Qualified Distributions Vs Direct And Indirect Rollovers

Direct and indirect rollovers are key aspects of Roth IRAs and other forms of retirement plans along with qualified distributions. Most rolloverswhether direct or indirectoccur when people change jobs, but some occur when account holders want to switch to an IRA with better benefits or investment choices.

In a direct rollover, the retirement plan administrator pays the plans proceeds directly to another plan or an IRA, such as a 401 plan. In an indirect rollover, a plan administrator transfers assets among plans by giving an employee a check to be deposited into their own personal account. With an indirect rollover, it is up to the employee to redeposit the funds into the new IRA within the allotted 60-day period to avoid penalty.

Who Can Receive Qualified Charitable Distributions

For tax purposes, qualified charities are defined by the IRS. This is their list of the types of organizations that qualify as qualified charities:

- A community chest, corporation, trust, fund, or foundation

- A church, synagogue, or other religious organization

- War veterans organizations

- Nonprofit volunteer fire companies

- A civil defense organization created under federal, state, or local law

- A domestic fraternal society that operates as a lodge

- A nonprofit cemetery

Donations to states or the federal government are also considered charitable contributions if the donation is made strictly for public purposes.

The IRS has a handy tool that lets you look up a charitable organization to see if it is registered and can accept donations.

What Type Of Acknowledgment Should I Expect To Receive From My Ira Gift To Harvard

Harvard sends an acknowledgment and statement that no goods or services were received in exchange for the gift to your IRA administrator. Separately, you will receive a letter of thanks that states the gift is an IRA QCD and confirms the designation. You will receive recognition gift credit for the full amount of your gift.

You May Like: How Do I Invest In My 401k

Make Deductible Contributions To Employer

As discussed earlier, the QCD anti-abuse rule requires that QCD amounts be reduced by the aggregate amount of deductions allowed to the taxpayer under section 219. And notably, IRC Section 219 is the Section of the Internal Revenue Code that provides for the deduction for contributions made to Traditional IRAs. And only Traditional IRAs.

So, one logical option for individuals who are 70 1/2 or older and want to lower their taxable income via contributions to a retirement account is to make those contributions to a retirement account that is not a Traditional IRA!

Those individuals who are 70 1/2 or older and work for a company over which they exercise no control will be at the mercy of the company when it comes to whether income-lowering employer retirement plan contributions can be made. If there isnt a 401 or similar option provided by the company, theres simply not much, if anything, theyll be able to do about it.

If, however, the employer does offer such a plan, then workers who are 70 1/2 or older can feel free to contribute to the plan, and do so without fear of running afoul of the IRA QCD anti-abuse rules .

How To Reap The Tax Benefits Of Charitable Giving During Retirement

Most people know that donating to charity can have tax benefits. But did you know that with the recent tax code changes, fewer and fewer people are benefiting from their cash donations?

In fact, youre even less likely to benefit from your charitable giving if you arent making mortgage payments or have a lower annual incomein other words, if youre retired. This is unfortunate news if youre charitably minded and had planned to increase your giving during retirement.

Thankfully, theres another way to engage in charitable giving that doesnt exclude you from a tax benefit: the qualified charitable distribution. Heres what you should know about making one.

Also Check: How To Invest My 401k Money

Remove 2020 Unwanted Traditional Ira Contributions As Excess Contributions

While the SECURE Act has not received the same amount of attention as other recent tax legislation, such as the Tax Cuts and Jobs Act, it has still received a fair amount of coverage, particularly in the financial media. Through such media coverage or otherwise, its possible that certain individuals may have become aware of the ability to make post-70 1/2 Traditional IRA contributions without fully understanding the potential impact that such contributions would have on future distributions intended as QCDs.

In such instances, if an individual wishes to make QCDs with existing IRA money, one option would be to remove traditional IRA contributions, to the extent possible, by using the excess contribution rules. Notably, while the excess contribution rules are generally used to remove contributions that cannot be in an IRA , they may also be used to voluntarily remove legally permissible contributions that the account owner no longer wants in the account for instance, because of the QCD anti-abuse rules and a plan to make future QCDs!

Requirements For Qualified Charitable Distributions From An Ira

The core requirements for making Qualified Charitable Distributions from an IRA to a charity are contained in IRC Section 408 .

Under the QCD rules, the IRA owner must be at least age 70 ½ to do the QCD to the charity . Under IRS Notice 2007-7, Q& A-37, even a beneficiary of an inherited IRA can be eligible for a QCD, as long as the beneficiary themselves is at least age 70 ½ on the date of the distribution.

The maximum dollar amount of a QCD for any individual from his/her IRAs is limited to $100,000 per year. For QCDs, this annual limitation is done on a per-taxpayer basis , though as a per-taxpayer limitation a married couple can each do up to $100,000 .

Only distributions from an individual IRA are eligible, and not from a SEP or SIMPLE IRA , nor from any type of employer retirement plan. Notably, a QCD is permitted from a Roth IRA as well, though most distributions from a Roth IRA are already tax-free and therefore QCD rules wouldnt be relevant anyway .

To qualify for QCD treatment, the rules also stipulate that the distribution must go to a public charity ), and thus cannot go to a private foundation, nor may a QCD go to a charitable supporting organization or a donor-advised fund, either.

Read Also: How Much In 401k To Retire

I Am Over Age 70 Must I Receive Required Minimum Distributions From A Sep

Both business owners and employees over age 70 1/2 must take required minimum distributions from a SEP-IRA or SIMPLE-IRA. There is no exception for non-owners who have not retired.

The SECURE Act made major changes to the RMD rules. For plan participants and IRA owners who reach the age of 70 ½ in 2019, the prior rule applies and the first RMD must start by April 1, 2020. For plan participants and IRA owners who reach age 70 ½ in 2020, the first RMD must start by April 1 of the year after the plan participant or IRA owner reaches 72.

How A Qualified Charitable Distribution Works

Normally, a distribution from a traditional IRA incurs taxes since the account holder didnt pay taxes on the money when they put it into the IRA. But account holders aged 70½ or older who make a contribution directly from a traditional IRA to a qualified charity can donate up to $100,000 without it being considered a taxable distribution. The deduction effectively lowers the donor’s adjusted gross income .

To avoid paying taxes on the donation, the donor must follow the IRS rules for qualified charitable distributions aka, charitable IRA rollovers. Most churches, nonprofit charities, educational organizations, nonprofit hospitals, and medical research organizations are qualified 5013 organizations. The charity will also not pay taxes on the donation.

This tax break does mean that the donor cannot also claim the donation as a deduction on Schedule A of their tax return. Other donations to charity that don’t use IRA funds, however, can still be claimed as an itemized deduction. Since the Tax Cuts and Jobs Act increased the base standard deduction, for 2019, to $12,200 for individuals, $18,350 for heads of household, and $24,400 for married couples filing jointly, many fewer taxpayers will itemize on Schedule A, making the upfront deduction potentially even more important.

For 2021, the base standard deduction is $12,550 for individuals or married individuals filing separately, $18,800 for heads of household, and $25,100 for married couples filing jointly.

Read Also: How To Get Your 401k Without Penalty

Advantages Of Making A Donor

Although designating any qualified charity as a beneficiary usually allows an estate to claim a charitable contribution deduction, naming a public charity with a donor-advised fund programsuch as Fidelity Charitableas beneficiary of a tax-deferred retirement account such as an IRA or 401 gives clients and heirs more flexibility. A donor-advised fund is a program of a public charity that functions like a tax-advantaged charitable checking account that can be used solely for giving.

- Upon death, your IRA assets can fund the donor-advised fund. It can then be distributed to charities immediately or over time through an endowed giving program. Or you can let a trusted friend or family member make the choicea designated account successor can then make grant recommendations over time to the charities they would like to support.

- Alternatively, you can use your assets to provide multiple heirs with a fund to support their individual charitable giving by specifying that the IRA be allocated across multiple Giving Accounts. In that case, each individual will have their own Giving Account, creating a legacy of giving that can stretch far into the future.

When To Consider This Strategy

These gifting tactics may pay off for a limited number of individuals, Foster said.

The strategy may work for someone planning to make a significant charitable gift in 2021. For example, it may be appealing to a philanthropic retiree with excess money in pretax retirement accounts.

“All you’re doing is accelerating future income into the present,” Foster said.

Don’t Miss: How To Open A Solo 401k

How Do I Take A Qualified Charitable Distribution

You can sell shares from your Vanguard mutual funds or Vanguard brokerage account by check to donate to a qualified charity. This is called a qualified charitable distribution . You can take a qualified charitable distribution from your IRA.

Why do this?

- You may be able to avoid taxes on otherwise taxable distributions if you’re drawing from a traditional IRA.

- A qualified charitable distribution is not subject to ordinary federal income taxes the amount is simply excluded from your taxable income. In general, QCDs must be reduced by deductible IRA contributions made for the year you reach age 70½ or later. If you’ve made deductible IRA contributions for the year you turn 70½ or later, consult a qualified tax advisor prior to taking a QCD to determine the amount by which your QCD must be reduced.

- Your annual Required Minimum Distribution may be donated to a qualified charity.

When can you do this?

- You must be at least 70½ at the time of the distribution. A QCD can be made after age 70½ even if you’re not subject to RMDs yet .

How can you do this?

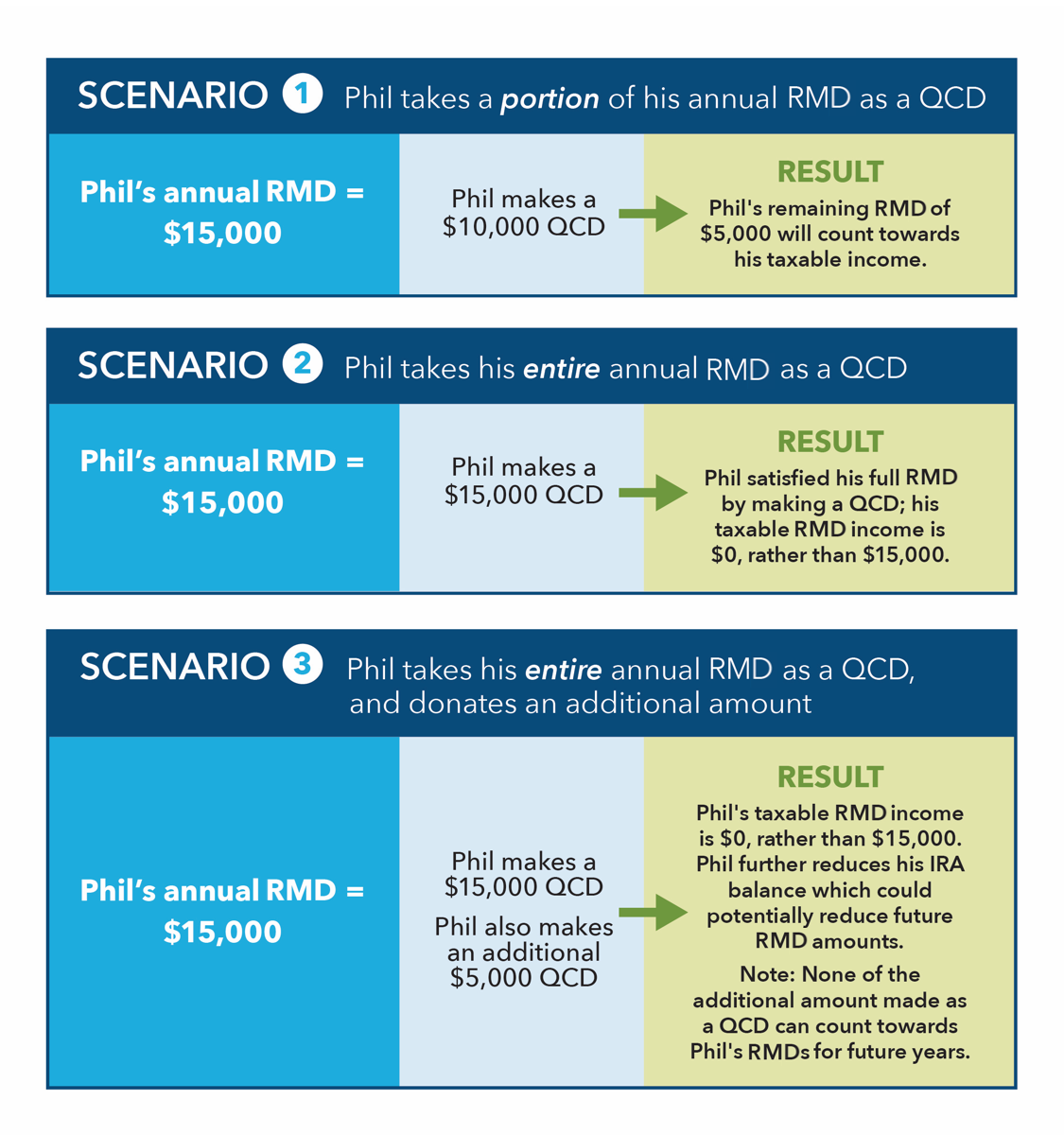

About taking a qualified charitable distribution for your RMD

- Your QCD counts towards satisfying your RMD once you reach RMD age.

- Up to a maximum of $100,000 of your RMD can be donated to a qualified charity.

- If you have the RMD service, be sure to factor in these donations to avoid distributing more than your annual RMD.

- Qualified charitable distributions are counted for the tax year in which they’re taken.

What Kind Of Charities Qualify

The charity must be a 501 organization, eligible to receive tax-deductible contributions.

Some charities do not qualify for QCDs:

- Private foundations

- Supporting organizations: i.e., charities carrying out exempt purposes by supporting other exempt organizations, usually other public charities

- Donor-advised funds, which public charities manage on behalf of organizations, families, or individuals

You May Like: Can I Contribute To Traditional Ira And 401k

Why Did The Secure Act Need To Include A Qcd Anti

Given the outcome described above, is it fair to wonder if the anti-abuse rule was really necessary in the first place? The answer, debatably, is probably.

Lets start with the premise that when it comes to the Internal Revenue Code, its fair for Congress to assume that where a so-called loophole or other gap in the tax law exists, taxpayers will attempt to drive a proverbial Mack Truck through that gap to exploit it to the extent legally permissible. Frankly, finding and using and maximizing those gaps is the principal job of many tax professionals and a significant component of the role that many Financial Advisors play for their clients!

With this in mind, one can begin to understand why Congress crafted its potentially-charitable-giving-disincentivizing QCD anti-abuse rule into the SECURE Act. Because without it, an individual could use the new ability to make a deductible Traditional IRA contribution, coupled with the continued ability to make QCDs, and skirt the limitations of regular charitable contributions by essentially using a deductible Traditional IRA contribution to really make a charitable contribution. Interestingly, however, Congress seems to only take issue with post-70 1/2 deductible Traditional IRA contributions, as such a contribution made in an individuals age-69-year could be used to make a QCD without fear of running into the QCD anti-abuse rule in future years.

Congress apparently thought so

Support Charitable Desires Via Other Tax

Perhaps the easiest way to avoid the QCD anti-abuse rule is to avoid making QCDs altogether. Instead, other tax-efficient methods of giving to charity can be considered, such as donating highly appreciated stock and avoiding the capital gains tax that would otherwise be due if the stock were sold instead.

For those who already itemize deductions on their income tax return prior to making any charitable contributions , this may be a viable alternative to consider.

Unfortunately, though, when the Tax Cuts and Jobs Act roughly doubled the Standard Deduction, it made it much more unlikely that a taxpayer would Itemize Deductions on their return, and thus, much more difficult to qualify to receive a tax break for charitable contributions.

Consider, for instance, two married spouses who are both 72 years old. In 2020, they have $10,000 of itemized deductions before making any charitable contributions for the year. For such a couple, their Standard Deduction would be $24,800 + $1,300 + $1,300 = $27,400. Thus, it would take more than $17,400 of charitable contributions before the couple would see any tax benefit in the form of a higher deduction !

Also Check: How To Do A Direct 401k Rollover

The Church Of Jesus Christ Of Latter

To make an IRA qualified charitable distribution to the Church that includes tithing, fast offerings, and/or ward mission fund:

The Church is able to accept IRA Qualified Charitable Distribution payments from donors when adequate information is provided with each donation. To accommodate the process, donors need to work with their IRA companies to ensure each payment includes the following information:

- Donors Member Record Number

- Donors Full Name

There are two options for sending an IRA QCD distribution to the Church:

Option #1The IRA company may send the distribution check directly to Church Headquarters at the address shown below. The donor must ensure the IRA company includes all required donation information or the payment may be returned to the company for further handling.

Option #2The IRA company may send the distribution check directly to the donor who will then be responsible to include the required donation details . The donor must send the original check from the IRA company, with the required donation details, to the Church at the address below.

All checks should be made payable to: The Church of Jesus Christ of Latter-day SaintsAn acceptable version of the payee name: The Church of Jesus Christ

Tax Identification Number: 87-0234341

Checks should be delivered to:The Church of Jesus Christ of Latter-day Saints50 E North Temple Street, Room 1521/IRASalt Lake City, UT 84150

Treasury Services may be contacted by email at or call 801-240-2554.

Penn Medicine Planned Giving

Retirement Account Beneficiary Designation

How It Works

You name Penn Medicine as the beneficiary of your IRA, 401, 403 or other qualified plan.

After your lifetime, the gift comes to Penn Medicine tax-free.

Benefits

-

You can escape income taxes by leaving it to Penn Medicine.

-

You can give the most-taxed asset in your estate to Penn Medicine and leave more favorably taxed property to your heirs.

-

You can continue to take withdrawals during your lifetime.

-

You can change the beneficiary if your circumstances change.

Qualified Charitable Distribution

Individuals who are at least age 70½ at the time of the contribution.

How much can I transfer?

Up to $100,000 each tax year.*

*The recent enactment of the SECURE Act made changes to dollar limits on QCDs. Please check with your advisor to determine how those changes may impact you.

From what accounts can I make transfers?

Transfers must come from traditional IRAs directly to charity. If you have retirement assets in a 401, 403, etc., you must first roll those assets into an IRA, and then can make the transfer from the IRA directly to charity.

Can I use the transfers to fund life-income gifts like charitable remainder trusts or charitable gift annuities?

No, these are not eligible.

Can I make a transfer to my donor advised fund or supporting organization?

No, these are not eligible.

What are the tax implications?

Can the transfer qualify as my minimum required distribution?

Yes, especially if:

For More Information

Also Check: How Do I Stop My 401k

Basic Requirements And Limitations For A Qualified Charitable Distribution Include:

- The donor must be at least 70½ years of age at the time of the distribution.

- The distribution must be from a Roth or Traditional IRA.

- The distribution must be made directly from the IRA administrator to a qualifying charity such as The Church of Jesus Christ of Latter-day Saints or any of its institutions of higher education .

- Qualified Charitable Distributions are limited to $100,000.00 per individual per year .