, but if these balances get run up again, you may have done yourself more harm.

Most financial experts caution against borrowing from your 401, but they also concede that a loan may be a more appropriate alternative to an outright distribution, if the funds are absolutely needed.

1. NerdWallet, 2020 American Household Credit Card Debt Study2. Distributions from 401 plans and most other employer-sponsored retirement plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 72, you must begin taking required minimum distributions.

Recommended Reading: How Much Money Do I Have In My 401k

How Do You Repay

Since youre borrowing from your 401 plan, you have to repay the loan. This is typically done by taking a portion of each paycheck and applying it toward your loan. In most cases, you can borrow for a term of up to five years, but longer-term loans may be allowed if youll use the money to buy your home. Again, borrowing is risky, and longer-term loans are riskier than shorter-term loans .

When you repay money that youve borrowed from your 401 plan, you dont get any tax benefits. That money is treated as normal taxable income to you, so it wont be like any pre-tax contributions that youve been making to the plan. You can still contribute to the plan with pre-tax dollars contributions if your plan allows) but you dont get to double-dip and get a tax break on loan repayments. Remember: You werent taxed on the money you received when you took the loan.

If you leave your job before you repay the loan, you should have an opportunity to repay any money you borrowed from the 401. But thats not always easy. You probably took the loan because you needed cash, and its therefore unlikely that you have a lot of extra money sitting around. Try to repay if possible, otherwise, you may face income taxes and tax penalties as described below. If youve been recruited to a new job, you might be able to get some help from your new employer .

If You Take A 401 Loan You’ll Pay Interest To Yourself

When you borrow against your 401, you have to pay interest on your loan. The good news is, you’ll be paying that interest to yourself. Your plan administrator will determine the interest rate, which is usually based on whatever the current prime rate is.

The bad news is, you will pay interest on your 401 loan with after-tax dollars. When you take money out as a retiree, you are still taxed on the distributions at your ordinary income tax rate. This means the money is effectively taxed twice — once when you earn it before using it to pay back your loan, and then again when the withdrawal is made.

The interest you pay yourself is generally also below what you would earn if you had left your money invested.

Also Check: What Employees Can Be Excluded From A 401k Plan

Drawbacks To 401 Loans

Assuming the loan and repayment process goes perfectly smoothly, there are several major reasons you should think twice before borrowing from your 401 fund:

- A 401 loan uses money that should be invested and helping accumulate wealth for your retirement. The funds you pull out of your 401 cannot gain investment value, and the interest payments you’re making to yourself are unlikely to come close to matching the gains you’d make in a moderately successful stock or index fund. contribution or invest elsewhere.)

- For most borrowers, retirement savings get put on hold until the 401 loan is repaid. Payroll deductions for 401 loan repayment typically eliminate or greatly reduce 401 payments for the five years it takes to pay off the loan. Losing five or so years of retirement savings, and likely forfeiting some or all of your employer’s matching contributions to your 401 in the process, is potentially a huge setback in your retirement savings process. The goal with 401 plans, as with all long-term savings programs, is to stash funds in small, steady amounts over long periods of time, and let money accumulate through the power of compound growth and reinvestment. A 401 loan disrupts that process in a major way, and most funds can never fully recover.

If your 401 loan process doesn’t go smoothly, you could face even worse consequences:

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

Don’t Miss: How To Find Your 401k Account Number

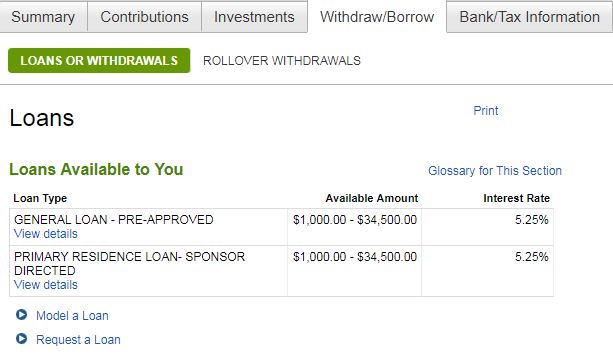

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Hardship Withdrawal Vs 401 Loan: An Overview

Is it ever OK to borrow from your 401 plan, either as a 401 loan or a hardship withdrawal? After all, your plan is a powerful retirement savings tool and should be carefully handled. Indeed, data from Fidelity shows that the average account balance has climbed to $112,300, as of February 2020.

The recently enacted CARES Act lets you make a penalty-free COVID-19 related withdrawal or take out a loan from your 401 in 2020 with special repayment provisions and tax treatment.

The primary advantage of saving in a 401 is the ability to enjoy tax-deferred growth on your investments. When youre setting aside cash for the long term, a hands-off approach is usually best. Nevertheless, there are some scenarios in which taking money out of your 401 can make sense.

Before you pull the trigger, though, its important to understand the financial implications of tapping your retirement plan early. There are two basic avenues for taking some money out before reaching retirement age.

Don’t Miss: What Is An Ira Account Vs 401k

Possible Uses Of A Margin Loan

For example, suppose you’ve been investing for a number of years and have built a diversified portfolio of investments in a marginable brokerage account worth $500,000 comprised of marginable securities like stocks, ETFs, and mutual funds. Now, you’re thinking about remodeling your kitchen, and you need $50,000 for the project. When thinking about how to pay for it, you might opt to simply liquidate $50,000 from your account. That’s a very simple, straightforward option, and it may be the best option for many people, but it might also mean you’d be subject to taxes on capital gains, and it would definitely reduce your exposure to potential market gains.

So, depending on your circumstances, you might also think about borrowing the $50,000. In that case, you might consider using a credit card, getting a bank loan, or leveraging some of the securities in your portfolio as a line of credit via margin. The right answer depends on a careful consideration of a variety of factors, including your financial needs, tax considerations, your liquidity situation, and risk tolerance.

Before considering margin as an option, it is important to fully understand margin requirements. Once again, the following is highly simplified, so it should be regarded only as a rough, high-level guide to the process.

X = $50,000 / X = $71,429

Why Use A Roth Ira To Buy A Home

Technically speaking, you can withdraw savings from almost any tax-advantaged retirement account to fund a first-time home down payment. IRS early withdrawal rules let you take out up to $10,000 of investment earnings penalty-free to fund the purchase of your first home. And the IRS considers you a first-time home buyer so long as you havent owned a home for the last two years.

But early withdrawals from accounts like your traditional 401 or individual retirement account still raise your tax bill. While youre off the hook for the 10% early withdrawal penalty, youll still owe income tax on everything you withdraw. Thats because your original contributions were tax free.

Withdrawals from a Roth IRA, on the other hand, are tax and penalty free as long as youve had the account open for at least five years. But just because you can withdraw from your Roth IRA to finance your first home purchase doesnt mean you should.

Pulling money out of your Roth IRA could mean missing out on investment growth, says Eric Roberge, CEO and lead advisor of Beyond Your Hammock, a a fee-only financial planning firm. However, it might make sense, depending on your situation.

If you no longer need your Roth IRA money for retirement, then you may be able to tap the account to generate the cash needed for the purchase, Roberge says.

You May Like: Can A Qualified Charitable Distribution Be Made From A 401k

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know

How Long Do You Have To Repay A 401 Loan

Generally, you have up to five years to repay a 401 loan, although the term may be longer if youre using the money to buy your principal residence. IRS guidance says that loans should be repaid in substantially equal payments that include principal and interest and that are paid at least quarterly. Your plan may also allow you to repay your loan through payroll deductions.

The CARES Act allows plan sponsors to provide qualified borrowers with up to an additional year to pay off their 401 loans.

The interest rate youll pay on the loan is typically determined by the plan administrator based on the current prime rate, but it and the repayment schedule should be similar to what you might expect to receive from a bank loan. Also, the interest isnt paid to a lender since youre borrowing your own money, the interest you pay is added to your own 401 account.

Read Also: How To Take Money Out Of 401k Without Penalty

Ways To Help Manage A Margin Line Of Credit

To ensure that you’re using margin prudently, it may be possible to manage your margin as a line of credit by employing the following strategies:

- Have a plan. You should never borrow more than you can comfortably repay. Think about a process for taking out the loan and ensuring that it aligns with your financial situation, and consider how you’ll respond in the event of various market conditions. Among other things, you should know how much your account can decline before being issued a margin call. Find out more on managing margin calls

- Set aside funds. Identify a source of funds to contribute to your margin account in the event that your balance approaches the margin maintenance requirement. This can be anything from cash in another account to investments elsewhere in your portfolio .

- Monitor your account frequently. Consider setting up alerts to notify you when the value of your investments declines by an amount where you need to start thinking about the possibility of a margin call.

- Pay interest regularly. Interest charges are automatically posted to your account monthly. It’s important to have a plan for reducing your margin balance to minimize the interest amount you’re charged which you can do by selling a security or depositing cash into your account.

Other Alternatives To A 401 Loan

Borrowing from yourself may be a simple option, but its probably not your only option. Here are a few other places to find money.

Use your savings. Your emergency cash or other savings can be crucial right now and why you have emergency savings in the first place. Always try to find the best rate on an online savings account so that youre earning the highest amount on your funds.

Take out a personal loan. Personal loan terms could be easier for you to repay without having to jeopardize your retirement funds. Depending on your lender, you can get your money within a day or so. 401 loans might not be as immediate.

Try a HELOC. A home equity line of credit, or HELOC, is a good option if you own your home and have enough equity to borrow against. You can take out what you need, when you need it, up to the limit youre approved for. As revolving credit, its similar to a credit card and the cash is there when you need it.

Get a home equity loan. This type of loan can usually get you a lower interest rate, but keep in mind that your home is used as collateral. This is an installment loan, not revolving credit like a HELOC, so its good if you know exactly how much you need and what it will be used for. While easier to get, make sure you can pay this loan back or risk going into default on your home.

Recommended Reading: How Much Should I Have In My 401k At 55