Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.

How To Do A Rollover

If you decide to roll over your 401s, opt for a direct rollover that leaves you out of the transfer process. Once you complete some basic paperwork, the firm where you have your IRA will contact your old employer and they will get the money transferred straight into the IRA.

If you have company stock in your 401 that has appreciated a lot, you may want to explore a separate IRA rollover for just the stock. An arcane Internal Revenue Service rule called net unrealized appreciation can reduce the tax bill you will owe when you eventually sell those shares. Thats one more valuable way to boost your retirement income.

Reason To Consolidate #: Calculating Rmds Is Much Easier

If youre old enough such that you are subject to Required Minimum Distributions , then having multiple retirement accounts makes tracking these RMDs much more difficult.

Given that youre charged a 50% excise tax on the RMD amount you dont withdraw, its crucial to get these calculations right. Consolidating gives you just one account to worry about and track.

Also Check: Can I Rollover From 401k To Roth Ira

How To Roll A 401 Into An Ira

Here’s how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If you’re not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

Option : Doing Nothing

Lastly, you may opt to leave your 401 accounts exactly as they are. Here are some pros and cons of this strategy:

Pros:

1. You are happy with the financial institution and/or investments

If you like your current investment allocation and investment options and want to continue using them, you may choose to leave your 401 as it is.

Cons:

1. Difficult to manage

It could be hard to manage a cohesive investing strategy across multiple accounts. This may be especially true for someone that has multiple accounts at different institutions.

2. Cannot add money to an old employer-sponsored 401

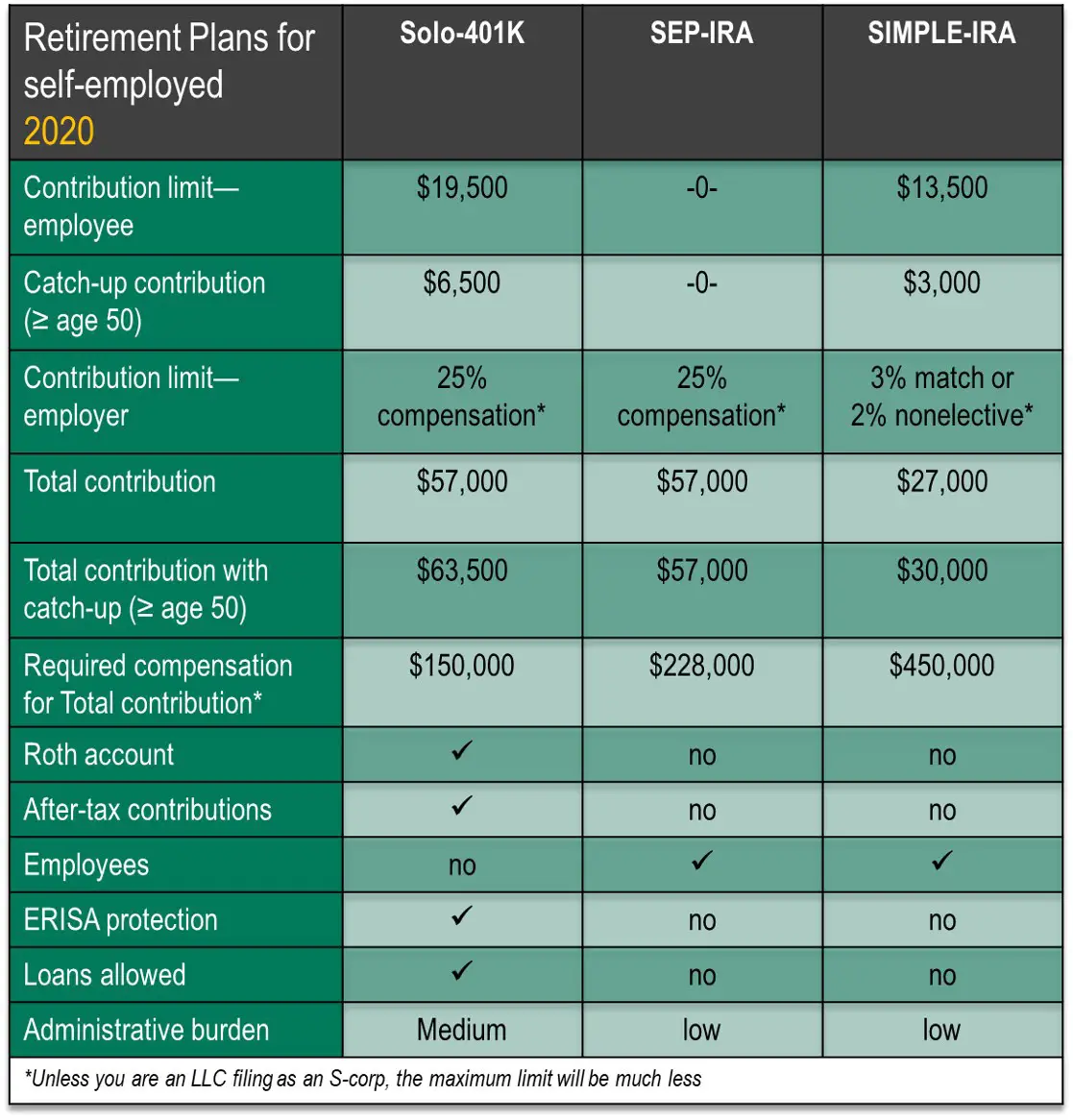

It is not possible to contribute new money to an old 401 account that was previously tied to an employer. New money must go into a current 401 or some other self-directed retirement account, such as a Solo 401, Roth IRA, or Traditional IRA.

If you do not currently have access to an employer-sponsored 401, you may want to seek out another retirement account for which you can make contributions.

3. Possible maintenance fees

Old 401 accounts may charge monthly or annual fees such as account maintenance fees. By consolidating, it may be possible to eliminate all or most of these fees.

For example, a person could roll old 401 accounts that charge a maintenance fee into an account that has no such fee, whether that be their current 401 or a Traditional IRA.

4. Limited investing options

In general, a Traditional IRA can provide more flexibility and investing options than a 401.

SOIN19068

Also Check: Can I Change My 401k Contribution At Any Time

Rolling Over To A New 401

The first step in transferring an old 401 to a new employer’s qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

Leaving Money In Your Current Plan

Just because youre leaving your job doesnt mean you have to also walk away from your employers retirement plan. There may be some advantages to leaving money in your old employers plan. For example, you could pay less in mutual fund fees through an employers plan than if you invested in those funds with an IRA.

However, by leaving the money in the prior employers plan, you risk having your retirement money scattered with more than one old employer over time as you switch jobs. Also, you wont be able to put aside more money into these accounts, and where you can invest that money is limited to the investment choices offered by your old employer.

You may also face additional fees. Some accounts may begin charging you a management fee if youre no longer contributing to them or no longer employed at your old company. When you consolidate, you may have access to a lower fee structure due to having more assets in one place.

Read Also: When Can You Start Withdrawing From 401k

Recommended Reading: How To Withdraw 401k From Previous Employer

Rollover To Ira: How To Do It In 4 Steps

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

A 401 rollover is a transfer of money from an old 401 to an individual retirement account or another 401. Youd most likely need to do a rollover when you leave a new job to start a new one, and if youre in this situation, you likely have a few options, such as rolling your old 401 into your new workplace 401, or cashing it out.

This article focuses on rolling a 401 over to an IRA, which is a great way to consolidate your retirement accounts and keep an eye on your investments.

Professionally Managed 401 Of Your Current Employer

You will not want to consolidate your current employers 401. An active 401 provides the best tax and savings benefits, especially if you are provided a matching contribution. However, all the challenges related to simplicity, investing, and holistic planning are very present with 401 accounts left to be managed on your own.

Thankfully, at Windgate Wealth Management we have launched a new tool that allows us to professionally manage your current 401 account for a fee. Traditionally, accounts such as 401s or 403s were not managed by your financial advisor, putting you further behind your financial goals. Advisors could not provide the ongoing management and oversight that is expected and required as a fiduciary due to limitations in technology. Now, current technology enables us to view, manage and trade any held away asset and provide you with the benefits of comprehensive portfolio management and reporting. This allows us to do the job you hired us to do full, holistic account management and wealth planning and helps you to rest easy that all your investable assets are being professionally managed.

Our innovative technology platform will allow us to manage your 401 the same way we manage your IRA and brokerage accounts. We will be able to proactively monitor and trade these accounts for you with a goal to increase account performance, implement tax strategies, and manage downside risk.

Don’t Miss: How Do I Take A Loan Against My 401k

Combining 401s And Other Retirement Accounts

If you decide a 401 rollover is right for you, were here to help. Call a Rollover Consultant at .

You may have accumulated several retirement accounts in different places over the years, including 401 plans from previous employers. Consolidating 401s and other retirement accounts can simplify your overall financial situation.

Should I Rollover My 401 Into An Ira

In most instances, you are better off rolling over your 401 into a traditional IRA, for which you will pay taxes on the monies when you withdraw them, according to Matt Markowski, a principal of Markowski Investments in Tampa, Florida.

However, if you think your tax rate will go up in your golden years, it may make sense to do a Roth IRA conversion, in which you would pay taxes on the amount converted from your 401, but the not have to pay them on future distributions.

It all depends on what you think your tax rate will be in the future, Markowski says.

Also Check: How Old Do You Have To Be To Start 401k

Recommended Reading: How To Move Money From A 401k To An Ira

Advantages Of Combining Multiple 401 Accounts

Combining multiple 401 accounts offers several advantages. According to financial services provider Charles Schwab, benefits include:

- reducing fees charged by various 401 plan managers

- providing a better overview of your complete retirement portfolio

- simplifying your finances and

- making it easier to prepare your tax return.

As MarketWatch explains, managing one account is almost always more practical than managing multiple accounts. Many people will not actively monitor their accounts, regularly review them, or effectively build a portfolio. When retirement assets are merged, however, they can also consolidate future savings from other retirement plans. If you are the type of person who may prefer a less hands-on approach to your retirement portfolio, combining accounts may be an option to consider.

Should You Have A Joint Retirement Account

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Update: The deadline for making IRA contributions for tax year 2020 has been extended to May 17, 2021.

No matter what stage of life youre intackling student loan debt or buying a houseits likely that planning for retirement may be looming in the back of your mind. And thats a good thing: According to the Center for Retirement Research, 50% of households are at risk for not having enough to maintain their living standards in retirement.

50% of households are at risk for not having enough to maintain their living standards in retirement.

One way to start your retirement savings plan is to work shoulder-to-shoulder with your partner. You have probably heard of joint checking accounts, but what about joint retirement accounts? While some retirement plans do not allow for multiple owners, there are ways couples can plan their retirement savings together.

Recommended Reading: How Much Can You Borrow From 401k

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent, on any appreciation. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

You May Like: How To Find 401k From An Old Employer

Read Also: Can You Do A Partial 401k Rollover

Is It Bad To Have Two Roth Iras

Having multiple Roth IRA accounts is perfectly legal, but the total amount of deposits made to both accounts must not exceed the federally set annual deposit limits.

Can I connect two Roth IRAs? Yes, each of you can create a traditional IRA and a Roth IRA and pool all of your funds into these accounts. Consolidation not only saves you money by reducing maintenance fees, but also makes it easier to track your investments.

Consolidating Your Retirement Accounts Can Help

Heres some good news. In most cases, you dont have to leave those accounts with your former employers. Instead, you may be able to roll them over into a single retirement account.

This is known as consolidating accounts. And it offers a lot of advantages.

Consolidating retirement accounts can make it easier to:

Don’t Miss: Can You Roll A 401k Into A Self Directed Ira

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Taking Advantage Of One Retirement Plan

One account can be easier to managewith one statement and one number to call if you have questions or need help. Having all your retirement savings in a single account offers you a number of advantages, including:

- A more complete view of your retirement picture and any ongoing activity

- An easier way to track your progress toward your retirement savings goal

- Potentially fewer, and lower, fees than you were likely paying for multiple accounts

- Help focusing on a single investment strategy for your retirement investments

Even if you kept multiple accounts, you still couldnt contribute more than the annual IRS contribution limits. And if youre nearing retirement, a single account may make it easier to calculate and take your required minimum distributions , which, for most of us, will start at age 72.

Donât Miss: What Happens When You Rollover A 401k

Read Also: Can You Use 401k To Buy A Home