A Deeper Dive On The 401 Loan Option

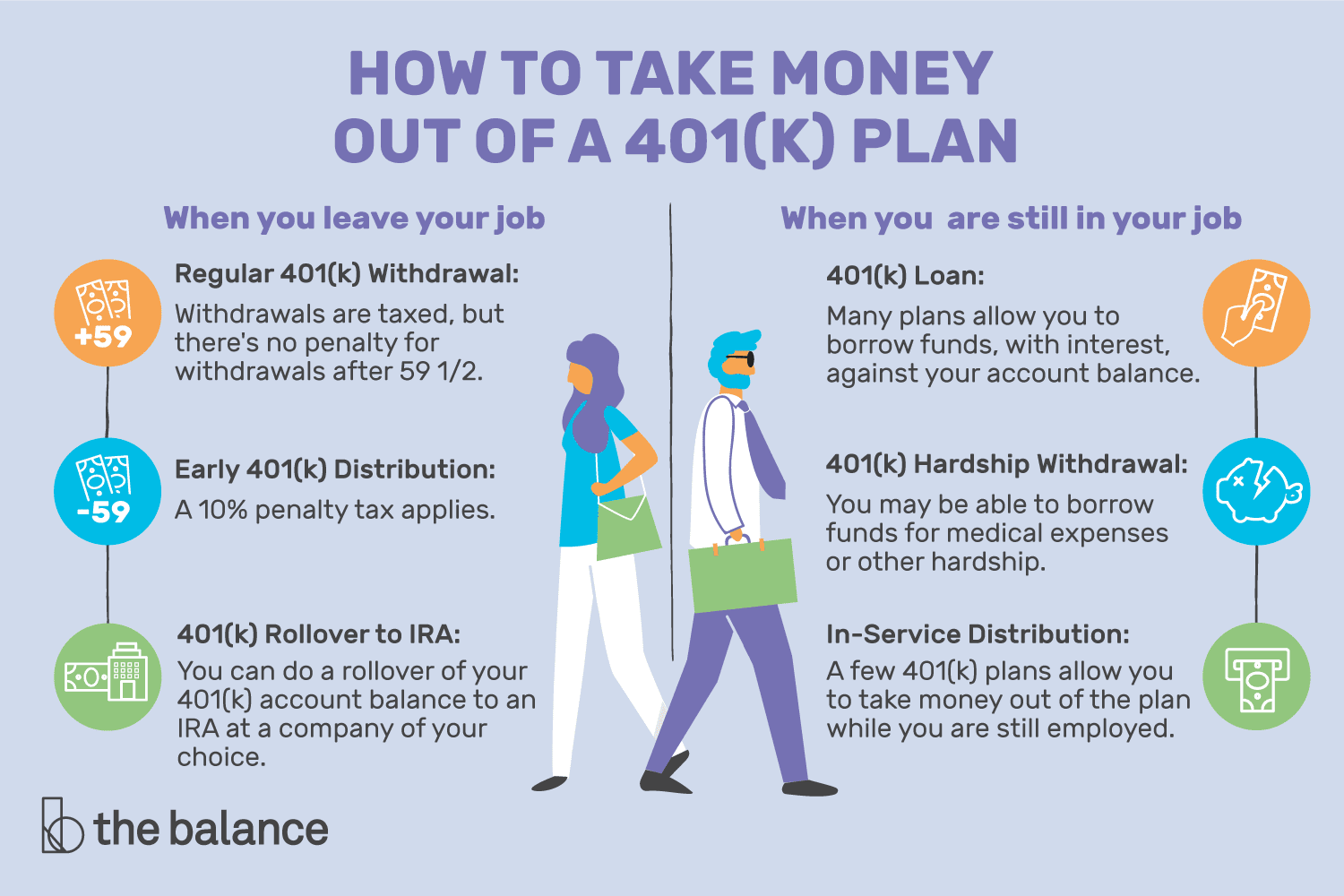

A loan is more strategic than a withdrawal, which torpedoes your savings altogether. With a full cash-out, instantly you lose a big chunk, paying a 10% penalty to the IRS if you leave the plan under age 55 plus another 20% for federal taxes. For instance, with a $50,000 withdrawal, you may keep just $32,500 and pay $17,500 in state and federal taxes. And the leftover sum you receive, if you happen to be in a higher tax bracket, may nudge you into paying even more taxes for that additional annual income.

Another adjustment in 2020 for workers affected by COVID-19: If your plan allows or through your IRA, you can withdraw up to $100,000 without the 10% penalty even if youre younger than 59½. The standard 20% federal tax withholding does not apply, but 10% withholding will unless you decide otherwise. You also can spread your income tax payments on the withdrawal over three years.

We understand emergencies can leave people with limited choices. Just remember that even the less extreme option of a 401 loan may paint your future self into a corner. The most severe impact of a 401 loan or withdrawal isnt the immediate penalties but how it interrupts the power of compound interest to grow your retirement savings.

At the very least, dont start stacking loans . Some employer retirement plans allow as many as three.

Withdrawing Funds From 401 At 72

If you are age 72, you must start taking annual distributions from the 401, commonly known as required minimum distributions . You must take the first distribution by April 1 of the year you turn 72, and thereafter, you will be required to take the annual withdrawals by December 31 each year. If you delay in taking the first distribution, you must take two distributions in the same year, which will push you to a higher tax bracket. If you miss taking a mandatory distribution, the IRS imposes a 50% penalty on the amount you were required to take during the specific period.

An exemption to the RMDs is if you are still working. To qualify for this exception, you must not own 50% or more of the employerâs company. You can use this exception to delay taking the mandatory distributions until when you stop working.

Taking A 401k Loan Might Not Be Such A Good Idea

A 401K is supposed to help you have money in retirement. When you temporarily take money out of the plan, it inhibits its ability to compound with interest or stock market growth. You may end up with less money in retirement than if you had left the money in your 401K. In addition, if you terminate your employment, youll owe a 10% penalty and income taxes on the balance unless you can pay the loan back right away. 401K loans may also have fees and the payment terms are often very inflexible. Finally, taking a 401K loan may be a sign of broader financial distress.

Don’t Miss: Is There A 401k For Self Employed

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. SmartAssets financial advisor matching tool makes it easy to quickly connect with professional advisors in your local area. If youre ready, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal., but only from a current 401 account held by your employer. You can’t take loans out on older 401 accounts.

However, you can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

Recommended Reading: When Can You Start Drawing From Your 401k

You Must Leave Your Job The Year You Turn 55or Later

If you retire or are laid off in the calendar year you turn 55 or lateror the year you turn 50 if youre a public service employeeyou can withdraw funds from your current 403 or 401 plan without paying the early withdrawal 403 or 401 penalty.

You cant retire at age 53 and then start taking 401 withdrawals at age 55, for instance. It only works if youve left your job in the year you turn 55 or later, says Luber. You cant start taking that money out if youve already retired early.

Note: Not all employers may support these early withdrawalsand even if they do, they may require you withdraw all of your money in one lump sum. Check with your retirement plan provider to figure out your plans policies.

When Can I Withdraw From My 401 Before Retirement But Without Tax Penalties

You don’t have to be in retirement to start withdrawing money from your 401. However, there are penalties involved depending on your age. If you wait until after you are 59 1/2, you can withdraw without any penalties. If you can’t wait until you are 59 1/2, then you will experience a 10% penalty on the amount withdrawn.

You May Like: When I Leave My Job What Happens To 401k

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Also Check: Where To Find Fidelity 401k Account Number

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

You May Like: Who Are The Top 401k Providers

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

You Can Still Withdraw Early Even If You Get Another Job

You arent locked in to early retirement if you choose to take early withdrawals at age 55. If you decide to return to part-time or even full-time work, you can still keep taking withdrawals without paying the 401 penaltyjust as long as they only come from the retirement account you began withdrawing from.

Read Also: How Much Does 401k Cost Per Month

What Is A Good Amount Of Money To Retire With At 65

THE 4-PERCENT RULE MAY BE THE FIRST THING So, if you find yourself wanting to make up to $ 120,000 a year on withdrawal from your savings, according to a 4-percent rule you would need up to $ 3 million in retirement savings to support that lifestyle. for thirty years. Of course, the 4-percent rule is not far from perfect.

How much should a 65-year-old retire before retirement? Retirement experts have set various rules about how much you want to save: somewhere around $ 1 million, 80% to 90% of your annual income before you retire, twelve times your salary before you retire.

Will My Credit Score Be Impacted If I Withdraw Early

Withdrawing funds from your 401 early won’t impact your credit directly since the credit bureaus don’t track activity on your retirement accounts.

Making an early withdrawal can indirectly affect your credit when you use the money to pay down outstanding debt. It may seem like an easy way to ease a debt burden or boost your credit, but in most cases, this shouldn’t be the only reason to withdraw funds from your 401. Such a move should only be considered in a financial emergency when you have exhausted all other options.

Also Check: What Is The Difference Between A Pension And A 401k

What Is The Tax Rate Of Withdrawing From 401 Before 59 1/2

Anyone who withdraws from their 401 before they reach the age of 59 1/2, they will have to pay a 10% penalty along with their regular income tax. However, you can withdraw at the age of 55 without penalty in a circumstance where you cannot be a employee of a company who runs your 401 and you must have left the company, during or after the calendar year when you turn 55. This is also called as a rule of 55.

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

Also Check: Is Fidelity A 401k Plan Administrator

What Is A 401 Plan

A 401 plan is a retirement savings account that allows employees to set aside a portion of their paycheck for long-term investments. Some employers will also match contributions up to a certain amount.

According to IRS guidelines, there are two different kinds of qualified retirement plans that are eligible for tax benefitsdefined contribution plans and defined benefit plans. A 401 is a defined contribution plan. Therefore, the available balance in a 401 account is determined by the amount contributed to the plan and the performance of investments.

The employee must contribute to the 401, but earnings from investments are not taxed until the funds are withdrawn.

Understanding 401 Early Withdrawals

If an account holder takes withdrawals from their 401 before age 59½, they may incur penalties in the form of additional taxes. The additional tax for taking an early withdrawal from a tax-advantaged retirement account is 10% on top of any applicable income taxes.

The 10% early withdrawal tax may be waived if the account owner withdraws 401 funds in order to pay for certain qualified expenses, however.

Read Also: How To Open A 401k Plan

What You Need To Know Before Taking A Hardship Withdrawal From Your 401

One of the top rules of retirement planning hasnt changedtaking money out of a qualified retirement savings account before you reach full retirement age could be a costly mistake. Withdrawals, such as hardship distributions, could affect the funds available to you when you are set to retire. Experts warn that a 401 hardship withdrawal should be your absolute last resort and should only be used when you have used or explored all other options.

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships dont influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

- A 401 plan is a retirement savings account that allows employees to contribute a portion of their paycheck for long-term investments and later withdraw for retirement income

- Securian Financial provides various investment options to choose from for their 401 clients, along with administrative services for the employers that offer benefit plans through Securian

- You can withdraw money from your Securian 401 by talking to your employer, using your Securian 401 login, or calling Securian directly

Therefore, weve provided some basic information you need to start taking advantage of your 401. Read more below about Securian 401 plans, how much you can contribute, how you can withdraw money, and more.

Read Also: How Much Can You Contribute To 401k Per Year

Caveats To The 4% Rule

Several variables can make this rule of thumb either too conservative or too risky, and you might not be able to live on 4%-ish a year unless your account has a significantly large balance.

The first caveat you should consider when thinking about applying the 4% rule to your personal situation is that it calls for putting 50% each in stocks and bonds. You may not be comfortable putting that much of your retirement assets in equities, and you may want to keep at least a portion of your nest egg in cash or a money market fund.

You also might not expect to live for 30 years after retirement, either because you retired later than most people do or for some health-related reason. And you may not feel you need the almost 100% confidence level Bengen was seeking in his rule a confidence level of 75% to 90% that you won’t run out of money might be acceptable to you and may afford a more flexible withdrawal rate.

How Much Tax Do I Pay On An Early 401 Withdrawal

The money will be taxed as regular income. That’s between 10% and 37% depending on your total taxable income.

In most cases, that money will be due for the tax year in which you take the distribution.

The exception is for withdrawals taken for expenses related to the coronavirus pandemic. In response to the coronavirus pandemic, account owners have been given three years to pay the taxes they owe on distributions taken for economic hardships related to COVID-19.

Recommended Reading: How To Tell If You Have A 401k