Withdrawals After Age 59 1/2

Age 59 1/2 is the magic number when it comes to avoiding the penalties associated with early 401 withdrawals. You can take penalty-free withdrawals from 401 assets that have been rolled over into a traditional IRA when you’ve reached this age. You can also take a penalty-free withdrawal if your funds are still in the 401 plan, and you’ve retired.

You can take a withdrawal penalty-free if you’re still working after you reach age 59 1/2, but the rules change a bit. Check with the plan administrator about its specific rules if you’re still working at the company with which you have your 401 assets.

Your plan might offer an “in-service” withdrawal that allows you to access your 401 assets penalty-free, but not all plans offer this option. And remember, the withdrawal will still be subject to income taxes, even if it’s not penalized.

Can I Use My 401 To Buy A House

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, there are some factors and drawbacks that you might want to consider.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if youre cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Recommended Reading: How Much Will My 401k Grow If I Stop Contributing

Roth Ira Statement From Fidelity Representative: Question:

Can you confirm whether this statement is true or not . The IRS does not allow for Roth IRA money to be rolled into any 401k plan. That is only allowed on pre-tax IRA and retirement accounts. I was hoping to roll over a Roth IRA into my solo 401k roth account. Is this allowed?

The Fidelity representative is correct that a Roth IRA cannot be transferred to a Roth solo 401k. This is a Roth IRA rule. Visit here for more on this rule. I suspect this rule was put in place because the distribution rules are different for a Roth IRA vs a Roth solo 401k.

How To Request A Withdrawal Or Loan From The Plan

You may request a withdrawal from your 403 retirement plan by contacting your investment carrier directly. Loans and hardship distributions are only available through Fidelity and can only be taken from the contributions that you put into the plan at Fidelity. Contact Fidelity to request a loan or hardship distribution.

You May Like: How Do I Invest In My 401k

Recommended Reading: How Often Can I Change My 401k Investments Fidelity

What If My Check Gets Misplaced Or Lost In The Mail

This unfortunately does happen every once in a while, but dont worry your money hasnt disappeared. If your check doesnt arrive then youll have to call your 401 provider again and ask them to issue a new one. Theyll place a stop on the first one, and nobody will be able to cash the first check since its generally made out to you or your IRA provider and will always stipulate that its for the benefit of or FBO, your name.

How To Close A Fidelity 401k

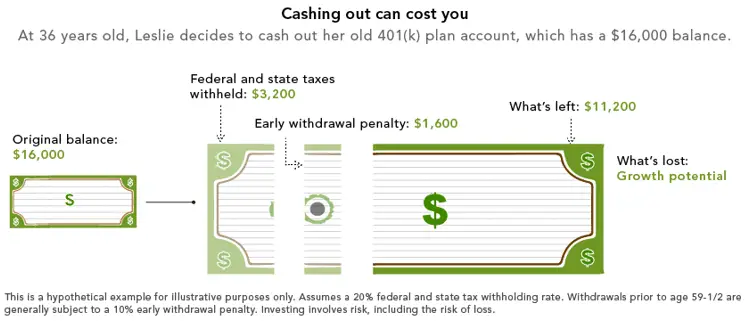

Although closing a Fidelity 401 account before you reach retirement age is not difficult, you need to understand the tax implications, which are the same regardless of whether you’re switching jobs or facing a dire financial situation. First, the plan administrator will deduct and send 30 percent of the proceeds to the Internal Revenue Service. Of this amount, 20 percent is federal income tax withholding and 10 percent is a penalty fee. You’ll also be responsible for paying state income tax and any federal tax that the withheld amount doesn’t cover.

Don’t Miss: Can I Set Up My Own 401k Plan

How Do You Withdraw Money From A 401 When You Retire

After retirement, one of the common questions that people ask is âhow do you withdraw money from a 401 when you retire?â. Find out the options you have.

As you plan your retirement, you should think about how you are going to live off your retirement savings once you are out of employment. You will need to figure out how to withdraw your retirement savings in your 401 post-retirement, and the best withdrawal strategies so that you donât exhaust your retirement savings.

When withdrawing your retirement savings from a 401, you can decide to take a lump-sum distribution, take a periodic distribution , buy an annuity, or rollover the retirement savings into an IRA.

Usually, once youâve attained 59 ½, you can start withdrawing money from your 401 without paying a 10% penalty tax for early withdrawals. Still, if you decide to retire at 55, you can take a distribution without being subjected to the penalty. However, any distribution you take after retirement is taxed, and you must include the distribution as an income when filing your annual tax return.

Read Also: What Is The Maximum I Can Contribute To My 401k

Initiate Your Rollover With Fidelity

Youre making great progress. Youve confirmed key details about your 401 plan and you have an IRA to transfer your money into. The next step is to initiate your rollover with Fidelity. Fidelity has two methods for requesting a rollover to another institution:

If you are rolling over your Fidelity 401 to an IRA at Fidelity, you can request a rollover online, through your NetBenefits account. For rollovers to another institution, youll have to call or use the form.

Recommended Reading: How Do I Cash Out My Fidelity 401k

Find The Mortgage Option Thats Right For You

Your 401 account may seem tempting as an untapped source of cash, especially if youre struggling to come up with the money for a down payment on your new home. While this is a viable option, and there are ways to mitigate the penalties, it should only be used as a last resort. Consider applying for a low down-payment loan like an FHA or VA loan, or, if you have one, making a withdrawal from your IRA.

Whatever you decide, make sure you consult with a mortgage specialist before committing to an option. Rocket Mortgage® has experts waiting to help you navigate the tricky waters of home loans. If youre ready to take that next step toward a mortgage, then get started with our experts today.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

What Are The Risks Of Withdrawing 401k Money

If youre using the Covid rules to withdraw cash from a 401k, keep in mind that youll need to pay tax on it or repay the withdrawal.

You also face a shortfall of cash in retirement, unless you already have enough money saved elsewhere.

In November, Fidelity said the average amount withdrawn of those who took advantage of the rule was $10,000.

It may seem small but it could eventually grow to be a significant amount if left untouched due to the benefits of compound interest.

For example, if youre 35, a $10,000 nest egg could grow to more than $100,000 by the time youre 70, assuming a 7% annual return.

Carrie Schwab-Pomerantz, a certified financial planner and president of the Charles Schwab Foundation, said: Even if its possible to borrow from your 401k or take a distribution, consider this a last resort.

While present circumstances may be difficult, Id counsel anyone to avoid jeopardizing their future retirement unless absolutely necessary.

You may not appreciate the full consequences until much later.

Don’t Miss: How Do You Take Out 401k Money

When Can I Withdraw From My 401 Before Retirement But Without Tax Penalties

You don’t have to be in retirement to start withdrawing money from your 401. However, there are penalties involved depending on your age. If you wait until after you are 59 1/2, you can withdraw without any penalties. If you can’t wait until you are 59 1/2, then you will experience a 10% penalty on the amount withdrawn.

Drawbacks To Using Your 401 To Buy A House

Even if it’s doable, tapping your retirement account for a house is problematic, no matter how you proceed. You diminish your retirement savingsnot only in terms of the immediate drop in the balance but in its future potential for growth.

For example, if you have $20,000 in your account and take out $10,000 for a home, that remaining $10,000 could potentially grow to $54,000 in 25 years with a 7% annualized return. But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,000 in 25 years, earning the same 7% return.

Don’t Miss: Can You Get 401k If You Quit

When You Can Borrow

Once you pull money out of your plan, those dollars no longer benefit from long-term market returns.

If you have a pool of emergency funds, its best to use that money first. If youre managing debt, its even better to build that repayment into your budget.

Even your boss wants you to keep your hands off your retirement plan savings.

That said, here are three extreme cases that may warrant a 401 loan.

You have an immediate emergency.Say that you need to meet the deductible on your high-deductible health-care plan, and you have no money in your health savings account, said Aaron Pottichen, president of retirement services at CLS Partners in Austin, Texas.

He is referring to the tax-advantaged health savings account that individuals may use to cover qualified medical expenses. Its also known as an HSA.

You have an urgent cash need, but your credit precludes you from obtaining a competitive interest rate. Ask yourself what you can repay in five years.

You need to pay off high-interest debt thats hampering your long-term financial goals. This is the case if the interest rate on your 401 is lower than what your creditor is offering you.

If youre in pay down debt mode, its all about whats your cheapest interest rate and how fast can you get the debt down, said Pottichen.

Read Also: How To See How Much Is In Your 401k

The 4% Withdrawal Rule

The 4% rule says that you can withdraw 4% of your savings in the first year, and calculate subsequent yearâs withdrawals on the rate of inflation. This rule is based on the idea that you should withdraw 4% annually, and maintain the financial security in retirement for 30 years. This strategy is preferred because it is simple to compute, and gives retirees a predictable amount of income every year.

For example, if you have $1 million in retirement savings, 4% equals $40,000 in the first year. If the inflation rises by 2.5% in the second year, you should take out an additional 2.5% of the first yearâs withdrawal i.e. $1000. Therefore, the withdrawal for the second year will be $41,000.

Read Also: What Happens To 401k When You Leave Your Job

Leave The Money Where It Is

Assuming your current employer allows it not all do you may decide to leave your 401 right where it is.

If the plan has top-notch, low-cost investment options, this might not be a bad choice.

Know that when leaving money behind in a 401, there may be restrictions on whether you can take a loan against that account or on the size of any pre-retirement withdrawals you might make so check the rules of the plan before making your final decision.

The decision to stay with your current plan, however, might not be yours to make if your balance is below $5,000. A majority of workplace plans will require that you transfer the balance elsewhere or cash it out, according to the most recent survey of workplace retirement plans by the Plan Sponsor Council of America.

If your balance is over $5,000 but your current plan doesnt have great, low-cost investments, you might be better off transferring the money to another tax-advantaged retirement account .

The same is true if you already have several other existing retirement accounts at old employers.

A really bad outcome is to have lots of little accounts scattered around. Its easy to forget about them. It doesnt let you appreciate how much youve really saved. And the odds of screwing something up gets higher, said Anne Lester, the former head of retirement solutions at JP Morgan Asset Management who founded the Aspen Leadership Forum on Retirement Savings in partnership with AARP.

Can Anybody Cash Out A 401 K Early

If you resign early, you might want to cash out your 401 k. However, you might face a financial penalty for doing so. If you havent reached retirement age, you can often expect to be charged 10% plus ordinary income tax on the amount in your 401 k for an early withdrawal. If you think you might want to take your 401 k money out of the IRA early, you should discuss this with your current employer.

Recommended Reading: Can You Roll A 401k Into A Roth

Also Check: When Can You Draw Money From 401k

Contributing To Your Mit 401 Account

You contribute to your 401 account through deductions from your MIT paycheck. You can contribute pre-tax dollars, Roth post-tax dollars, or a combination of both. You may change your contribution preferences any time through Fidelity NetBenefits.

Your contributions are sent to Fidelity Investments at the end of each pay period. You may contribute as little as 1% and as much as 95% of your salary after amounts for Social Security and Medicare taxes and health and dental insurance have been subtracted. You may start, stop, or change your deferral or investment elections at any time.

Federal law limits the amount of your pay each year that may be recognized for determining your allowable contribution. In 2021, MIT can consider only the first $290,000 of pay for calculating your allowable contributions. This means that if your annual compensation exceeds $290,000, MIT Payroll will take 401 deductions from your pay until your pay for the year reaches $290,000, or one of the other 401 program limits has been reached .

Contribution limits

What MIT contributes to your 401 Plan

- MIT matches your 401 contributions dollar-for-dollar up to the first 5% of your MIT pay .

- MIT only contributes a match during months in which you have made a contribution

- The MIT match is provided pre-tax, and therefore is fully taxable when you withdraw your matching contributions from the plan, along with associated investment earnings.

When contributions are invested in your 401 account

Automatic Enrollment Or Making Changes

Enrollment is Automatic for All Employees

Participation in the Supplemental Retirement and Savings Plan is automatic for all employees. You will automatically be enrolled to contribute 3% of your eligible compensation, as defined under the BU Retirement Plan, on a tax-deferred basis and your contribution will be invested in a Vanguard Target Date Fund closest to the year in which you will turn age 65. Your first contribution to the plan will commence in the month following your hire date.

You may change or stop your contribution at any time. You may also change the investment allocation of your contributions at any time.

Automatic Enrollment and BU Matching Contribution After Two Years of Service

Once you have completed two years of service with at least a nine-month assignment at 50% or more of a full-time schedule, you will be eligible to receive the University matching contributions to the Boston University Retirement Plan.

In addition, you will automatically be enrolled in the Supplemental Retirement and Savings Plan to contribute 3% of your eligible compensation as defined under the BU Retirement Plan on a tax-deferred basis if you are not already doing so when you complete two years of service. BU matches your contribution dollar-for-dollar up to 3% of your eligible compensation as defined under the BU Retirement Plan.

You may make the following changes at any time:

Don’t Miss: Can A Sole Proprietor Have A Solo 401k