Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

Check Unclaimed Property Databases

If youre still unable to locate your plan, try searching for it via unclaimed property databases. Keep in mind that youll want to have your name, Social Security number, employer name and the dates you worked for your former employer at the ready.

Some databases worth searching include:

- Pension Benefit Guaranty Corporation:

- If you had coverage under an old pension plan, the PBGC can help you locate your unclaimed plan.

Before you sift through these databases, its a good idea to verify that you contributed to a 401 at your old job in the first place. You can see any amounts contributed to your 401 by referring to Box 12 of your W-2 from when you worked for your former employer.

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search the DOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.

Don’t Miss: How Do I Find Previous 401k Accounts

How To Search For Unclaimed 401 Retirement Assets

You can take a few steps to search for your unclaimed 401 retirement benefits. The first step is to gather as much information as you can about your former employers. If your employer is still in regular operation, theres a chance that your 401 is still in the account that you had when you were with the company.

If you need to do a bit more digging, here are some further steps you can take:

Dont Miss: Can A Small Business Set Up A 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: What To Do With 401k

Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

You May Like: Prudential Retirement Insurance And Annuity Company

How Long Do You Have To Move Your 401 After Leaving Your Job

Theres no time limit on how long you can keep your 401 after leaving your job. You can leave it in your former employers plan, roll it into an IRA, or cash it out. Each option has different rules and consequences, so its important to understand your choices before making a decision.

If you leave your 401 in your former employers plan, youll still be able to access your account and make changes to your investment choices. However, you may have limited options for withdrawing your money and may be subject to higher fees.

Rolling your 401 into an IRA gives you more control over your account and typically lower fees. Youll also be able to access your money more easily. However, youll need to roll over the account within 60 days to avoid paying taxes and penalties.

Cashing out your 401 should be a last resort. Youll have to pay taxes on the money you withdraw, and you may also be hit with a 10% early withdrawal penalty if youre under age 59 1/2. Cashing out will leave you without the tax-deferred savings to help you reach your retirement goals.

Don’t Miss: Does My 401k Transfer From Job To Job

Find 401 Plan Information Through The Labor Department

Another option is to find plan information through the Department of Labors website. By locating the companys Form 5500, an annual report required to be filed for employee benefit plans, you should be able to find contact information and who the plans administrator was during your employment.

You may also be able to find information on lost accounts through FreeERISA. You must register to use the site, but it is free to search once youve set up your account.

Other Forgotten Funds And Where To Find Them

Retirement funds arent the only assets that may be lost or forgotten. Others include insurance accounts or annuities unpaid wages pensions from former employers FHA-insurance refunds tax refunds savings bonds accounts from bank or credit union failures. In addition, heirs may easily overlook one or more accounts, if the estate plan failed to list all of them.

The National Association of Unclaimed Property Administrators reports that about 1 in 10 Americans have unclaimed property, and more than $3 billion is returned to owners each year.

Brokerage firms and other financial institutions must report unclaimed or abandoned accounts once they have made a diligent effort to locate the owner. Should they be unsuccessful, they must report it to the state agency that handles such matters. The agency then claims it through a process known as escheatment so that the owners can find it.

Websites you can use to find lost funds include your states unclaimed property site NAUPAs missingmoney.com the U.S. Department of Labor database for back wages or the Pension Benefit Guaranty Corp to claim your pension funds. To find accounts at failed banks, try the Federal Deposit Insurance Corp. For credit unions, go to the National Credit Union Administration.

A final note: Claiming your assets is free. Beware of anyone who wants to charge you for doing so.

Also of Interest

Recommended Reading: Who Does Walmart Use For 401k

How To Track Down That Lost 401 Or Pension

Tweet This

Cant Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401. USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

What happens when a 401 plan is terminated?

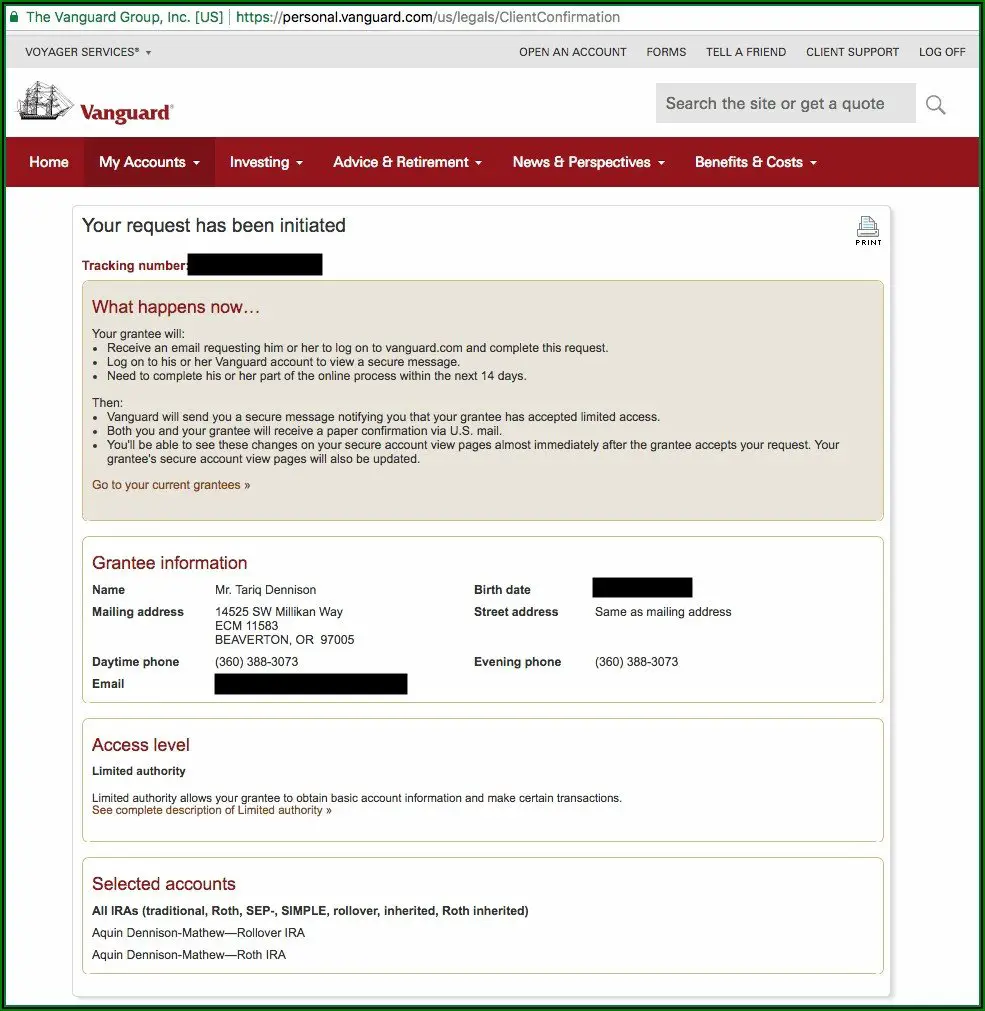

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Read Also: How To Withdraw My 401k

National Registry Of Unclaimed Retirement Benefits

You may be able to locate your retirement account funds on the National Registry of Unclaimed Retirement Benefits. This registry is a secure search website designed to help both employers and former employees. Employees can perform a free database search to determine if they may be entitled to any unpaid retirement account money. Employers can register names of former employees who left money with them. Youll need to provide your Social Security number, but no additional information is required.

Dont Miss: How To Get Money From 401k Before Retirement

You Can Roll It Over To A New Employers Plan

If youre starting a new job, you can roll over your 401k money directly into your new employers retirement plan, in most cases. Thats something to ask about during the onboarding process. You should also ask if your new company will match any of your rollover. If youre lucky, youll get even more money out of your job change.

Also Check: When You Retire Is Your 401k Taxed

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Lost And Abandoned Pension Resources

The Pension Benefit Guaranty Corporation is a U.S. government agency. It provides information on pension-related topics to help people understand and find their pensions. A few resources that you can use to find a lost or abandoned pension include:

- The National Registry of Unclaimed Retirement Benefits: This website can help former government and non-government employees find their retirement plan account balances that are left unclaimed.

- Abandoned Plan Program: The Abandoned Plan Program helps terminate and distribute the benefits from pension plan accounts that have been terminated by their employers. You can search this database to help you find your abandoned plan.

- Department of Labor: The Department of Labor can help you find your lost or abandoned pension through its Form 5500 search.

You May Like: Can I Start My Own 401k

You Can Leave Your Money Where It Is

If you have more than $5,000 in your 401k, you can leave it in your old employers 401k plan and even if you have less than that, they still might let you leave the money where it is, but you should ask. If you have less than $5,000, your employer has the option to make you take a distribution, but not all employers will exercise that right.

This is the simplest option, and its the one many people choose when theyre fired suddenly. You usually cant plan for a job loss, so you might not even have time to decide what to do with your 401k money before you get fired or laid off. And you might need some time to process the layoff for a while before you even get around to worrying about the money in your retirement plan.

Well, you might ask, how long do I have to rollover my 401k from a previous employer? Thats a good question. If you want to do a direct rollover, in which your former employer writes a check directly to your new employer for deposit into your new employers 401k plan, you can pretty much wait as long as you want.

However, if you want to do an indirect rollover, where you cash out the money and then deposit it into another tax-advantaged account yourself, you have 60 days from the time you cash out to deposit the money into another such tax-advantaged account, like an IRA. If youre planning to roll over the money into another 401k, you want to avoid this option, since your old employer will be required to withhold 20% from your payout for taxes.

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Recommended Reading: How Can I Get A Loan From My 401k

Finding Your Old 401k: Here’s What To Do

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Ever wish you could click on an app called Find my 401? Its surprisingly easy to lose track of a 401 account when you change jobs or careers. The good news: The money isnt gone, and there are ways to reclaim your missing account.

The quickest way to find old 401 money is to contact your former employer to see where the account is now. Its possible that your lost 401 isnt lost at all instead, its right where you left it. In some cases, however, employers may cash out an old 401 or roll it over to an IRA on behalf of a former employee. In that case, you might have to do a little more digging to find lost 401 funds.

If you need to rescue an unclaimed 401, heres what you need to know.

What You Can Do Next

To keep track of your retirement accounts, you first must know where they all are. Once you gather all your old accounts in one place and make sure they are properly balanced, its about sticking to the same investment principlesensuring your money is in diversified, low-cost fundsthat you would follow for your current company retirement plan.

For Compliance Use Only:1020356-00003-00

Read Also: Can You Put Money In Roth Ira After Retirement

You May Like: How To Take Money Out Of 401k Fidelity