When Should I Take Out A 401 Loan

Most employer-sponsored 401 retirement plans allow employees to borrow against their accounts, but employers can restrict what you’re allowed to use the funds for. You’re also putting your retirement savings at risk, so be careful about what you’re borrowing for regardless of if there’s a restriction.

Situations that may necessitate a 401 loan include:

- Funeral expenses

- Making a down payment on a house

- Covering costs to prevent foreclosure or eviction

- Paying education costs for yourself or your family members

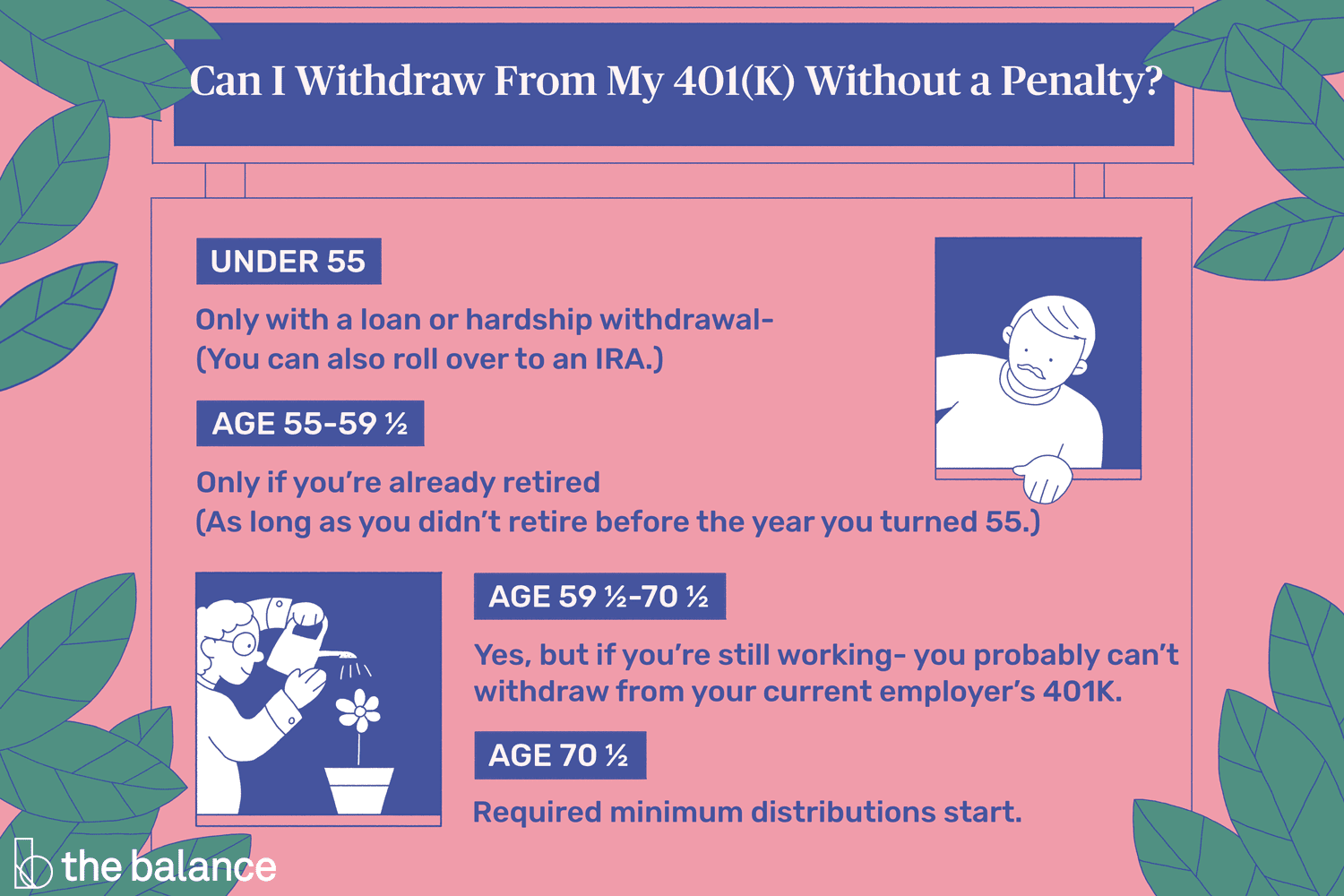

When Can I Withdraw From My 401 Before Retirement But Without Tax Penalties

You don’t have to be in retirement to start withdrawing money from your 401. However, there are penalties involved depending on your age. If you wait until after you are 59 1/2, you can withdraw without any penalties. If you can’t wait until you are 59 1/2, then you will experience a 10% penalty on the amount withdrawn.

If You Default On Your 401 Loan You’ll Owe A Penalty

If you do not pay your 401 loan back as required, the defaulted loan is considered a withdrawal or distribution and thus subject to a 10% penalty applicable to early withdrawals made before age 59 1/2. That’s potentially a huge cost, especially when you also consider the loss of the potential gains your money would have made had you left it invested.

The penalty for defaulted loans still applies to COVID-19 related loans taken under the CARES Act’s special rules applicable in 2020. This can be confusing, as the CARES Act also altered the rules for withdrawals, enabling you to take a coronavirus-related distribution from your 401 in 2020 without incurring the customary 10% tax penalty. Unfortunately, if you default on your 401 loan, it doesn’t convert to a penalty-free withdrawal, even if you would have been entitled to one in 2020.

Recommended Reading: Should I Do Roth Or Traditional 401k

Will A 401 Loan Default Affect Your Credit Score

If you default on a 401 loan, your employer will not report the delinquent account to credit bureaus. Hence, defaulting on a 401 will not affect your credit score. Rather, once you default on your 401 repayment, the plan administrator will send you Form 1099 and a copy of this form will be sent to the IRS. This form reports the amount you owe the IRS in taxes, and you will have until April 15 of the following year to pay annual income tax returns.

What Happens If You Leave Your Job

When you take out a loan from a 401, you may have no intention of leaving your current employer. But if you receive a better job offer, or are laid off or otherwise leave, you could be required to pay the loan back in full or face some serious tax consequences.

Employees who leave their jobs with an outstanding 401 loan have until the tax-return-filing due date for that tax year, including any extensions, to repay the outstanding balance of the loan, or to roll it over into another eligible retirement account. That means if you left your job in January 2020, you would have until April 15, 2021 when your 2020 federal tax return is due to roll over or repay the loan amount. Prior to the Tax Cuts and Jobs Act of 2017, the deadline was 60 days.

If you cant repay the loan, your employer will treat the remaining unpaid balance as a distribution and issue Form 1099-R to the IRS. That amount is typically considered taxable income and may be subject to a 10% penalty on the amount of the distribution for early withdrawal if youre younger than 59½ or dont otherwise qualify for an exemption.

Unfortunately, this worst-case scenario isnt rare. A 2014 study from the Pension Research Council at the Wharton School of the University of Pennsylvania found that 86% of workers in the sample who left their jobs with a loan outstanding eventually defaulted on the loan.

Read Also: What Happens When You Roll Over 401k To Ira

Repaying The 401 Loan

You should make payments at least quarterly, but commonly, this interval is manageable as you’ll repay your loan through payroll deductions. The longest repayment term allowed is five years, though there are exceptions. Some 401 plans do not allow you to contribute to the plan for a certain period after you take out a loan.

If you lose your job while you have an outstanding 401 loan, you may need to repay the balance in full or risk having it be categorized as an early distribution, which can result in both taxes owed and a penalty from the IRS.

How Does A 401 Loan Work

Madelyn Goodnight / The Balance

Borrowing from your 401 isn’t the best ideaespecially if you don’t have any other savings put toward your retirement years. However, when it comes to a financial emergency, your 401 can offer loan terms that you won’t be able to find at any bank. Before you decide to borrow, make sure you fully understand the process and potential ramifications. Below are seven things you need to know about 401 loans before you take one out.

Don’t Miss: Why Cant I Take Money Out Of My 401k

How Much Can Be Borrowed From A 401 Loan

It depends on how much you have in your account. You can borrow up to 50% of your vested account balance, but you cant borrow more than $50,000. Even if you have a balance of $200,000, the IRS wont let you touch more than $50,000 of it.

The only time you can borrow more than 50% is when you have a balance of less than $20,000. In that case, you can borrow up to $10,000, even if you only have $10,000 stashed away.

Possible Consequences If You Borrow From Your 401

Although paying yourself interest on money you borrow from yourself sounds like a win-win, there are risks associated with borrowing from your retirement savings that may make you want to think twice about taking a 401 loan.

- The money you pull out of your account will not be invested until you pay it back. If the investment gains in your 401 account are greater than the interest paid to your account, you will be missing out on that investment growth.

- If you are taking a loan to pay off other debt or because you are having a hard time meeting your living expenses, you may not have the means to both repay the loan and continue saving for retirement.

- If you leave your job whether voluntarily or otherwise, you may be required to repay any outstanding loan, generally within 60 days.

- If you cannot repay a 401 loan or otherwise break the rules of the loan terms, in addition to reducing your retirement savings, the loan will be treated as taxable income in the year you are unable to pay. You will also be subject to a 10% early distribution tax on the taxable income if you are younger than age 59½. For example, if you leave your employer at age 35 and cannot pay your outstanding loan balance of $10,000, you will have to include $10,000 in your taxable income for the year and pay a $1,000 early distribution tax.

Don’t Miss: How Do I Transfer 401k To New Employer

Alternatives To Tapping Your 401

If you must tap into retirement savings, it’s better to look at your other accounts firstspecifically IRAsespecially if you’re buying a first home .

Unlike 401s, IRAs have special provisions for first-time homebuyerspeople who haven’t owned a primary residence in the last two years, according to the IRS.

First, look to take a distribution from your IRAif you have one. You may be able to withdraw IRA contributions without penalty due to a qualified financial hardship. You can also withdraw up to $10,000 of earnings tax-free if the money is used for a first-time home purchase. As a first-time homebuyer, you can take a $10,000 distribution without owing the 10% tax penalty, although that $10,000 would be added to your federal and state income taxes. If you take a distribution larger than $10,000, a 10% penalty would be applied to the additional distribution amount. It also would be added to your income taxes.

What Qualifies As A Hardship Withdrawal For 401k

Hardship distributions

A hardship distribution is a withdrawal from a participants elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrowers account.

Read Also: How Much Money Should I Put In My 401k

When Faced With A Sudden Cash Crunch It Can Be Tempting To Tap Your 401 More Than A Few Individuals Have Raided Their Retirement Account For Everything From Medical Emergencies To A Week

But if you’re under 59-1/2, keep in mind that an early withdrawal from your 401 will cost you dearly. You’re robbing your future piggy bank to solve problems in the present.

You’ll miss the compounded earnings you’d otherwise receive, you’ll likely get stuck with early withdrawal penalties, and you’ll certainly have to pay income tax on the amount withdrawn to Uncle Sam.

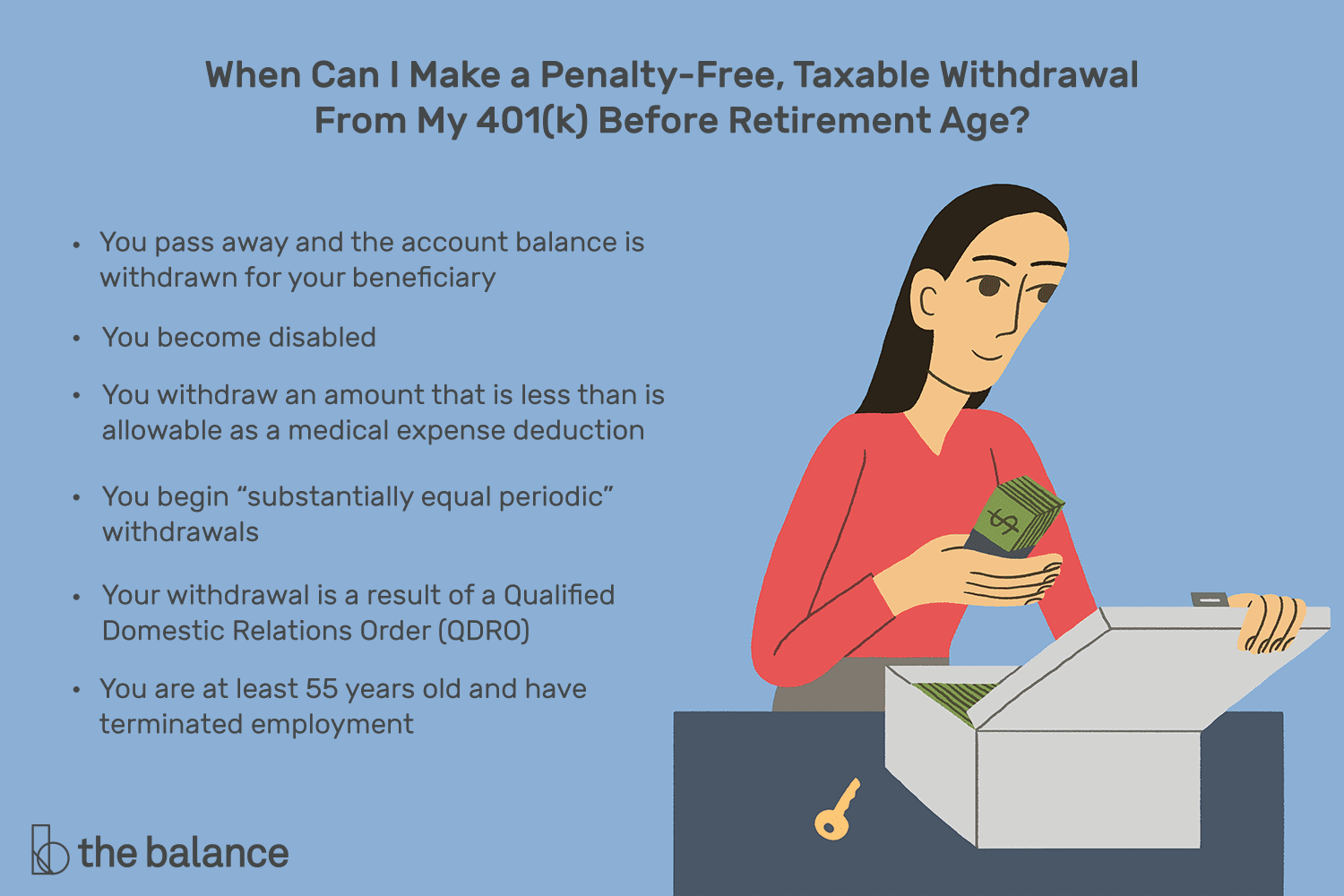

If you absolutely must draw from your 401 before 59-1/2, and emergencies do crop up, there are a few ways it can be done.

Hardship withdrawals

You are allowed to make withdrawals, for example, for certain qualified hardships — though you’ll probably still face a 10% early withdrawal penalty if you’re under 59-1/2, plus owe ordinary income taxes. Comb the fine print in your 401 plan prospectus. It will spell out what qualifies as a hardship.

Although every plan varies, that may include withdrawals after the onset of sudden disability, money for the purchase of a first home, money for burial or funeral costs, money for repair of damages to your principal residence, money for payment of higher education expenses, money for payments necessary to prevent eviction or foreclosure, and money for certain medical expenses that aren’t reimbursed by your insurer.

Loans

Most major companies also offer a loan provision on their 401 plans that allow you to borrow against your account and repay yourself with interest.

You then repay the loan with interest, through deductions taken directly from your paychecks.

Our Take: When Can You Withdraw From Your 401k Or Ira Penalty

There are a number of ways you can withdraw from your 401k or IRA penalty-free. Still, we recommend not touching your retirement savings until you are actually retired. Compounding is a huge help when it comes to maximizing your retirement savings and extending the life of your portfolio. You lose out on that when you take early distributions. To see how much compounding can affect your 401k account balance, check out our article on the average 401k balance by age.

We understand that its always possible for unforeseen circumstances to arise before you reach retirement. Being aware of the exceptions allows you to make informed decisions and possibly avoid paying extra fees and taxes.

To take control of your finances, a good place to start is by stepping back, getting organized, and looking at your money holistically. Personal Capitals free financial dashboard will allow you to:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Also Check: How To Find My 401k Money

What Happens If I Have A 401k Loan And Quit My Job

If you quit working or change employers, the loan must be paid back. If you cant repay the loan, it is considered defaulted, and you will be taxed on the outstanding balance, including an early withdrawal penalty if you are not at least age 59 ½. You have no flexibility in changing the payment terms of your loan.

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Visit the IRS website for more details.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Don’t Miss: How To Avoid Penalty On 401k Withdrawal

A Deeper Dive On The 401 Loan Option

A loan is more strategic than a withdrawal, which torpedoes your savings altogether. With a full cash-out, instantly you lose a big chunk, paying a 10% penalty to the IRS if you leave the plan under age 55 plus another 20% for federal taxes. For instance, with a $50,000 withdrawal, you may keep just $32,500 and pay $17,500 in state and federal taxes. And the leftover sum you receive, if you happen to be in a higher tax bracket, may nudge you into paying even more taxes for that additional annual income.

Another adjustment in 2020 for workers affected by COVID-19: If your plan allows or through your IRA, you can withdraw up to $100,000 without the 10% penalty even if youre younger than 59½. The standard 20% federal tax withholding does not apply, but 10% withholding will unless you decide otherwise. You also can spread your income tax payments on the withdrawal over three years.

We understand emergencies can leave people with limited choices. Just remember that even the less extreme option of a 401 loan may paint your future self into a corner. The most severe impact of a 401 loan or withdrawal isnt the immediate penalties but how it interrupts the power of compound interest to grow your retirement savings.

At the very least, dont start stacking loans . Some employer retirement plans allow as many as three.

Late Repayment Is Potentially Costly

When you take a 401 loan, you pay no taxes on the amount received. However, if you don’t repay the loan on time, taxes and penalties may be due. Specifically, if the loan is not repaid according to the specific repayment terms, then any remaining outstanding loan balance can be considered a distribution. In that case, it becomes taxable income to you, and if you are not yet 59 1/2 years old, a 10% early withdrawal penalty tax will also apply.

If you leave employment while you have an outstanding 401 loan, your remaining loan balance is considered a distribution at that time, unless you repay it. However, you can avoid taking the tax hit by rolling over the outstanding balance into an IRA or another eligible retirement plan by the due date for filing your federal income tax return for the year in which the loan was characterized as a distribution.

Read Also: How To Open A Solo 401k

If You Lose Your Job You May Have To Repay The Money By Tax Day Next Year

Departing from your job used to trigger a requirement that you repay your loan within 60 days. However, the rules changed in 2018. Now, you’ll have until tax day for the year you took the withdrawal to pay what you owe.

So if you borrowed in 2020 and lost your job, you’ll have to repay the full balance of your loan by April 15, 2021 . The CARES Act did not change this rule for loans taken in 2020. Similarly, if you borrow in 2021, you will need to repay the full balance by April 15, 2022 .

This longer deadline does slightly reduce the risks of borrowing. But if you take out a loan now, spend the money, and then are faced with an unexpected job loss, it could be hard to repay your loan in full.

If You Need Cash Borrowing From Your 401 Can Be A Low

Provided your 401 plan permits loans, borrowing from your 401 may help you pay bills, fund a big purchase or make a down payment on a home.

But youll need to pay interest if you want to tap your retirement account. How much you can borrow right now may depend on whether youve been affected by the COVID-19 pandemic .

Well review how 401 loans and repayment works, as well as the temporary rules implemented by the Coronavirus Aid, Relief and Economic Security Act, or CARES Act.

Don’t Miss: What Is An Ira Account Vs 401k

Can A Loan Be Taken From An Ira

Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans that satisfy the requirements of 401, from annuity plans that satisfy the requirements of 403 or 403, and from governmental plans. Reg. Section 1.72-1, Q& A-2)