Making Sure Your Financial Advisor Fees Are Fair

Before you agree to work with an advisor, make sure you understand the advisors fee structure and what services that fee includes. Some advisors may charge extra for certain services and programs. It shouldnt be difficult for an advisor to explain how he or she is adding value to your accounts. If an advisor gives a roundabout or elusive answer, steer clear. Its a red flag if an advisor tells you not to worry about costs. Ditto if he or she implies that his or her services are free.

If an advisor makes money from commissions, be sure to inquire about his or her fiduciary responsibility to put your best interest first. You should know all of their compensation sources, and if there are any other professionals they work with. Some advisors include tax-planning services without an additional cost, but many partner with accounting firms for all tax-related work. That means tax and legal services may incur an additional cost.

How Much Does Lifelock Cost

LifeLock offers four plans, starting at $9.99 per month and going up to $25.99 per month. If you purchase an annual subscription upfront, you get a discount off monthly prices. After the first year, the plans renew at a higher price. All plans are for one user only.

All annual memberships get a 60-day money back guarantee.

We’ll go over the plans and pricing and what you get. First, here’s a chart to compare at a glance:

STANDARDAverage Small Business 401 Cost Example

| Asset-Based Fee |

| $14,700 | $1,470 |

As you can see, the asset-based percentage fees drop as the plan assets grow. 401 providers favor larger plans, as it means more money for them. But in our opinion, $14,700 a year is still much too high. Whether youre starting a brand new plan, or have some assets ready to invest, there are a few simple tactics you can use to get yourself a low-cost plan thatll help you maximize your savings.

But in order to get a low-cost 401, it helps to understand how 401 pricing is actually calculated. Well quickly break that down next.

Also Check: Can You Merge 401k Accounts

What Is The Forgotten 401 Problem

401s are one of the most popular retirement savings vehicles for Americans. By the end of 2020, Americans had accumulated over $6.7 trillion in 401 accounts. These accounts are employer-sponsored, which means theyre provided by and linked to our employers much like healthcare benefits. While 401 accounts are great tools for saving money in a tax-efficient way, theres one major problem: we tend to change jobs every few years and need to decide what to do with the 401 savings weve accumulated.

We generally have a few options for those savings when we change jobs:

Job transitions are busy times for all of us, so its not surprising that many of us choose the path of least resistance and leave our 401 account behind for some extended period of time. The result is that we can accumulate multiple 401 accounts as we move throughout our careers and may end up with more than a dozen of them at the end of our working lives.

So how many accounts have been left behind, and how much money is in them?

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

You May Like: How To Switch 401k To Ira

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

How Much Does Freshbooks Cost

Before I get into pricing, its worth mentioning that every new customer receives a free 30-day trial. You can try all the features too. This helps you decide if Freshbooks is right for you and which program suits you best.

After your free trial, heres what Freshbooks costs.

Lite $6/month

If youre just starting your business, Freshbooks Lite may be all you need. You can bill up to 5 clients an unlimited number of times as well as:

- Create custom invoices

- Store clients credit card information

- Set up a client self-service portal to collect credit card payments

- Set up automatic recurring invoicing

- Send estimates

- Track time spent on a project

- Track expenses

Also Check: What’s The Most You Can Contribute To A 401k

Keep Employee Costs Below 075%

You’ve already seen how average 401 costs can cut into annual the bottom line. Here’s how those fees can impact employee retirement over the years:

For a 30 year old employee contributing $4,000 a year, with a 6% yearly return, with all-in fees of $0.6%, theyll have $390,028 in their account when they retire at age 65. Drop those fees to 1.9%, and theyll have $291,519 in their accounts a difference of almost $100,000!

About $100,000 less in your retirement savings is a significant and unsettling sum – something that neither employees nor plan sponsors want to see. Prevent this kind of unpleasant situation by picking a low-cost 401 from the get-go.

Heres how…

Fixing The Problem: A Responsibility For Policy Makers Employers And Innovators

The forgotten 401 problem is a large, expensive feature of the modern retirement savings market for individuals, employers, and the system as a whole. Unfortunately, its driven by the reality that retirement benefits have become something we expect from the employer. As we continue to switch jobs at a rapid pace, the risk of us leaving behind 401 accounts with meaningful balances in them also increases. These forgotten 401 accounts might be stuck in high-fee 401 plans or be left in low-return investments the combination of which can lead to significant foregone savings.

At Capitalize, we believe the responsibility for solving the problem rests with multiple stakeholders including private sector institutions. In particular, we believe that several key initiatives can meaningfully reduce the prevalence and cost of forgotten 401 accounts:

Recommended Reading: How To Check My Walmart 401k

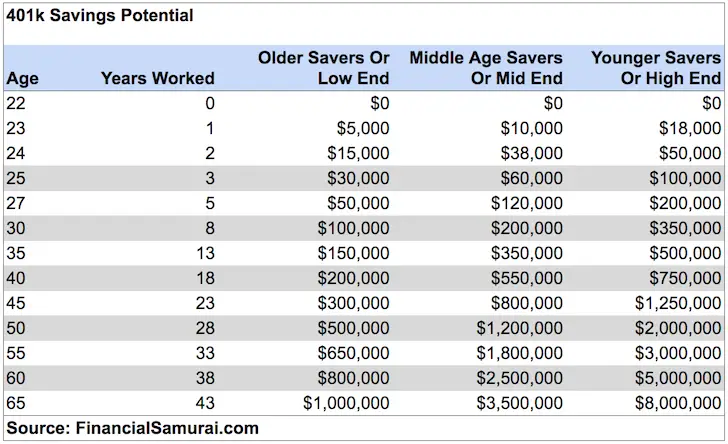

K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

You May Like: How Should I Invest My 401k

Keep An Eye On Your 401 Fees And The Fine Print

Once you understand what types of fees you are paying, either as the business owner of the 401 plan or as a saver in the plan, it is also essential to keep an eye on plan costs over time to ensure you continue to receive the best value. This is especially true for investment fees because they usually make up the largest portion of expenses in a 401 plan.

Employers, with the assistance of their service providers, must provide information about 401 fees to employees who save in the 401 plan. Employees can also find an explanation of fees charged to their accounts in their quarterly account statements, which is an IRS requirement.

How To Read Your 401 Statements

To help investors make educated decisions, the Department of Labor introduced a fiduciary rule calling for 401 fees to be disclosed on statements. Though in limbo under the current administration, the rule also requires that 401 administrators always act in the best interest of plan participants. That includes keeping fees low.

Still, many investment professionals say 401 fees are hiding in plain sight. Administrators dont send bills every year to demonstrate how much youre paying for plan management and services. They also dont itemize fees on statements. Instead, fees are shown in relation to the plans reduced net returns. When you receive a 401 statement, check for labels like Total Asset-Based Fees, Total Operating Expenses As a % or Expense Ratios. These technical terms arent very participant-friendly, but it is possible to figure out what the numbers represent.

Read Also: How Is 401k Paid Out

Understand Who Is Getting Paid And How Much

With these documents in hand, you can now identify every service provider receiving payment from your plan. Depending on your adviser and the level of support they offer in administration, you may have met all or just a few members of your service provider team. This team might include:

- Third Party Administrator : Handles many of the ongoing tasks required to keep your plan functioning.

- Custodian: Holds your plans assets and processes transactions in and out of the plan.

- Recordkeeper: Documents participants, their assets and investments, and how money moves in and out of the plan.

- Bundled: Some 401 providers bundle the TPA, custodian, and recordkeeper into one solution, which typically shows up in fee statements with the designation Bundled. If you see fees for Bundled service, that would replace the first three providers in this list.

- Adviser: Helps you make good decisions managing your plan, and helps your employees make the most of their savings and investments.

- Other Third-Party Vendors: Your plan may also utilize the services of other vendors, as well, including auditors, brokers, asset managers, or fund managers.

Questions About Our Pricing

Fees are taken right from your Betterment Investing account at the end of each month. No action is required on your part, and we’ll never charge fees if you don’t have a balance. Our fees are calculated based on the average daily balance of assets under management and assessed monthly, and add up to the total annual percentage .

If a clients account exclusively consists of mutual funds, due to small price fluctuations in mutual funds that may occur on the transaction date, Betterment will accrue any fees over- or under-assessed and apply the difference to adjust the following periods fee.

Yes. For the portion of your household balance above $2 million, you’ll receive a 0.10% discount. So, on the Digital plan, you’ll pay just 0.15% for the portion of your balance above $2 million, and on the Premium plan, you’ll play 0.30% for the portion of the balance above $2 million.

The minimum balance requirement for the Premium plan is based on your combined balance across individual and joint taxable accounts, trusts, and any IRAs you hold at Betterment.

For more in-depth financial advice, you can purchase flat-fee advice packages with our team of CFP® professionals, for a one-time fee of $299-$399. An advice package can be especially useful if you’re looking to build a financial plan but do not have the $100,000 minimum balance for our Premium Plan. Each advice package includes a tailored call and a personalized action plan and educational content.

Looking for more details?

Also Check: How To Take Out 401k Money For House

How To Minimize Financial Advisor Fees

Generally, investors with less assets under management pay a higher percentage of their assets in fees. Think hard about whether a traditional advisor is right for your situation or if you might be better served by a robo-advisor. Robo-advisors generally have lower fees and lower minimums.

If you decide a traditional advisor is right for you, there are two typical fee structures: fee-only and fee-based. Fee-only advisors fee structures tend to be simpler and hold less potential for possible conflicts of interest. As youre shopping around for an advisor, ask pointed questions about advisors fee structures, as well as all-in costs. Dont hesitate to negotiate for a better fee rate.

Theres $135 Trillion Of Assets And More Than 24 Million Forgotten 401s In 2021

In our latest white paper on The True Cost of Forgotten 401 Accounts , we estimate that there are 24.3 million forgotten 401s holding $1.35 trillion in assets, as of May 2021. Importantly, an additional 2.8 million accounts are left-behind by job changers each year, though some will eventually be reclaimed or liquidated.

These estimates reflect detailed analysis of public and private sector data in consultation with leading policy experts:

- 24.3 million forgotten 401 accounts in 2021: we started our analysis with the Form 5500 documents filed with the Department of Labor by each 401 plan sponsor. We also reviewed additional 401 provider and Department of Labor data to estimate how many new accounts are forgotten annually, and GAO data to estimate how many of those accounts are transferred or liquidated each year.

- Average forgotten 401 account balance of $55,400: we analyzed Department of Labor data to estimate national account balances and then adjusted those estimates based on summary data provided by 401 recordkeepers on their terminating 401 participants.

- Our analysis here reflects extensive consultation with leading policy experts, particularly the Center for Retirement Research.

- For a detailed explanation of our methodology, download our full white paper here.

Also Check: Can I Use My 401k To Start A Business

How Much Does A 401 Cost Employers

LAST REVIEWED May 07 202112 MIN READ

Think that 401 plans are an expensive benefit reserved exclusively for large businesses with deep pockets? Think again. While this may have been a reality in the past, modern providers use technology to cut costs. And many companies, including small businesses, arent aware that 401 plans are now a realistic option for them.Adding a 401 to your benefits package is a cost-effective way to compete for great talent and reduce turnover of current employees.

How Much Are Your Benefits Really Worth

Getty

Are you overlooking the real value of your benefits when you think about your compensation? Probably. According to the Bureau of Labor Statistics, benefits accounted for about 32% of employer costs of compensation for U.S. workers in June 2018, with salary making up the other 68%.

Thats an impressive number to start with, but when you look at it from the perspective of the employee, the impact is more striking. Employer-paid benefits improved wages for private industry workers by 46.6% . Did I mention that most of those employee benefits are not taxable to the employee?

Its a good time to practice some benefits appreciation.

While youre making decisions about your health insurance and other employee benefits for the upcoming year during this open enrollment season, I invite you to take some time to calculate and appreciate their value. Think of it this way: if you were self-employed, youd have to earn more than 50% more per hour to pay your own benefits costs plus the employers share of FICA taxes . Thats assuming you could get similar pricing on insurance, which is unlikely. While there are many advantages to being your own boss, lack of access to group insurance coverages and retirement planning contributions arent in the plus column.

How to estimate the financial value of your benefits

Whats your total?

Recommended Reading: How To Avoid Penalty On 401k Withdrawal